The 5 best forex trading apps in the UAE revealed. We have explored and tested several prominent forex trading apps for forex trading in Dubai to identify the 5 best.

This is a complete guide to Dubai’s 5 best forex trading apps. In this in-depth guide you’ll learn:

- The Best Forex Trading Apps in Dubai (2023) – a List

- The Best Forex Brokers for Phones (Android), PC, and, Download

- The Best Forex Trading Apps to Use and Earn Money

- The Best and Legit Forex Trading Apps for Beginner and Professional Traders

- MetaTrader 4 and MetaTrader 5 Apps

and much, MUCH more!

The 5 Best Forex Trading Apps in the UAE – a Comparison

| 🔎 Provider | 📲 Mobile App | 🏆 Notable Feature |

| 🥇 Exness | Exness Trade | 24/7 in App Support |

| 🥈 AvaTrade | AvaTradeGO | Comprehensive Dashboard |

| 🥉 Tickmill | Tickmill App | User-Friendly Platform |

| 🏅 FXTM | FXTM Trader | Live Currency Rates |

| 🎖️ HFM | HFM App | Feature Rich |

The 5 Best Forex Trading Apps in the UAE (2024)

- ☑️ Exness Trade – Overall, the Best Forex Trading App in Dubai

- ☑️ AvaTradeGO – Top MetaTrader 4 App for Beginners in the UAE

- ☑️ Tickmill Mobile – Fast Fingerprint and Facial Recognition Login

- ☑️ FXTM Trader – Commission-Free Trading and Low Spreads

- ☑️ HFM Mobile – Award-Winning Mobile Application

We have listed the 5 best Forex trading apps for traders in Dubai. These apps have a variety of features for beginners and advanced traders alike and are offered by regulated Forex brokers in Dubai.

Exness – Exness Trade

Exness is fully licensed and authorized to offer its full suite of trading products and services to Dubai traders. Exness offers multiple types of accounts to Dubai traders, and the company’s dedicated support staff is available around the clock, every day of the week. Exness has a trust score of 97%

Exness Overview

| 🔎 Broker | 🥇 Exness |

| 📌 Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📈 Social Media Platforms | Instagram YouTube |

| 📉 DFSA Regulation | None |

| 📊 Trading Accounts | Standard Account Standard Cent Account Raw Spread Account Zero Account Pro Account |

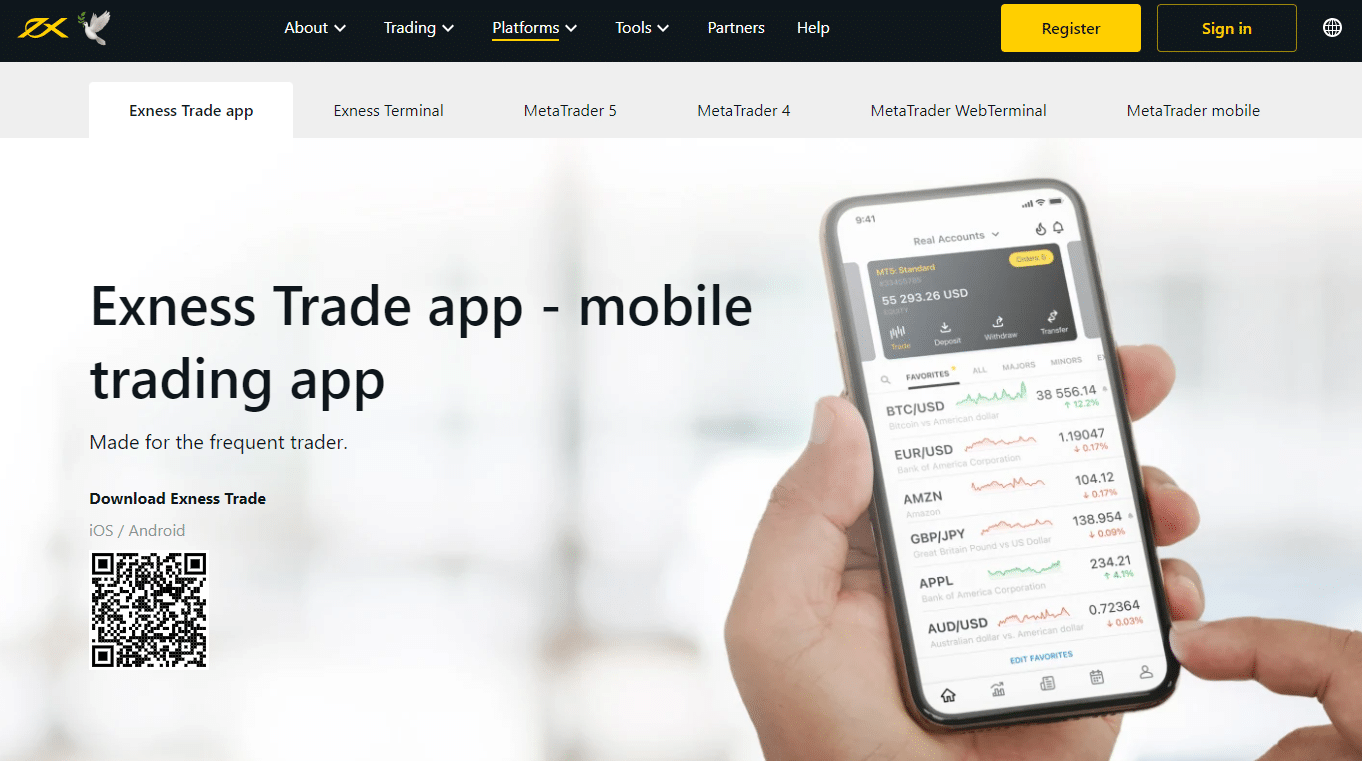

| 📍 Trading Platforms | MetaTrader 4 MetaTrader 5 Exness Terminal Exness Trade app |

| 💴 Minimum Deposit in AED | 36,73 AED or USD10 |

| 💹 Trading Assets | Forex, Metals, Crypto, Energies, Indices, Stocks |

| ▶️ Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

Exness Trade Overview

The Exness Trade app provides you with everything you need to start trading on the Dubai Forex market straight from your computer. Both the mobile and desktop versions of Exness’ website are sleek and easy to use. The Exness Trade app makes it simple for Dubai traders to toggle between their many open positions and assets. Notable Features of the Exness app include:

- ✅ Convenient Deposits and Withdrawals

- ✅ A Wide Range of Payment Options

- ✅ 24/7 in App Support

- ✅ Full Trading Functionality

- ✅ +200 Instruments (Crypto, Indices, Stocks)

You can manage your accounts quickly and easily using the Exness app. It’s great that the Exness mobile app now offers live chat support.

Aside from the Exness Trade App, the MetaTrader Mobile App is also made available. Users can download the MetaTrader 5 App for iOS, Android and Android.apk. The MT5 App makes trading quick and convenient offering access to comprehensive analysis and a Diversity of Assets.

Exness Pros and Cons

The Pros of Choosing to trade with Exness will include:

- ✅ Exness is well-regulated and keeps all client funds in segregated accounts with top-tier institutions

- ✅ Dubai traders can choose between several retail investor accounts

- ✅ Exness offers an Islamic account conversion with no additional fees charged

- ✅ Instant deposits and withdrawals are offered

- ✅ Exness has customer support available 24 hours a day, 7 days a week

The Cons of Trading with Exness may include:

- ✅ There is a limited portfolio of financial instruments offered

- ✅ Exness offers a limited number of payment methods that can be used for deposits and withdrawals

What account security features does Exness offer to Dubai traders?

Exness accounts use techniques to verify the account owner’s identity to Exness, and it’s critical to understand how these mechanisms function to safeguard you. These include security barriers and security pins.

AvaTrade – AvaTradeGO App

AvaTrade is a leading Forex Broker that offers traders a world-class trading Experience. AvaTrade offers access to advanced tools, personalized support, and uncompromising security. AvaTrade offers its services to 400,000+ traders across the globe, with roughly 2 million trades made per month. AvaTrade has a high trust score of 96%

AvaTrade Overview

| 🔎 Broker | 🥇 AvaTrade |

| 📈 Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| 📉 Social Media Platforms | Instagram, Facebook, Twitter, YouTube |

| 📊 DFSA Regulation | None |

| 📌 Trading Accounts | Retail Account, Professional Account |

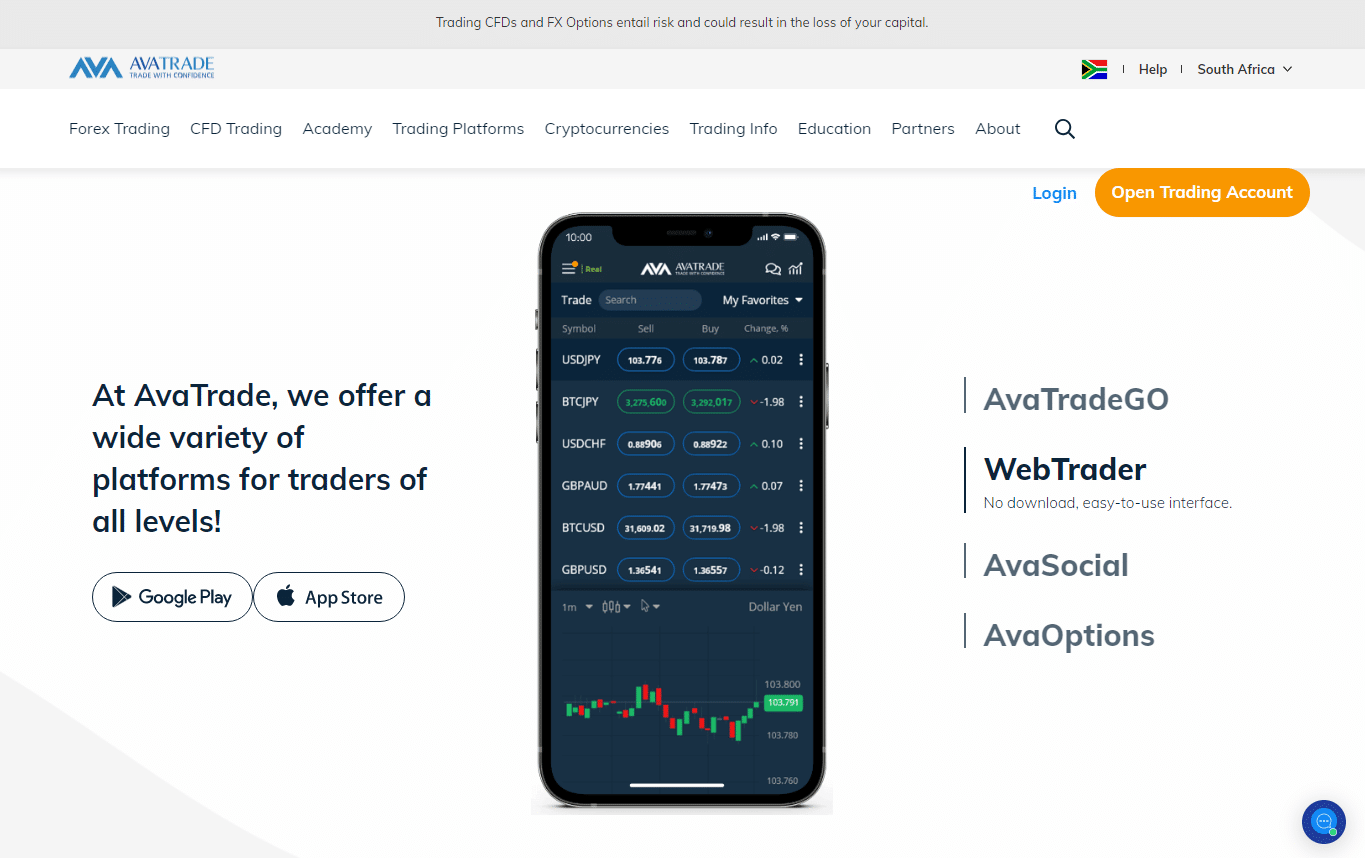

| 📍 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💴 Minimum Deposit in AED | 367,30 AED or $100 |

| 💹 Trading Assets | Forex, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🎁 Bonuses for Dubai traders | ✅Yes |

| 💱 Minimum spread | From 0.9 pips EUR/USD |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

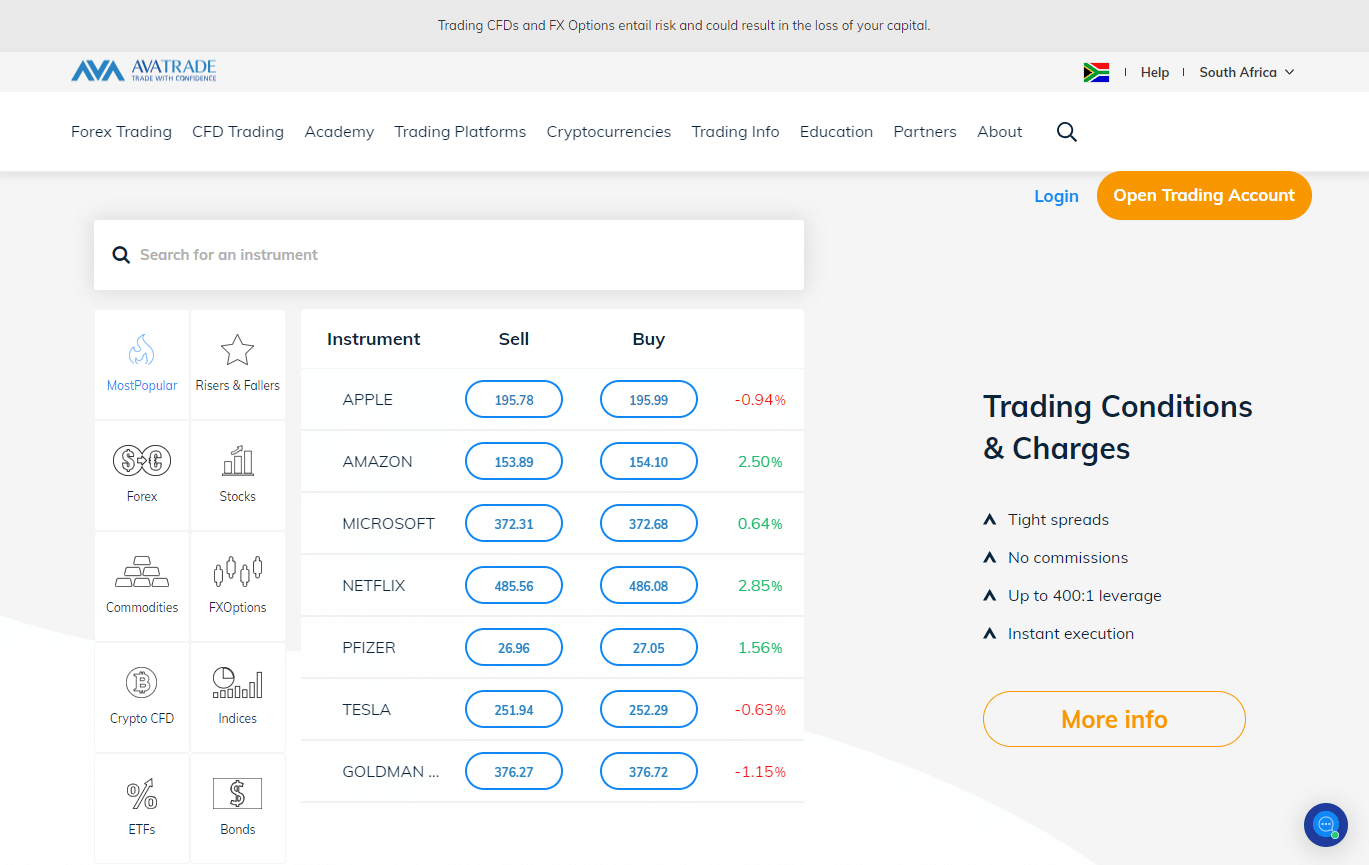

AvaTradeGO App Overview

Dubai traders can connect to global markets via live feeds and social trends to discover fresh trading possibilities on the simple and easy-to-use AvaTradeGO app.

Traders in Dubai can experience a seamless trading experience with a comprehensive dashboard that includes a set of straightforward management tools, clear charts, zoom for details, and many other useful features that are exclusive to this software.

Trading is easy with AvaTradeGO since the app gives step-by-step assistance on opening trades, feedback on your activity, and support whenever you need it.

To obtain all the data you need on your trades while using your AvaTrade account credentials, manage several accounts and switch between demo, real, and competitive spreads accounts.

AvaTrade Pros and Cons

The Pros of Trading AvaTrade will include:

- ✅There are no hidden fees associated with AvaTrade’s Islamic Account, and professional traders have access to a wide variety of financial instruments, technical indicators, research tools, and educational resources.

- ✅AvaTrade also offers a demo account so that novice traders can test their strategies and get a feel for the market without risking any real money.

The Cons of Trading with AvaTrade may include inactivity fines and foreign exchange costs.

Is the AvaTradeGO app a good fit for beginner traders from Dubai?

Yes, AvaTradeGO offers support for beginner Dubai traders that includes step-by-step assistance on opening trades, feedback on your activity, and support whenever they need it.

What is the minimum deposit to open an account with AvaTrade in Dubai?

The minimum deposit to open an account with AvaTrade is 367,30 AED or $100.

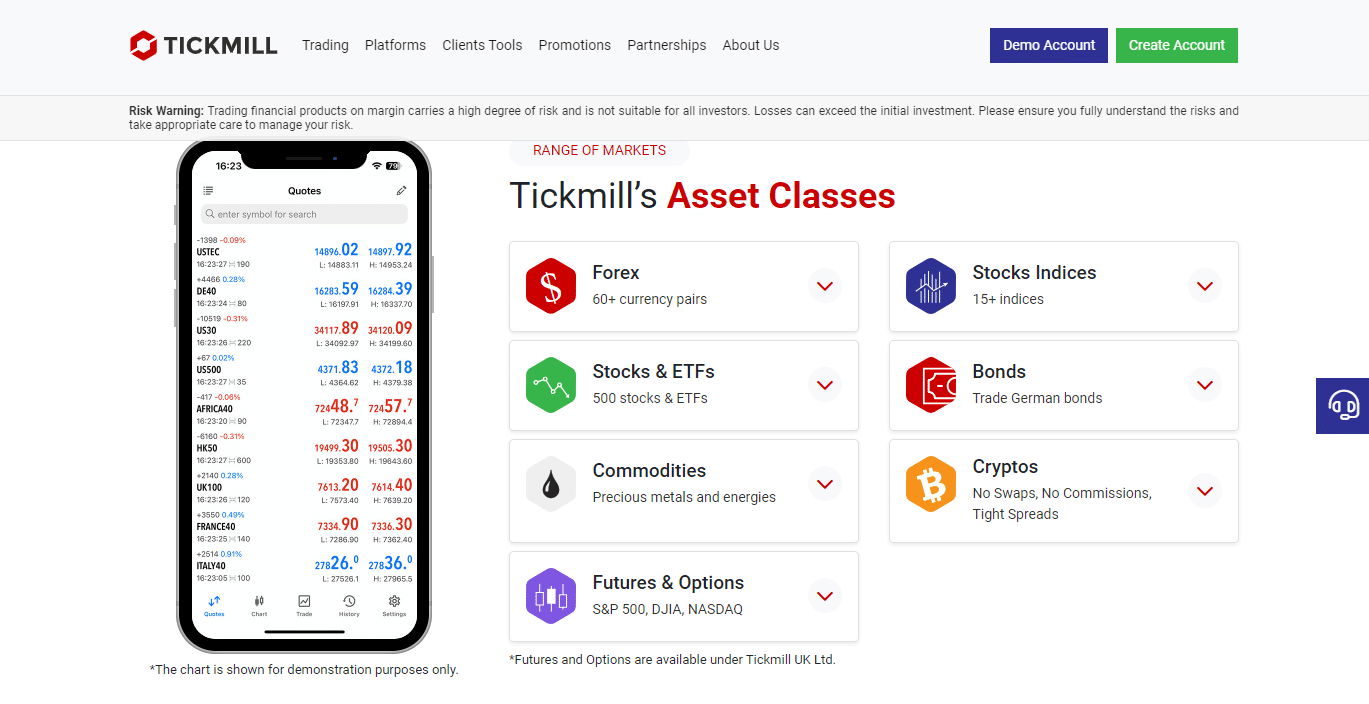

Tickmill – Tickmill Mobile

Tickmill is a Seychelles Financial Services Authority (FSA) regulated Forex Broker with an Expressive record. Traders will have access to multiple trading accounts and platforms, plus a range of markets that include Forex, Commodities, Bonds, and, Cryptos. Tickmill has a trust score of 81%

Tickmill Overview

| 🔎 Broker | 🥇 Tickmill |

| 📈 Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA |

| 📉 DFSA Regulation | ✅Yes |

| 📊 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 📌 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 💴 Minimum Deposit in AED | 18,37 AED or $5 |

| 📍 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 🎁 Bonuses for Dubai traders | ✅Yes |

| 💹 Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

Tickmill Mobile Overview

Using the CQG or MT4 platform, Tickmill traders from Dubai can speculate on the price movements of a wide range of financial instruments, including but not limited to currency pairs, stock indexes, metals, bonds, and commodities.

Tickmill has risen to prominence among the CFD Group of brokers because of its favorable trading conditions and large assortment of trading instruments.

One of the main reasons that Tickmill is so well-liked among investors all around the world is because of its very knowledgeable support staff. Having earned over 20 awards for their work, this team can give comprehensive support in 16 distinct languages.

Traders in Dubai now have a more convenient way to keep tabs on their accounts and make transactions thanks to the Tickmill app. The tools necessary for effective account administration are readily available in this comprehensive software package.

Tickmill Pros and Cons

The Pros of trading with Tickmill will include:

- ✅ Tickmill is a popular trading platform because it has low trading fees, a high level of customer confidence, and the availability of several convenient payment ways including Skrill and Neteller. Additionally, Tickmill has a high degree of consumer confidence.

- ✅ Professional traders in Dubai will find that Tickmill’s features, including the FIX API, AutoChartist, and virtual private servers, are an excellent fit for their specific requirements.

However, Tickmill does not provide fixed spreads.

Are Dubai traders’ funds protected at Tickmill?

Yes, Tickmill has recently opened a Dubai office which operates under DFSA regulation. As such, Tickmill’s internal systems comply with the DFSA regulations, which means that your funds are held in segregated accounts to protect your assets.

What are some of the advantages of trading with Tickmill?

Spreads on Tickmill begin at 0 pips, and the average execution time is under 0.15 seconds. Withdrawals are processed within one business day, while deposits made with Skrill, Neteller, FasaPay, UnionPay, and credit cards are processed promptly.

FXTM – FXTM Trader

FXTM is a well-established trusted Forex Broker that offers its services to Millions of clients in 150+ countries worldwide. FXTM Traders will have access to multiple account types to choose from, zero spreads, popular trading platforms, and, a wealth of free educational tools. FXTM has a trust score of 93%

FXTM Overview

| 🔎 Broker | 🥇 FXTM |

| 📈 Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| 📉 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💴 Minimum Deposit in AED | 18,37 AED or $5 |

| 📌 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs, Commodities, Stock Baskets |

| 🎁 Bonuses for Dubai traders | ✅Yes |

| 📍 Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

FXTM Trader Overview

The FXTM Trader app allows you to trade Forex (FX), oil, gold, natural gas, and other assets wherever you are. Trading on the app begins with picking an account type and making a first deposit.

The market is volatile, so planning is essential. Users of the FXTM Trader platform can immediately respond to changes in the market by opening and canceling deals.

Forex traders in FXTM can trade major currency pairs and gold without paying spreads or commissions.

Customer monies are kept in a separate account from the company’s general finances to ensure compliance with the regulations of the several countries in which FXTM operates.

FXTM Pros and Cons

The Pros of Trading with FXTM will include:

- ✅ FXTM is a trusted Forex broker that abides by all the rules and regulations in the industry.

- ✅ Depositing and withdrawing funds with FXTM is quick and simple.

- ✅ Deposits made with FXTM are always free of charge.

- ✅ FXTM provides its users with several educational resources.

- ✅ The Dubai support staff of FXTM is well-versed and fluent in several languages.

However, Dormant FXTM accounts incur a monthly fee of $5.

How many trading accounts can be opened with FXTM?

Dubai traders can open as many accounts as they wish with FXTM.

Does FXTM charge a commission to Dubai traders?

Yes, some fees apply to Advantage MT4 and Advantage MT5 accounts.

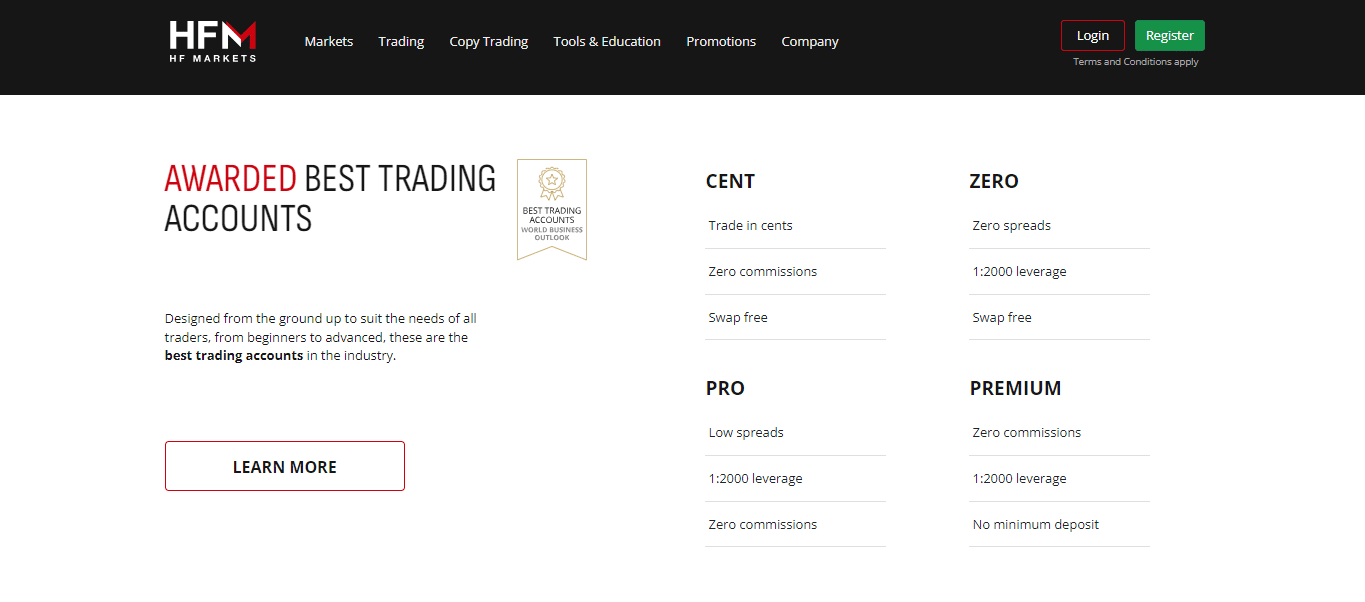

HF Markets – HFM App

HFM is a popular broker choice amongst beginner and established traders. Traders will have access to superior trading conditions, loyalty rewards, excellent trading tools, and multiple account types. HF Markets has a trust score of 83%

HFM Overview

| 🔎 Broker | 🥇 HF Markets |

| 📈 Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📉 DFSA Regulation | ✅Yes |

| 📊 Trading Accounts | Premium, Premium Pro, VIP, VIP Pro, Professional Clients |

| 💹 Trading Platform | MT4, MT5, HFM Trading App |

| 💶 Minimum Deposit in AED | $0, 0 AED |

| 📌 Trading Assets | Forex, Metals, Energies Indices, Stocks, Commodities, Bonds, ETFs |

| 🎁 Bonuses for Dubai traders | ✅Yes |

| 📍 Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

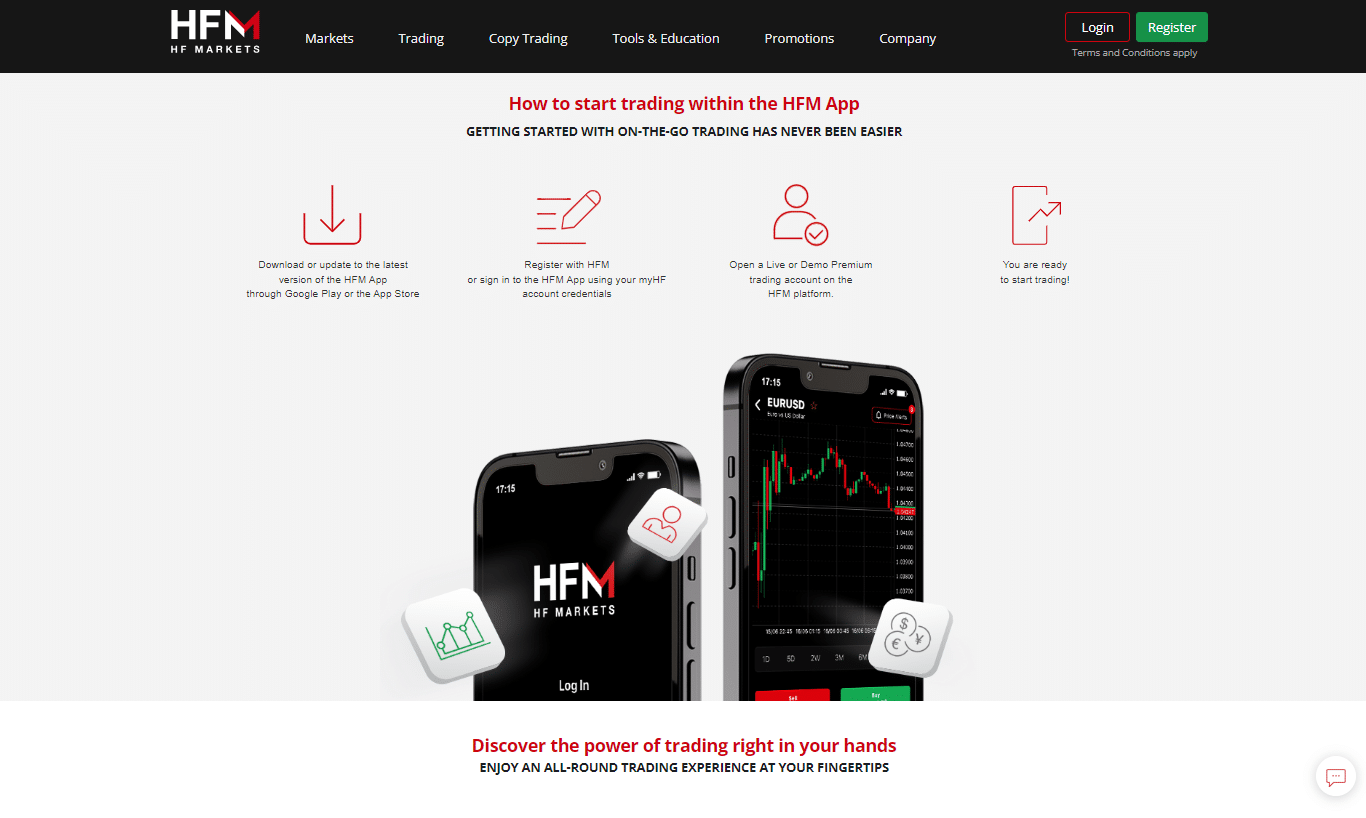

HF Markets App Overview

The HFM app provides all the resources necessary for users of all skill levels to successfully participate in the financial markets.

The HFM software provides charting tools and common indicators that Dubai traders can use to make the most of market openings. Because of this, users can access more information, which can help them make better business decisions. The employment of these tools also facilitates opening, closing, and repositioning.

HFM Pros and Cons

The Pros of trading with HFM will include:

- ✅ For Dubai traders, the EUR/USD currency pair offers a low spread of just 0.9 pips.

- ✅ Traders of all skill levels might benefit from using a demo trading platform.

- ✅ HFM’s user-friendly MetaTrader 4 and 5 platforms allow Dubai traders to trade several assets from any computer, smartphone, or tablet connected to the internet.

However, there is a lack of convenient local withdrawal and deposit methods for Dubai HFM traders.

What leverage is applied to HFM accounts for Dubai traders?

Leverage available for HFM trading accounts is up to 1:2000 depending on the account type.

Is HFM regulated in Dubai?

Yes, Dubai is one of the few international Forex brokers that is regulated by the DFSA.

How to choose the best Forex trading apps in Dubai

Dubai traders must evaluate the following components of a forex trading app to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Dubai traders must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirements, commissions and spreads, initial deposits, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Dubai traders must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Dubai traders must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Dubai traders must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Dubai trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

- ✅ eBooks

- ✅ Trading guides

- ✅ Trading knowledge on leveraged products

- ✅ A risk warning on complex instruments

- ✅ Educational videos

Research can include some of the following:

- ✅ Trading tools

- ✅ Commentary

- ✅ Status of International Markets

- ✅ Price movements

- ✅ Market sentiments

- ✅ Whether there is a volatile market

- ✅ Exchange Rates

Expert opinions and several other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Dubai

In this article, we have listed the best brokers that offer Forex trading apps to Dubai traders. We have further identified the brokers that offer additional services and solutions to Dubai traders.

Best MetaTrader 4 / MT4 Forex Broker – Alpari

Overall, Alpari is the best MT4 Forex broker in Dubai. Alpari is highly regarded by financial experts as a reliable market maker because of its stellar record. Alpari guarantees that its trading latency is below one millisecond. There are currently more than 2 million people using Alpari.

Best MetaTrader 5 / MT5 Forex Broker – AvaTrade

Overall, AvaTrade is the best MT5 Forex broker in Dubai. AvaTrade has built a solid reputation as a reliable CFD and FX broker. AvaTrade’s sterling reputation stems from the fact that it uses only the most renowned institutions in each regulatory country to house its customers’ funds separately.

Best Forex Broker for Beginners – eToro

Overall, eToro is the best Forex broker for beginners in Dubai. The eToro Academy, the eToro Plus paid membership plan, and practice trading accounts are just some of the ways users may learn more about the platform.

Best Low Minimum Deposit Forex Broker – Oanda

Overall, Oanda is the best low-minimum deposit Forex broker for traders in Dubai. Oanda’s state-of-the-art trading platform is useful for FX traders of all experience levels.

Best ECN Forex Broker – XM

Overall, XM is the best ECN forex broker in Dubai. XM gives top consideration to cost, client service, cash flow, and security.

Best Islamic / Swap-Free Forex Broker – Tickmill

Overall, Tickmill is the best Islamic / Swap-Free forex broker in Dubai. Tickmill is a reliable and trustworthy brokerage. This broker is great for a wide variety of investors because of the flexibility it offers with accounts, the low costs of those accounts, and the competitive spreads. Currently, Tickmill may be accessed in several languages and used in a variety of scenarios.

Best Forex Trading App – Exness

Overall, Exness offers the best trading app for traders in Dubai. The Exness Trader app is very helpful for traders in Dubai because of its numerous useful functions and features. Candlestick charts, technical indicators, and quantitative tools help novice traders.

Best Forex Rebates Broker – FXPro

Overall, FxPro is the Best Forex Rebates Broker in Dubai. FxPro is a trading platform that offers STP and ECN connectivity to its users. Retail traders in the foreign exchange market can earn cash returns of 30% each month.

Best Lowest Spread Forex Broker – Pepperstone

Overall, Pepperstone is the best lowest spread forex broker in Dubai. Spreads for trading the US dollar against the euro at Pepperstone start at 0.0 pips. Pepperstone Markets is among the best brokerages because of its extensive track record of performance.

Best Nasdaq 100 Forex Broker – IG

Overall, IG is the best Nasdaq 100 forex broker in Dubai. IG’s state-of-the-art trading tools, a wide range of available products, and favorable market conditions have helped propel it to the ranks of the city’s top 20 platforms. Among the many reliable online brokers serving the Dubai market, IG stands out because it is subject to stringent regulations and gives clients access to a diverse selection of assets.

Best Volatility 75 / VIX 75 Forex Broker – IC Markets

Overall, IC Markets is the best Volatility 75 / VIX 75 forex broker in Dubai. With the advanced trading tools provided by IC Markets, Dubai traders can now take part in transactions on global financial markets.

Best NDD Forex Broker – BDSwiss

Overall, BDSwiss is the best NDD forex broker in Dubai. When it comes to CFD and forex services, BDSwiss is a major player on a global scale. There are around 16,000 affiliate accounts, and each month it processes up to €20 billion in foreign exchange transactions.

Best STP Forex Broker – OctaFX

Overall, OctaFX is the best STP forex broker in Dubai. OctaFX has received over 28 industry awards. Using STP (Straight Through Processing) and ECN (Electronic Communication Network), OctaFX has cut its trade costs by around a third.

Best Sign-up Bonus Broker – HFM

Overall, HFM is the best sign-up bonus broker in Dubai. HFM’s trading platform is well-liked by investors due to its reasonable fees and high quality. The HFM website caters to users with varying levels of expertise in foreign exchange trading by providing access to numerous account types and asset markets.

Why Forex traders in Dubai prefer Forex trading apps

A major contributor to the success of mobile trading apps in Dubai is the country’s rapidly growing smartphone market. Recent estimates put the number of smartphone users at over 3.8 billion in 2019, with a further billion expected to join them by 2024.

Because of the widespread availability of smartphones, traders now have easier access to the foreign exchange market and can maintain continual contact with it. Smart trading decisions may be made on the go with the help of a forex trading software that provides a user-friendly interface and access to real-time market data.

Technology advancements have contributed to the meteoric rise in the popularity of mobile trading apps. In-depth chart analysis, trade execution, and portfolio monitoring are all simplified with the help of these trading applications.

Regular forex traders may stay abreast of market developments and opportunities with the help of the app’s customizable alerts and notifications. In addition, these apps integrate with safe payment gateways, which keep traders’ money safe at all times.

Mobile trading apps have leveled the playing field for Dubai’s retail traders. Foreign exchange trading has traditionally been the domain of huge financial institutions and highly trained traders with access to electronic trading platforms.

However, with the advent of trading apps for mobile devices, private investors have access to the same tools. Therefore, ordinary Dubai traders can now engage in foreign exchange trading on an even playing field with banks and other financial institutions.

How Traders in Dubai can use Forex apps successfully

To begin the process, it is advisable to create a demo account to evaluate the effectiveness of your meticulously devised forex trading strategy. This should be done after the selection of a mobile trading platform that aligns with your specific requirements, device specifications, and operating system.

There are several considerations to keep in mind when engaging in personal trading, irrespective of whether one is utilizing a desktop computer or a mobile device. Outlined below are several strategies for achieving effective trading outcomes on Forex apps:

Trade with a goal

In instances where the market exhibits an upward trend, it is advisable to engage in a “buy” trade, while during periods of decline, it is prudent to consider a “sell” trade.

Nevertheless, it is possible to take advantage of temporary decreases in prices by employing speculative techniques such as engaging in spread betting inside the Forex market.

Nevertheless, it is not advisable to engage in buying or selling activities at the highest or lowest point of the market. Therefore, it is crucial to develop one’s investment philosophy and determine their level of risk tolerance at an early stage.

In light of these limitations, it is imperative to establish and precisely articulate your goals, as they will serve as a guiding framework for all subsequent decisions.

Make incremental investments

Even if you’re familiar with the market and the trading platform, putting your own money at risk can be nerve-wracking.

Therefore, it is essential to begin with a small amount of capital and focus on just one or two major currency pairs, such as the EUR/USD (which accounts for about 24% of daily trade volumes worldwide).

If you’re already fluent in one currency, say the Australian dollar (AUD), you may find it useful to focus on widely traded, interconnected pairs like the Chinese Yuan (CNY) and Japanese Yen (JPY).

Whatever the case may be, it’s best to take things slowly at first and gradually ramp up your efforts (and investment) as your profits and experience allow.

Manage your risk exposure

For those engaging in mobile trading and seeking to assume risks, it is advisable to utilize the available online risk management resources and tactics.

To effectively mitigate present losses and enhance future earnings potential, it is imperative to incorporate this aspect into a comprehensive risk management approach.

The creation of stop loss and take profit levels is widely recognized as a highly successful approach to risk management.

Both stop-loss orders and take-profit orders have practical purposes in trading. Stop-loss orders are designed to automatically end a position when its value drops below a certain level. On the other hand, take-profit orders specify a precise price at which to sell a position to realize a profit.

In Conclusion

Overall, we highly recommend downloading one of the top-rated Forex apps from our list if you reside in Dubai and seek a reliable and user-friendly platform for conducting Forex trading activities while on the move.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the financial markets are volatile and could shift and change at any given time, even if the information supplied is correct at the time of going live.

Frequently Asked Questions

Is Forex trading legal in Dubai?

Yes, if you live in Dubai, you can legally trade forex with brokers that are properly licensed and regulated.

How much do Forex traders make in Dubai?

A trader in Dubai might earn an average salary of AED 30,000 per month in the Dubai, United Arab Emirates.

Is Dubai tax-free for Forex traders?

In contrast to many other countries, Dubai does not tax individuals, including forex traders. This means that traders can keep all of their earnings, thereby increasing their potential returns on investment.

Is mobile Forex trading in Dubai halal?

The permissibility of forex trading, according to Islamic scholars, is dependent on the precise conditions of the exchange. In general, currency trading is halal as long as specific standards are followed. These guidelines are as follows: There will be no interest-based transactions.

Can Dubai traders open a swap-free account on Forex trading apps?

Yes, but this will depend on whether the Forex broker offers an Islamic account option. Luckily most Forex brokers today do offer Islamic accounts to Muslim traders.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai