Overall, FXTM can be summarised as a trustworthy and highly regulated Forex Broker, a leader in online financial trading and investing. FXTM offers access to a comprehensive trading platform with advanced features and trusted customer support. FXTM has a trust score of 93 out of 99.

| 🔎 Order Execution | 4/5 |

| 💴 Commissions and Fees | 4/5 |

| 📈 Range of Markets | 5/5 |

| 📉 Variety of Markets | 5/5 |

| 📊 Withdrawal Speed | 5/5 |

| 💖 Customer Support | 5/5 |

| 💻 Trading Platform | 4/5 |

| 🖍️ Education | 4/5 |

| 🗂️ Research | 4/5 |

| ⚙️ Regulation | 5/5 |

| 📱 Mobile Trading | 4/5 |

| 💯 Trust Score | 93% |

FXTM Review – Overview of the Brokers’ Main Features

- ☑️ FXTM Overview

- ☑️ FXTM Detailed Summary

- ☑️ FXTM Advantages Over Competitors

- ☑️ Who will Benefit from Trading with FXTM?

- ☑️ FXTM Safety and Security

- ☑️ FXTM Bonus Offers and Promotions

- ☑️ FXTM Minimum Deposit

- ☑️ FXTM Account Types and Features

- ☑️ FXTM Base Account Currencies and Basic Order Types

- ☑️ How to Open and Close an FXTM Account

- ☑️ FXTM Trading Platforms

- ☑️ Which Markets Can You Trade with FXTM?

- ☑️ FXTM Fees, Spreads, and Commissions

- ☑️ FXTM Deposits and Withdrawals

- ☑️ FXTM Education and Research

- ☑️ FXTM Customer Support

- ☑️ FXTM VPS Review

- ☑️ FXTM Cashback Rebates Features and Conditions

- ☑️ FXTM Web Traffic Report

- ☑️ FXTM Geographic Reach and Limitations

- ☑️ Best Countries by Traders

- ☑️ FXTM vs Yadix vs LiteFinance – A Comparison

- ☑️ FXTM Alternatives

- ☑️ FXTM Awards and Recognition

- ☑️ Our Experience with FXTM

- ☑️ Recommendations according to our in-depth review of FXTM

- ☑️ FXTM Customer Reviews

- ☑️ Pros and Cons of Trading with FXTM

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

FXTM Overview

FXTM is a global leader in online financial trading and investing, providing FX, indices, commodities, and other products. The FCA of the United Kingdom, the CySEC of Cyprus, and the FSC of Mauritius all regulate FXTM. FXTM provides the widely used online trading platform MetaTrader, which allows traders to monitor markets and trade in real-time.

FXTM does not limit traders’ ability to choose a trading strategy but rather sets a standard.FXTM provides a comprehensive trading platform with advanced features, competitive pricing, and a diverse range of tradable assets, including stocks, forex, CFDs, and cryptocurrencies, to Emirati traders.

The trading platform at FXTM is user-friendly and fully digital, making account opening quick and simple. Emirati traders can also deposit and withdraw using credit/debit cards. Excellent order execution and a proprietary copy trading platform are two of FXTM’s distinguishing features

FXTM Detailed Summary

| 🔎 Broker | 🥇 FXTM |

| 📈 Headquartered | Cyprus |

| 📉 Global Offices | Cyprus, Mauritius, Kenya, Nigeria, India, Malaysia, South Korea, South Africa, United Kingdom |

| 📊 Local Market Regulators in Dubai | Dubai Financial Services Authority (DFSA) |

| 💹 Foreign Direct Investment in Dubai | 23 billion USD (2022) |

| 📌 Foreign Exchange Reserves in Dubai | 158 billion USD (July 2024) |

| 📍 Regulation | CySEC, FSCA, FCA, CMA, FSC Mauritius |

| ☪️ Islamic Account | ✅Yes |

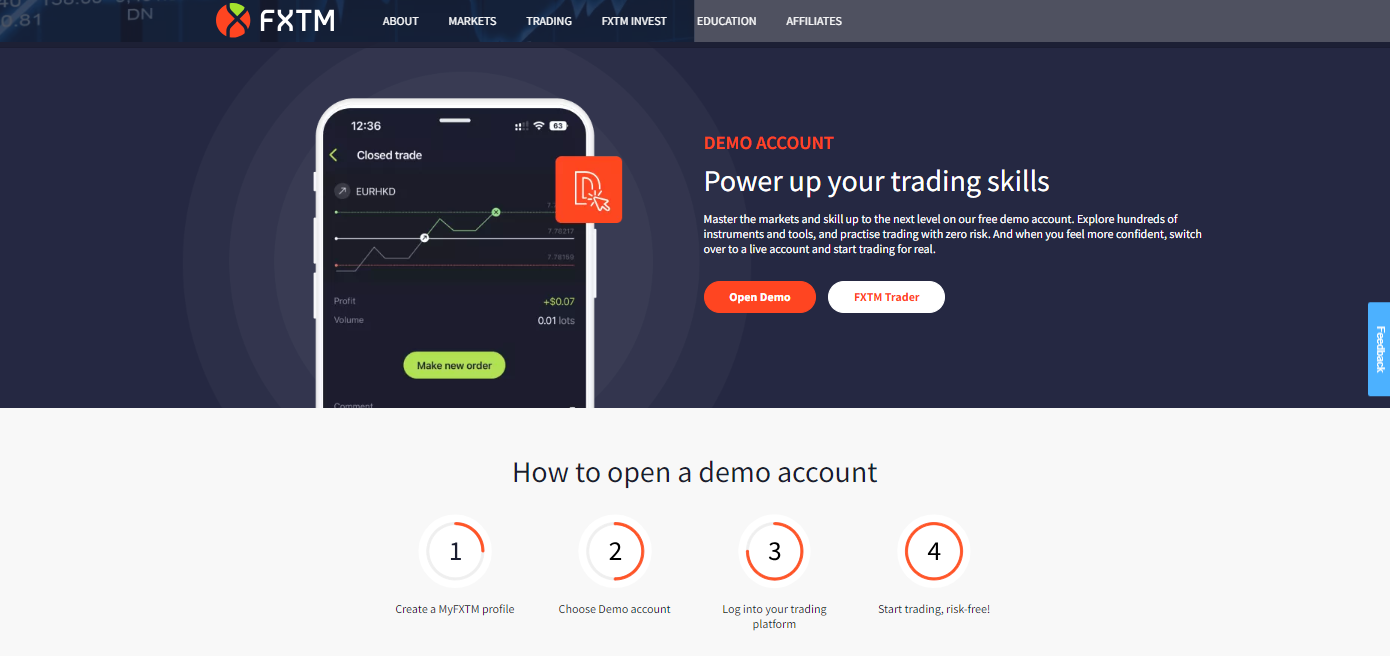

| 🆓 Demo Account | ✅Yes |

| ⏰ Demo Duration | 30 days |

| 🔟 Retail Investor Accounts | 3 |

| 🤝 Affiliate Program | ✅Yes |

| ↪️ Order Execution | Instant and Market |

| ▶️ OCO Orders | None |

| ✔️ One-Click Trading | ✅Yes |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📊 Expert Advisors | ✅Yes |

| 📰 News Trading | ✅Yes |

| 📌 Trading API | None |

| 📍 Starting spread | 0.0 pips, variable |

| 💴 Minimum Commission per Trade | $0.40 to $2, depending on the trading volume |

| 💹 Margin Call | 60% to 80% |

| ⛔ Stop-Out | 40% to 50% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| 🪙 Crypto trading offered | Yes, CFDs |

| 📊 Maximum Leverage | 1:2000 |

| 💷 Minimum Deposit (AED) | 37 AED ($10) |

| 💶 AED Deposits Allowed | ✅Yes |

| 💵 Account Base Currency | USD, EUR, GBP, NGN |

| 👤 Active Dubai Trader Stats | 49,000+ |

| 🔁 Dubai Daily Forex Turnover | 13.1 billion USD |

| ⏲️ Minimum Withdrawal Time | Instant |

| ⏱️ Maximum Estimated Withdrawal Time | Up to 5 working days |

| ⌚ Instant Deposits and Instant Withdrawals | ✅Yes |

| 🔊 Customer Support Languages | Multilingual |

| ➕ Copy Trading Support | ✅Yes |

| ⏰ Customer Service Hours | 24/5 |

| 🏷️ Dubai-based customer support | ✅Yes |

| 🎁 Bonuses and Promotions for Dubai Traders | ✅Yes |

| 🖍️ Education for Emirati beginners | ✅Yes |

| 💻 Proprietary trading software | ✅Yes |

| 😎 Most Successful Trader in Dubai | Several – Yasser R, Ali A, Maaz A, Warren Takunda |

| 💗 Is FXTM a safe broker for Dubai Traders | ✅Yes |

| 🔟 Rating for FXTM Dubai | 9/10 |

| 💯 Trust score for FXTM Dubai | 93% |

FXTM Advantages Over Competitors

FXTM has the following advantages over competitors:

- ✅ Beginner-friendly tools and resources, such as demo accounts and copy trading, help novice traders get a confident start in their trading journey.

- ✅ FXTM has received numerous industry awards, demonstrating its dedication to excellence.

- ✅ Stocks, forex, CFDs, and cryptocurrencies are among the tradable assets available.

- ✅ The trading platform is simple to use and fully digital, which speeds up the account opening process.

- ✅ Emirati traders can use credit/debit cards for both deposits and withdrawals.

- ✅ The platform provides low-cost trading experiences with tight spreads and low commission rates, allowing traders to keep more profits.

- ✅ Educational materials and market insights are widely available, assisting traders, including those in the UAE, in making sound decisions.

- ✅ FXTM has a transparent pricing policy with no hidden fees or charges, which builds trust among traders.

- ✅ Customer service is available in more than 30 languages, allowing Emirati traders who prefer to communicate in Arabic to do so.

- ✅ Negative balance protection measures are in place to protect traders from losing more than their initial investment.

and many more!

Who will Benefit from Trading with FXTM?

- ✅ Traders who prefer to communicate in languages other than English will find FXTM accommodating, as customer support is available in over 30 languages, including Arabic.

- ✅ Those who value continuous learning will benefit from FXTM’s extensive educational materials and market insights, which can be especially useful for traders new to specific markets.

- ✅ FXTM’s low commission rates and tight spreads make it an appealing option for cost-conscious traders looking to maximize their profits.

- ✅ FXTM’s offerings are comprehensive for traders interested in a wide range of assets such as stocks, forex, CFDs, and cryptocurrencies.

- ✅ Those new to the trading world can confidently begin their journey thanks to FXTM’s beginner-friendly tools, such as demo accounts and copy trading.

How does FXTM’s customer service compare to other brokers?

FXTM offers customer service in multiple languages and around-the-clock availability from Monday to Friday.

Is FXTM more globally accessible than other brokers?

No, FXTM, like other brokers, has a strong global presence, serving clients in various countries

FXTM Safety and Security

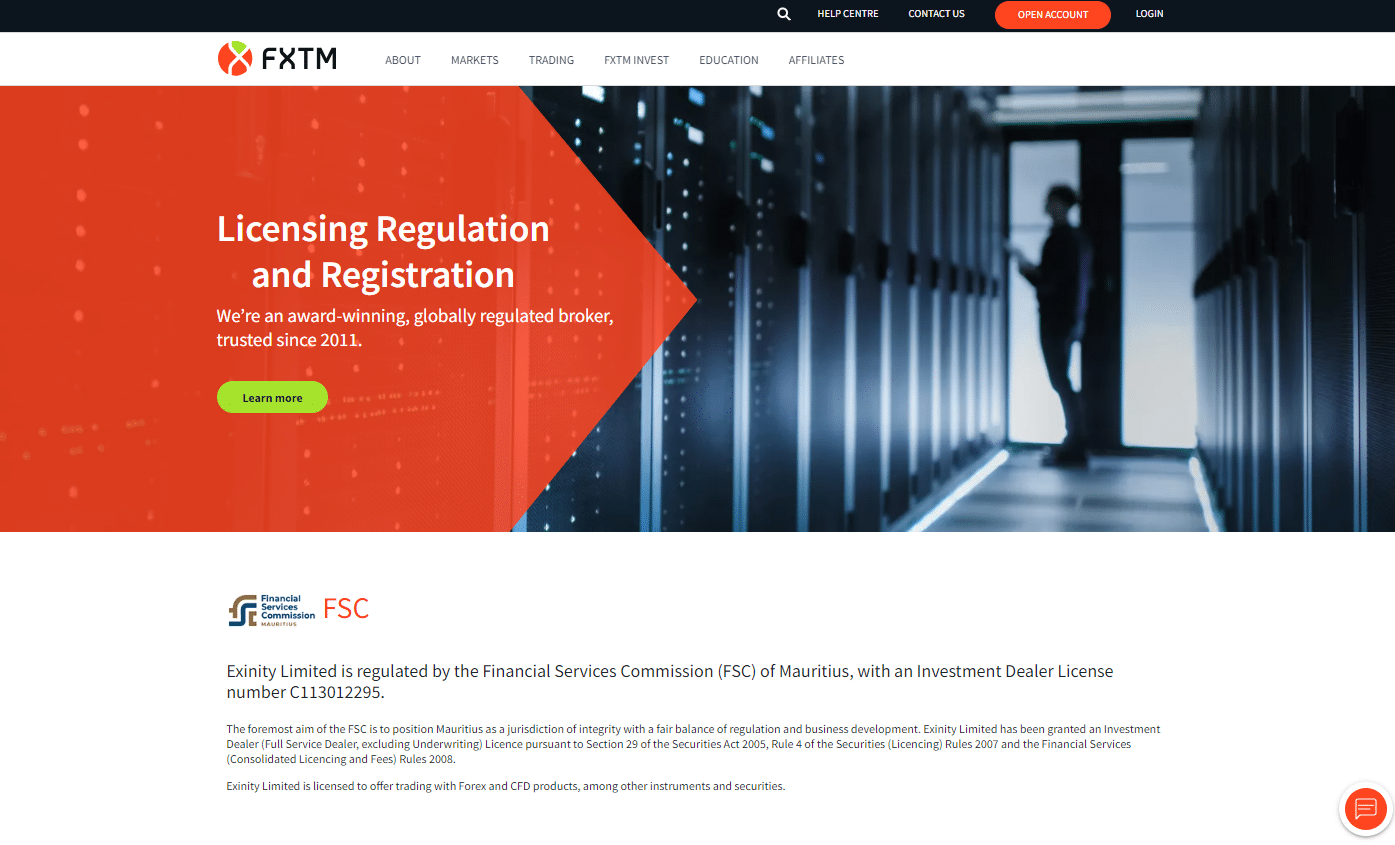

FXTM is not currently regulated by the Dubai Financial Services Authority (DFSA). However, FXTM global regulations are listed in the table below.

FXTM Global Regulations

| 🔎 Registered Entity | 🌎 Country of Registration | 📌 Regulatory Entity | 📈 Tier | 📉 License Number/Ref |

| 1️⃣ ForexTime Ltd | Cyprus | CySEC | 2 | 185/12 |

| 2️⃣ Exinity Capital East Africa | Kenya | CMA | 2 | 135 |

| 3️⃣ Exinity UK Limited | United Kingdom | FCA | 1 | 777911 |

| 4️⃣ Exinity Limited | Mauritius | FSC | 3 | C113012295 |

| 5️⃣ FOREXTIME LTD | South Africa | FSCA | 2 | FSP 46614 |

FXTM Protection of Client Funds

| 🔎 Security Measure | 📌 Information |

| 🔒 Segregated Accounts | ✅Yes |

| 🔏 Compensation Fund Member | Financial Commission |

| 🔐 Compensation Amount | €20,000 |

| 🔓 SSL Certificate | ✅Yes |

| 🗝️ 2FA (Where Applicable) | ✅Yes |

| 🔑 Privacy Policy in Place | ✅Yes |

| 🔒 Risk Warning Provided | ✅Yes |

| 🔏 Negative Balance Protection | ✅Yes |

| 🔐 Guaranteed Stop-Loss Orders | ✅Yes |

FXTM Security while Trading

To provide its customers with a secure trading environment, FXTM places a high priority on security. FXTM’s regulatory compliance is one of its most comforting qualities; it is overseen by several financial regulators, including the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), among others.

These regulatory bodies place stringent requirements on companies that offer financial services, such as adequate capital and separating client funds from operating funds.

This adds another layer of financial security because it ensures that traders’ funds are kept in separate accounts and cannot be used by FXTM for internal operating costs.

FXTM uses cutting-edge technological safeguards to protect its trading platforms and websites in addition to financial regulations.

All information transmitted between the client and FXTM is encrypted and safe from unauthorized access, thanks to Secure Sockets Layer (SSL) encryption. This is crucial for protecting sensitive data like financial transactions and individual identity information.

Additionally, FXTM provides risk management tools like negative balance protection, which shield traders from suffering losses that exceed the funds deposited into their accounts. This important feature can provide security, especially for new traders who might not fully understand the risks associated with leveraged trading.

How transparent is FXTM about its security measures?

FXTM’s security protocols, including fund segregation and encryption methods, are extremely transparent.

Does FXTM have a track record of security breaches?

There is no record of significant security breaches affecting FXTM available to the public.

FXTM Regulation and Safety of Funds – Pros and Cons

| ✅ Pros | ❎ Cons |

| FXTM is regulated in South Africa, the UK, Mauritius, Kenya, and Cyprus | The DFSA in Dubai does not regulate FXTM |

| Investor Protection of up to 20,000 EUR is available to eligible traders | Emiratis might not be eligible for investor protection |

| FXTM has a high trust score of 93% | High leverage can lead to loss of funds regardless of negative account protection |

FXTM Bonus Offers and Promotions

FXTM offers Emirati traders the following bonuses and promotions:

- ✅ Refer a Friend

The FXTM Refer a Friend program allows you to supplement your income by introducing your friends to the trading world. You can earn $50 for each person you refer to FXTM using your unique referral link through this program.

There are no limits to how many people you can refer, allowing you to earn up to $10,000 in tangible, withdrawable funds. Furthermore, if your referrals meet the specified criteria, they will also receive a $50 bonus.

Furthermore, you can easily access the ‘Refer a Friend Program’ section within your MyFXTM portal to track your referrals’ progress.

Does FXTM offer a loyalty program?

No, FXTM does not have a formal loyalty program at this time.

How can I stay updated on FXTM’s latest promotions?

You can stay current on FXTM’s promotions by subscribing to their newsletter or frequently visiting their website.

FXTM Affiliate Program

Emirati traders can earn up to $600 per qualified trader through FXTM’s Affiliate Program. Emirati traders who want to participate in the program must fill out a registration form and choose a banner to display on their website.

Emirati traders who place the banner can drive traffic to FXTM and earn commissions for each qualified trader. The program is free to join, and Emirati traders can participate in as many Affiliate/IB programs as they want.

FXTM’s Affiliate Program includes a variety of benefits, such as high pay-outs, detailed reporting, and cutting-edge marketing tools. Furthermore, the program also gives you access to various marketing tools, such as banners, landing pages, and widgets.

FXTM requires Affiliates to act in good faith at all times and not make any false or misleading representations or statements about FXTM Partners, the Affiliate Program, FXTM Products, or the Services provided to ensure that the program is fair and transparent.

Furthermore, at the request of FXTM Partners or FXTM, Affiliates must provide details and evidence of their status and business and the licensing and authorization requirements applicable to their activities.

How to open an Affiliate Account with FXTM

To register an Affiliate Account, Emirati traders can follow these steps:

- ✅ Register on the FXTM Affiliates page with the required personal and contact details. Accept the terms and conditions to continue.

- ✅ Access the affiliate dashboard to select promotional banners that best suit the content and audience of your platform.

- ✅ Incorporate the banner’s code into a strategic location on your website so that it is easily accessible to visitors.

- ✅ Utilize diverse marketing techniques, such as SEO, content creation, and social media, to direct traffic from your platform to FXTM’s website.

- ✅ Earn up to $600 per qualified trader that you refer to FXTM via your affiliate link.

What is the commission structure for FXTM affiliates?

FXTM offers a CPA program for active traders who qualify and progressive refunds for Introducers.

How often do FXTM affiliates get paid?

The frequency of affiliate payments may vary but is typically monthly.

Can I refer clients to FXTM from any country?

Yes, you can refer clients from most countries, but there may be certain geographic restrictions.

Can FXTM affiliates earn commissions on trades made by their referrals?

Yes, affiliates continue to earn commissions for each Qualified Active Trader following the conclusion of the Qualification Period.

FXTM Minimum Deposit

| 🔎 Live Account | 💴 Minimum Dep. |

| 🥇 Micro | 37 AED / $10 |

| 🥈 Advantage | 1,800 AED / $500 |

| 🥉 Advantage Plus | 1,800 AED / $500 |

How quickly are funds available after making the minimum deposit with FXTM?

The availability of funds following a deposit varies by payment method but is typically prompt.

Is the FXTM minimum deposit refundable?

No, the minimum deposit is not a fee; it represents your trading capital and will remain in your account until you withdraw it.

FXTM Account Types and Features

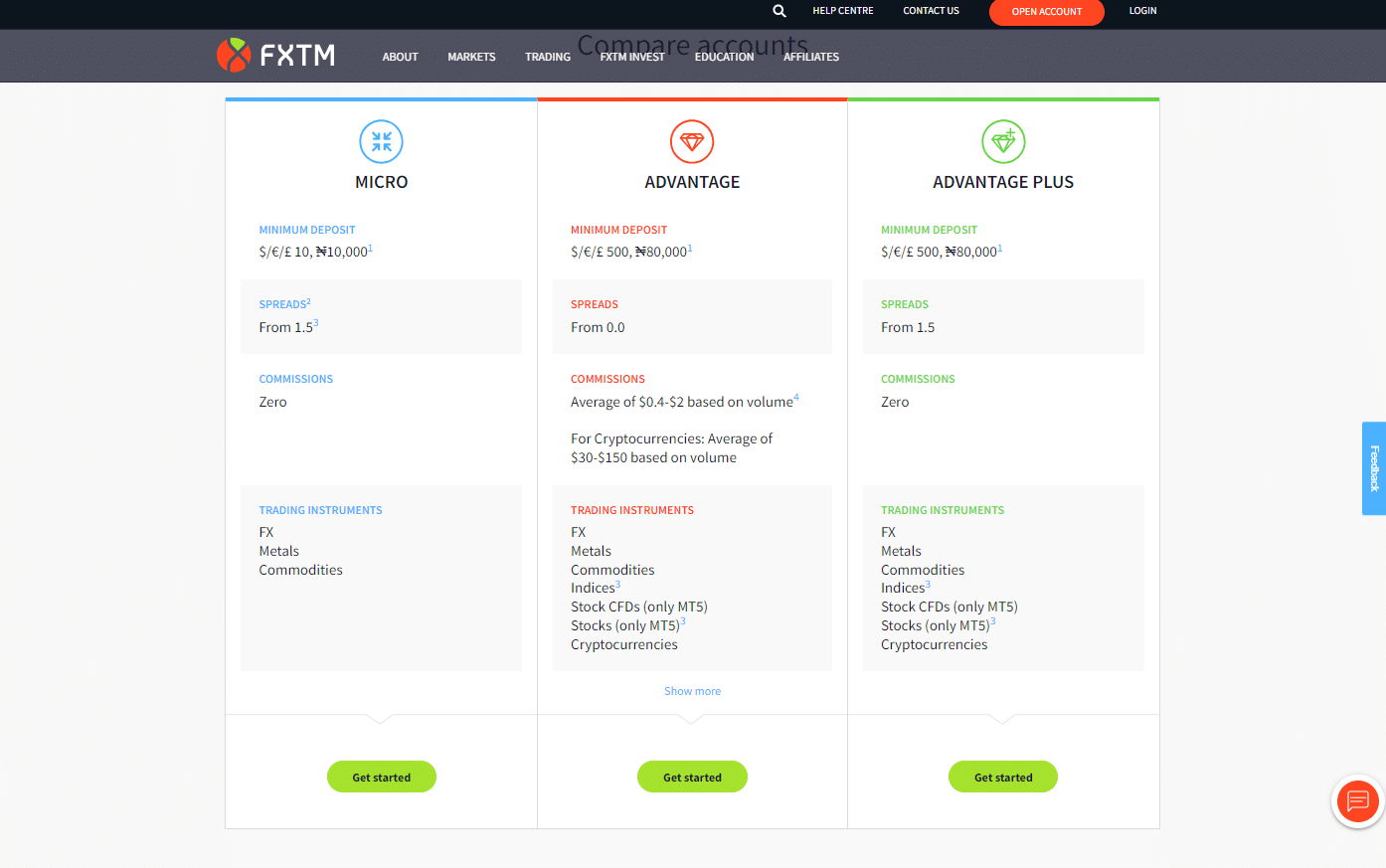

| 🔎 Live Account | 💴 Minimum Dep. | 📈 Average Spread | 💵 Commissions | 💶 Average Trading Cost |

| 🥇 Micro | $10 | 1.5 pips | None | 15 USD |

| 🥈 Advantage | $500 | 0.0 pips | $0.4 to $2 | 6 USD |

| 🥉 Advantage Plus | $500 | 1.5 pips | None | 15 USD |

FXTM Micro Account

For traders who want to gain experience without taking big financial risks, FXTM offers a Micro Account. Traders can access several markets, including forex, metals, commodities, and indices, with just a minimum deposit of 37 AED ($10).

Although advanced traders also use this account to test new tactics, new traders tend to favor it. It offers leverage up to 1:1000 for forex and 1:500 for metals, and it supports the MetaTrader 4 and FXTM Trader platforms.

Additionally, the account offers an Islamic option and has no commission fees. Here is a comprehensive breakdown of the Micro Account features:

| 🔎 Account Feature | ☑️ Value |

| 💴 Minimum Deposit Required | 37 AED ($10) |

| 📈 Average Spreads | Floating from 1.5 pips EUR/USD |

| 📉 Trading Instruments available | Forex Metals Commodities Indices Forex Indices Stock Baskets |

| 📊 Commission charges | None |

| 🖥️ Platforms Supported | MetaTrader 4 FXTM Trader |

| 🪙 Base Account Currency | US Cent, EU Cent, GBP Pence, or Nigerian kobo |

| 💹 Leverage and Margin | Forex – from 1:3 to a maximum of 1:1000 (Fixed) Metals – up to a maximum of 1:500 (Fixed) |

| 💻 Order Execution | Instant Execution |

| 📈 Margin Call (%) | 60% |

| ⛔ Stop-Out Level (%) | 40% |

| ☪️ Islamic Account Option | Yes |

| ❌ Limit and Stop Levels | 1 spread |

| 💱 Quote Decimals on Forex and Special Metals | Forex: 5 decimals (3 on JPY pairs) Metals: 2 decimals for XAU/USD, 3 decimals for XAG/USD |

| 🖇️ Minimum Volume per trade (lots) | 0.01 lots |

| 📈 Maximum Orders | 300 lots |

| 📉 Maximum Volume per Order | 10 lots |

| 📊 Maximum Volume in lots per order | 3,000 lots |

| 📊 Maximum Pending Orders | 100 lots |

FXTM Advantage Account

FXTM’s Advantage Account is the most popular product, with a minimum deposit of 1,800 AED ($500). It has some of the best pricing in the industry, with zero spreads on major currency pairs like EUR/USD and USD/JPY.

This account includes commission-free stock trading on the MT5 platform and various trading instruments. Leverage can be increased to 1:2000, and an Islamic option is available.

| 🔎 Account Feature | 📌 Value |

| 💴 Minimum Deposit Required | 1,800 AED ($500) |

| 📈 Average Spreads | From 0.0 pips EUR/USD |

| 📉 Trading Instruments available | Forex Precious Metals Commodities Indices Forex Indices Stock Baskets Stock CFDs on MetaTrader 5 Individual Stocks on MetaTrader 5 |

| 📊 Commission charges | An average between $0.40 and $2, according to the trading volume |

| 💻 Platforms Supported | MetaTrader 4 MetaTrader 5 FXTM Trader |

| 💵 Base Account Currency | USD, EUR, GBP, or NGN |

| 💹 Leverage and Margin | Up to 1:2000 (floating) |

| 📌 Order Execution | Market Execution |

| 📍 Margin Call (%) | 80% |

| ⛔ Stop-Out Level (%) | 50% |

| ☪️ Islamic Account Option | ✅Yes |

| ❌ Limit and Stop Levels | None |

| ▶️ Minimum Volume per trade (lots) | 0.01 lots |

| ⏩ Maximum Orders | Unlimited |

| 📈 Maximum Volume per Order | 100 lots |

| 📉 Maximum Volume in lots per order | Unlimited |

| 📊 Maximum Pending Orders | 300 lots |

FXTM Advantage Plus Account

The Advantage Plus Account, like the Advantage Account, allows for commission-free trading but has wider spreads starting at 1.5 on EUR/USD. This account is better suited for experienced traders who prefer not to pay commissions.

The Advantage Plus Account also requires a minimum deposit of 1,800 AED ($500) and offers leverage of up to 1:2000. There is also an Islamic account option.

| 🔎 Account Feature | 📌 Value |

| 💶 Minimum Deposit Required | 1,800 AED ($500) |

| 📈 Average Spreads | From 1.5 EUR/USD |

| 📉 Trading Instruments available | Forex Precious Metals Commodities Indices Forex Indices Stock Baskets Stock CFDs on MetaTrader 5 Individual Stocks on MetaTrader 5 |

| 📊 Commission charges | None |

| 💻 Platforms Supported | MetaTrader 4 MetaTrader 5 FXTM trader |

| 💷 Base Account Currency | USD, EUR, GBP, or NGN |

| 💹 Leverage and Margin | Up to 1:2000 (Floating) |

| ▶️ Order Execution | Market Execution |

| ⏩ Margin Call (%) | 80% |

| ⛔ Stop-Out Level (%) | 50% |

| ☪️ Islamic Account Option | ✅Yes |

| ❌ Limit and Stop Levels | None |

| 💱 Quote Decimals on Forex and Special Metals | Forex: 5 decimals (3 on JPY pairs) Metals: 2 decimals for XAU/USD, 3 decimals for XAG/USD |

| 📈 Minimum Volume per trade (lots) | 0.01 lots |

| 📉 Maximum Orders | Unlimited |

| 📊 Maximum Volume per Order | 100 lots |

| 📌 Maximum Volume in lots per order | Unlimited |

| 📍 Maximum Pending Orders | 300 lots |

FXTM Demo Account

The FXTM Demo Account is a valuable tool for traders, providing a thorough and risk-free simulation of a live trading environment. One of its distinguishing features is the 30-day trial period, which allows traders to become acquainted with the platform’s functionalities and explore various markets.

This extended trial period is especially beneficial for novice traders who are new to the financial markets and experienced traders who want to test new strategies without putting their money at risk.

The demo account is more than just a stripped-down version of the live platform; it also allows full customization. This feature enables traders to customize their trading environment to closely resemble real-world market conditions, enhancing their readiness for live trading.

Furthermore, the demo account gives you access to various markets and assets, such as forex, commodities, indices, and stocks. This broad access allows traders to gain insights into how different markets interact, which can be critical for making informed trading decisions.

Another notable feature of the FXTM demo account is its support for Expert Advisors (EAs). EAs are automated trading systems that carry out trades according to predefined rules.

The demo account enables traders to test these EAs in a risk-free environment, providing an invaluable opportunity to evaluate their effectiveness before deploying them in a live trading environment.

FXTM Islamic Account

The Islamic Account at FXTM is intended to meet the specific needs of traders who wish to adhere to Islamic financial principles. These principles forbid accruing or paying interest (Riba) and engaging in excessively speculative or risky transactions (Gharar).

The Islamic Account at FXTM ensures that traders do not earn or pay interest on leveraged positions per the Riba prohibition.

The Islamic Account may use alternative structures rather than interest to comply with Islamic law. Furthermore, investments are carefully chosen to avoid sectors considered haram or forbidden by Islamic principles.

Furthermore, these industries include alcoholic beverages, gambling, pork, and weapons. One of the key benefits of FXTM’s Islamic Account is that it is available for all account types, including Micro, Advantage, and Advantage Plus.

This flexibility enables traders to select the account that best suits their trading style while adhering to Islamic law. However, it is important to note that spreads may be wider, and additional fees may be incurred to comply with Islamic financial principles.

FXTM Account Types and Features – Pros and Cons

| ✅ Pros | ❎ Cons |

| FXTM has a Micro Account with a low minimum deposit and smaller position sizes, making it a safe option for beginners | The FXTM demo account is only valid for a month after registration |

| FXTM has negative balance protection on all retail trading accounts | AED is not an accepted account base currency |

| Traders can use leverage of up to 1:2000 | Micro Account holders have limited access to FXTM’s range of tradable instruments |

Do all FXTM account types have access to all trading instruments?

No, FXTM’s account types can access different financial instruments that can be traded.

Are Islamic accounts available with FXTM?

Yes, FXTM offers Shariah-compliant Islamic accounts.

FXTM Base Account Currencies and Basic Order Types

The base account currencies available to Emiratis include the following:

- ✅ USD

- ✅ EUR

- ✅ GBP

- ✅ NGN

FXTM Basic Order Types include:

- ✅ A market order can be either a buy or a sell order that executes at the current market price. This is the current price displayed on your price chart. If you place a market order, you will be immediately entered at the best available price.

- ✅ Market orders are most effective when a trading opportunity requires prompt action. Click buy/sell at the market to enter the trade immediately.

- ✅ A stop order can be either a buy or sell stop, depending on whether you wish to purchase above or below the market.

- ✅ This is useful for trading breakouts or trend continuation strategies when you want the market to continue moving in the same direction.

Alternatively, if you believe the price will reverse when it reaches a certain price, you can place a limit order.

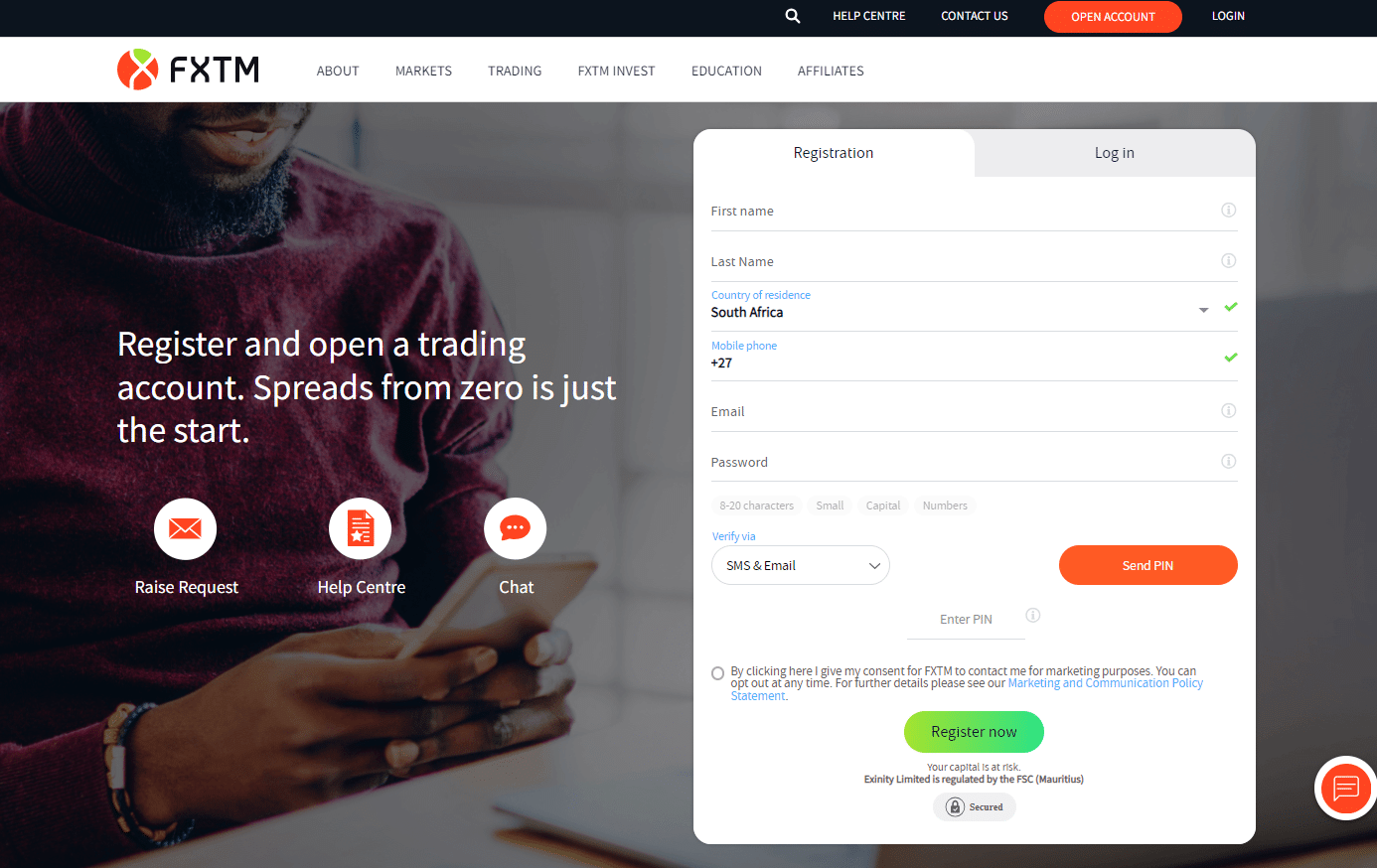

How to Open and Close an FXTM Account

To open an account with FXTM, Emiratis can follow these steps:

- ✅ To start opening an account, go to the official FXTM website.

- ✅ Click the “Open Account” or “Register” button.

- ✅ Enter your name, email address, and phone number in the requested fields for personal information.

- ✅ Select whether you want to open a Micro, Advantage, Advantage Plus, or Islamic Account.

- ✅ From the available options, choose your preferred base account currency. For Emiratis, these include USD, EUR, GBP, and NGN.

- ✅ Upload scanned copies of identification documents, like a passport or national ID, and evidence of residency, like a utility bill or bank statement, for identification verification.

- ✅ Respond to a short questionnaire that evaluates your financial literacy and trading experience. This is a legal requirement to ensure the services you offer are appropriate.

- ✅ Double-check your application’s details to ensure accuracy, then hit “confirm” to finish.

- ✅ An email will be sent to you as verification. To verify your account, click the link in the email.

- ✅ You will receive an email confirming your account is active once your documents and information are reviewed and approved.

- ✅ Sign in to your brand-new FXTM account and go to the deposit tab to deposit money. Select your preferred deposit method to fund your account and adhere to the instructions.

Download the MetaTrader 4 or MetaTrader 5 trading platform appropriate for your account type. You can start trading after the funds have been deposited and the trading platform has been set up.

To close a live trading account with FXTM, Emirati traders can follow these steps:

- ✅ You can log in to your FXTM account by visiting the official website.

- ✅ Before closing the account, ensure all funds have been transferred from your trading account to your bank account or through alternative withdrawal methods.

- ✅ Close any open positions to avoid financial inconsistencies after the account is closed.

- ✅ Contact FXTM’s customer service to let them know you want to close the account. Arabic is among the languages in which customer service is offered.

- ✅ Depending on FXTM’s policies, you might be required to deliver a formal request or finish an account closure form.

- ✅ Wait for a confirmation from FXTM that they have received your request after submitting the required paperwork.

- ✅ FXTM will examine your account to ensure all payments have been made, including paying off any fees or negative balances.

- ✅ After the review, a final confirmation email informing you that your account has been successfully closed will be sent to you.

For your records, it is recommended that you keep all email correspondence and documents related to the account closure. After confirming your account has been closed, you can remove the trading platform app from your devices.

Is there an option for a joint account with FXTM?

No, FXTM does not offer joint accounts at this time.

Can I open an account through FXTM Trader?

Yes, you can create an FXTM account via the mobile application.

Can I reopen a closed FXTM account?

Yes, you can reopen a closed account but must undergo the verification process again.

Is account closure permanent with FXTM?

Yes, the closure of your account is permanent unless you go through the steps to reopen it.

FXTM Trading Platforms

FXTM offers Emirati traders a choice between these trading platforms:

- ✅ MetaTrader 4

- ✅ MetaTrader 5

- ✅ FXTM Trader

FXTM MetaTrader 4

MetaTrader 4 (MT4) is a potent platform renowned for its intuitive design, sophisticated charting features, and a wealth of technical indicators.

Emirati traders can use Expert Advisors (EAs) for automated trading strategies and access various markets and instruments through MT4.

All forex traders can use MT4, which gives them access to numerous currency pairs or Forex CFDs from a single platform. The Multi Account Manager (MAM) and VPS trading features of MT4 are also available to Emirati traders.

FXTM MetaTrader 5

In addition to MT4, MetaTrader 5 (MT5) gives Emirati traders access to a wider range of financial markets, including forex, commodities, CFDs, indices, and stocks. Additional timeframes, different order types, and an integrated economic calendar are all features of MT5.

MT5 can connect to more markets (over 500) and a larger geographic range than MT4. Additionally, Emirati traders can use the MQL5.community chat feature built into MT5.

FXTM Trader

The exclusive mobile trading app, FXTM Trader, offers traders in the Emirate unrivaled convenience.

This easy-to-use app gives users access to real-time price updates, a wide range of trading tools, and the ability to manage positions, keep track of market trends, and leverage charts and technical analysis tools right from their hands. FXTM Trader also allows Emirati traders to view trading histories, deposit and withdraw money and access educational resources.

FXTM Trading Platforms Pros and Cons

| ✅ Pros | ❎ Cons |

| FXTM’s MT4 and MT5 are suitable for all types of traders and allow all trading strategies | FXTM MT4 has a poor and dated design |

| With MT5, Emiratis can execute, manage and monitor their trades across devices | FXTM MT5 does not have facial recognition or order confirmation |

| FXTM’s MT5 connects traders to a large range of markets | FXTM Trader does not have 2FA |

Do all FXTM platforms offer advanced charting tools?

Yes, MetaTrader platforms from FXTM include advanced charting tools and technical indicators.

Is one-click trading available with FXTM?

Yes, one-click trading is available on the MetaTrader platforms offered by FXTM.

Which Markets Can You Trade with FXTM?

Emirati traders can expect the following range of markets from FXTM:

- ✅ Forex

- ✅ Forex Indices

- ✅ Spot Metals

- ✅ CFD Kenya Stocks

- ✅ Kenya Stocks

- ✅ CFD US Stocks

- ✅ US Stocks

- ✅ Hong Kong Stocks

- ✅ CFD EU Stocks

- ✅ Spot Commodities

- ✅ Spot Indices

- ✅ Stock Baskets

- ✅ Cryptocurrency CFDs

Financial Instruments and Leverage offered by FXTM

| 🔎 Instrument | 🅰️ Number of Assets Offered | 🅱️ Max Leverage Offered |

| 📈 Forex | 60 | 1:25 – 1:2000 |

| 📉 Forex Indices | 6 | 1:25 – 1:500 |

| 📊 Spot Metals | 5 | 1:25 – 1:2000 |

| 💹 CFD Kenya Stocks | 17 | N/A |

| 📈 Kenya Stocks | 17 | N/A |

| 📉 CFD US Stocks | 764 | 1:500 |

| 📊 US Stocks | 647 | N/A |

| 💹 Hong Kong Stocks | 626 | N/A |

| 📈 CFD EU Stocks | 50 | 1:500 |

| 📉 Spot Commodities | 3 | 1:25 – 1:500 |

| 📊 Spot Indices | 17 | 1:25 – 1:500 |

| 💹 Stock Baskets | 5 | N/A |

| 📈 Cryptocurrency CFDs | 11 | 1:100 |

Broker Comparison for a Range of Markets

| 🔎 Broker | 🥇 FXTM | 🥈 Yadix | 🥉 LiteFinance |

| 📈 Forex | ✅Yes | ✅Yes | ✅Yes |

| 💎 Precious Metals | ✅Yes | ✅Yes | ✅Yes |

| 📉 ETFs | None | None | None |

| 📊 CFDs | ✅Yes | ✅Yes | ✅Yes |

| 💹 Indices | ✅Yes | ✅Yes | ✅Yes |

| 🏦 Stocks | ✅Yes | None | ✅Yes |

| 🪙 Cryptocurrency | ✅Yes | None | None |

| 📌 Options | None | None | None |

| 💡 Energies | ✅Yes | ✅Yes | ✅Yes |

| 📍 Bonds | None | None | None |

FXTM Range of Markets – Pros and Cons

| ✅ Pros | ❎ Cons |

| FXTM’s range of market spans across forex, commodities, Kenyan stocks, CFDs on Indices, Spot Indices, Crypto CFDs, and more | While FXTM’s range of markets is impressive, there are only 250 instruments, fewer than most competitors |

| Traders can use MT4 and MT5 to trade instruments across all financial markets | The CFD fees with FXTM can be extremely expensive |

| Leverage of up to 1:2000 allows traders to open larger positions | High leverage can increase the risk of total loss of capital |

Is social trading considered a separate market on FXTM?

No, social trading is a feature, not a separate market, that enables you to copy trades from other markets, such as forex and commodities.

Are there any markets that FXTM plans to add in the future?

FXTM does not publicly disclose the markets that will be added to the platform in the future.

FXTM Fees, Spreads, and Commissions

FXTM Spreads

Spreads at FXTM are based on some variables, including the type of account, the particular financial instrument being traded, and the current state of the market. For example, the Advantage Account offers spreads from as low as 0.0 pips for the same currency pair, while the Micro Account offers average spreads starting from 1.5 pips for EUR/USD.

For EUR/USD, the Advantage Plus Account also begins at 1.5 pip. Other financial instruments, including stocks, precious metals, and forex indices, among others, have a wide range of spreads.

FXTM Commissions

The Advantage Account at FXTM provides traders with the tightest spreads, also known as zero pip spreads, thanks to specialized commission fees. Depending on the trader’s overall trading activity, the commission rates for this account type can range from $0.40 to $2 per transaction.

FXTM Overnight Fees

Overnight Fees For positions left open throughout the night, FXTM charges overnight fees, also called swap fees. The kind of trading instrument, the size of the position, and how long the position is held all impact these fees. Due to the fees’ transparency, traders can understand the costs involved in holding positions open for a long time.

FXTM Deposit and Withdrawal Fees

FXTM does not charge any fees for deposits. There are, however, withdrawal fees, and they change depending on the method. For instance, FasaPay charges 0.5%, African Local Solutions charges 1 USD for withdrawals, and bank wire transfers cost 30 EUR.

In addition to these fees, withdrawals made using a credit or debit card will cost you 3 USD, 2 EUR, or 2 GBP.

FXTM Inactivity Fees

A $5 monthly inactivity fee is applied to inactive accounts for longer than six months. This is a crucial factor to consider for traders who might not be actively trading for a long time.

FXTM Currency Conversion Fees

Currency Conversion Fees Emirati traders may be charged currency conversion fees when making deposits or withdrawals in AED. For those who prefer to conduct business in their home currency, it is imperative to take these fees into account.

Pros and Cons – FXTM Trading and Non-Trading Fees

| ✅ Pros | ❎ Cons |

| The FXTM Advantage account has zero-pip spreads | FXTM’s variable spreads can widen significantly according to market conditions |

| FXTM is extremely transparent about its trading fees | There are swap fees charged |

| FXTM charges flexible commissions on the Advantage Account | A monthly inactivity fee applies when an account becomes dormant |

| There are no deposit fees, which makes FXTM cost-effective when Emiratis fund their accounts | FXTM applies withdrawal fees on several payment methods |

| There is an Islamic Account exempting Muslim traders from overnight fees | Some financial instruments have extremely wide spreads |

| FXTM accepts a few currencies as the account base currency | Deposits in AED could be subject to currency conversion fees |

Are deposit and withdrawal fees applicable with FXTM?

FXTM does not charge fees for deposits, but fees apply for withdrawals depending on the method used.

Does FXTM charge inactivity fees?

Yes, FXTM charges an inactivity fee after a specified period of inactivity.

FXTM Deposits and Withdrawals

To deposit funds to an account with FXTM, Emirati traders can follow these steps:

- ✅ By logging in through the official website or trading platform, you can access your FXTM account.

- ✅ Go to the “Deposit” section.

- ✅ From the list of options, select the deposit method you prefer, such as a credit/debit card, a bank wire transfer, or an e-wallet like FasaPay.

- ✅ Enter the desired deposit amount. Make sure it satisfies the minimal deposit standards for the account type you are using.

- ✅ Examine all the information, including potential fees, and verify the transaction.

- ✅ Complete the transaction by following the on-screen instructions. This may require you to confirm your identity or the transaction by entering a secure code sent to your email or mobile device.

You will receive a confirmation email or notification once the deposit has been successfully processed. To withdraw funds from an account with FXTM, Emirati traders can follow these steps:

- ✅ Log in to the official website or trading platform to access your FXTM account.

- ✅ Navigate to the ‘Withdrawal’ section under the ‘Funds Management’ or ‘Banking’ tab.

- ✅ From the available options, select your preferred withdrawal method.

- ✅ Enter the amount you want to withdraw, ensuring it is within the FXTM limits for your account type.

- ✅ Review all the details, including applicable fees, and confirm the withdrawal.

- ✅ Complete the transaction by completing any additional steps, such as identity verification.

Once the withdrawal has been successfully processed, you will receive a confirmation email or notification.

How long do FXTM Deposits take?

Depending on the deposit method used, a deposit can take a while to appear in your FXTM account. Deposits using a credit/debit card or an e-wallet typically happen instantly, but bank wire transfers can take one to five business days.

Do I need to verify my FXTM account before making a deposit?

Yes, account verification is required before making a deposit.

Can I make multiple deposits with FXTM at once?

Yes, you can. Multiple deposits are permitted, but each will be processed separately.

How long do FXTM Withdrawals take?

Withdrawals from e-wallets are typically processed within 24 hours, whereas credit/debit card withdrawals may take up to 5 business days. In contrast, bank wire transfers can take one to five business days.

What is the first step to initiate a withdrawal from FXTM?

To initiate a withdrawal, log into your FXTM account and visit the withdrawal section.

Do I need to provide any documents for withdrawal?

Yes, you might. Withdrawals may require additional verification documents, especially for large sums.

FXTM Education and Research

Education

FXTM offers the following Educational Materials to Emirati traders:

- ✅Forex trading guides

- ✅Forex trading strategies

- ✅eBooks

- ✅Forex Glossary

- ✅Educational Videos

and more!

FXTM also offers Emirati traders the following additional Research and Trading Tools:

- ✅Daily Market Analysis

- ✅Podcasts

- ✅Economic Calendar

- ✅Forex Market News Timeline

and more!

Research and Trading Tool Comparison

| 🔑Broker | 🥇FXTM | 🥈Yadix | 🥉LiteFinance |

| 📝Economic Calendar | ✅Yes | None | ✅Yes |

| 💹VPS | ✅Yes | ✅Yes | ✅Yes |

| 🗂️AutoChartist | None | None | None |

| 👁️Trading View | None | None | None |

| 📍Trading Central | None | None | None |

| 📈Market Analysis | ✅Yes | None | ✅Yes |

| 🗞️News Feed | ✅Yes | None | ✅Yes |

| 🖥️Blog | ✅Yes | None | ✅Yes |

Pros and Cons FXTM Education and Research

✅Pros ❎Cons

FXTM provides educational materials FXTM’s education and product offerings are lacking

FXTM offers trading ideas, quality news flow, and user-friendly interfaces for research Price alerts and two-step login are missing from some FXTM trading platforms

Does FXTM offer educational resources for beginners?

Yes, FXTM offers educational materials for traders of all skill levels, including beginners.

Is one-on-one training available with FXTM?

No, FXTM does not offer one-on-one training.

FXTM Customer Support

| 🔑Customer Support | 🥇FXTM Customer Support |

| ⏰Operating Hours | 24/5 |

| 🌎Support Languages | Multilingual |

| 🔊Live Chat | Yes |

| 💻Email Address | Yes |

| ☎️Telephonic Support | Yes |

| 🏆The overall quality of FXTM Support | 4/5 |

Pros and Cons FXTM Customer Support

| ✅Pros | ❎Cons |

| In many languages, FXTM’s customer service is helpful and reliable, providing fast and relevant answers | There are a few negative user reviews regarding FXTM’s customer support |

| 24/5 multilingual customer support is available via phone, email, and live chat on its website or via WhatsApp, Telegram, or Messenger | Customer support only operates during the week |

What channels are available for FXTM’s customer support?

FXTM provides multiple support channels, including live chat, email, and phone.

Is FXTM’s customer support available 24/7?

No, FXTM offers customer service 24 hours a day, five days a week.

FXTM VPS Review

FXTM’s Virtual Private Server (VPS) is a comprehensive digital platform that provides secure and flexible trading conditions for forex traders.

The server can be tailored to accommodate individual requirements and maintains a constant internet connection, facilitating more stable trading experiences, especially during periods of market volatility.

To use FXTM’s VPS service, authorization from the network administrators is requisite. Upon approval, users have a unique username and password, allowing a remote desktop client connection through the server’s IP address.

Once this connection is established on a laptop or personal computer of the user’s choosing, they gain access to a specialized virtual workspace with interactive tools akin to those found on physical laptops or PCs. This enables a seamless transition back to preferred trading interfaces without any hindrances.

Is the VPS service compatible with Expert Advisors (EAs)?

Yes, the VPS service is fully compatible with Expert Advisors for automated trading applications.

What are the technical specifications of FXTM’s VPS?

Unfortunately, FXTM does not publicly disclose the VPS service’s technical specifications.

FXTM Cashback Rebates Features and Conditions

FXTM’s cashback rebate system is designed to enhance the trading experience for those engaged in Forex transactions and those utilizing Micro, Advantage, or Advantage Plus Accounts.

This system allows traders to benefit from a 25% commission discount on trades or receive $5 per traded lot. Consequently, traders are assured of reduced fees irrespective of the trade outcome.

In addition, FXTM collaborates with affiliate partners, offering them the potential to earn up to an 80% commission rate.

This is facilitated through a meticulously designed systems plan to minimize transaction costs, maximizing profitability and ensuring exceptional returns at minimal expense.

Does FXTM offer cashback rebates?

Yes, FXTM offers a cashback rebate program for Emirati traders.

Can I combine FXTM cashback rebates with other promotions?

No, combining cashback rebates with other promotions might not be permitted.

FXTM Web Traffic Report

| 🌎Global Rank | 45,932 |

| 🌐Country Rank | 806 |

| 📊Category Rank | 506 |

| 📌Total Visits | 1.4 million |

| 📈Bounce Rate | 54.54% |

| 📖Pages per Visit | 3.14 |

| ⏱️Average Duration of Visit | 00:02:35 |

| 🔎Total Visits in the last three months | June – 1.2 million July – 1.6 million August – 1.4 million |

FXTM Geographic Reach and Limitations

FXTM Current Expansion Focus

FXTM focuses on markets with regulated entities in Europe, Africa, Asia, and the United Kingdom.

Countries not accepted by FXTM

FXTM does not provide service to the following areas:

- ✅The United States

- ✅Canada

- ✅Japan

- ✅Mauritius

- ✅Haiti

- ✅Suriname

- ✅The Democratic Republic of Korea

- ✅Puerto Rico

- ✅Brazil

- ✅The Occupied Area of Cyprus

- ✅Hong Kong

Popularity among Emirati traders who choose FXTM

FXTM is one of the Top 25 forex and CFD brokers in Dubai.

Is FXTM regulated in the European Union?

Yes, CySEC regulates FXTM, allowing them to operate within the European Union.

Is FXTM accessible in the Middle East?

Yes, FXTM is available in several Middle Eastern nations, including the United Arab Emirates.

Best Countries by Traders

| 🌎Country | 📈Market Share |

| 🥇Egypt | 13.92% |

| 🥈Kenya | 9.80% |

| 🥉India | 7.50% |

| 🏅United States | 6.45% |

| 🎖️Malaysia | 4.98% |

FXTM vs Yadix vs LiteFinance – A Comparison

| 🔑Broker | 🥇FXTM | 🥈Yadix | 🥉LiteFinance |

| 🖋️Regulation | CySEC, FSCA, FCA, CMA, FSC Mauritius | FSA | CySEC |

| 📈Trading Platform | MetaTrader 4 MetaTrader 5 FXTM Trader | MetaTrader 4 | MetaTrader 4 MetaTrader 5 cTrader LiteFinance Trading App |

| 💴Withdrawal Fee | ✅Yes | None | None |

| 🆓Demo Account | ✅Yes | ✅Yes | ✅Yes |

| ⬇️Min Deposit | 47 AED | 367 AED | 47 AED |

| 📌Leverage | 1:2000 | 1:500 | 1:500 |

| 📉Spread | 0.0 pips, Variable | From 0.0 pips | 0.0 pips |

| 💰Commissions | From $0.4 to $2 | From $5 per lot | $0.25 per share on Stock Indices |

| ⛔Margin Call/Stop-Out | 40% to 50% (M) 60% to 80% (S/O) | 100%/30% | 100%/20% |

| 📝Order Execution | Market, Instant | Market | Market |

| 💵No-Deposit Bonus | None | None | None |

| 🪙Cent Accounts | None | None | None |

| 📊Account Types | Micro Account Advantage Account Advantage Plus Account | Classic Account Scalper Account Pro Account | CENT CLASSIC ECN |

| 🗂️DFSA Regulation | None | None | None |

| 💶AED Deposits | None | ✅Yes | None |

| ✴️AED Account | None | None | None |

| ⏰Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 💷Retail Investor Accounts | 3 | 3 | 2 |

| ☪️Islamic Account | ✅Yes | ✅Yes | ✅Yes |

| ⬇️Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| ⬆️Maximum Trade Size | 100 lots | 1,000 lots | 100 lots |

| ⏱️Minimum Withdrawal Time | Instant up to 24 hours | Same-day | Instant |

| ⌚Maximum Estimated Withdrawal Time | Up to 5 working days | Same-day | Up to 5 working days |

| 💳Instant Deposits and Instant Withdrawals | ✅Yes instant deposits | Deposits | ✅Yes |

FXTM Alternatives

🥇 TMGM is a well-known trading platform providing diverse financial instruments such as forex, commodities, and indices. For Emirati traders, TMGM offers Islamic swap-free accounts that comply with Shariah law. The platform also has ultra-low spreads and a high leverage ratio, which can be especially useful for traders in the UAE looking for low-cost trading options.

🥈 IFC Markets is well-known for its one-of-a-kind offering of synthetic instruments via its Portfolio Quoting Method. This feature enables Emirati traders to design their own instruments, providing a level of customization uncommon in the industry. Furthermore, IFC Markets offers Islamic accounts, making it a good choice for traders in the UAE who follow Islamic finance principles.

🥉 Tickmill is a trading platform distinguished by its emphasis on transparency and trader education. It provides a variety of webinars, tutorials, and articles that may be useful to Emirati traders looking to broaden their knowledge base. Tickmill also provides Islamic accounts and has some of the lowest spreads in the industry, making it a cost-effective option for traders in the UAE.

FXTM Awards and Recognition

FXTM received the following recent awards and recognition:

- ✅The Best Educational Program in 2022 – World Financial Award.

- ✅The Most Trusted Forex Broker in 2022 – World Financial Award.

- ✅The Best Islamic Forex Account in 2022 – World Financial Award.

- ✅The Best Mobile App in 2022 – World Financial Award.

and more!

Our Experience with FXTM

FXTM stands out from other forex brokers by consistently providing a hassle-free trading environment.

The platform’s intuitive design immediately caught our attention during the sign-up process, and it has since proven useful for both novice and experienced traders alike.

FXTM’s commitment to enabling traders is further demonstrated by FXTM’s prominence of educational resources and tools. It’s also worth noting FXTM’s openness, particularly regarding fees and processes.

FXTM Trading Platform

Our interactions with FXTM taught us that multiple trading platforms are available, including MetaTrader 4 and MetaTrader 5.

The advanced charting functions, wide selection of technical analysis tools, and added convenience of automated trading with Expert Advisors (EAs) are hallmarks of these platforms.

In our experience, the FXTM Trader mobile app stands out because of how user-friendly it is and how well-suited it is for traders who are constantly traveling; this gives them a decisive advantage in today’s competitive market.

Quality of Customer Service

When testing FXTM’s customer support, we that the representatives to be speedy, helpful, and knowledgeable. They quickly responded to our inquiries, helped explain our various account options, and resolved technical issues.

Live chat, email, and phone support make contacting FXTM’s help desk easy. FXTM’s dedication to serving customers worldwide is reflected in the availability of assistance in multiple languages.

FXTM Response Time

| 🔑Support Channel | ⏰Average Response Time | ⏱️User-based Response Time |

| ☎️Phone | 5 minutes | 4 minutes |

| 24 hours | Same-day | |

| 🔊Live Chat | 5 – 10 minutes | 6 minutes |

| 📱Social Media | 5 – 10 minutes | 5 minutes |

| 👥Affiliate | 24 hours | Same-day |

Recommendations according to our in-depth review of FXTM

- ✅FXTM should consider enhancing its trading tools, such as its advanced charting capabilities, many technical indicators, and the ability to use Expert Advisors (EAs) for automated trading strategies. This can help Emirati traders execute, manage, and monitor trades more efficiently.

- ✅FXTM should reduce its CFD, inactivity, and withdrawal fees to make trading more cost-effective for Emirati traders. This can help attract more traders and improve customer satisfaction.

- ✅FXTM should continue to develop its educational materials, such as videos, tutorials, e-books, forex trading seminars, glossaries, beginner’s guides, trading strategies, educational videos, articles, and market analysis videos. This can assist Emirati traders in enhancing their skills and knowledge, allowing them to make more informed business decisions.

- ✅FXTM should improve its customer service so that traders receive prompt and competent responses to their inquiries. This can enhance the trading experience for Emirati traders.

Finally, FXTM should consider expanding its product offering to encompass additional trading assets and instruments. This can help to attract more traders and give Emirati traders more opportunities to diversify their portfolios.

FXTM Customer Reviews

🥇 Positive Experience.

So far, my experience with FXTM has been positive, encompassing registration, funding, and trading. The platform provides consistent account feedback daily, weekly, and monthly. Their attention to customer service is noteworthy. The availability of a cent account as an alternative to a demo account for learning to trade forex is especially beneficial. – Ameema Barada

🥈 Commendable Customer Service.

FXTM is a highly reputable online broker that provides favorable trading conditions and a diverse range of over 20 payment methods. The platform offers instant deposit and withdrawal services, and the customer service is efficient and courteous. Furthermore, FXTM’s copy trading service is among the best I’ve seen. – Shahd Alomari

🥉 Exceeded Expectations.

I started trading with FXTM three years ago, initially skeptical of the platform. FXTM, on the other hand, exceeded my expectations by providing quick transaction executions with no requotes or slippage. My only concern was a four-day delay in my initial withdrawal, which the support team eventually resolved. – Lamis Alsafi

Pros and Cons of Trading with FXTM

| ✅Pros | ❎Cons |

| Multiple awards give FXTM credibility and show its dedication to excellence | FXTM is regulated, but traders should still be cautious and comfortable with the oversight |

| Low commissions and tight spreads help traders maximize profits | Some users have reported withdrawal delays, which may concern traders who need their funds quickly |

| Demo accounts and copy trading make FXTM accessible to beginners | Multilingual customer support could be faster |

| FXTM offers many educational materials and market insights to help traders make decisions | FXTM is great for beginners but may lack advanced trading tools for professionals |

| FXTM’s pricing policy is transparent | Dubai regulations or FXTM policies may prohibit trading certain financial instruments |

In Conclusion

Based on our in-depth analysis of FXTM, we conclude that it is a multifaceted trading platform that serves a diverse clientele. FXTM’s variety of account options demonstrates its commitment to providing a customized trading environment, which we view as a significant advantage.

The educational arsenal at FXTM is not a supplementary feature but a fundamental component of their service, which we highly value.

However, the fee structure could be more transparent. Although the cashback rebate system is a commendable initiative, its complexity could hinder novice traders in the financial markets.

The technological offerings of the platform are robust, with MetaTrader 4 and MetaTrader 5 catering to novice and experienced traders. The FXTM Trader mobile app is a feature that stands out for us, as it provides the flexibility that modern traders require.

Customer service is an additional strength of FXTM. The multilingual support is a nod to their global reach, but we believe greater fee transparency would further enhance the user experience.

FXTM appears to be a well-rounded broker emphasizing empowering traders through education and technology. Even though areas could be improved, such as fee transparency, FXTM is a commendable option for traders at all stages of their trading journey.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Emirati investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Frequently Asked Questions

What trading accounts does FXTM offer for CFD trading?

FXTM offers a Micro, Advantage, and Advantage Plus Account.

What trading platforms does FXTM offer?

FXTM provides two popular trading platforms, MetaTrader 4 and MetaTrader 5, favored by traders of all experience levels worldwide. FXTM also provides a proprietary mobile trading application known as FXTM Trader.

How long does it take to withdraw from FXTM?

Some withdrawal methods are instant; others take a few days before funds are returned to traders.

Does FXTM have VIX 75?

Unfortunately, the Volatility index is not part of FXTM’s 250 financial instruments that can be traded.

Does FXTM offer market analysis?

Yes, FXTM provides weekly market updates in its Market Analysis Videos section on Tuesdays and Thursdays. Quarterly, FXTM also publishes a market forecast.

Does FXTM have Nasdaq 100?

Yes, FXTM has Nasdaq 100 as a spot and CFD index, with spreads from 0.0 pips.

Is FXTM Safe or a Scam?

FXTM is extremely safe. Not only does FXTM have a good reputation as a broker, but it has a long history of offering superior trading solutions to traders worldwide.

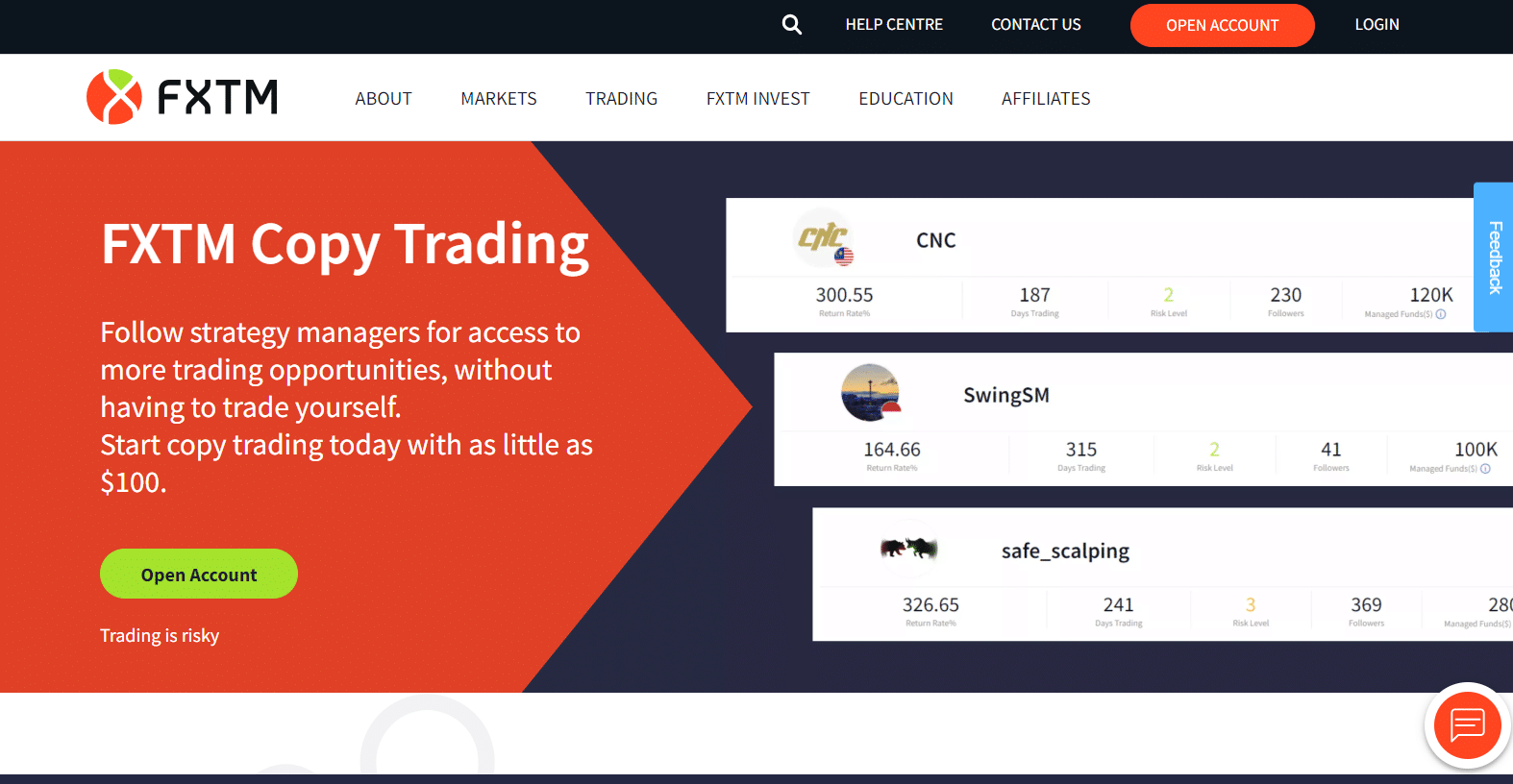

What is FXTM Invest?

FXTM Invest is a feature that enables you to copy and follow the trades of successful traders (Strategy Managers).

Is FXTM regulated?

Yes, FXTM has regulations in several regions worldwide, including the UK, Cyprus, South Africa, Kenya, and Mauritius.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai