CMTrading Review

Overall, CMTrading offers Emirati traders multiple trading solutions and vast educational materials. Emiratis can expect an easy withdrawal process using several flexible options. CMTrading Review shows that they provide fair trading conditions ideal for scalping and day trading forex strategies.

- Maryke Myburgh

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 1

Regulators

FSCA,FSA

Trading Platform

MT4, PandaTS, Webtrader

Crypto

Yes

Total Pairs

174+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overview

CMTrading is a renowned financial trading platform in the UAE, known for its commitment to ethical trading and customer support.

Furthermore, CMTrading offers a diverse trading environment, including tools for forex, cryptocurrencies, commodities, stocks, and indices.

The broker has adapted and innovated over the years, incorporating the MetaTrader 4 platform and its CopyKat system to cater to Dubai’s diverse population. They also offer different account types, such as Bronze, Silver, Gold, and Premium, to suit traders of all levels.

It has earned a high trust score among Emiratis and has expanded into many countries globally. They prioritize trustworthiness and customer empowerment, providing educational resources and services that prioritize customer needs.

CMTrading is now known for its competitive spreads and no commissions, attracting Emirati traders seeking access to global markets. Therefore, they are not just brokers but partners for UAE traders in achieving their financial goals in a global economy.

How can I contact CMTrading’s customer service?

Emirati traders can contact CMTrading’s customer support staff at any time via phone, email, or live chat, and they will respond quickly to any questions or issues.

Does CMTrading provide referral programs?

Yes, CMTrading offers referral schemes for Emirati traders, which allow users to earn benefits for bringing friends or acquaintances to the platform, therefore strengthening the trading community.

CMTrading At a Glance

| 🗓Established Year | 2012 |

| 🪪Regulation and Licenses | FSA, FSCA |

| 🌟Ease of Use Rating | 4/5 |

| 💰Bonuses | Yes, a referral program |

| ⏰Support Hours | 24/5 |

| 📊Trading Platforms | MetaTrader 4, CMTrading Web, CopyKat |

| 📈Account Types | Bronze, Silver, Gold, Premium |

| 💸Base Currencies | USD, EUR, GBP, ZAR |

| 📊Spreads | From 0.9 pips |

| 📈Leverage | 1:200 |

| 💳Currency Pairs | 50; Minor, Major, Exotic |

| 💰Minimum Deposit | 367 AED ($100) |

| 💸Inactivity Fee | Yes, $15 after 60 days of inactivity |

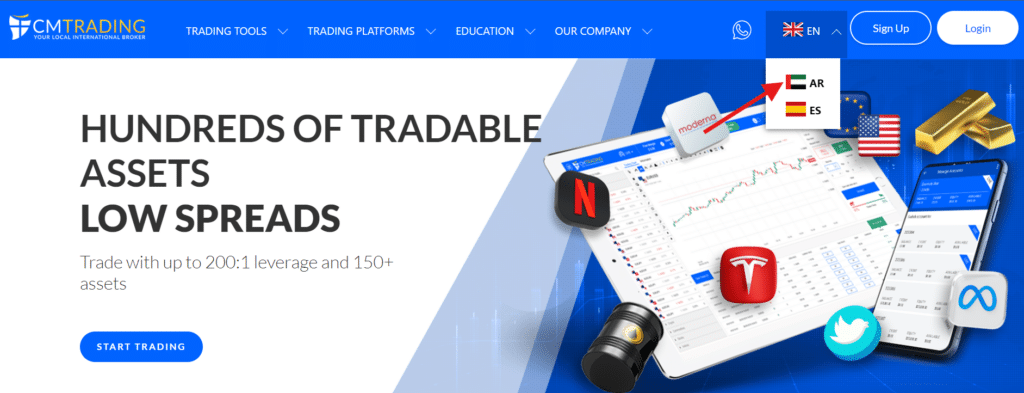

| 🗣Website Languages | English, Spanish, Arabic |

| ⚖️Fees and Commissions | Spreads from 0.9 pips, commission-free |

| 📚Affiliate Program | Yes |

| 🏛️Banned Countries | The United States, Hong Kong, Israel, EU regions |

| 💻Scalping | Yes |

| 🔎Hedging | Yes |

| ✴️Trading Instruments | Forex, Commodities, Indices, Stocks, Crypto CFDs |

| 👉 Open Account | 👉 Open Account |

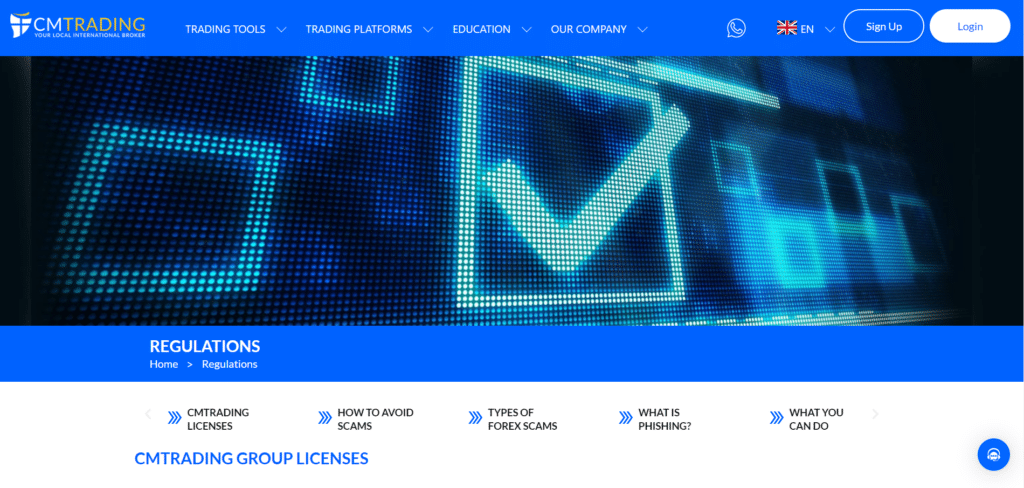

Regulation and Safety of Funds

Furthermore, CMTrading operates under the supervision of South African authorities like the Financial Sector Conduct Authority (FSCA) and the Financial Services Authority (FSA), ensuring their interests are protected.

CMTrading uses advanced encryption technology to protect sensitive information, such as personal data and financial transactions, from unauthorized access.

The broker also segregates client funds into separate accounts that are held with top-tier banks to ensure capital security and operational risk insulation.

Regulation in Dubai

CMTrading is not regulated by the Dubai Financial Services Authority (DFSA). However, CMTrading’s global regulations are listed in the table below.

| 🏛️Registered Entity | 🌎Country of Registration | 🪪Registration Number | ⚖️Regulatory Entity | 📊Tier | 🖺License Number/Ref |

| GCMT Limited T/a CMTrading | Seychelles | 8425982-1 | FSA | 3 | SD070 |

| Blackstone Marketing SA (PTY) LTD | Indonesia | 2013/045335/07 | FSCA | 2 | FSP 38782 |

| 🛡️Security Measure | 📜Information |

| Segregated Accounts | Yes |

| Compensation Fund Member | No |

| Compensation Amount | None |

| SSL Certificate | Yes |

| 2FA (Where Applicable) | Yes |

| Privacy Policy in Place | Yes |

| Risk Warning Provided | Yes |

| Negative Balance Protection | Yes |

| Guaranteed Stop-Loss Orders | No |

Awards and Recognition

According to our in-depth analysis of the CMTrading website, we found the following awards and recognition:

- CMTrading was named the Best Financial Broker in South Africa in 2024 by Global Business Review Magazine.

- Global Business Review Magazine awarded the broker as the Best Performing Financial Broker in Africa in 2024.

- In 2024, They received an award for being the “Most Trusted Forex Broker” in Africa.

- Brand Review Magazine recognized CMTrading as having the “Most Innovative Trading App in Africa” in 2024.

- The broker was awarded the “Best Financial Broker” in Nigeria for 2024 by the Global Review Magazine.

- It was recognized as the “Fasted Growing Financial Broker” in the Gulf Cooperation Council (GCC) by Global Business Review Magazine.

- CMTrading was named the “Best Partner Program” in GCC by Global Business Review Magazine.

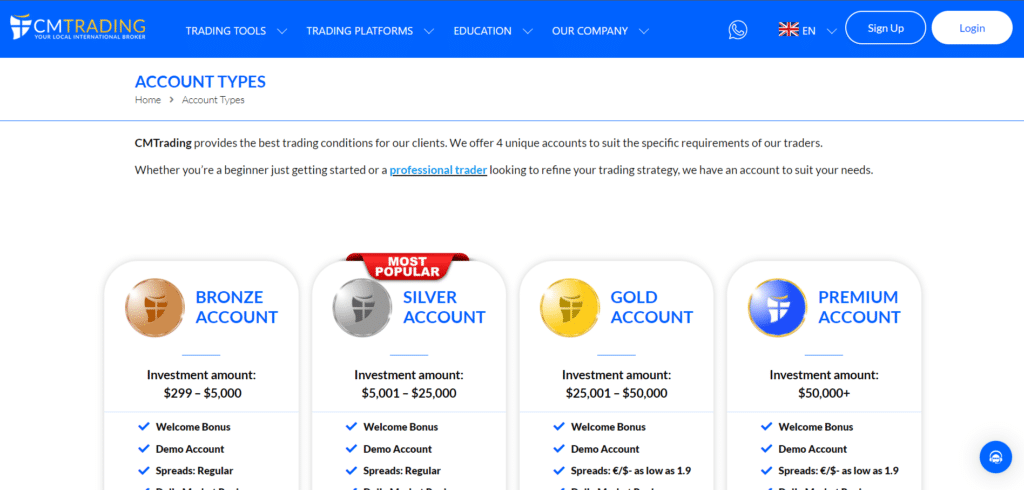

Account Types

| Bronze | Silver | Gold | Premium | |

| ⚖️Availability | All traders | All traders | All traders | All traders |

| 📈Markets | All | All | All | All |

| 💳Commissions | None; only the spread is charged | None; only the spread is charged | None; only the spread is charged | None; only the spread is charged |

| 💻Platforms | All | All | All | All |

| 📊Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 📈Leverage | 1:200 | 1:200 | 1:200 | 1:200 |

| 💰Minimum Deposit | 367 AED | 918 AED | 18,360 AED | 184,000 AED |

Bronze Account

The CMTrading Bronze Account is an affordable starting point for Emirati traders entering the financial markets. It requires a minimum deposit of 367 AED and offers educational resources like market reviews and webinar access.

The account also includes a demo feature for risk-free testing of strategies and adjusting to market dynamics. This reflects Their commitment to nurturing new traders by providing essential tools in a supportive environment.

Silver Account

The CMTrading Silver Account is designed for Emirati traders who have advanced beyond the initial stages of trading, offering a refined trading atmosphere with narrower spreads and expert trading signals.

Furthermore, the Silver Account requires a 918 AED deposit and bridges the gap between basic and advanced trading, providing enhanced services and tools to enhance trading strategies and outcomes.

Gold Account

The CMTrading Gold Account is a premium trading option for experienced Emirati traders. With an 18,360 AED minimum deposit, the Gold Account offers tighter spreads, value-added services like risk-free trades and cash-back rebates, and personalized support from a dedicated account manager.

Furthermore, this account recognizes the expertise and dedication of serious traders in Dubai who invest capital and market knowledge.

Premium Account

The CMTrading Premium Account is designed for Emirati traders with a minimum deposit of 184,000 AED. It offers competitive spreads, a specialized trading room, exclusive promotional offers, and strategic consultations with trading experts.

Furthermore, the Premium Account caters to the high-end market segment in Dubai, providing a sophisticated trading environment for serious investors to engage deeply with the markets.

Demo Account

The CMTrading Demo Account offers Emiratis a dynamic, flexible, and risk-free account that replicates the live trading environment.

Furthermore, this valuable tool provides unlimited virtual funds, letting Emiratis practice and refine their skills. In addition, the demo account reflects Their commitment to risk-free learning and ongoing trader development in Dubai.

Islamic Account

CMTrading offers an Islamic Account designed in line with Sharia law principles, allowing Emirati traders to participate in financial markets without interest.

This account, similar to conventional accounts, excludes trading in cryptocurrency and shares to comply with Islamic finance principles.

This Swap-Free trading option demonstrates their commitment to inclusivity and respect for diverse religious beliefs, allowing Emirati traders to engage in financial activities that align with their ethical and religious values.

Does CMTrading provide any bonuses for creating an account?

Yes, It has a referral program for Emirati traders, which lets users earn money for referring new clients to the platform, in addition to the account benefits.

Can I tailor my trading experience using CMTrading’s account types?

Yes, their account types let Emirati traders customize their trading experience by choosing features that match their interests and methods.

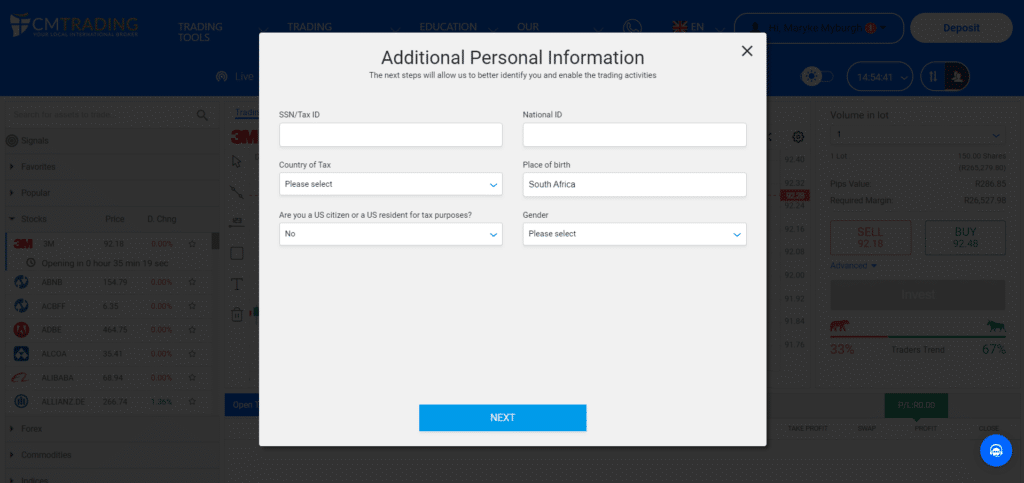

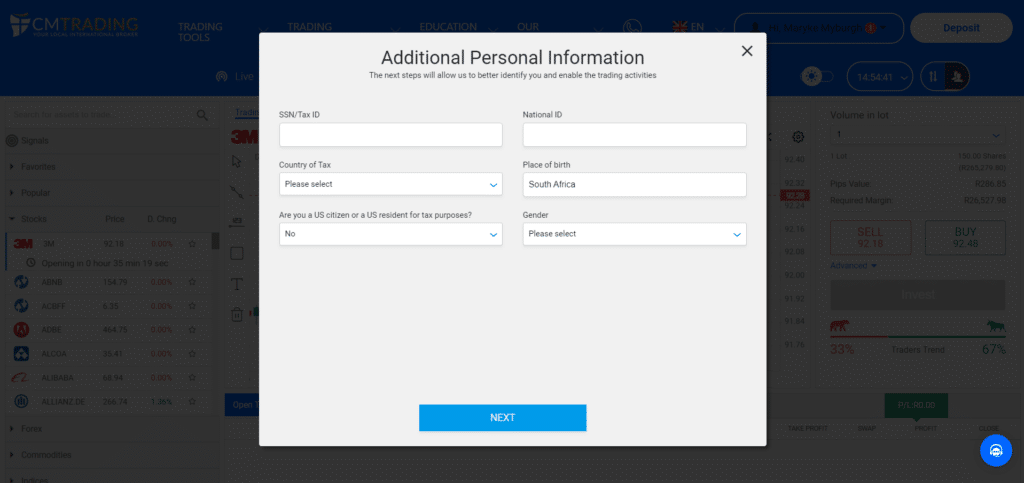

How To Open a CMTrading Account

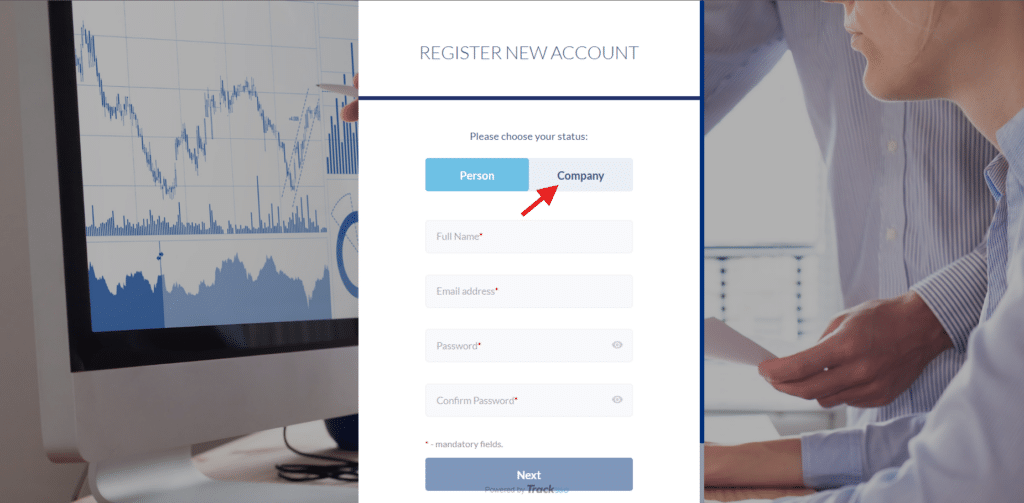

To register an account with CMTrading, follow these steps:

Go to the official CMTrading website and find the “Sign Up” option on the homepage. Click the “Sign Up” button and wait for the registration form to load.

Complete the information and choose the account type that suits your needs from the available options: Choose between Bronze, Silver, Gold, or Premium, based on your trading experience and financial objectives.

Complete the registration form by providing your personal information.Complete the Know Your Customer (KYC) process by submitting the necessary documents for identity verification. These include a government-issued ID (such as a passport or national ID card) and proof of residence (like a utility bill or bank statement).

Complete the registration form by providing your personal information. Complete the Know Your Customer (KYC) process by submitting the necessary documents for identity verification. These include a government-issued ID (such as a passport or national ID card) and proof of residence (like a utility bill or bank statement).

Is there any software needed to open a CMTrading account?

No, Emirati traders only need a computer or mobile device with an internet connection to open a CMTrading account, as the registration procedure is performed online via the official website.

Can I finance my CMTrading account with various payment methods?

Yes, CMTrading provides a range of payment options for Emirati traders, such as bank transfers, credit/debit cards, e-wallets, and cryptocurrency payments, giving them flexibility and convenience when funding their accounts.

Broker Comparison

| CMTrading | XM | BDSwiss | |

| 🔎Regulation | FSA, FSCA | FSCA, IFSC, ASIC, CySEC, DFSA, FCA | CySEC, FSC, BaFIN, FSA, Mwali International Services Authority |

| 💻Trading Platform | • MetaTrader 4 • CMTrading Web • CopyKat | • MetaTrader 4 • MetaTrader 5 • XM Mobile App | • MetaTrader 4 • MetaTrader 5 • BDSwiss Mobile • BDSwiss Web |

| 💳Withdrawal Fee | Yes | None | No |

| ✅Demo Account | Yes | Yes | Yes |

| 💰Min Deposit | 367 AED ($100) | 18 AED ($5) | 37 AED ($10) |

| 📊Leverage | 1:200 | 1:1000 | Up to 1:2000 |

| 📈Spread | From 0.9 pips | 0.7 pips | From 0.0 pips |

| 💸Commissions | None; only the spread is charged | $1 to $9 | From $2 |

| ➡️Margin Call/Stop-Out | From 20% | • 50%/20%, • 100%/50% (EU) | 50%/20% |

| 📜Order Execution | Market | Market, Instant | Instant/Market |

| ❌No-Deposit Bonus | No | No | No |

| 🪙Cent Accounts | No | Yes, Micro | Yes |

| 🖺Account Types | • Bronze Account • Silver Account • Gold Account • Premium Account | • Micro Account • Standard Account • XM Ultra-Low Account • Shares Account | • Cent Account • Classic Account • VIP Account • Zero Spread Account |

| 🏛️DFSA Regulation | No | Yes | No |

| 💳AED Deposits | No | No | Yes |

| 🖺AED Account | No | No | No |

| 📞Customer Service Hours | 24/5 | 24/7 | 24/5 |

| 🖺Retail Investor Accounts | 4 | 4 | 4 |

| ☪️Islamic Account | Yes | Yes | Yes |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Trade Size | Unknown | 100 lots | 50 lots |

| ⏰Minimum Withdrawal Time | Instant | 1 working day | Instant |

| ⏲️Maximum Estimated Withdrawal Time | Up to 3 working days | 5 working days | Within 24 hours |

| 💰Instant Deposits and Instant Withdrawals? | Yes, deposits and withdrawals | Yes, deposits | Yes |

Min Deposit

USD 1

Regulators

FSCA,FSA

Trading Platform

MT4, PandaTS, Webtrader

Crypto

Yes

Total Pairs

174+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Trading Instruments & Products

CMTrading offers the following trading instruments and products:

- Commodities – the broker offers Emirati traders 16 commodities, including precious metals and energy, allowing them to hedge against market volatility and capitalize on commodities’ opposite direction of equities.

- Indices – Traders in the UAE can access 17 global indices through them, offering exposure to various stock market sectors and geographical markets, representing the performance of significant economies and sectors.

- Cryptocurrencies – CMTrading provides Emirati traders with a diverse selection of 21 cryptocurrencies, including popular options like Bitcoin and Ethereum, offering high risk and significant returns.

- Forex – They offer forex trading with over 50 currency pairs, allowing Emirati traders to profit from global market fluctuations with leverage up to 1:200.

- Stocks – It provides Emirati traders with over 109 stock CFDs, enabling them to analyze and predict company price fluctuations, leverage both upward and downward market trends, and avoid significant capital investment.

How many digital assets does CMTrading provide for trading?

CMTrading provides Emirati traders with access to 21 different cryptocurrencies, allowing them to engage in the dynamic cryptocurrency market while diversifying their trading portfolios.

Are indices accessible for trading with CMTrading?

Yes, CMTrading gives Emirati traders access to 17 worldwide indices, allowing them to invest in composite measures of sectoral or national economic performance with leverage of up to 1:50.

Trading Platforms and Software

CopyKat Trading

CopyKat Trading is a social trading platform by CMTrading designed for Emirati traders who want to combine community insights with their trading strategies. It allows users to mimic the trades of experienced investors, making it particularly helpful for new traders.

Furthermore, the platform seamlessly integrates with CMTrading’s tiered account system, allowing traders to match their account types with the expertise of the traders they want to follow.

This fosters a collaborative trading environment where traders can share and adopt strategies, creating a vibrant ecosystem of shared knowledge. CopyKat Trading serves as a learning accelerator, providing real-time insights into successful traders’ decision-making processes.

MetaTrader 4

MetaTrader 4 is a trading platform designed for Emirati traders, offering detailed analytics and flexible trading processes.

MetaTrader 4 is suitable for CMTrading’s diverse assets, including Forex, commodities, and indices. Its advanced charting capabilities are crucial for risk management and decision-making in high-leverage environments.

The platform’s real-time data feeds and execution capabilities are valuable for clients who need timely information. Its comprehensive analysis tools complement their educational resources, allowing Emirati traders to apply learned strategies directly to their trading activities.

CMTrading Web

Their Web is a web-based trading platform designed for UAE traders who prefer a direct, user-friendly approach to market access without downloading extra software.

The broker’s Web platform offers real-time market analysis tools for informed decision-making and is compatible with various browsers.

The platform also provides educational resources and customer support directly from the platform, streamlining the learning and trading process.

Furthermore, their Web offers convenience and comprehensive support, enhancing the trading experience for UAE clients, and aligns with CMTrading’s commitment to user-friendliness.

Can traders in Dubai use CMTrading to access MetaTrader 4 (MT4)?

Yes, Emirati traders can use MetaTrader 4 (MT4) with the broker.

How does CMTrading keep the platform stable and reliable for Emirati traders?

They promote platform stability and dependability by using modern technological infrastructure, regular maintenance, and monitoring systems to reduce downtime and assure continuous trading experiences for Emirati traders.

Leverage and Margin

CMTrading offers Emirati traders leverage of up to 1:200, enabling them to trade positions larger than their initial capital.

This leverage ratio is beneficial in the Forex market, where small changes can lead to significant outcomes.

Margin serves as collateral for positions with the broker, which is crucial in a leveraged trading environment.

Furthermore, CMTrading sets margin requirements as low as 2%, making it easier for Emiratis to enter larger trading positions.

However, despite its benefits, high leverage can lead to increased profits but also increases the risk of larger losses.

They address such risks by providing educational materials emphasizing the importance of using leverage wisely and managing risks effectively.

Furthermore, by incorporating leverage and margin into its offerings, CMTrading demonstrates its understanding of Emirati traders’ strategies and goals, promoting an empowering trading atmosphere and promoting responsible trading.

This strategic move aligns with the UAE’s dynamic trading culture, which values active and aggressive market opportunities and robust risk management.

What are the benefits of employing leverage while trading with CMTrading?

Using leverage enables Emirati traders to boost their market exposure and potential earnings without making a substantial initial commitment, maximizing trading chances in unpredictable markets.

How does CMTrading handle margin calls from Dubai traders?

When Emirati traders’ account equity falls below a specific threshold, It sends them a margin call, requiring them to deposit extra funds or liquidate positions to fulfill margin obligations.

Spreads and Fees

Spreads

CMTrading offers a competitive spread structure for Emirati traders, starting at as low as 0.9 pips on major currency pairs.

This is especially beneficial for high-frequency strategies like scalping, where the cost of spread can impact profitability.

Furthermore, the broker spread model maximizes trade execution efficiency, allowing traders to capture potential market movements more effectively.

This policy supports Emirati traders in the UAE, where the financial markets are characterized by vigorous trading activity. CMTrading’s focus on keeping spreads narrow aligns with its financial goals, allowing it to manage trade costs and capitalize on global market volatility.

Commissions

CMTrading is a prominent trading platform in the UAE that offers a commission-free structure on most trades, catering to Emirati traders who value transparency and simplicity in fee structures.

This approach allows traders to focus on spread costs without the need to calculate varying commission rates for different instruments or trade sizes.

Furthermore, this straightforward and predictable cost management enhances the trading experience for clients, particularly cost-conscious traders seeking lean operations in the financial markets.

Overnight Fees

CMTrading charges Emirati traders overnight or swap fees, which are standard across the industry. These fees vary based on position size, asset size, and trade direction. Their policy is transparent, ensuring traders are well informed about any charges.

This information helps them plan entry and exit points, especially for longer-term trading strategies. Understanding the structure of overnight fees is crucial for traders in different time zones or executing multiple trading sessions.

Deposit and Withdrawal Fees

The broker prioritizes financial transparency and efficiency for Emirati traders by eliminating internal fees for deposits and withdrawals. This simplifies the transaction process and helps traders optimize their trading capital.

However, Emiratis need to note that while CMTrading does not charge internal fees, there may be external fees imposed by banks or payment processors.

Therefore, considering the impact these fees might have, Emirati traders must stay informed about potential fees from third parties while enjoying the benefit of fee-free transactions within them.

Inactivity Fees

CMTrading has introduced an inactivity fee to encourage active trading among UAE traders. If an account remains inactive for 60 days or more without any trades, a $15 monthly fee will be applied.

Furthermore, this serves as a reminder to continue trading or consider withdrawing funds if traders no longer wish to participate. This fee structure encourages traders to stay engaged and make informed decisions about their accounts, ensuring their trading journey aligns with their goals.

Currency Conversion Fees

Emirati traders face significant currency conversion fees, especially when trading with base currencies like USD, EUR, GBP, or ZAR.

However, despite these fees, CMTrading is transparent about such non-trading fees, providing Emiratis with the necessary information to make informed decisions about their capital and trading strategies.

This includes strategic fund transfers and currency management to mitigate adverse effects on profitability. The broker is committed to providing traders with the tools and knowledge needed to navigate the financial aspects of trading successfully.

How does CMTrading manage overnight costs for Dubai traders?

It calculates swap fees depending on position size and instrument traded, crediting or debiting trading accounts appropriately to provide transparent and equitable overnight fee computations for Emirati traders.

How does CMTrading ensure that Emirati traders have transparent fee structures?

Their website and trading platforms include thorough information regarding spreads, commissions, overnight fees, and other expenses, allowing Emirati traders to make educated decisions.

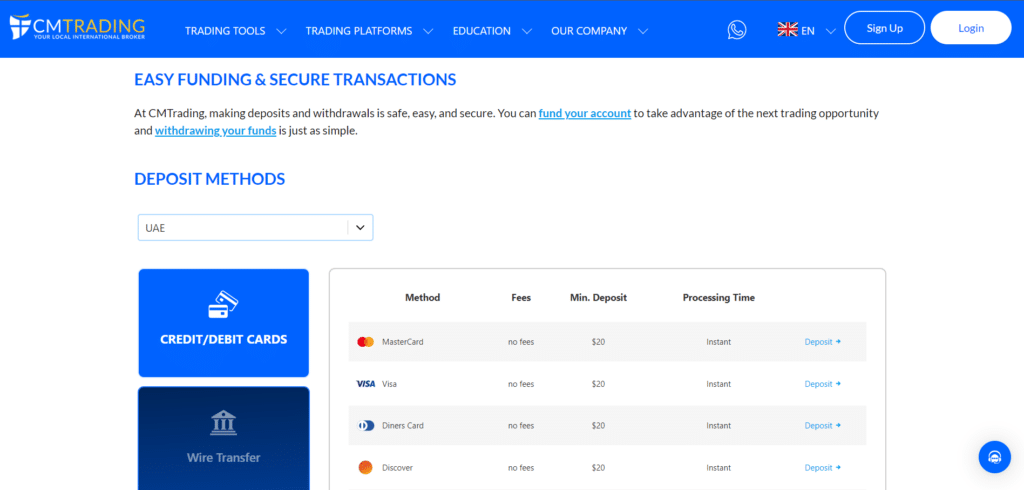

Deposit & Withdrawal Options

| 💰Payment Method | 🌎Country | 💳Currencies Accepted | ⏰Processing Time |

| 💳MasterCard | All | USD, EUR, GBP, ZAR | Instant (deposit and withdrawal) |

| 🏦Visa | All | USD, EUR, GBP, ZAR | Instant (deposit and withdrawal) |

| 📇Diners Card | All | USD | Instant (deposit and withdrawal) |

| 💵Discover | All | USD | Instant (deposit and withdrawal) |

| 🏧Visa Electron | All | USD, EUR, GBP, ZAR | Instant (deposit and withdrawal) |

| 🔃Bank Transfers | All | USD, EUR, GBP, ZAR | 1 – 3 days on deposits and withdrawals |

| 💱Cryptocurrency Payments | All | BTC, ETH, etc | Instant |

| 💻Skrill | All | USD | Instant (deposit and withdrawal) |

| 💸EFTPay | All | USD, EUR, GBP, ZAR | Instant (deposit and withdrawal) |

| 🤑Neteller | All | USD | Instant (deposit and withdrawal) |

| 💰Perfect Money | All | USD | Instant (deposit and withdrawal) |

Deposits

How to Deposit using Bank Wire Step by Step

- Access the ‘Deposit’ area in your CMTrading account.

- Choose ‘Bank Wire’ as your preferred deposit method.

- Get the bank details for your region from the broker.

- Use the information provided by them to initiate a wire transfer from your bank.

- Send a confirmation of the wire transfer to CMTrading for verification and keep all receipts.

Deposit using Credit or Debit Card Step by Step

- Access your CMTrading account and go to the ‘Deposits’ section.

- Select the ‘Credit or Debit Card’ option.

- Provide your card information and the desired deposit amount.

- As part of the verification process, you might be required to provide a copy of the card used, but ensure that any sensitive information (like your CVV code) is concealed.

- Confirm the transaction to finalize the deposit.

To Deposit using Cryptocurrency Step by Step

- Navigate to the ‘Deposit’ section on your CMTrading account dashboard.

- Choose the cryptocurrency you prefer to use for your deposit.

- They will provide all the required information for the transfer.

- Please proceed with the transfer from your crypto wallet to the CMTrading address.

How to Deposit using e-Wallets or Payment Gateways Step by Step

- To make a deposit in your CMTrading account, locate and click on the ‘Deposit’ button in the client area.

- Choose your preferred e-wallet or payment gateway from the available options.

- You will be directed to the login page for the chosen service, where you can indicate the deposit amount.

- Complete the transaction on the payment service’s page.

Withdrawals

How to Withdraw using Bank Wire Step by Step

- Navigate to the ‘Withdrawal’ section of your CMTrading account.

- Select the ‘Bank Wire Transfer’ option for your withdrawal.

- Provide the necessary banking information for the account where you would like to receive funds.

- Submit the request for the withdrawal.

Withdraw using Credit or Debit Cards Step by Step

- Go to the withdrawal section in your CMTrading account.

- Choose to withdraw funds to your credit or debit card.

- Provide the withdrawal amount in the required field, ensuring it aligns with your available balance.

- Enter your card information and submit your withdrawal request.

To Withdraw using Cryptocurrency Step by Step

- When you are ready to withdraw funds from your CMTrading account, simply select ‘Cryptocurrency’ as your preferred withdrawal method in the designated section.

- Enter the public address of your cryptocurrency wallet.

- Enter the requested withdrawal amount, ensuring that it meets the minimum requirements.

- Ensure that you review all the details before finalizing the withdrawal.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

- To initiate a withdrawal from your CMTrading account, simply navigate to the ‘Withdraw’ option.

- Select your preferred e-wallet or payment service from the list provided.

- Provide the withdrawal amount and the required details for the chosen service.

- Confirm the details of the transaction, and submit your request to CMTrading.

How long does it take for deposits to be reflected in a CMTrading account?

The processing time for deposits with CMTrading varies based on the payment method used, with credit/debit cards and e-wallets often allowing immediate deposit processing for Dubai traders.

Does CMTrading charge Dubai traders any withdrawal fees?

No, CMTrading does not impose internal costs for withdrawals. However, Emirati traders should be aware that third-party payment providers typically charge transaction fees when processing withdrawals.

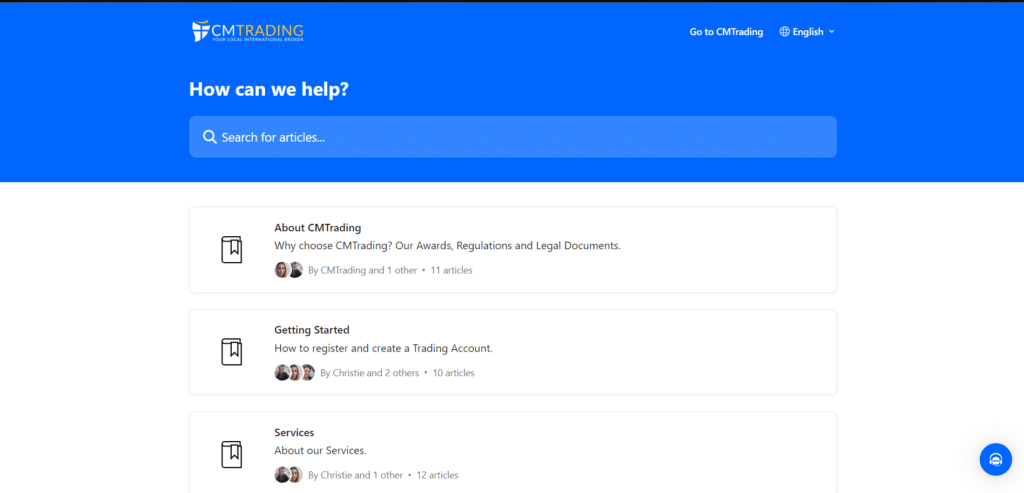

Educational Resources

Webinars

CMTrading offers its Emirati traders a series of webinars to educate and empower them. These online seminars cater to all skill levels, providing beginners with a solid foundation in trading basics and experienced traders with advanced strategies and market insights.

The interactive nature allows UAE traders to engage directly with financial experts, providing real-time answers on topics like forex trends and commodity movements.

Training Videos

The broker provides Emirati traders with a range of training videos focusing on market analysis techniques and trading tools.

These videos cover basic market principles and technical analysis, making them particularly beneficial for UAE traders who prefer self-paced learning and visual explanations.

How-To Videos

CMTrading offers ‘How-To’ videos for Emirati traders, giving them unique and comprehensive step-by-step instructions on setting up a trading account and executing trades on their platforms.

Furthermore, these videos are particularly beneficial for new traders, helping them navigate the complexities of online trading and maximize the potential of their tools and platforms in a digitally savvy UAE environment.

Live Seminars

CMTrading’s live seminars are valuable for Emirati traders seeking face-to-face learning. These events provide direct access to industry experts, offering first-hand insights into trading strategies and market trends.

These unique seminars also facilitate the exchange of ideas and experiences within the trading community, benefiting from a culture that values personal connections for learning and business growth.

eBooks

CMTrading’s eBooks are a comprehensive resource for Emirati traders, covering various trading topics. They cater to all skill levels, covering forex trading fundamentals, technical analysis, and risk management.

Overall, the flexible format is perfect for UAE’s fast-paced lifestyle, allowing traders to enhance their market knowledge at their own pace and apply insights effectively in trading.

What educational materials does CMTrading provide to Emirati traders?

They offer a variety of instructional tools, including training videos, live seminars, webinars, how-to videos, and eBooks, to meet the different learning needs of Emirati traders.

How can Emirati traders access CMTrading’s webinars?

Emirati traders can watch CMTrading webinars online from the comfort of their own homes or workplaces, giving them convenient chances to learn about a variety of trading themes and strategies.

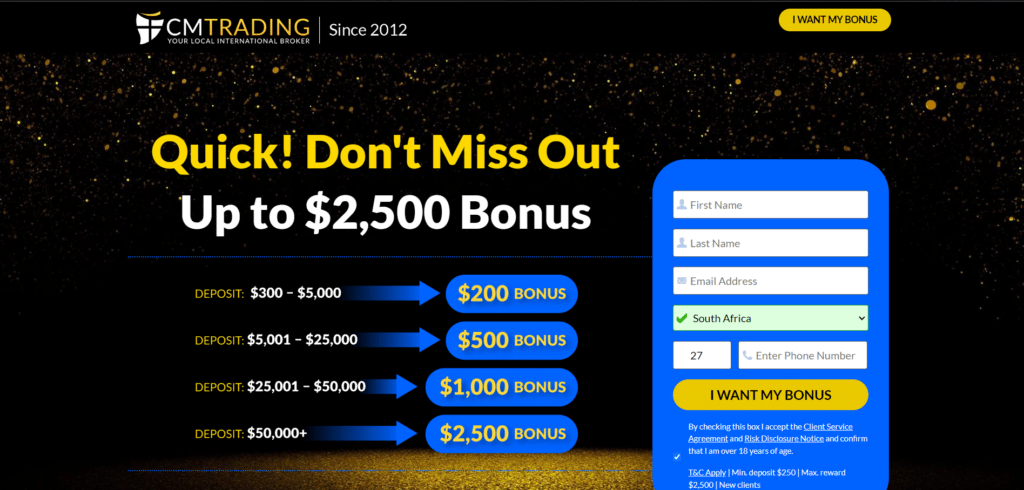

CMTrading Bonuses and Promotions

Our detailed investigation of CMTrading’s bonuses and promotions for Dubai traders reveals a tailored approach to incentives that aligns with the region’s trading preferences.

One noteworthy feature that we found is the $200 Refer a Friend Bonus, which encourages traders to refer new clients to CMTrading. This benefit appeals to Dubai’s tight-knit trading environment, where referrals can greatly increase a trader’s prospective earnings.

To qualify, the suggested individual must establish an account and meet strict financial and trading conditions explicitly stated on the CMTrading website.

Furthermore, from what we can see, CMTrading’s advertising approach in Dubai attempts to attract both new and experienced traders by providing bonuses that can be used to enhance leverage or to protect against future trading losses.

The terms and conditions for these promos are rigorously developed to ensure openness and fairness, giving traders a thorough grasp of what is required to take advantage of these deals.

Overall, we believe this proactive strategy stimulates new account registrations and fosters a devoted trading community that takes advantage of CMTrading’s diverse market offers.

How can new Dubai traders profit from CMTrading’s welcome bonuses?

No. CMTrading does not currently offer any welcome bonuses to newly registered Emirati traders.

Are there any loyalty awards for long-term CMTrading customers in Dubai?

No. CMTrading does not offer loyalty rewards but offers forex trading rebates to Introducing Brokers in Dubai up to $2 million traded.

CMTrading Affiliate Programs

Features

In Dubai’s thriving market, recognized for its emphasis on entrepreneurship and innovation, the CMTrading affiliate program stands out as a good option for those seeking financial independence.

Our evaluation of the program reveals that it is well-suited to Dubai’s diversified community, which is continually looking for adaptable and successful business initiatives.

By becoming a Business Referral partner with CMTrading, you can easily capitalize on Dubai’s prominence as a financial hub, drawing clients from around the Middle East and outside.

This program provides remote work possibilities to fit Dubai’s fast-paced lifestyle. Your referrals will benefit from CMTrading’s powerful technology, which includes top-tier trading platforms such as MT4 and WebTrader.

Furthermore, our investigation also shows that CMTrading offers extensive support, including specialized account managers and frequent training sessions, allowing partners to build their networks quickly.

In addition, real-time referral monitoring and timely commission pay-outs add to the attraction, making this program an excellent alternative for individuals benefiting from Dubai’s thriving economic scene.

How to Register an Affiliate Account with CMTrading Step-by-Step

We’ve simplified the process involved with registering an affiliate account with CMTrading by indicating the steps involved as follows:

👉Step 1 – Register as an Affiliate

Visit the CMTrading website and choose Arabic from the language option. Find the “شركتنا” )Our Company) tab and click on it.

👉Step 2 – Select Introducing Business

From the dropdown menu, choose “تقديم الأعمال” (Introducing Business). You will be given two alternatives to start the affiliate registration process. Clicking either of these links will start the online application.

👉Step 3 – Complete Form

To register, you must provide extensive personal and business information to allow CMTrading to evaluate your eligibility for the program. Provide relevant and accurate contact information in the required fields. Wait for the verification email, click the link, and return to the CMTrading website, where you can complete the application, submit the necessary documentation, and submit your form.

CMTrading will take a few days to evaluate your application and documentation. Once approved, you should receive an email with the information and links to log into your affiliate portal to get started.

What are the advantages of joining the CMTrading affiliate program in Dubai?

Joining CMTrading’s affiliate program in Dubai provides competitive commission structures, marketing assistance, and a personal account manager, among other things.

How can Emiratis get started with the CMTrading affiliate program?

Residents in Dubai can begin using CMTrading’s affiliate program by registering on the CMTrading Partners website, where they can receive promotional materials and tracking tools once accepted into the program.

CMTrading Customer Support

| 🤝Customer Support | 🪪CMTrading Customer Support |

| ⌛Operating Hours | 24/5 |

| 🗣️Support Languages | English, Arabic |

| 🎙️Live Chat | Yes |

| 💻Email Address | Yes |

| 📞Telephonic Support | Yes |

| ⭐The overall quality of CMTrading Support | 4/5 |

CMTrading Response Time

| 📺Support Channel | ⏰Average Response Time | ⏲️User-based Response Time |

| 📞Phone | 5 – 10 minutes | 7 minutes |

| 24 – 48 hours | 1 working day | |

| 🗣️Live Chat | 2 – 7 minutes | 5 minutes |

| 📱Social Media | 5 minutes | 5 minutes |

| 🪪Affiliate | 24 – 48 hours | Same-day |

What languages does CMTrading’s customer support provide to traders in Dubai?

CMTrading provides customer service in many languages, including English and Arabic, catering to a diverse Emirati population.

How can traders in Dubai contact CMTrading for assistance?

Traders in Dubai can reach CMTrading by live chat, email, or phone. Furthermore, CMTrading is also available on several social media platforms like X, Facebook, LinkedIn, YouTube, TikTok, etc.

CMTrading Social Responsibility

While CMTrading has no CSR projects based in Dubai, we found the following initiatives on the CMTrading website.

CMTrading exhibits its commitment to social responsibility by sponsoring youth sports programs in South Africa, as seen on its website. The “Giving Back to the Community” section discusses a recent successful coaching session in partnership with Sporting Chance.

Furthermore, according to our research, this project offered local youngsters the necessary equipment, competent coaching, and a platform to improve their athletic ability in a dynamic and inclusive environment.

This approach is very beneficial in encouraging young people to live healthy lifestyles and develop an interest in sports.

CMTrading can increase its effect through its CSR initiatives by expanding this program or launching similar programs in other locations, like Dubai. Such measures could help CMTrading’s image for social responsibility, especially among prospective clients in the Middle East.

User Comments

➡️The company assigns a trader who teaches and guides you in trading as we are new here.

➡️They have patience and give clear explanations of all your questions.

➡️We especially like the fact that they are not fast and move at our pace.

➡️We applaud the fact that they responded quickly when we sent them an email, eg yesterday we sent a message in the morning telling them that we were free in the afternoon, and soon after we got home they called us.

Min Deposit

USD 1

Regulators

FSCA,FSA

Trading Platform

MT4, PandaTS, Webtrader

Crypto

Yes

Total Pairs

174+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Conclusion

According to our findings, CMTrading is a forex and CFD broker available in the UAE that caters to traders of all skill levels despite their trading objectives.

CMTrading offers various account types and educational resources, such as webinars, eBooks, and instructional videos, to help Emiratis navigate the complexities of financial markets.

Furthermore, per our research, traders in Dubai can access CMTrading through multiple platforms like MetaTrader 4 and CopyKat Trading, ensuring flexibility and convenience.

However, we found that CMTrading is not regulated locally in Dubai, raising concerns about regulatory oversight and trader protection.

Additionally, CMTrading does not offer accounts denominated in AED. However, despite these issues, CMTrading offers competitive spreads, commission-free trading, and multilingual customer support.

In our analysis of CMTrading’s security measures, we found that CMTrading adheres to international regulatory standards, such as the FSCA and FSA, providing security and reliability.

Overall, despite its limitations, we can conclude that CMTrading’s strengths lie in its educational resources, platform diversity, and regulatory compliance, making it a viable option for Emirati traders interested in forex and CFD trading opportunities.

Our Insight

CMTrading provides a easy-to-use platform for trading stocks, indices, and cryptocurrencies. Their customer support is outstanding in terms of service. Their emphasis on education and mobile apps is appealing to new traders, although active traders may be put off by potentially higher fees.

CMTrading Pros and Cons

| ✅Pros | ❌Cons |

| CMTrading has innovative trading platforms that offer robust tools and innovative technology | CMTrading is not locally regulated by the DFSA in Dubai |

| Emiratis can deposit and withdraw funds without incurring internal fees | Currency conversion fees apply as AED is not an accepted deposit, withdrawal, or account base currency |

| CMTrading’s spreads and commission-free structure make it ideal for high-volume traders | Inactivity fees can affect the profitability of long-term trading strategies |

| There are flexible account types that cater to different Emirati traders | There are several withdrawal limits, and processing times can be long |

| The educational materials are diverse and comprehensive, giving Emiratis a good starting point | |

| Emiratis can access multilingual customer support across channels | |

| There is a decent selection of tradable instruments that can be traded | |

| CMTrading is extremely well-regulated in several regions | |

| Emirati traders can participate in social trading using CopyKat, offering them more trading opportunities |

You might also like: BDSwiss Review

You might also like: FXGT Review

You might also like: Alpari Review

You might also like: AvaTrade Review

You might also like: Exness Review

Frequently Asked Questions

Is customer support available in Arabic for Emirati traders?

Yes, CMTrading provides customer support in multiple languages, including Arabic, to cater to the needs of Emirati traders who prefer assistance in their native language.

Does CMTrading offer research and analysis tools to support Emirati traders?

CMTrading provides a variety of research and analysis tools, such as market news, economic calendars, and technical analysis, to assist Emirati traders in making well-informed trading choices.

How long does CMTrading’s withdrawal take?

Withdrawals with CMTrading are usually processed within 1 to 3 business days, taking into account the withdrawal method and the processing time of the Emirati bank.

Are there any limitations on trading strategies for Emirati traders using CMTrading?

Emirati traders using CMTrading can use a wide range of trading strategies, such as scalping and hedging, without facing any limitations.

Where is CMTrading based?

CMTrading is located in Seychelles and has a strong operational presence in South Africa, serving traders in different areas, including Dubai.

What can I trade with CMTrading?

Emirati traders can access forex, stocks, commodities, indices, and cryptocurrencies. This provides them with plenty of opportunities to diversify their portfolios.

Can I open a demo account with CMTrading that focuses on practicing trading in the Dubai market?

Yes, you can. CMTrading’s demo accounts offer a realistic simulation of trading in live market conditions.

What is CMTrading’s minimum deposit?

The Bronze Account has a starting deposit of 367 AED ($100). Furthermore, other account types with CMTrading have varying minimum deposit requirements.

Is CMTrading a safe broker?

Yes, CMTrading is a safe broker for traders in the UAE. Although CMTrading is not locally regulated in Dubai, it is regulated by reputable institutions such as the FSCA in South Africa and the FSA in Seychelles, which ensures a certain level of safety for Emirati traders.

Can I participate in CMTrading events or seminars in Dubai?

Yes, you might be able to; CMTrading might organize captivating events, seminars, and masterclasses in Dubai. For more information and to stay updated, you can view their events page for upcoming opportunities to expand your knowledge and connect with others.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai