Overall, IC Markets can be summarized as reliable and adaptable with competitive trading fees. IC Markets offers an easy-to-use social copy trading platform with excellent customer support. IC Markets has a trust score of 86 out of 99.

| 🔑Order Execution | 5/5 |

| 💴Commissions and Fees | 4/5 |

| 📈Range of Markets | 5/5 |

| 📊Variety of Markets | 5/5 |

| ⏰Withdrawal Speed | 5/5 |

| 🤝Customer Support | 5/5 |

| 📉Trading Platform | 5/5 |

| 🎓Education | 4/5 |

| 📖Research | 5/5 |

| 🚨Regulation | 5/5 |

| 📱Mobile Trading | 4/5 |

| 💯Trust Score | 86% |

IC Markets Review –Analysis of Brokers’ Main Features

- ☑️ IC Markets Overview

- ☑️ IC Markets Detailed Summary

- ☑️ IC Markets Advantages Over Competitors

- ☑️ Who will Benefit from Trading with IC Markets?

- ☑️ IC Markets Safety and Security

- ☑️ IC Markets Affiliate Program Features

- ☑️ IC Markets Minimum Deposit

- ☑️ IC Markets Account Types and Features

- ☑️ IC Markets Base Account Currencies and Basic Order Types

- ☑️ How to Open and Close an IC Markets Account

- ☑️ IC Markets MAM / PAMM Features

- ☑️ Social Trading with IC Markets

- ☑️ IC Markets Trading Platforms

- ☑️ Which Markets Can You Trade with IC Markets?

- ☑️ IC Markets Fees, Spreads, and Commissions

- ☑️ IC Markets Deposits and Withdrawals

- ☑️ IC Markets Education and Research

- ☑️ IC Markets Customer Support

- ☑️ IC Markets VPS Review

- ☑️ IC Markets Cashback Rebates Features and Conditions

- ☑️ IC Markets Web Traffic Report

- ☑️ IC Markets Geographic Reach and Limitations

- ☑️ Best Countries by Traders

- ☑️ IC Markets vs Pepperstone vs FXCM – A Comparison

- ☑️ IC Markets Alternatives

- ☑️ IC Markets Awards and Recognition

- ☑️ Our Experience with IC Markets

- ☑️ Recommendations according to our in-depth review of IC Markets

- ☑️ IC Markets Customer Reviews

- ☑️ Pros and Cons of Trading with IC Markets

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

IC Markets Overview

IC Markets stands out as a strong option for Emirati traders looking for a reliable and adaptable trading platform. The broker provides a high level of security and compliance.

IC Markets has its corporate headquarters in Australia and is governed by numerous international agencies, including ASIC, CySEC, FSA, and SCB.

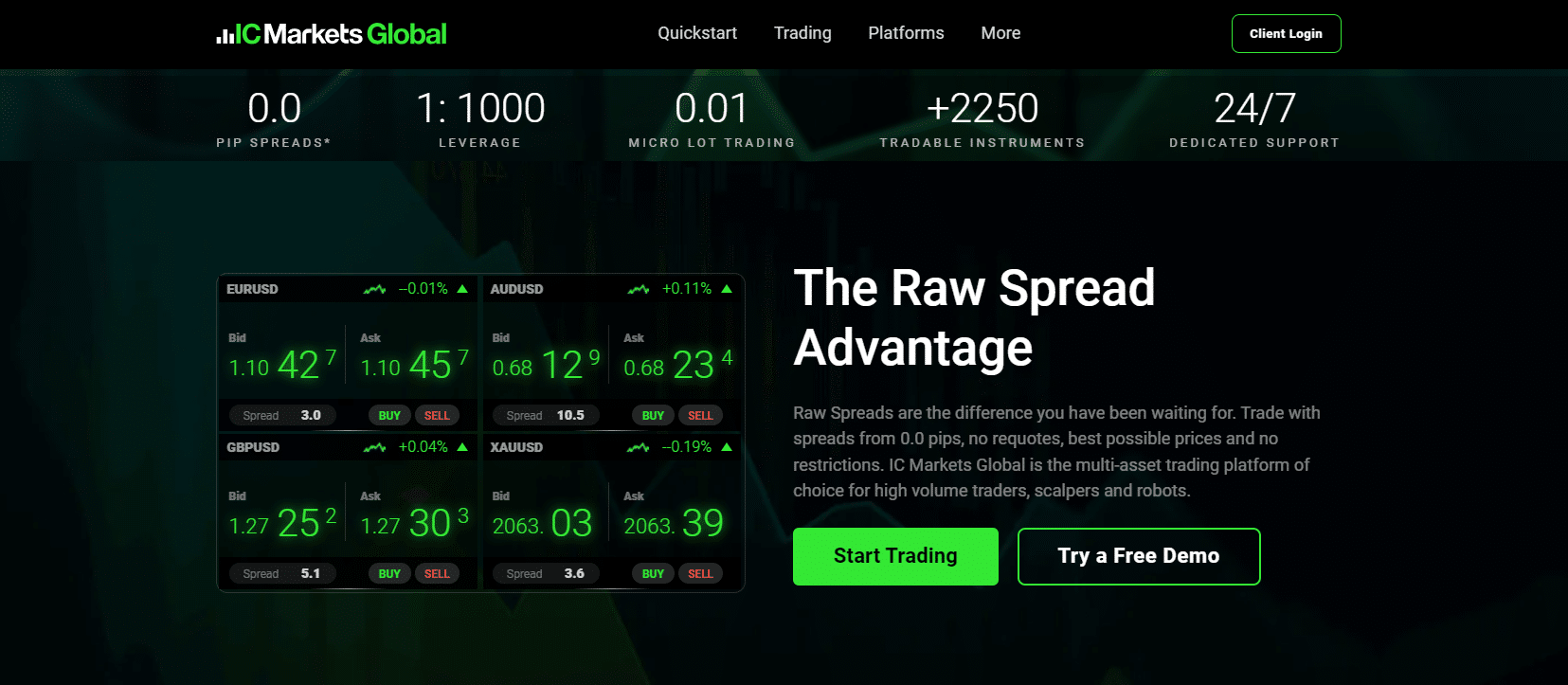

Its competitive pricing structure, which boasts an average spread starting at 0.0 pip and a round-turn commission of either $6 or $7, is one of its standout features. This makes the fee schedule at IC Markets significantly more advantageous than many other brokers in the sector.

The platform caters to traders looking for high-risk, high-reward opportunities by offering a maximum leverage ratio of up to 1:500. To meet various needs, IC Markets also offers specialized account types, such as demo accounts for practice and Islamic accounts for those who follow Sharia law.

Furthermore, IC Markets supports three cutting-edge trading platforms: MT4, MT5, and cTrader, each designed to satisfy the needs of seasoned traders.

Another area where IC Markets excels is in the simplicity of account creation. The entire procedure is simplified, digital, and supported by round-the-clock customer service.

Furthermore, making informed decisions is simpler for traders of IC Markets’ transparency regarding the differences when opening accounts with their various globally regulated entities.

IC Markets Detailed Summary

| 🔑Broker | 🥇IC Markets |

| 🏠Headquartered | Sydney, Australia |

| 🌎Global Offices | Australia |

| 🚨Local Market Regulators in Dubai | Dubai Financial Services Authority (DFSA) |

| ➡️Foreign Direct Investment in Dubai | 23 billion USD (2022) |

| 💱Foreign Exchange Reserves in Dubai | 158 billion USD (July 2024) |

| 📍Local office in Dubai | None |

| 👤Governor of SEC in Dubai | Khaled Mohamed Balama is the Governor of the Central Bank of the UAE |

| 🚩Accepts Dubai Traders | ✅Yes |

| 🎉Year Founded | 2007 |

| 🔢Dubai Office Contact Number | None |

| 💻Social Media Platforms | Facebook X |

| 📝Regulation | ASIC, CySEC, FSA, SCB |

| 🥇Tier-1 Licenses | Australian Securities and Investments Commission (ASIC) |

| 🥈Tier-2 Licenses | Cyprus Securities and Exchange Commission (CySEC) |

| 🥉Tier-3 Licenses | Financial Services Authority (FSA) Securities Commission of the Bahamas (SCB) |

| 📒License Number | Seychelles – SD018 Australia – AFSL 335692 Cyprus – 362/18 Bahamas – SIA-F214 |

| 🗂️DFSA Regulation | None |

| 📌Regional Restrictions | United States, Canada, Iran, Yemen, and OFAC countries |

| ☪️Islamic Account | ✅Yes |

| 🆓Demo Account | ✅Yes |

| ⏰Non-expiring Demo | ✅Yes, if it remains active |

| ⏱️Demo Duration | Unlimited, but will close after 30 days of inactivity |

| 💸Retail Investor Accounts | 3 |

| 📈PAMM Accounts | ✅Yes |

| 💧Liquidity Providers | 25 |

| 👥Affiliate Program | ✅Yes |

| 🖋️Order Execution | Market |

| 🔎OCO Orders | None |

| ▶️One-Click Trading | ✅Yes |

| ✴️Scalping | ✅Yes |

| ✳️Hedging | ✅Yes |

| 🎓Expert Advisors | ✅Yes |

| 🗞️News Trading | ✅Yes |

| 📊Trading API | ✅Yes |

| 📉Starting spread | From 0.0 pips |

| 💰Minimum Commission per Trade | From $3 to $3.5 |

| 💴Decimal Pricing | 5th decimal pricing after the comma |

| 📒Margin Call | 100% |

| ⛔Stop-Out | 50% |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | Unlimited |

| 🪙Crypto trading offered | ✅Yes |

| 📝Offers an AED Account | None |

| 👤Dedicated Dubai Account Manager | No |

| 🚩Maximum Leverage | 1:500 |

| 📌Leverage Restrictions for Dubai | None |

| 💵Minimum Deposit (AED) | 735 AED ($200) |

| 💶Deposit Currencies | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD |

| 💳AED Deposits Allowed | None |

| 💷Account Base Currency | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD |

| 💹Active Dubai Trader Stats | 49,000+ |

| 🔖Active Dubai-based IC Markets customers | Unknown |

| 🔃Dubai Daily Forex Turnover | 13.1 billion USD |

| 🖋️Deposit and Withdrawal Options | Credit Card Debit Card PayPal Neteller Neteller VIP Skrill UnionPay Bank Wire Transfer Bpay FasaPay Broker to Broker POLi Thai Internet Banking Vietnamese Internet Banking Rapidpay Klarna |

| ⏰Minimum Withdrawal Time | Instant |

| ⏱️Maximum Estimated Withdrawal Time | Up to 14 business days |

| ➡️Instant Deposits and Instant Withdrawals | ✅Yes, on PayPal, Neteller, and Skrill |

| ↘️Segregated Accounts with Emirati Banks | None |

| 🖥️Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader IC Social Signal Start ZuluTrade |

| ⌚Trading Platform Time | UTC +03:00 |

| 👁️Observe DST Change | ✅Yes |

| 🌐DST Change Time zone | Eastern Standard Time (EST) |

| 💎Tradable Assets | Forex Commodities Indices Bonds Cryptocurrencies Stocks Futures |

| 💴Offers USD/AED currency pair | None |

| ⏲️USD/AED Average Spread | None |

| 📈Offers Emirati Stocks and CFDs | None |

| 🌎Languages supported on the Website | English, Spanish, Russian, Thai, Malay, Vietnamese, Italian, Portuguese, and several others |

| 🔊Customer Support Languages | Multilingual |

| 🔎Copy Trading Support | ✅Yes |

| ⏰Customer Service Hours | 24/7 |

| 📍Dubai-based customer support | None |

| 💰Bonuses and Promotions for Dubai Traders | None |

| 🎓Education for Emirati beginners | ✅Yes |

| 💻Proprietary trading software | ✅Yes |

| 🎖️Most Successful Trader in Dubai | Several – Yasser R, Ali A, Maaz A, Warren Takunda |

| 🫶Is IC Markets a safe broker for Dubai Traders | ✅Yes |

| 🏆Rating for IC Markets Dubai | 9/10 |

| 💯Trust score for IC Markets Dubai | 86% |

IC Markets Advantages Over Competitors

IC Markets has the following advantages over competitors:

- ✅By having regulation in Tier-1 and Tier-4 jurisdictions, IC Markets further enhances its standing as a dependable and trustworthy company.

- ✅With strict ASIC oversight and an impeccable track record, IC Markets gives its clients high security and confidence.

- ✅The process of opening an account at IC Markets is quick and simple, allowing traders to start their trading immediately.

- ✅Due to its narrow spreads and flexible pricing model, IC Markets is a cost-effective trading option for Emirati investors.

- ✅IC Markets distinguishes itself from rival platforms by offering a wide variety of financial instruments, including the inclusion of cryptocurrencies.

- ✅IC Markets recently expanded its educational and research capabilities, better aligning it with other significant players in the market.

- ✅By providing a variety of complimentary methods for both deposits and withdrawals, IC Markets increases client convenience.

- ✅Due to its competitive fee structure and effective order execution, IC Markets is a top choice for algorithmic traders.

and more!

Who will Benefit from Trading with IC Markets?

- ✅The platform’s simple account setup and extensive educational resources will be appreciated by novice and less experienced traders, facilitating immediate trading and well-informed decision-making.

- ✅Traders of all experience levels enjoy the platform’s user-friendly approach to financial transactions, which provides cost-free options for deposits and withdrawals.

- ✅IC Markets’ competitive pricing model, which includes tight spreads and flexible fees, is very advantageous to active day traders and scalpers sensitive to pricing.

- ✅IC Markets’ strong regulatory framework, including supervision from top-tier authorities like ASIC, will reassure traders prioritizing security and regulatory compliance.

- ✅IC Markets’ extensive product offerings, which include the special accessibility of cryptocurrencies, will appeal to traders looking to diversify their investment portfolios.

- ✅Scalable execution and affordable pricing from IC Markets will be advantageous to algorithmic traders, enabling more effective automated trading strategies.

What makes IC Markets stand out in terms of spreads?

With an average EUR/USD spread of 0.1 pips, IC Markets has some of the lowest spreads in the business.

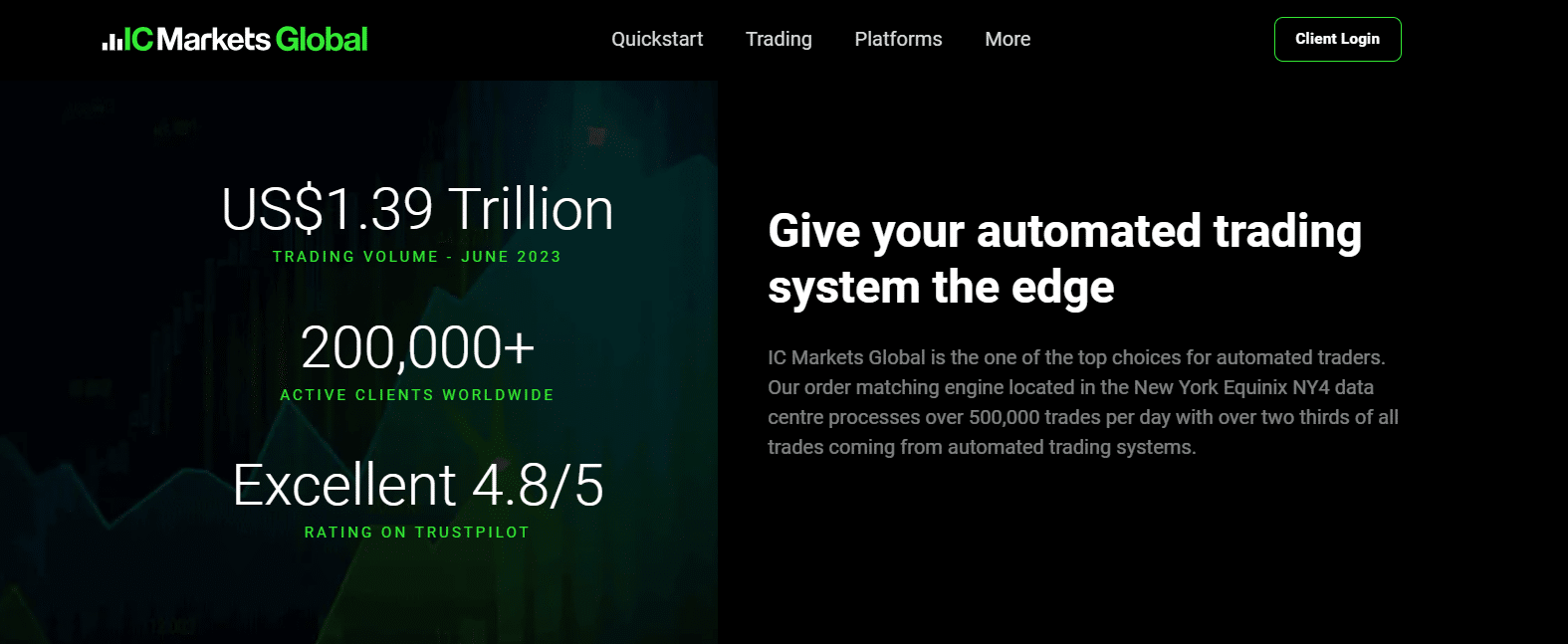

How does IC Markets ensure fast order execution?

The Equinix NY4 data center in New York is home to servers for IC Markets, ensuring low latency and quick order execution.

IC Markets Safety and Security

IC Markets Regulation in Dubai

IC Markets is not currently regulated by the Dubai Financial Services Authority (DFSA). However, IC Markets’ global regulations are listed in the table below:

| 🔑Registered Entity | 🌎Country of Registration | 🔢Registration Number | 🚨Regulatory Entity | 🥇Tier | 🖋️License Number/Ref |

| 1️⃣Raw Trading Ltd | Seychelles | N/A | FSA | 3 | SD018 |

| 2️⃣International Capital Markets Pty Ltd. | Australia | CAN 123 289 109 | ASIC | 1 | AFSL 335692 |

| 3️⃣IC Markets EU Ltd | Cyprus | N/A | CySEC | 2 | 362/18 |

| 4️⃣IC Markets Ltd | Bahamas | 76823 C | SCB | 3 | SIA-F214 |

IC Markets Protection of Client Funds

| 🔑Security Measure | ℹ️ Information |

| 🔒Segregated Accounts | ✅Yes |

| 🔏Compensation Fund Member | None, in-house insurance |

| 🔐Compensation Amount | $1 million |

| 🔓SSL Certificate | None |

| 🗝️2FA (Where Applicable) | None |

| 🔒Privacy Policy in Place | ✅Yes |

| 🔏Risk Warning Provided | ✅Yes |

| 🔐Negative Balance Protection | ✅Yes |

| 🔓Guaranteed Stop-Loss Orders | None |

Security while Trading

Emirati traders trust IC Markets because of its reputation for strongly emphasizing security. Multiple financial authorities rigorously monitor the platform to ensure it complies with industry standards for financial reporting, integrity, and the protection of client funds.

The segregation of traders’ funds into separate bank accounts from the company’s operational capital is a distinctive feature that underlines its dedication to the security of client funds. This adds another level of protection against insolvency problems.

The platform also uses cutting-edge encryption technologies to protect transaction data. Secure Sockets Layer (SSL) is used when transmitting data, guaranteeing the highest confidentiality level for private data shared online.

Despite different jurisdictional requirements, the global regulatory recognition of IC Markets provides traders with peace of mind regarding the security of their investments in the UAE.

Another factor supporting this is the availability of various dispute resolution options while trading on the platform, available only through IC Markets engagements.

Pros and Cons of Regulation and Safety of Funds

| ✅Pros | ❎Cons |

| Emiratis can expect negative balance protection on retail accounts | Despite negative protection, IC Markets clients can still lose their investments when they do not trade responsibly |

| IC Markets offers investor protection of up to $1 million | The DFSA does not regulate IC Markets in Dubai |

Is IC Markets regulated?

Yes, IC Markets is regulated by multiple financial authorities, providing traders with an extra layer of security.

Are there any additional security features like two-factor authentication with IC Markets?

Yes, for added account security, IC Markets provides two-factor authentication.

IC Markets Affiliate Program Features

Emirati traders can make money by referring customers to IC Markets through its affiliate program. The IC Markets Affiliate Program includes the following features:

- ✅Traders can quickly join the IC Markets Affiliate Program by completing an application form on the IC Markets Partners website.

- ✅Emirati traders will receive a special partner ID and a campaign link to post on their websites, social media accounts, and other channels to begin referring customers.

- ✅Through the Affiliate Program, partners can receive up to 50% of the revenue generated by the customers they refer to IC Markets.

- ✅Trading income can be increased by commissions paid to affiliate accounts in real time.

- ✅Emirati traders receive a daily revenue share from eligible clients when referrals become clients and begin trading.

- ✅IC Markets offers continuous assistance and updates on the performance of Emirati traders.

- ✅IC Markets does not impose additional fees for withdrawals or deposits made through the Affiliate Program.

How to open an Affiliate Account with IC Markets

To register an Affiliate Account, Emirati traders can follow these steps:

- ✅Begin by going to the IC Markets Partners website.

- ✅Fill in your personal information on the application form, such as your name, email address, and phone number.

- ✅Upload the required documents to prove your identity. Photocopies of the PAN, photos, business documents, business experience certificates, and proof of government-registered identity are examples of acceptable documents.

- ✅Please be patient while your application is reviewed. This procedure usually takes one day.

- ✅You will be assigned a unique partner ID and a campaign link when your application is approved.

- ✅To begin referring clients, share your partner link on various platforms such as social media, your website, and other channels.

- ✅You will receive daily revenue-sharing benefits from eligible clients as your referrals become clients and begin trading.

Finally, IC Markets provides regular updates on your performance and support to help you succeed in your partnership journey.

Is there a fee to become an IC Markets affiliate?

No fees are associated with becoming an affiliate with IC Markets.

Do I get a unique referral link when I become an IC Markets affiliate?

Yes, you will be assigned a unique partner ID and a campaign link.

Is there a limit on how many people I can refer to IC Markets?

No, there is no limit to the number of referrals you can make.

Are there any exclusive benefits for high-performing IC Markets affiliates?

No, the program details do not mention exclusive benefits for top-performing affiliates.

IC Markets Minimum Deposit

| 🔑Live Account | 💴Minimum Dep. |

| 🥇cTrader | 735 AED/$200 |

| 🥈Raw Spread | 735 AED/$200 |

| 🥉Standard | 735 AED/$200 |

Can the IC Markets minimum deposit be made in different currencies?

Yes, IC Markets accepts multiple currencies for deposits, allowing traders to avoid conversion fees.

Is the IC Markets minimum deposit a one-time requirement?

The initial account opening requires a minimum deposit, but subsequent deposits can be of any amount.

IC Markets Account Types and Features

| 🔑Live Account | 💳Minimum Dep. | ⏰Average Spread | 💰Commissions | 💵Average Trading Cost |

| 🥇cTrader | $200 | 0.0 pips | $3 or $6 per side | 6.02 USD |

| 🥈Raw Spread | $200 | 0.0 pips | $3.5 or $7 per side | 7.02 USD |

| 🥉Standard | $200 | 0.6 pips | None | 6.30 USD |

IC Markets cTrader Account

Day traders, scalpers, and users of expert advisors are the target demographic for the IC Markets cTrader Raw Spread Account. This account type uses the cTrader platform and provides quick order execution and substantial liquidity.

For the EUR/USD pair, the average spread is just 0.1 pip, and there is a $3 per side commission, making it a desirable choice for active traders. Additionally, the account offers a demo account for practice and supports a variety of trading approaches.

| 🔑Account Feature | ℹ️ Value |

| 📈Trading Platform | cTrader |

| 💰Commission | $3 per side and $6 per round turn |

| ⏰Typical Average Spreads | 0.0 pips |

| 💳Minimum Deposit Requirement | 735 AED ($200) |

| 🔎Leverage | 1:500 |

| ✴️Maximum positions per account | 2,000 lots |

| 📍Server Location | London |

| 🚩Is micro-trading allowed | ✅Yes |

| 💴Currency Pairs | 64 |

| 📊Index CFD Trading | ✅Yes |

| ⛔Stop-out | 50% |

| ▶️One-Click Trading offered | ✅Yes |

| ☪️Islamic Accounts | ✅Yes |

| 📉Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic strategies, etc. |

| 🔊Programming Language | C# |

| 👍Suitable for | Day traders, scalpers, active traders |

| 🆓Is a Demo Account offered | ✅Yes |

IC Markets Raw Spread Account

Both the MetaTrader 4 and the MetaTrader 5 platforms offer the Raw Spread Account. It is intended for day traders, scalpers, and expert advisors like the cTrader account. Low spreads and a $3.50 per lot per side commission are available with this account.

Furthermore, New York-based servers minimize latency and increase trading effectiveness. For practice, there is also a demo account available.

| 🔑Account Feature | ℹ️ Value |

| 📈Trading Platform | MetaTrader 4 and 5 |

| 💰Commission | $3.5 per side and $7 per round turn |

| ⏰Typical Average Spreads | 0.0 pips |

| 💳Minimum Deposit Requirement | 735 AED ($200) |

| 🚩Leverage | 1:500 |

| 📌Maximum positions per account | 200 lots |

| 📍Server Location | New York |

| ✴️Is micro-trading allowed | ✅Yes |

| 💶Currency Pairs | 64 |

| 💹Index CFD Trading | ✅Yes |

| ⛔Stop-out | 50% |

| ▶️One-Click Trading offered | ✅Yes |

| ☪️Islamic Accounts | ✅Yes |

| 📉Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic trading, etc. |

| 🔊Programming Language | MQL4 |

| 👍Suitable for | Expert advisers, scalpers, |

| 🆓Is a Demo Account offered | ✅Yes |

IC Markets Standard Account

The IC Markets Standard Account is perfect for traders who favor a commission-free trading environment. Although the spreads begin at one pip, the lack of commissions makes it a financially sensible decision.

This account is compatible with MetaTrader 4 and 5 and provides affordable access to various trading instruments. It offers a demo account for practice and is especially suitable for discretionary traders.

| 🔑Account Feature | ℹ️ Value |

| 📈Trading Platform | MetaTrader 4 and 5 |

| 💰Commission | None |

| 📉Typical Average Spreads | 0.6 pips |

| 💳Minimum Deposit Requirement | 735 AED ($200) |

| 🖋️Leverage | 1:500 |

| 📝Maximum positions per account | 200 lots |

| 📍Server Location | New York |

| 📌Is micro-trading allowed | ✅Yes |

| 💶Currency Pairs | 64 |

| 📊Index CFD Trading | ✅Yes |

| ⛔Stop-out | 50% |

| ▶️One-Click Trading offered | ✅Yes |

| ☪️Islamic Accounts | ✅Yes |

| 💹Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic trading, etc. |

| 🔊Programming Language | MQL4 |

| 👍Suitable for | Discretionary Traders |

| 🆓Is a Demo Account offered | ✅Yes |

IC Markets Demo Account

The IC Markets Demo Account is a crucial tool for traders who want to test out and become familiar with the platform’s features without risking real money. The demo account’s unlimited time frame enables traders to practice for however long they need.

The virtual balance of up to $5,000,000 is one of its unique features, which enables Emirati traders to simulate trading with sizeable sums of capital, improving the learning experience.

Due to the account settings’ extensive flexibility, traders can customize certain features to suit their unique trading preferences and styles.

Additionally, real-time market data is offered, enabling traders to test their strategies in a simulated but accurate trading environment and analyze price changes.

In addition, to aid Emirati traders in honing their trading abilities, IC Markets offers a variety of educational resources to supplement the demo account, including webinars and tutorials.

IC Markets Islamic Account

IC Markets offers the Islamic Account, a swap-free account for traders prohibited from engaging in interest-based financial activities due to religious convictions.

By doing away with the payment or receipt of interest, this account type is intended to simplify halal trading. The Islamic Account offers cutting-edge trading infrastructure and quick execution speeds. It is accessible on all major IC Markets platforms, including MetaTrader 4, MetaTrader 5, and cTrader.

These accounts give users access to over 90 trading instruments, 1:500 leverage, and 0.0 pip spreads. Islamic accounts have no additional costs in the form of interest, in contrast to conventional accounts that might incur swap fees.

However, a small overnight financing fee might apply to unusual currency pairs and commodities like Brent, Natural Gas, and WTI.

One distinctive feature of IC Markets’ Islamic accounts is the absence of swaps or interest payments on trades involving currencies, metals, and indices. However, a small financing charge might be imposed on trades open for longer than one day.

IC Markets Professional Account

IC Markets’ Professional Account is intended for experienced traders who satisfy certain requirements. For those with a solid financial market foundation, this specialized account type offers several benefits to improve the trading experience.

Professional clients can access higher leverage than retail clients, who have fewer options and can increase their trading potential. Additionally, negative balance protection ensures that professional clients’ account balances can never drop below zero, adding monetary security.

In terms of fund management, IC Markets (EU) Ltd protects the financial assets of professional clients by holding their money in segregated Client Trust bank accounts.

Professional clients are also free to ask to be reclassified as retail clients, allowing them to change account types depending on their trading requirements and risk tolerance.

Traders who wish to open a professional account must satisfy two out of the three requirements listed below:

- ✅Sufficient Financial Instrument Portfolio: The client’s portfolio, which may include cash deposits and financial instruments, should exceed EUR 500,000.

- ✅Sufficient Trading Activity: Over the preceding four quarters, the client should have carried out at least 10 significant transactions, on average, in the relevant market.

- ✅Relevant Financial Sector Experience: The client must possess at least a year of relevant professional experience in the financial industry, including familiarity with the questioned transactions or services.

However, it is important to remember that while the Professional Account has several benefits, it could also have disadvantages.

For instance, the Investor Compensation Fund does not cover professional clients, which could put them at greater risk in certain circumstances.

Furthermore, as they are presumed to have more trading knowledge and experience, professional Emirati clients might not receive the same regulatory protections as retail clients.

Pros and Cons of IC Markets Account Types and Features

| ✅Pros | ❎Cons |

| IC Markets offers an unlimited demo account that traders can use to practise trading and test strategies | IC Markets does not support AED as an account base currency |

| IC Markets has competitive trading conditions across all account types | There are administrative commissions/fees charged on the Islamic Account |

Do all IC Markets account types support automated trading?

Yes, automated trading is available for all account types via platforms such as MetaTrader and cTrader.

Is scalping allowed on IC Markets accounts?

Yes, scalping is permitted, and the broker’s low spreads and quick execution make it an appealing option for scalpers.

IC Markets Base Account Currencies and Basic Order Types

IC Markets Base Account Currencies

The base account currencies available to Emiratis include the following:

- ✅USD

- ✅JPY

- ✅AUD

- ✅GBP

- ✅CAD

- ✅SGD

- ✅NZD

- ✅EUR

IC Markets Basic Order Types

- ✅Market Order – A market order can be either a buy or a sell order that executes at the current market price. This is the current price displayed on your price chart. If you place a market order, you will be immediately entered at the best available price.

- ✅Market orders are most effective when a trading opportunity requires prompt action. Click buy/sell at the market to enter the trade immediately.

- ✅Stop Order – A stop order can be either a buy or sell stop, depending on whether you wish to purchase above or below the market.

- This is useful for trading breakouts or trend continuation strategies when you want the market to continue moving in the same direction.

Alternatively, if you believe the price will reverse when it reaches a certain price, you can place a limit order. Limit orders can be either buy or sell limits, depending on the market’s direction before your anticipated reversal. A sell limit is used to sell above the market, while a buy limit is used to purchase below the market.

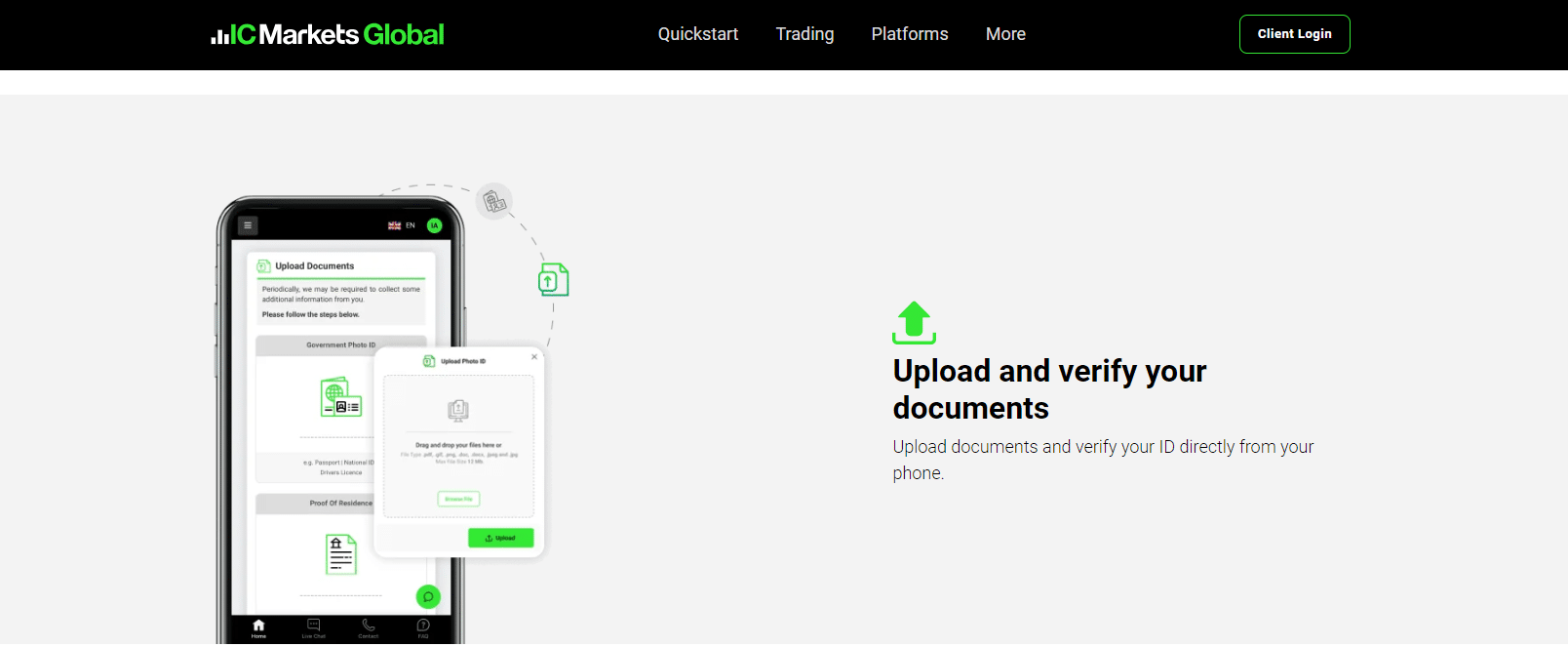

How to Open and Close an IC Markets Account

How to open an IC Markets Account

To open an account with IC Markets, Emiratis can follow these steps:

- ✅Visit the IC Markets website and select “Start Trading.”

- ✅Complete the registration form by entering your contact details, including your name, email address, and phone number.

- ✅Select the type of account that best suits your trading requirements. Three account types are available from IC Markets: Standard, Raw Spread, and cTrader.

- ✅Confirm your identity by submitting the required paperwork, such as a photo ID and proof of address.

- ✅Wait for your application to be verified, which typically takes one day.

When your application is accepted, you can make a deposit and begin trading.

Do I need to verify my identity with IC Markets?

Yes, identity verification is required, with a government-issued ID and proof of residence typically required.

Can I open an IC Markets account if I’m not an Australian resident?

Yes, IC Markets accepts clients from all over the world, though there are some geographical limitations.

How to Close an IC Markets Account

To close a live trading account with IC Markets, Emirati traders can follow these steps:

- ✅Contact IC Markets customer service via email, phone, or live chat to cancel your account.

- ✅IC Markets may offer account deactivation steps on their website or through customer service.

- ✅IC Markets’ Client Area allows for hiding trading accounts but not permanent deletion. Click the arrow next to the account number on the account summary page to hide it.

- ✅Withdraw any remaining funds before closing your account. Follow IC Markets’ withdrawal instructions to transfer your balance to your preferred payment method.

IC Markets should confirm account closure after all steps. Keep this confirmation for future reference.

Is there a fee for closing an IC Markets account?

No, IC Markets does not charge a fee to close an account.

How do I initiate the IC Markets account closure process?

You can close your account by contacting IC Markets’ customer service.

IC Markets MAM / PAMM Features

IC Markets provides specialized MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) solutions for traders who manage multiple accounts and execute trades for clients.

Due to their many features and advantages, these solutions are highly favored by both individual investors and professional money managers. The MAM/PAMM solutions from IC Markets feature a user-friendly interface that enables effective trade execution and account management.

Furthermore, trading professionals can closely monitor their activities and profits as they develop, thanks to real-time reporting capabilities.

These solutions are integrated with the cTrader platform to give traders a competitive edge and provide various advanced trading tools like depth of market (DOM), advanced order types, and volume-weighted average price (VWAP).

Another important characteristic is flexibility, as the solutions provide allocation methods like equity-based, lot-based, and percentage-based options to accommodate various trading strategies and risk management techniques.

IC Markets stands out for its competitive trading conditions, which include low spreads, high leverage, and superior liquidity. These features are especially helpful for users of MAM/PAMM solutions.

In addition, the platform’s reputation for high quality and potency in multi-account management solutions has been further cemented by its recognition as one of the top PAMM brokers in 2024.

Is the MAM/PAMM service available on all trading platforms?

No, only the cTrader platform offers the MAM/PAMM service.

What are the key features of the MAM/PAMM service?

Key features include a user-friendly interface, real-time reporting, advanced trading tools, and flexible allocation methods.

Social Trading with IC Markets

A strong social trading platform is provided by IC Markets, allowing users to either follow or start their successful signal providers.

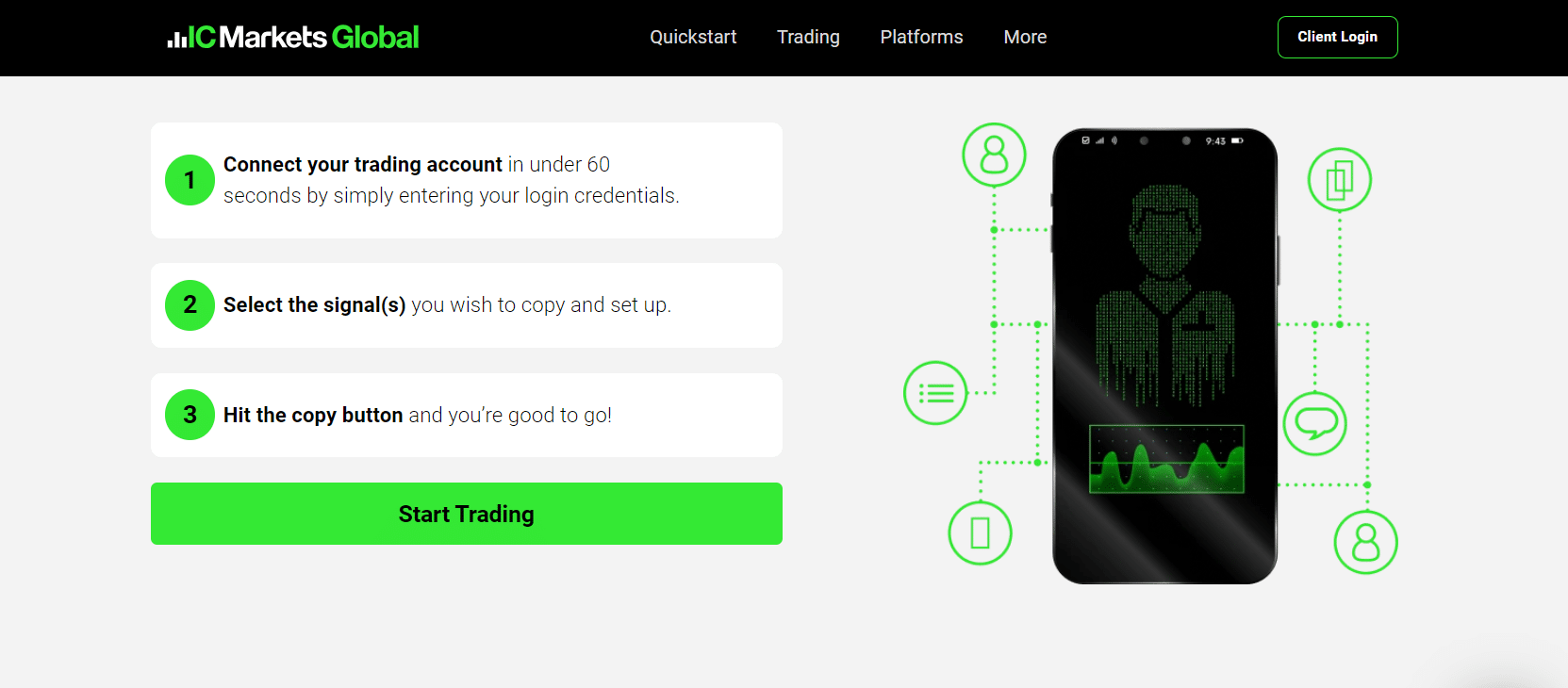

IC Markets offers real-time performance metrics to aid traders in making wise decisions and is accessible on various platforms, including IC Social, ZuluTrade, and cTrader Copy Trading. Social trading is accessible on mobile devices thanks to the IC Social app on the Google Play Store.

Furthermore, the IC Markets’ social trading solutions give traders a sizable competitive advantage when combined with aggressive trading conditions, like low spreads and high liquidity.

Do you know if I can copy trades from other traders with IC Markets?

Yes, IC Markets has social trading features that allow you to copy successful traders’ trades.

Which IC Markets platforms support social trading?

Platforms that support social trading with IC Markets include IC Social, ZuluTrade, and cTrader Copy Trading.

IC Markets Trading Platforms

IC Markets offers Emirati traders a choice between these trading platforms:

- ✅MetaTrader 4

- ✅MetaTrader 5

- ✅cTrader

- ✅IC Social

- ✅Signal Start

- ✅ZuluTrade

IC Markets MetaTrader 4

IC Markets provides its clients access to the well-known MetaTrader 4 platform, which forex traders primarily use.

Because of its user-friendly interface, rich feature set, and automated trading capabilities, MT4 has evolved from a basic trading tool into a global community where technological innovations meet traders’ needs.

Furthermore, IC Markets works with various technology providers to provide its clients with an enhanced version of the MetaTrader 4 platform to improve their trading experience.

IC Markets MetaTrader 5

MetaTrader 5 is a more advanced version of MetaTrader 4, with new features and improved performance. The platform broadens trading capabilities to include a broader range of financial instruments, including stocks, futures, options, forex, and CFDs.

MT5 has a more advanced and customizable interface, improved charting tools, and a built-in economic calendar.MT5, like its predecessor, allows for automated trading through Expert Advisors (EAs) and includes a comprehensive set of technical indicators and drawing tools.

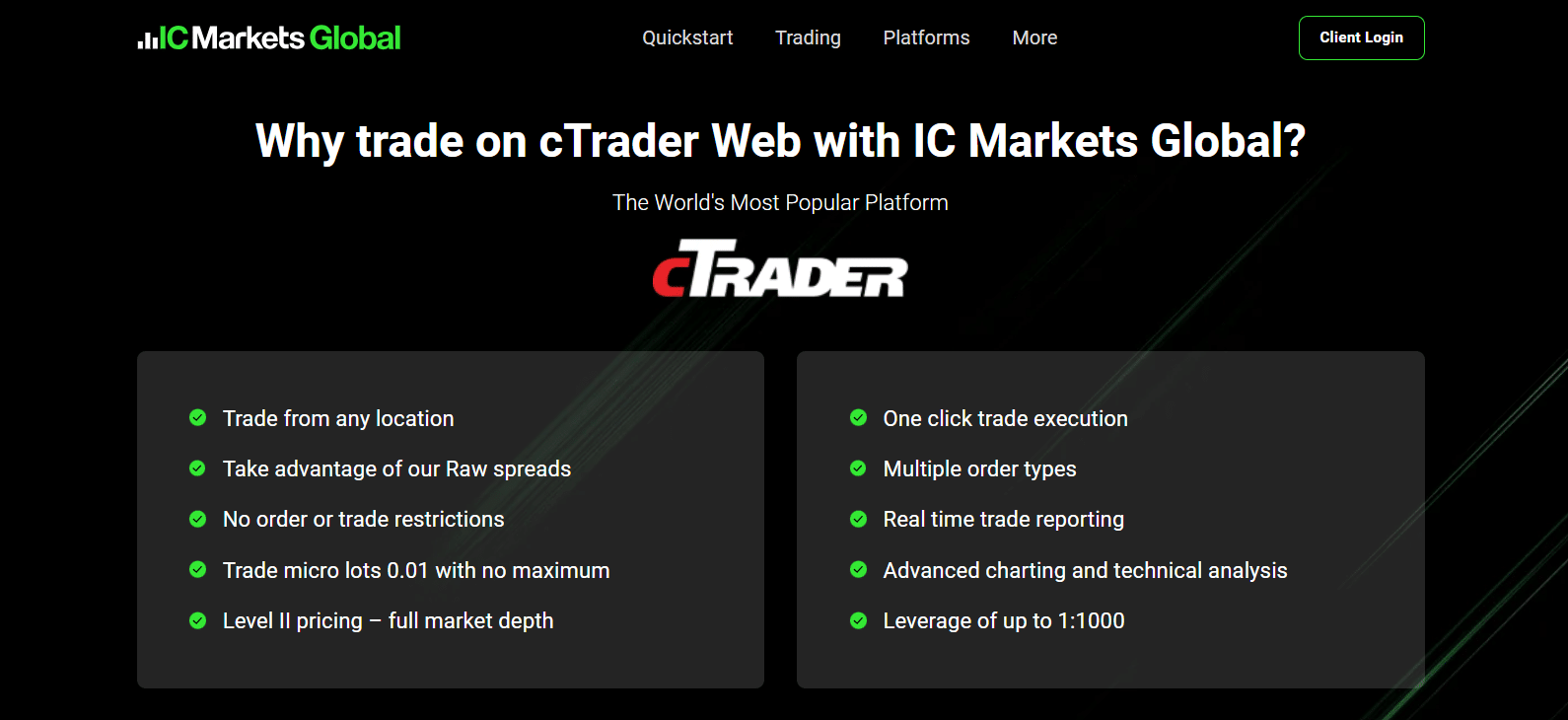

IC Markets cTrader

Because of its advanced trading capabilities and simple user interface, professional traders prefer cTrader. The platform offers deep liquidity, tight spreads, and quick execution times, making it an excellent choice for scalpers and high-volume traders.

Advanced charting features, numerous technical indicators, and the ability to create and back-test custom indicators and trading systems are all included in cTrader. It also supports automated trading through cBots, which function similarly to EAs in MT4 and MT5.

IC Markets Social

IC Social is an IC Markets-developed proprietary social trading app that allows traders to copy the trades of successful traders or become signal providers themselves. The mobile-friendly platform provides real-time performance metrics, making social trading convenient and accessible.

IC Markets Signal Start

Signal Start is another platform that facilitates automated trading, which allows traders to copy signals from various providers. It integrates seamlessly with the trading conditions of IC Markets, providing traders with low spreads and high liquidity while using the service.

IC Markets ZuluTrade

ZuluTrade is a social trading platform that connects traders and signal providers, allowing users to follow and replicate trading strategies. It supports advanced risk management and customization.

Because IC Markets is integrated with ZuluTrade, traders benefit from competitive trading conditions such as low spreads and high liquidity.

Pros and Cons of IC Markets Trading Platforms

| ✅Pros | ❎Cons |

| IC Markets offers the best social trading platforms to Emirati traders | While mobile apps offered are innovative, some functionality is restricted and can only be found on the desktop and web versions |

| IC Markets supports MetaTrader 4 and 5 across several devices | IC Markets does not have a proprietary app |

Does IC Markets support automated trading?

Yes, automated trading is possible with Expert Advisors and cBots on MetaTrader 4, MetaTrader 5, and cTrader.

Can I use multiple platforms with a single IC Markets account?

You can use multiple platforms, but some features may be platform-specific.

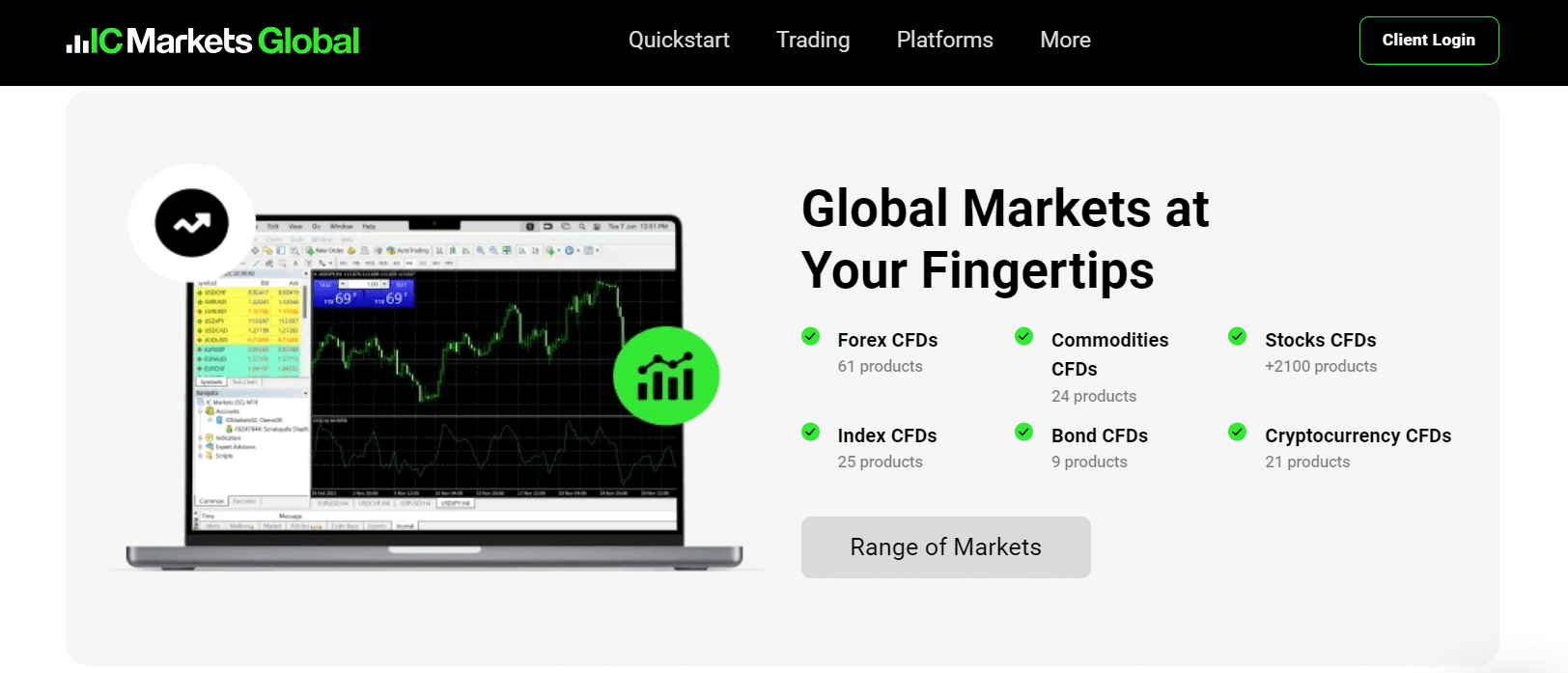

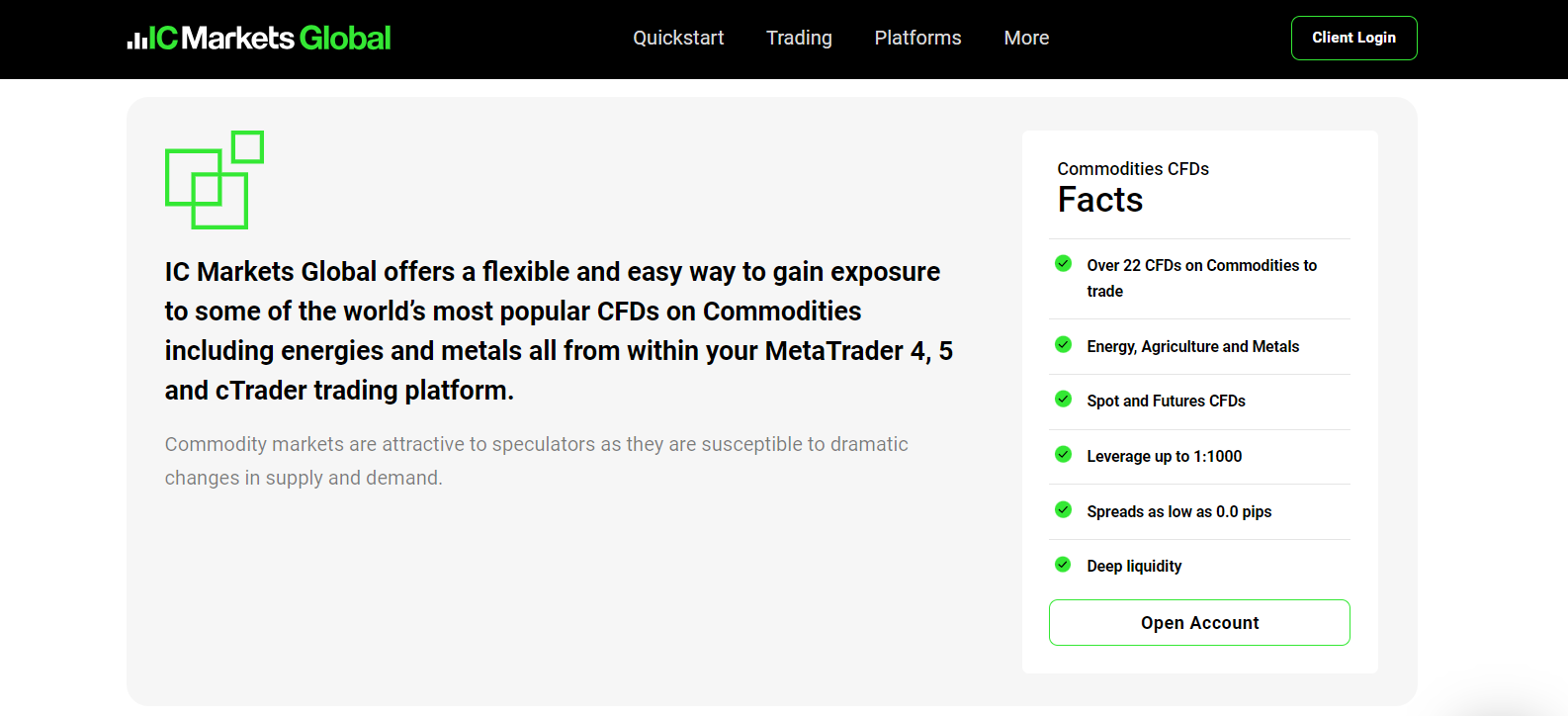

Which Markets Can You Trade with IC Markets?

Emirati traders can expect the following range of markets from IC Markets:

- ✅Forex

- ✅Commodities

- ✅Indices

- ✅Bonds

- ✅Cryptocurrencies

- ✅Stocks

- ✅Futures

Financial Instruments and Leverage offered by IC Markets

| 🔑Instrument | 🅰️Number of Assets Offered | 🅱️Max Leverage Offered |

| 📈Forex | 64 | 1:500 |

| 💎Commodities | 22 | 1:100 |

| 📉Indices | 25 | 1:200 |

| 📊Stocks | 1,600 | 1:20 |

| 🪙Cryptocurrency | 18 | 1:5 |

| 📌Futures | 4 | 1:200 |

| 🗂️Bonds | 11 | 1:200 |

Broker Comparison for a Range of Markets

| 🔑Broker | 🥇IC Markets | 🥈Pepperstone | 🥉FXCM |

| 📈Forex | ✅Yes | ✅Yes | ✅Yes |

| 💎Precious Metals | ✅Yes | ✅Yes | ✅Yes |

| 💹ETFs | None | ✅Yes | None |

| ✴️CFDs | ✅Yes | ✅Yes | ✅Yes |

| 📉Indices | ✅Yes | ✅Yes | ✅Yes |

| 📊Stocks | ✅Yes | ✅Yes | ✅Yes |

| 🪙Cryptocurrency | ✅Yes | ✅Yes | ✅Yes |

| 🔃Options | None | None | None |

| 💡Energies | ✅Yes | ✅Yes | ✅Yes |

| 🗂️Bonds | ✅Yes | None | None |

Pros and Cons IC Markets Range of Markets

| ✅Pros | ❎Cons |

| All financial instruments can be accessed through each trading account | Regardless of negative balance protection, Emiratis can still lose their entire investment if they use leverage recklessly |

| IC Markets offers Emiratis access to several international markets by offering CFD trading | Compared to other brokers, IC Markets’ non-forex instruments are limited |

Can I trade commodities with IC Markets?

Yes, commodities such as gold, oil, and natural gas can be traded.

Is there a market for bonds with IC Markets?

Yes, Government bonds can be traded with IC Markets.

IC Markets Fees, Spreads, and Commissions

IC Markets Spreads

Variable spreads are available from IC Markets and vary according to the type of account, the particular financial instrument, and the state of the market.

The typical spreads for Emirati traders trading EUR/USD are 0.0 for both cTrader and Raw Spread Accounts and 0.6 for the Standard Account.

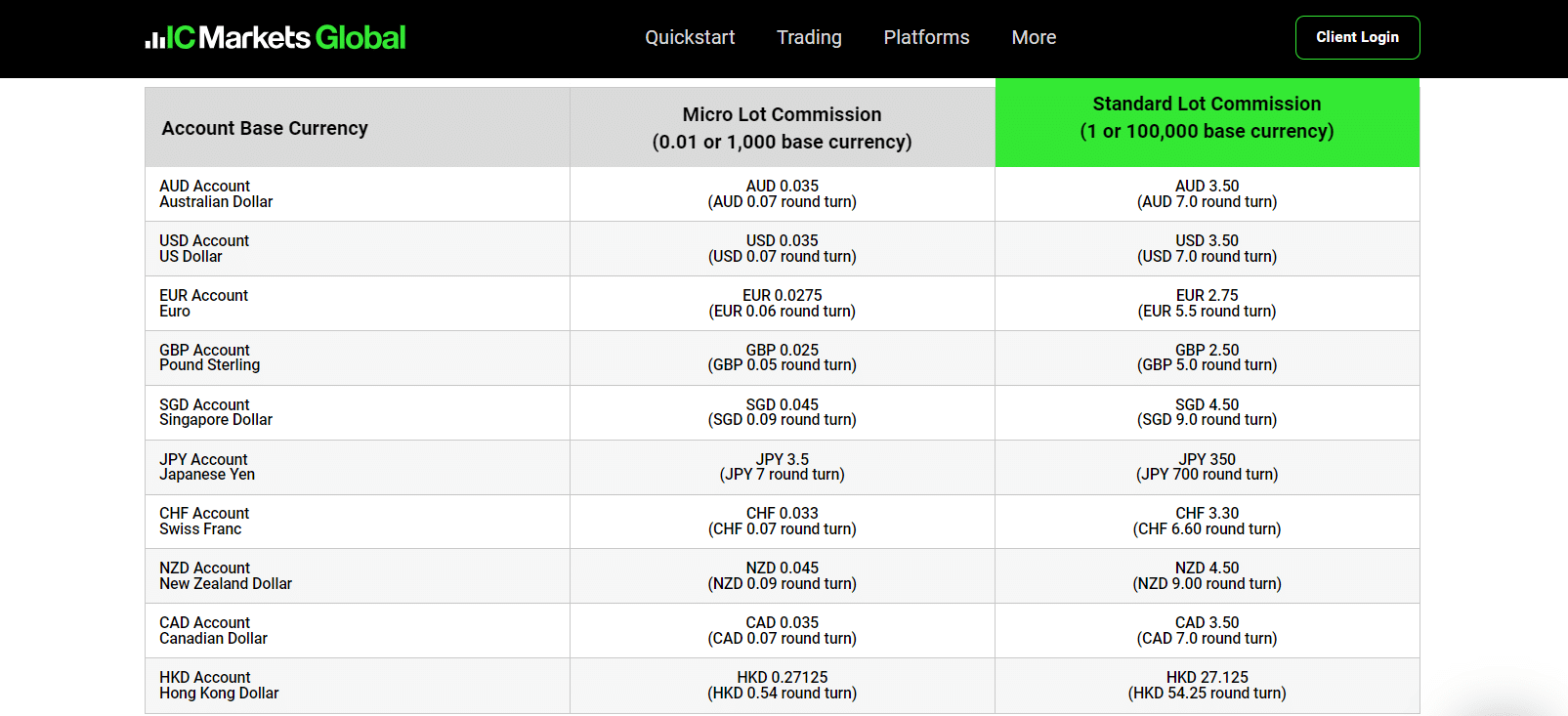

IC Markets Commissions

Commissions are charged for accounts with no spreads to cover the costs of the transaction. The commission in a cTrader Account is $3 for each side or $6 for a round turn.

It costs slightly more for a Raw Spread Account ($3.5 per side or $7 for a round turn). Islamic accounts have a commission ranging from $5 to $80 to make up for this because they are made to be Shariah-compliant by not charging overnight fees.

IC Markets Overnight Fees, Rollovers, or Swaps

Interest rates are applied to positions held overnight in derivatives trading, known as swap rates or rollovers. Depending on the difference in overnight interest rates between the two currencies, these rates can be added to or subtracted from a deal.

The trading platform determines the swap value in points and automatically converts it to the account’s base currency.

IC Markets Deposit and Withdrawal Fees

Financial transactions are more convenient for Emirati traders thanks to IC Markets’ lack of fees for deposits or withdrawals.

Inactivity Fees

IC Markets does not charge inactivity fees, giving flexibility to traders who may not engage in regular trading activities.

IC Markets Currency Conversion Fees

Emirati traders should know that currency conversion fees may be charged when making AED deposits or withdrawals.

Pros and Cons of IC Markets Trading and Non-Trading Fees

| ✅Pros | ❎Cons |

| IC Markets is renowned for its zero-pip spreads and ECN execution | Because IC Markets does not have an AED-denominated account, currency conversion fees apply |

| Traders can use commission-free accounts to get started in forex trading | IC Markets’ CFD financing fees are expensive compared to other brokers |

Is leverage free with IC Markets?

Yes, leverage is free of charge, but it increases potential gains and risks.

Are there any withdrawal fees with IC Markets?

No, there are no withdrawal fees, but payment providers may charge their own.

IC Markets Deposits and Withdrawals

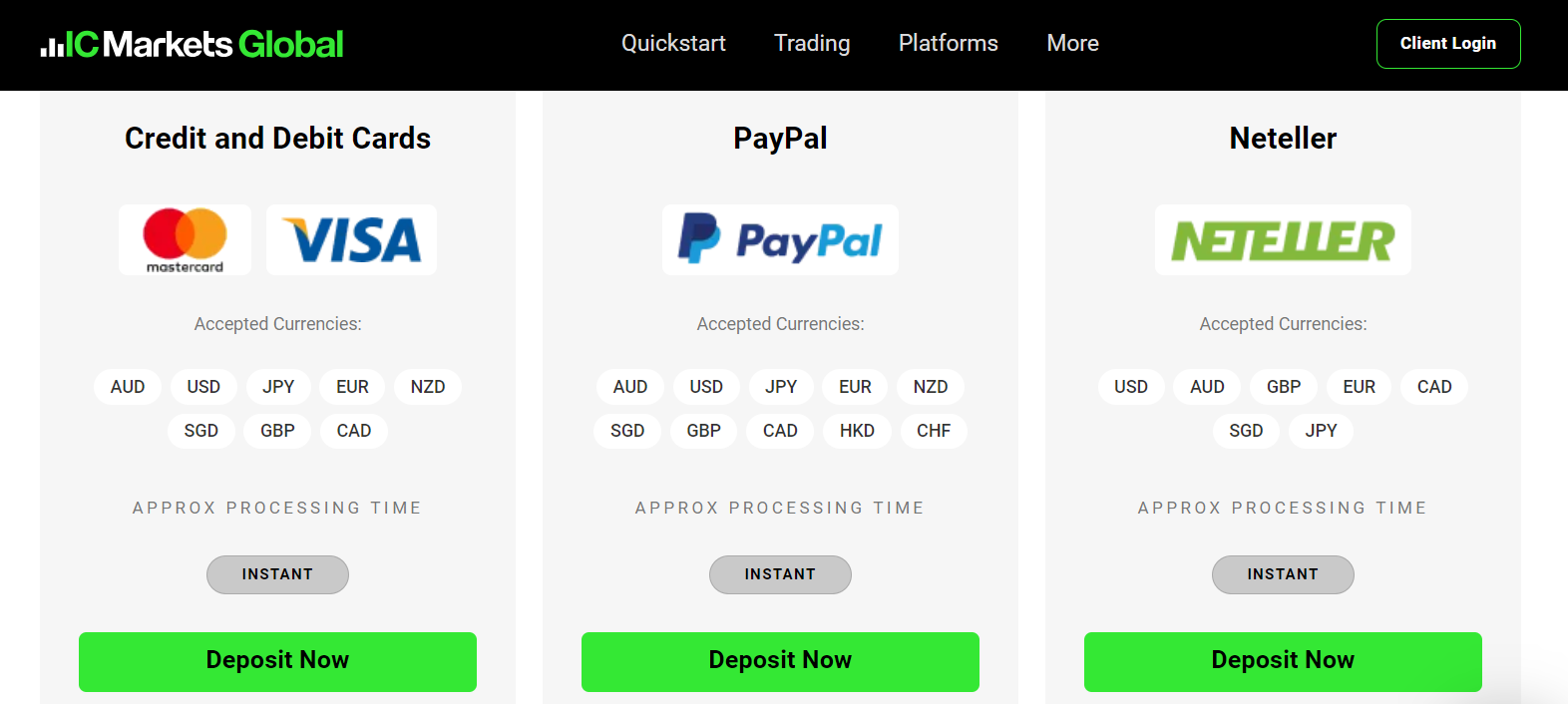

IC Markets offers Emirati traders the following deposit and withdrawal methods:

- ✅Credit Card

- ✅Debit Card

- ✅PayPal

- ✅Neteller

- ✅Neteller VIP

- ✅Skrill

- ✅UnionPay

- ✅Bank Wire Transfer

- ✅Bpay

- ✅FasaPay

- ✅Broker to Broker

and much more!

How to make a Deposit with IC Markets

To deposit funds to an account with IC Markets, Emirati traders can follow these steps:

- ✅Go to the Secure Client Area after signing into your IC Markets account.

- ✅Select the method of deposit that best meets your needs. In addition to credit and debit cards, PayPal, Neteller, Skrill, UnionPay, wire transfers, and Bpay, IC Markets also provides a variety of other deposit methods.

To finish the deposit process, adhere to the instructions. While deposits made using other methods may take up to an hour to process, deposits made using the Secure Client Area are processed instantly.

How long do IC Markets Deposits take?

IC Markets offers several instant deposits. However, other payment methods, like bank transfers, can take a few working days before funds are available in the trading account.

Is there a maximum deposit limit with IC Markets?

IC Markets does not have a maximum deposit limit, but payment providers may have their own.

Is it safe to deposit large amounts with IC Markets?

Yes, large deposits can be safely done with IC Markets. To protect your transactions, IC Markets employs secure encryption methods.

How to Withdraw from IC Markets

To withdraw funds from an account with IC Markets, Emirati traders can follow these steps:

- ✅Navigate to the Secure Client Area after logging into your IC Markets account.

- ✅Select the ‘Withdraw Funds’ option.

- ✅Select the withdrawal method that best meets your requirements. Withdrawal options at IC Markets include bank transfer, credit and debit cards, PayPal, Neteller, Skrill, UnionPay, and Bpay.

To complete the withdrawal process, follow the instructions provided.

How long do IC Markets Withdrawals take?

Withdrawals processed through the Secure Client Area are typically processed within one business day, whereas withdrawals processed through other methods may take several working days.

Can I withdraw to a different payment method than I used for depositing to an IC Markets Account?

No, withdrawals must be made using the same payment method used to deposit.

Do I need to verify my IC Markets account for withdrawals?

Yes, account verification is required before making a withdrawal.

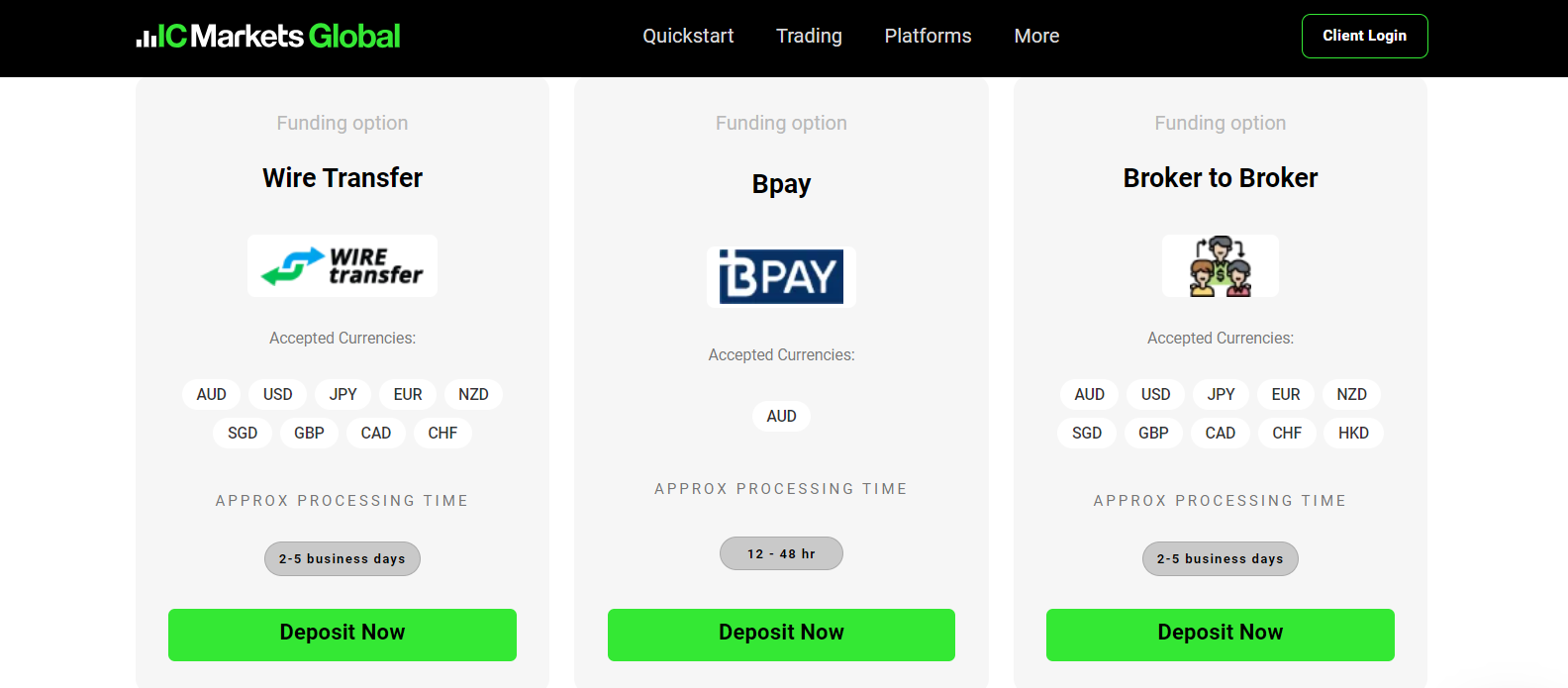

IC Markets Deposit Currencies, Deposit and Withdrawal Processing Times

| 🔑Payment Method | 💵Deposit Currencies | 📝Deposit Processing | 🗂️Withdrawal Processing |

| 💳Credit Card | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD | Instant | 3 to 5 working days |

| 💶Debit Card | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF | Instant | 3 to 5 working days |

| 💵PayPal | USD, AUD, GBP, EUR, CAD, SGD, JPY | Instant | Instant |

| 💻Neteller | AUD, GBP, EUR, CAD, SGD, JPY | Instant | Instant |

| 💴Neteller VIP | AUD, GBP, EUR, CAD, SGD, JPY | Instant | Instant |

| ⏩Skrill | AUD, USD, JPY, EUR, SGD, GBP | Instant | Instant |

| 💷UnionPay | RMB | Instant | Instant |

| 🏦Bank Wire Transfer | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, CHF | 2 to 5 working days | Up to 14 days |

| ➡️Bpay | AUD | 12 to 48 hours | 2 to 3 working days |

| ✴️FasaPay | USD | Instant | 3 to 5 working days |

| 👥Broker to Broker | AUD, USD, JPY, EUR, NZD, SGD, GPB, CAD, CHF, HKD | 2 to 5 working days | 3 to 5 working days |

| 💰POLi | AUD | Instant | 2 to 3 working days |

| 🔎Thai Internet Banking | USD | 15 to 30 minutes | One business Day |

| 💻Vietnamese Internet Banking | USD | Instant | One Business Day |

| ⏩Rapidpay | EUR, GBP | Instant | 3 to 5 working days |

| 💸Klarna | EUR, GBP | Instant | 3 to 5 working days |

Broker Comparison – Deposit and Withdrawals

| 🔑Broker | 🥇IC Markets | 🥈Pepperstone | 🥉FXCM |

| ⏰Minimum Withdrawal Time | Instant | 1 business day | Instant |

| ⏱️Maximum Estimated Withdrawal Time | Up to 14 business days | Up to 7 business days | Up to 2 working days |

| 💳Instant Deposits and Instant Withdrawals | ✅YesYes, on PayPal, Neteller, and Skrill | None | ✅Yes |

Pros and Cons of IC Markets Deposits and Withdrawals

| ✅Pros | ❎Cons |

| IC Markets has multi-currency payment methods for deposits and withdrawals | IC Markets does not provide any local payment methods for Emiratis and does not support AED on deposits or withdrawals |

| IC Markets has instant deposits, allowing Emiratis to start trading immediately once an account is funded | Currency conversion fees might apply to AED deposits and withdrawals |

| IC Markets keeps all client funds in segregated accounts as per strict regulations | Bank Wire withdrawals can take up to two weeks before funds return to the trader’s account |

What withdrawal methods are available with IC Markets?

Funds can be withdrawn via bank transfer, credit/debit cards, and e-wallets.

How long do withdrawals take with IC Markets?

Although IC Markets does not charge withdrawal fees, payment providers may.

IC Markets Education and Research

Education

IC Markets offers the following Educational Materials to Emirati traders:

- ✅Trading Knowledge

- ✅Advantages of Forex

- ✅Advantages of CFDs

- ✅Video Tutorials

- ✅Web TV

- ✅Webinars

- ✅Podcasts

and more!

IC Markets also offers Emirati traders the following additional Research and Trading Tools:

- ✅Economic Calendar

- ✅Analysis Blog

- ✅Forex Calculators

- ✅Forex Glossary

Research and Trading Tool Comparison

| 🔑Broker | 🥇IC Markets | 🥈Pepperstone | 🥉FXCM |

| 📈Economic Calendar | ✅Yes | ✅Yes | ✅Yes |

| 🔒VPS | ✅Yes | ✅Yes | ✅Yes |

| 📉AutoChartist | ✅Yes | ✅Yes | None |

| 👁️Trading View | None | ✅Yes | ✅Yes |

| 📍Trading Central | ✅Yes | None | None |

| 📊Market Analysis | ✅Yes | ✅Yes | ✅Yes |

| 🗞️News Feed | ✅Yes | ✅Yes | ✅Yes |

| 🖥️Blog | ✅Yes | ✅Yes | ✅Yes |

Pros and Cons IC Markets Education and Research

| ✅Pros | ❎Cons |

| IC Markets offers comprehensive educational material and tools for beginners | The trading tools and research offered by IC Markets pale in comparison to other brokers |

Is there an IC Markets demo account for practice?

Yes, IC Markets provides a demo account for traders to practice without risk.

Are there any research tools available from IC Markets?

Yes, IC Markets provides various research tools, such as market analysis and trading signals.

IC Markets Customer Support

| 🔑Customer Support | 🥇IC Markets Customer Support |

| ⏰Operating Hours | 24/7 |

| 🌎Support Languages | Portuguese, English, Vietnamese, Chinese |

| 🔊Live Chat | ✅Yes |

| 💻Email Address | ✅Yes |

| ☎️Telephonic Support | ✅Yes |

| 💯The overall quality of IC Markets Support | 4.3/5 |

Pros and Cons of IC Markets Customer Support

| ✅Pros | ❎Cons |

| IC Markets offers 24/7 customer support to traders | IC Markets does not have a local office in Dubai |

Is IC Markets’ support available in multiple languages?

Yes, support is available in a variety of languages.

How responsive is the IC Markets live chat feature?

The live chat service is typically responsive, with short wait times.

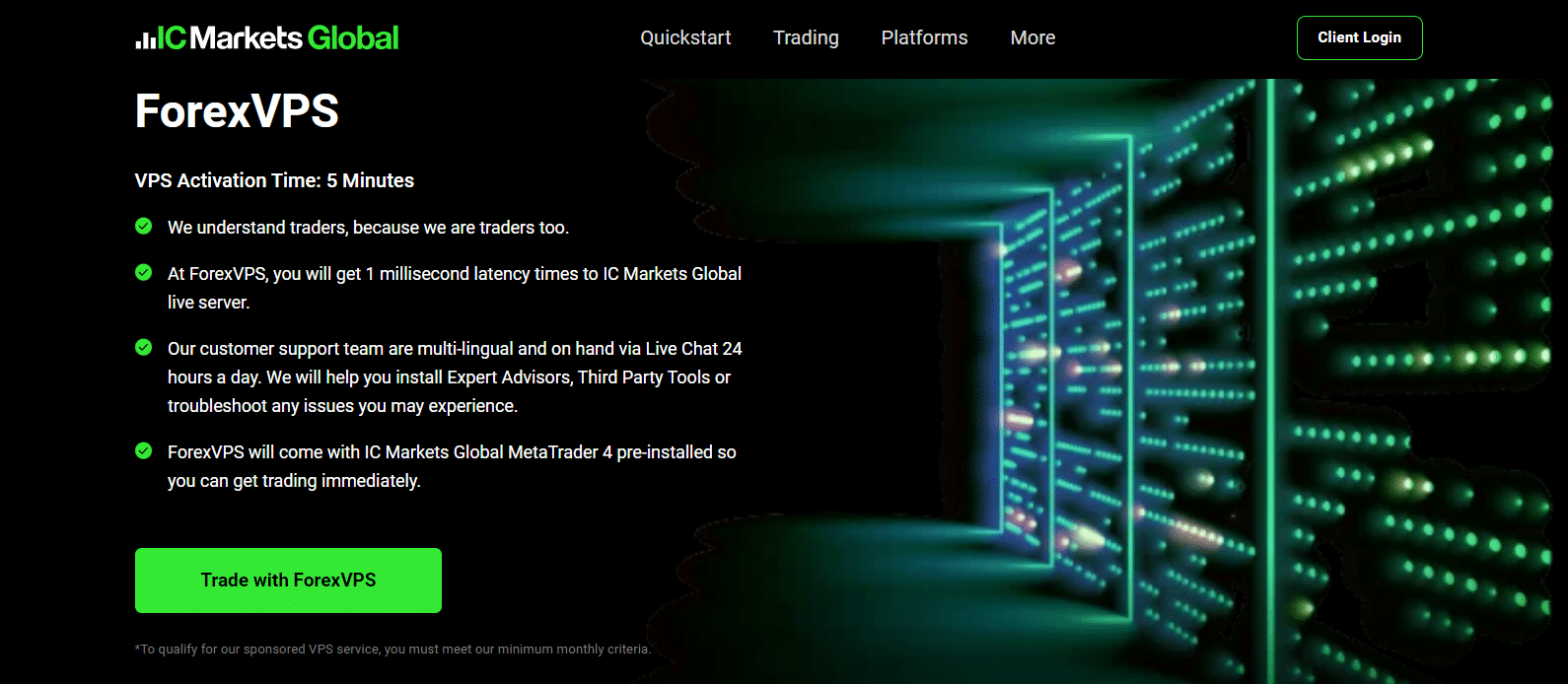

IC Markets VPS Review

IC Markets’ VPS solutions are strategically placed in Equinix data hubs and have direct connections to trading servers in Equinix NY4. This means that the connections are fast, and there is little latency.

Traders who buy or sell more than 15 lots (round turns) per month are eligible for a free VPS subscription from a provider that is suggested. On the other hand, if this volume threshold is not met for two consecutive months, the subscription will end automatically.

In partnership with ForexVPS.net and FXVM, IC Markets offers reliable VPS services with a guarantee of 100% uptime and as little as 1 ms latency to trading platform servers.

These VPS options include a dedicated IP address, Windows Server, 1.5 GB of RAM, 40 GB of SSD storage, and a single CPU core. Traders can easily access their VPS through the client area’s remote desktop protocol (RDP) clients or web clients.

Can I use the IC Markets VPS with MetaTrader 5?

Yes, the VPS supports both MetaTrader 4 and MetaTrader 5.

Is there a minimum trading volume to keep the free IC Markets VPS?

Yes, to keep the sponsored VPS, you must maintain a trading volume greater than 15 lots per month.

IC Markets Cashback Rebates Features and Conditions

A portion of Emirati traders’ trading commissions can be refunded as a discount on spreads and commissions through IC Markets’ cashback rebates program. The rebate amount varies based on the type of account, trading volume, and other factors.

Once the specific requirements are satisfied, the rebates are automatically paid each day. Both Standard and Raw Spread accounts can take advantage of the cashback rebates program at IC Markets.

The cashback rebates program at IC Markets can help Emirati traders become more profitable by lowering their trading expenses. Churning, or generating rebates without actually trading, is not accepted by brokers and could result in the rebates being void, so traders should be aware of this.

IC Markets has structured a cashback rebate program with three distinct tiers, each with its own benefits and eligibility criteria.

The rebates are granted per lot for both forex and metals trading in the following manner:

- ✅Traders in Tier 1 are rewarded with a rebate of $1.50 per lot.

- ✅With Tier 2, the rebate value is elevated to $2.25 per lot.

- ✅Lastly, Tier 3 traders can earn a rebate of $2.50 per lot.

How are IC Markets’ cashback rebates calculated?

IC Markets rebates are determined by the number of standard lots traded, with higher trading volumes resulting in higher rebates.

Is there a minimum trading volume for IC Markets’ rebates?

Yes, traders must meet certain volume requirements over three months to keep their Raw Trader Plus membership.

IC Markets Web Traffic Report

| 🌎Global Rank | 19,690 |

| 📍Country Rank | 9,357 |

| 📈Category Rank | 63 |

| 🔢Total Visits | 3.4 million |

| 🌐Bounce Rate | 47.11% |

| 📖Pages per Visit | 3.56 |

| ⏱️Average Duration of Visit | 00:03:48 |

| 🖋️Total Visits in the last three months | June – 3 million July – 3.3 million August – 3.4 million |

IC Markets Geographic Reach and Limitations

IC Markets Current Expansion Focus

IC Markets is expanding across Europe, Asia, Africa, and other regions.

Countries not accepted by IC Markets

IC Markets does not accept traders from these regions:

- ✅Canada

- ✅Iran

- ✅The United States

- ✅Yemen

- ✅OFAC Countries

Popularity among Emirati traders who choose IC Markets

IC Markets is among the Top 25 Forex and CFD brokers for Emirati traders.

Are there any countries where IC Markets is not available?

Yes, IC Markets does not operate in countries where regulations apply, such as the United States and Canada.

Does IC Markets offer local payment methods for different countries?

IC Markets accepts various payment methods; however, the availability of local payment options varies by country.

Best Countries by Traders

| 🌎Country | 📈Market Share |

| 🥇United Kingdom | 8.02% |

| 🥈Australia | 7.19% |

| 🥉Thailand | 5.97% |

| 🏅Indonesia | 5.61% |

| 🎖️Mexico | 4.56% |

IC Markets vs Pepperstone vs FXCM – A Comparison

| 🔑Broker | 🥇IC Markets | 🥈Pepperstone | 🥉FXCM |

| 🚨Regulation | ASIC, CySEC, FSA, SCB | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB | FCA, ASIC, CySEC, FSCA |

| 📈Trading Platform | MetaTrader 4 MetaTrader 5 cTrader | MetaTrader 4 MetaTrader 5 cTrader TradingView Myfxbook DupliTrade | Trading Station MetaTrader 4 NinjaTrader ZuluTrade Capitalise AI TradingView Pro QuantConnect MotiveWave AgenaTrader Sierra Chart SeerTrading NeuroShell Trader |

| 💴Withdrawal Fee | None | None | Yes, bank wire |

| 🆓Demo Account | ✅Yes | ✅Yes | ✅Yes |

| 💵Min Deposit | 735 AED | 232 AED | 184 AED |

| 💹Leverage | 1:500 | 1:400 | 1:30 (FCA) 1:400 (Other Reg) |

| 📉Spread | From 0.0 pips | Variable, from 0.0 pips | From 0.2 pips EUR/USD |

| 💰Commissions | From $3 to $3.5 | From AU$7 | $25 per $1m traded |

| ⛔Margin Call/Stop-Out | 100%/50% | 90%/20% | 100%/50% |

| 📝Order Execution | Market | Market | Market |

| 💶No-Deposit Bonus | None | None | None |

| 🪙Cent Accounts | None | None | None |

| 🗂️Account Types | cTrader Account Raw Spread Account Standard Account | Standard Account Razor Account | Spread Betting CFD Trading Active Trader Professional Trader |

| 🖋️DFSA Regulation | None | None | None |

| 💷AED Deposits | None | None | None |

| 🚩AED Account | None | None | None |

| ⏰Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📒Retail Investor Accounts | 3 | 2 | 1 |

| ☪️Islamic Account | ✅Yes | ✅Yes | ✅Yes |

| ⬇️Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| ⬆️Maximum Trade Size | Unlimited | 100 lots | 50 million per trade on Forex |

| ⏱️Minimum Withdrawal Time | Instant | 1 business day | Instant |

| ⏲️Maximum Estimated Withdrawal Time | Up to 14 business days | Up to 7 business days | Up to 2 working days |

| 💳Instant Deposits and Instant Withdrawals | ✅Yes, on PayPal, Neteller, and Skrill | None | ✅Yes |

IC Markets Alternatives

- 🥇RoboForex offers a variety of trading instruments and platforms to traders of varying levels of expertise. Their MetaTrader 4 and MetaTrader 5 trading platforms are well-known for providing advanced charting tools, trading robots, and copy trading. The CopyFX platform allows traders to replicate the strategies of successful investors, which could be useful for Emirati traders looking to diversify their trading strategies.

- 🥈Axiory is well-known for its user-friendly platforms and extensive library of educational resources. They provide MetaTrader 4 and cTrader platforms, including advanced trading tools and analytics. The broker also highly values customer service and provides daily market analysis, which can help Emirati traders make informed decisions.

- 🥉FOREX.com has been recognized for its outstanding all-around services, making it a viable platform for Emirati traders. It is referred to as a specialist Forex Broker for UAE traders, implying that it provides a service tailored to this demographic. Forex.com improves the trading experience with features such as Smart Signals and Performance Analytics, which aid in strategy optimization.

IC Markets Awards and Recognition

IC Markets received the following recent awards and recognition:

- ✅In the 2024 Annual Awards, ForexBrokers.com named IC Markets the best MetaTrader broker.

- ✅The podcast “IC Your Trade” by IC Markets was recognized for “Branded Business Show and Advertising” by Signal Awards.

- ✅In the DayTrading.com Broker Awards for 2024, IC Markets was named the Best Overall Broker winner.

- ✅2019’s Best ECN Broker was awarded to IC Markets by the ADVFN International Financial Awards.

- ✅In the FxScouts India Annual Forex Awards, IC Markets won Best Forex MT5 Broker.

and many more!

Our Experience with IC Markets

Working with IC Markets has greatly facilitated this process for us. The broker has made a name for itself in Forex and CFD trading. It is renowned for its open pricing policies and quick order execution.

We were particularly impressed by the wide selection of financial instruments as we browsed its offerings. This gave us more trading options and allowed us to examine market dynamics thoroughly.

Low spreads and affordable commissions benefit traders who want to increase profits. Furthermore, the strong regulatory environment that IC Markets operates in fostered confidence and security.

Furthermore, we felt more confident in our trading endeavors because the ASIC and CySEC regulations guarantee a fair trading environment.

IC Markets Trading Platform

In our experience, IC Markets accommodates a wide range of trader preferences by providing both the MetaTrader and cTrader platforms. In our opinion, the platforms are very user-friendly, well-designed, and packed with all the resources and tools needed for trading.

Our trading efficiency was increased by how simple it was to use the market analysis tools, charting features, and order management systems.

Furthermore, it was a big plus that the platforms maintained stability even during high market volatility. Our trades were carried out at the desired prices because of the quick order execution, which reduced slippage.

Additionally, the availability of automated trading via Expert Advisors (EAs) and cAlgo facilitated the implementation of the strategy and freed us up to concentrate more on market research.

Quality of Customer Service

Our interactions with the customer service staff at IC Markets were generally positive. Our questions were quickly answered thanks to the availability of several communication channels, including live chat, email, and phone support.

The support agents demonstrated a thorough knowledge of the trading platform and market operations while being polite and knowledgeable.

Although there were occasions when responses were delayed during the busiest trading times, IC Markets’ extensive FAQ section on their website frequently provided the necessary information, ensuring that our trading activities were rarely interfered with.

IC Markets Response Time

| 🤝Support Channel | ⏰Average Response Time | ⌚User-based Response Time |

| ☎️Phone | 5 minutes | 2 minutes |

| 24 hours | Same-day | |

| 🔊Live Chat | 5 minutes | 4 minutes |

| 📱Social Media | 5 minutes | 2 – 3 minutes |

| 👥Affiliate | 24 hours | Same-day |

Recommendations according to our in-depth review of IC Markets

- ✅IC Markets could add more instruments to its current selection to serve long-term investors better.

- ✅Adding more languages to customer service could improve the platform’s usability for clients worldwide.

- ✅To improve the overall trading experience for its users, IC Markets could continue to create more trading tools.

- ✅A loyalty or rewards program can promote long-term trading and attract more retail clients.

- ✅Increasing the number of regional payment options could streamline deposit and withdrawal procedures for traders in different areas.

- ✅IC Markets may want to consider lowering its minimum deposit to make its services more available to a wider range of traders.

- ✅Allowing traders to alter the platform’s user interface could lead to a more tailored trading experience.

- ✅Addressing concerns about spreads and stop-loss manipulation could be done by IC Markets by increasing transparency and educating the public about these issues.

Finally, the security of traders would increase by introducing more sophisticated risk management tools, like guaranteed stop-loss orders.

IC Markets Customer Reviews

🥇 Good Customer Service.

I’ve been a customer of IC Markets for five years, and their customer service has always been helpful, providing detailed explanations for all website features. It is the best liquidity platform I have used among all brokers. – Amina Sharif

🥈Trustworthy.

IC Markets is an excellent choice for those seeking a trustworthy broker. They provide quick deposit and withdrawal processes, and their customer service representatives are always quick to resolve any issues. The only disadvantage is that those not yet registered with IC Markets will miss out on these advantages. – Abdullah Abadi

🥉One of the Best!

IC Markets is one of the best brokers I’ve worked with. Their trading platforms are extremely stable; I have never encountered any issues. While I have rarely needed to contact customer service, my interactions have been excellent on those rare occasions. My only wish is that the company establish a spread-betting service in the United Kingdom. – Fatima Hashemi

Pros and Cons of Trading with IC Markets

| ✅Pros | ❎Cons |

| IC Markets is a reputable broker with a safe, transparent trading environment | The DFSA does not regulate IC Markets in Dubai |

| IC Markets offers low, competitive spreads and ECN execution | IC Markets is ideal for scalpers but not medium to long-term investors |

In Conclusion

We conclude that IC Markets is a respectable broker with a selection of trading platforms, attentive customer service, and an Affiliate Program that enables traders to make money by referring customers to the broker.

With an emphasis on supplying a balanced trading environment, IC Markets is a good option for both inexperienced and seasoned traders.

The trading platforms offered by IC Markets are extensive and designed to accommodate a wide range of traders. MetaTrader 4 is particularly user-friendly and offers robust automated trading capabilities.

By incorporating more financial instruments and a better user interface, MetaTrader 5 improves upon these features. On the other hand, cTrader is designed for professional traders and offers sophisticated charting features and a sizable liquidity pool.

The support staff at IC Markets provides responsive and efficient customer service and is skilled at finding solutions to problems quickly. The general customer service standard aligns with IC Markets’ dedication to offering first-rate client support.

Through IC Markets’ lucrative affiliate program, traders can refer customers to the broker in exchange for commissions. By receiving a discount on spreads and commissions through the cashback rebates program, traders can lower their trading expenses and boost their profitability.

Due to the lack of stocks, ETFs, or funds, IC Markets is not advised for long-term investors. The research is still weak in comparing its overall offering to the best brokers in this category.

Furthermore, our research showed that spreads and stop-loss manipulation have raised concerns from some traders, so it is important to proceed cautiously.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Emirati investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Frequently Asked Questions

What are the pros of using IC Markets?

Among the benefits are low average spreads, competitive pricing across all account types, and third-party research and trading tool plugins.

Does IC Markets support automated trading?

Yes, IC Markets, which conducts over 500,000 automated trades daily, is a top choice for traders who use automation.

Is IC Markets regulated?

Yes, several regulatory entities oversee IC Markets’ operations, including SCB, CySEC, FSA, and ASIC.

What are the spreads on IC Markets?

IC Markets has some of the most competitive spreads in the industry, with raw spreads starting at 0.0 pips and averaging 0.1.

How long does it take to withdraw from IC Markets?

Some withdrawals are instant, while others take a few days, depending on which is being used.

Is IC Markets Safe or a Scam?

IC Markets is extremely safe. Apart from its reputation in the industry, IC Markets is well-regulated and popular among many traders.

Does IC Markets have Nasdaq 100?

Yes, the Nasdaq 100 forms part of IC Markets’ 2,000 CFDs that can be traded on MT4, MT5, and cTrader.

What is the leverage on IC Markets?

Certain financial instruments are eligible for leverage up to 1:500 in some areas.

Does IC Markets have VIX 75?

Yes, the Volatility 75 is available with IC Markets, allowing Emiratis to diversify their portfolios.

What platforms does IC Markets support?

IC Markets offers MetaTrader 4, MetaTrader 5, and cTrader. Furthermore, IC Markets offers access to its trading platforms compatible with modern web browsers, Microsoft Windows, Apple Mac, Apple iOS, and Android devices.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai