The 5 best forex no deposit bonuses in the UAE – Revealed. We have explored and tested several prominent forex no-deposit bonuses for forex trading in Dubai to identify the 5 best. This is a complete guide to the 5 best forex no-deposit bonuses in Dubai.

In this in-depth guide you’ll learn:

- The Best Forex No-Deposit Bonus Offers and Promotions in Dubai – a List

- Which Broker gives a Free, Sign-Up, Welcome Bonus without a Deposit?

- The Best $30, $50, $100, $500 Forex Deposit Bonus Offers for Beginner Traders

- Is Dubai good for Forex Trading + Is Forex Trading Legit in the UAE

and much, MUCH more!

The 5 Best Forex No Deposit Bonuses in the UAE – a Comparison

| 🔎 Broker | 🎁 No-Deposit Bonus | 💵 Bonus Amount |

| 🥇 Tickmill | ✅Yes | $30 Welcome Account |

| 🥈 HF Markets | ✅Yes | $30 No-Deposit Bonus |

| 🥉 XM | ✅Yes | $30 Trading Bonus |

| 🏅 Windsor Brokers | ✅Yes | $30 Welcome Account |

| 🎖️ Admirals | ✅Yes | 100% Welcome Bonus |

The 5 Best Forex No Deposit Bonuses in the UAE (2024)

- ☑️ Tickmill – Overall, the Best Forex No-Deposit Bonus in Dubai

- ☑️ HFM – The Best Broker for Beginners in the UAE

- ☑️ XM – Low Minimum (Dirham) Deposit

- ☑️ Windsor Brokers – High User Trust Score

- ☑️ Admirals – Popular Broker Choice amongst Traders in the UAE

The 5 Best Forex No Deposit Bonuses in UAE

Read on to learn all about the 5 Best Forex No Deposit Bonuses offered by leading Forex brokers in Dubai. These brokers likewise are well-regulated and offer competitive trading conditions in a feature-rich environment.

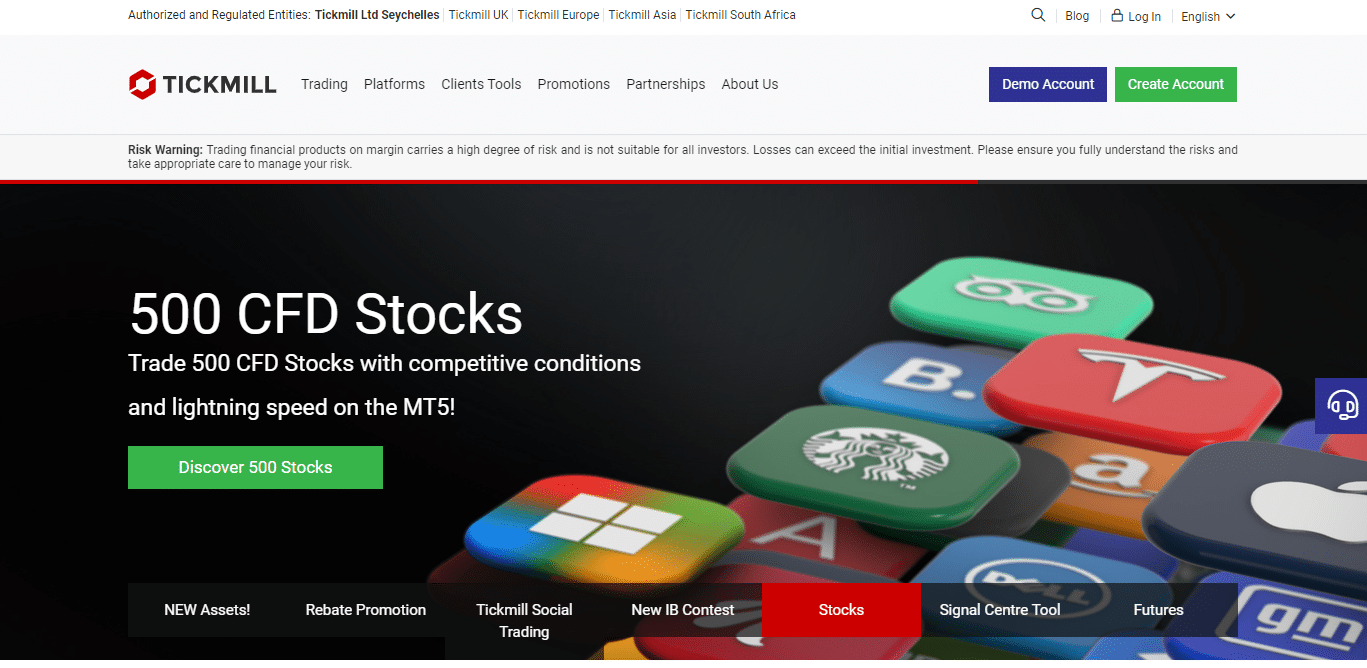

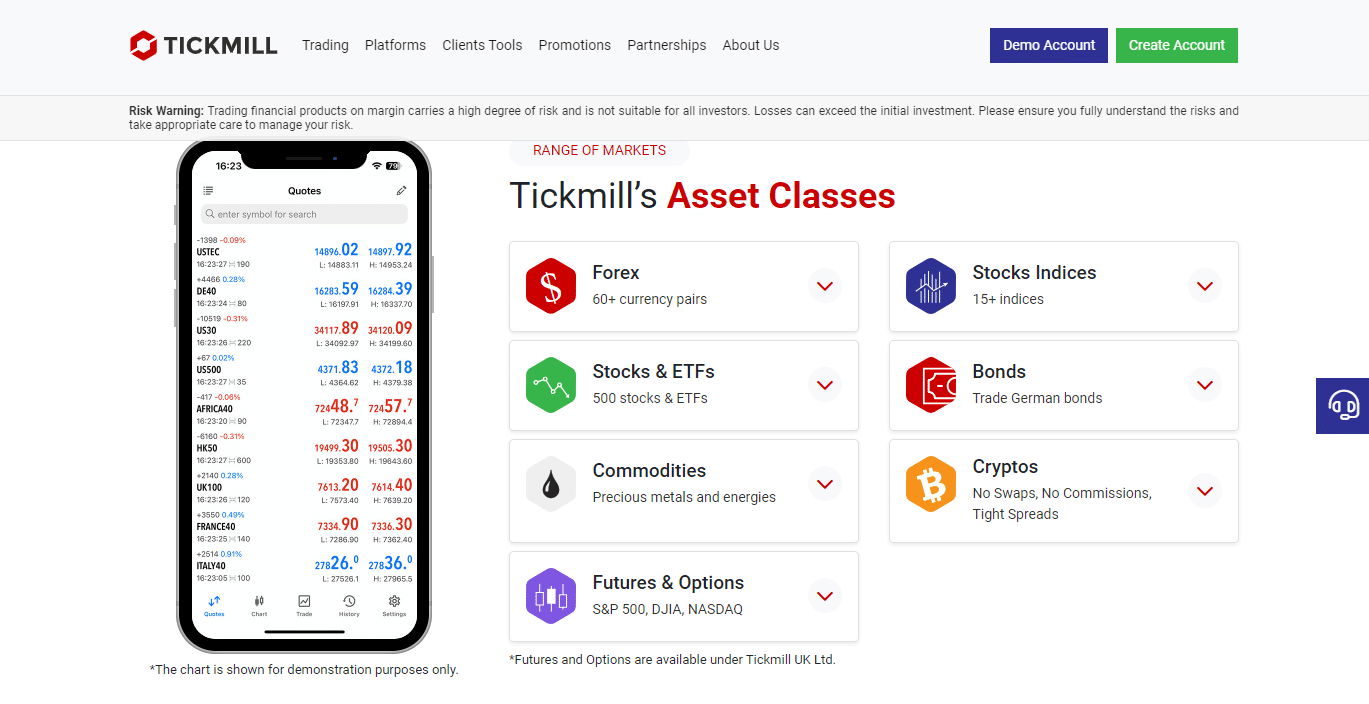

Tickmill

Tickmill is a highly regulated Forex Broker that offers access to premium trading products, best known for posterizing client safety. Tickmill has a trust score of 81%

Tickmill Overview

| 🔎 Broker | 🥇 Tickmill |

| 📈 Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA |

| 📉 DFSA Regulation | ✅Yes |

| 📊 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 📌 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 💴 Minimum Deposit in AED | 18,37 AED or $5 |

| 📍 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 🎁 Bonuses for Dubai traders | ✅Yes |

| 💹 Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

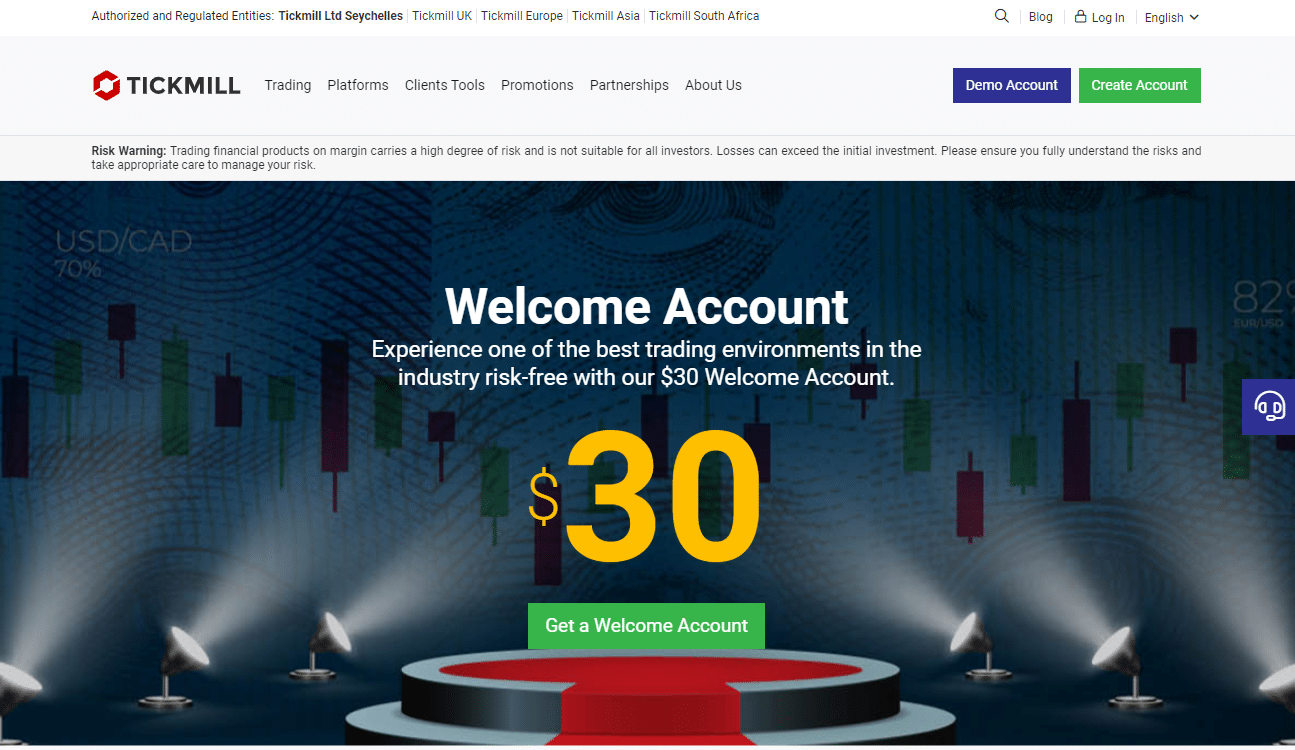

Tickmill No-Deposit Bonus

The $30 Welcome Account offered by Tickmill presents a favorable opportunity for novice traders from Dubai to initiate their involvement in the realm of Foreign Exchange trading. This account has been specifically created for inexperienced traders to enhance their abilities without putting their assets at risk.

The initial deposit bonus of $30 and the user-friendly interface offered by the Welcome Account serve as the initial components of the overall package.

Withdrawals from this account can be made at any given time. To engage in trading activities, it is necessary to possess a minimum Wallet amount of $100, complete the registration process in the designated Client Area, and provide the required paperwork for identification verification.

Before transferring any gains to the Client’s Wallet, the profits generated in the Welcome Account must satisfy specific requirements, including a minimum trading volume.

Notwithstanding the non-refundable nature of the $30 deposit, the opportunity to withdraw any accrued earnings at one’s discretion renders this offer highly appealing.

Tickmill Pros and Cons

The Pros of Trading with Tickmill will include:

- ✅ Tickmill has gained recognition as a leading trading platform due to its competitive trading costs, favorable customer satisfaction rates, and extensive range of simple payment methods, such as Skrill and Neteller.

- ✅ Additionally, Tickmill enjoys a strong degree of confidence and trust from its clientele.

- ✅ In Dubai, experienced traders will discover that Tickmill offers a range of services, such as the FIX API, AutoChartist, and virtual private servers, that are tailored to meet their individual needs.

The Cons of Trading with Tickmill may include:

- ✅ No fixed spreads

What platforms does Tickmill offer to Dubai traders?

Traders from Dubai can access the full MetaQuotes suite consisting of MT4 and MT5.

What are the terms for profit withdrawal from the Welcome Account at Tickmill?

Dubai traders will have to reach a minimum trading volume before they can withdraw their profits.

HF Markets

HFM is a well-established Forex Broker popular amongst Beginner and Established traders. HFM allows investors to trade CFDs on Forex, Commodities, Bonds, Metals, Energies, Shares, Indices, and more.

HF Markets Overview

| 🔎 Broker | 🥇 HF Markets |

| 📈 Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📉 DFSA Regulation | ✅Yes |

| 📊 Trading Accounts | Premium, Premium Pro, VIP, VIP Pro, Professional Clients |

| 💹 Trading Platform | MT4, MT5, HFM Trading App |

| 💶 Minimum Deposit in AED | $0, 0 AED |

| 📌 Trading Assets | Forex, Metals, Energies Indices, Stocks, Commodities, Bonds, ETFs |

| 🎁 Bonuses for Dubai traders | ✅Yes |

| 📍 Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

HF Markets No-Deposit Bonus

HF Markets does not currently offer no a no-deposit bonus in Dubai

HF Markets Pros and Cons

The Pros of Trading with HF Markets will include:

- ✅ DFSA Regulated broker

- ✅ Utilizing a demo trading platform may prove advantageous for traders at any proficiency level.

- ✅ UAE bank accounts

- ✅ Tight spreads

- ✅ Quick deposits & withdrawals

HFM Trading App is available for both Android and iOS users. Combining It is now possible for clients to have access to their accounts, trading CFDs on more than 500 assets immediately on the app.

The Cons of Trading with HFM may include:

- ✅ Inactivity charges are incurred on dormant accounts

What is the spread on the EUR/USD at HFM?

The spread is as low as 1.4 pips when trading the EUR/USD at HF Markets.

Is HFM regulated in Dubai?

Yes, HF Markets is one of the few brokers to be regulated by the DFSA.

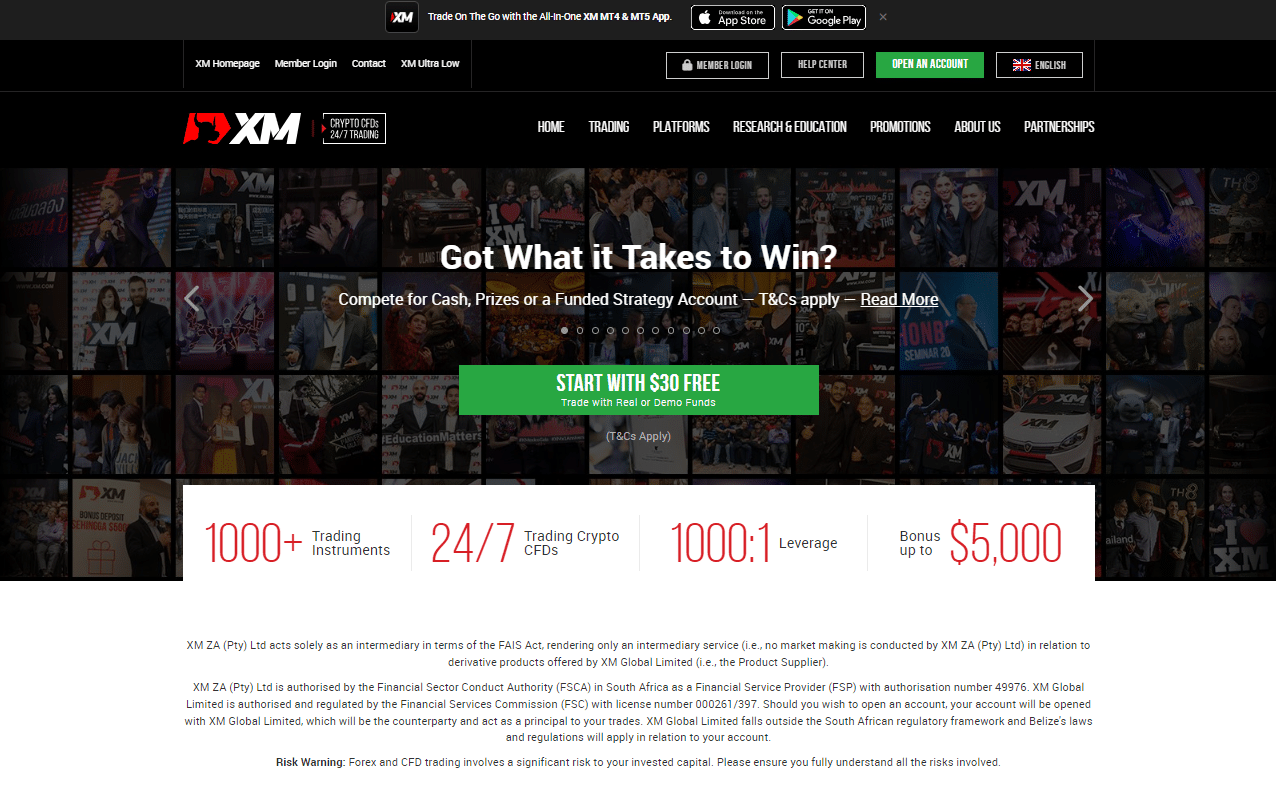

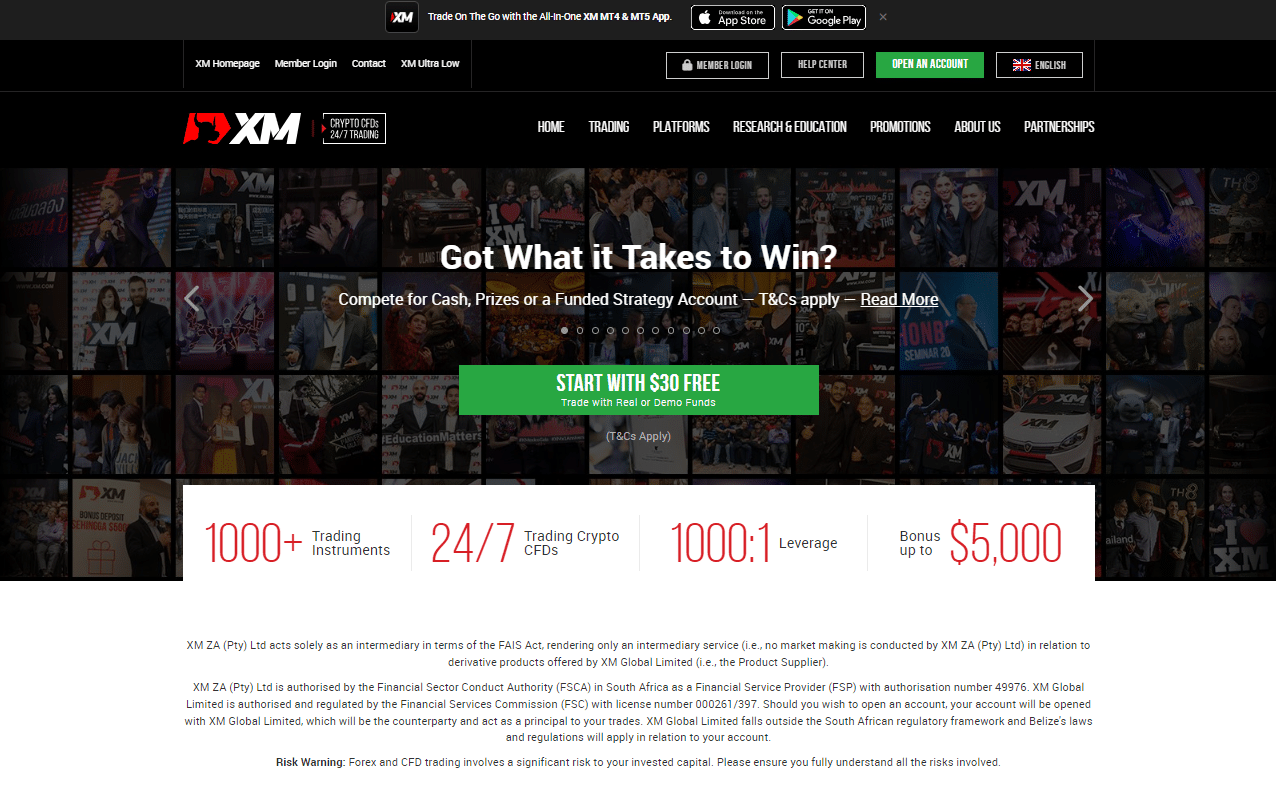

XM

XM is a Popular Broker Choice in the UAE that offers access to 1000+ trading instruments, leverage of up to 1000:1, and Bonus offers of up to $5000 USD.

XM Overview

| 🔎 Feature | ↪️ Information |

| 📌 Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| 📍 Social Media Platforms | Facebook YouTube |

| 📈 DFSA Regulation | ✅Yes |

| 📉 Trading Accounts | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, XM Mobile App |

| 💴 Minimum Deposit in AED | 18,37 AED or $5 |

| 💹 Trading Assets | Forex, Cryptocurrencies, Stock CFDs, Commodities, Equity Indices, Precious Metals, Energies, Shares, |

| 💵 AED-based Account | None |

| 💶 AED Deposits Allowed | None |

| 🎁 Bonuses for Dubai traders | ✅Yes |

| 📑 Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

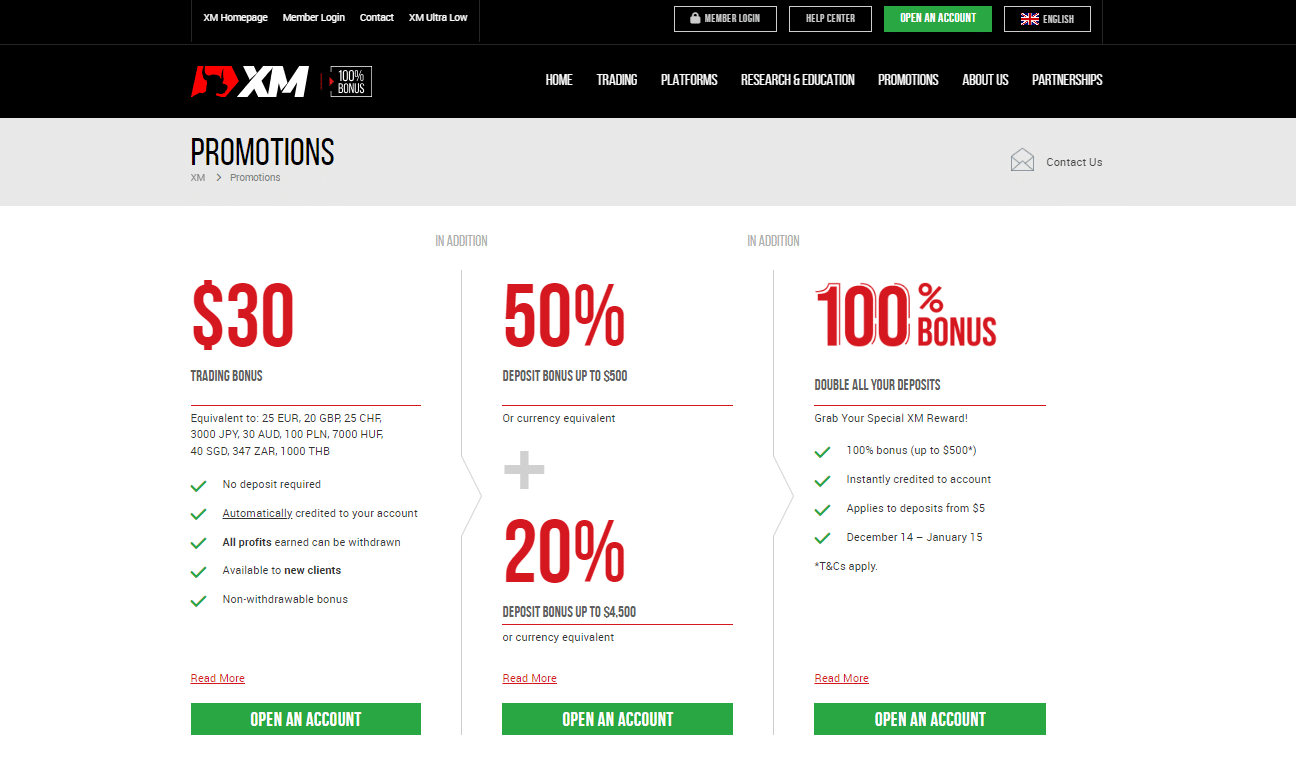

XM No-Deposit Bonus

Upon registration for an XM Real Account, users will receive a non-refundable credit of $30 as an incentive. The Welcome Bonus of USD 30 can be obtained without requiring an initial deposit, and any resulting winnings can be withdrawn as cash.

XM is widely recognized as a leading online Forex broker, being hailed as the next generation in this field. This reputation is primarily attributed to its advanced platform, which caters to traders of all levels of experience in Dubai.

Noteworthy features of this platform include auto trading functionality, transparent pricing with no concealed fees or commissions, and exceptionally fast order executions, with a success rate of 99.35 percent completed within one second.

To assist novice traders in gaining first experience, XM offers a simulated trading account endowed with USD 100,000 in virtual cash, alongside an extensive array of educational resources.

XM Pros and Cons

The Pros of Trading with XM will include:

- ✅ The daily usage of XM’s services exceeds 5 million individuals.

- ✅ The security of client funds is consistently ensured.

- ✅ Measures are in place to safeguard Dubai traders.

- ✅ Since its establishment in 2009, the company has been the recipient of multiple prestigious awards.

- ✅ Deposits and withdrawals are conducted without any associated fees.

- ✅ XM is recognized as a forex broker with a commendable level of trust and competitive pricing.

The Cons of Trading with XM may include:

- ✅ Inactivity charges are incurred on dormant accounts

How many people trade with XM?

Recent stats show that XM has a daily trading activity of up to 5 million users.

Has XM won any awards?

Yes, XM is a reputable Forex broker that has won numerous industry awards.

Windsor Brokers

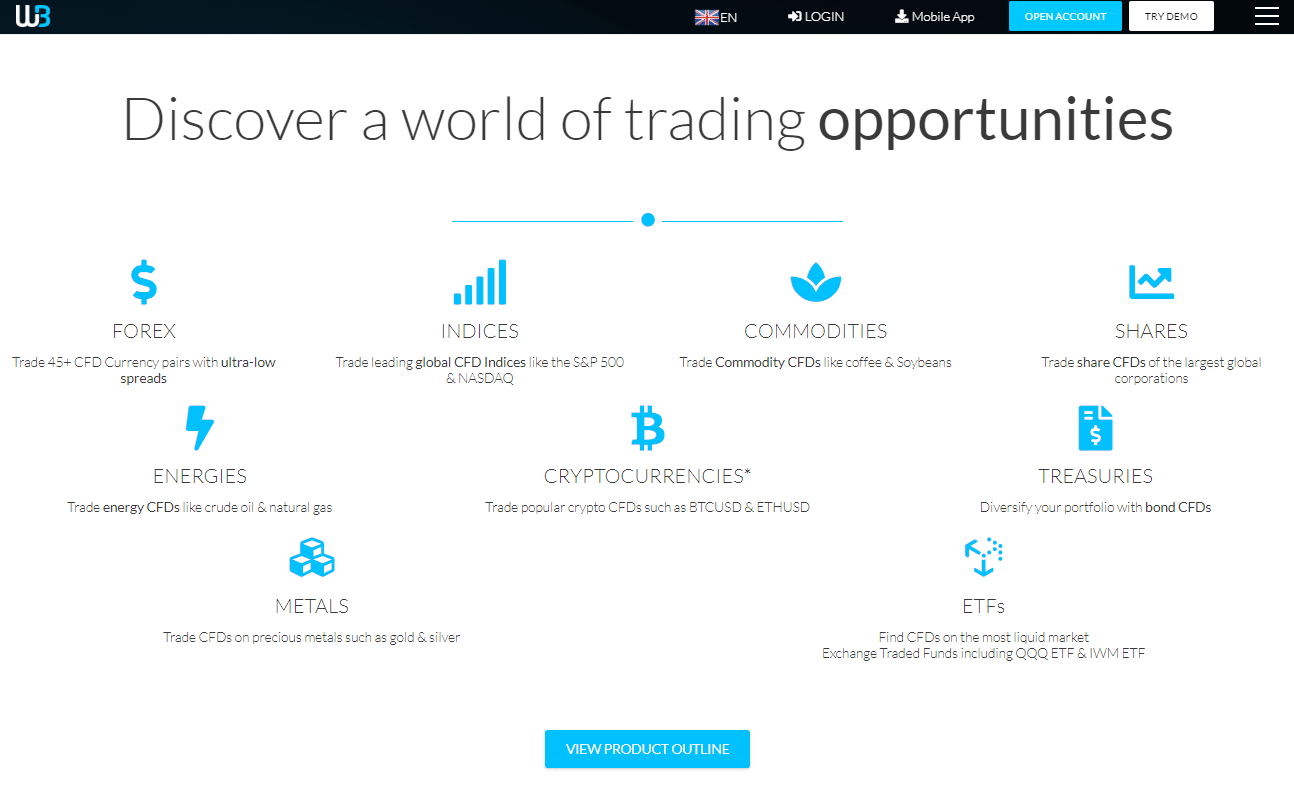

Windsor Brokers is a leading investment firm that offers access to Forex and CFD trading on gold, oil, soft commodities, shares, indices and more.

Windsor Brokers Overview

| 🔎 Trading Platform | MetaTrader 4 |

| 📈 Trading Assets | Forex Metals Spot and CFD indices Spot and CFD energies Commodities Treasuries Shares |

| 📉 Trading Accounts | Prime or Zero MT4 Account |

| 📊 Social Media Platforms | Facebook Telegram YouTube |

| 📌 Regulation | CMA, CySEC, FCA, FSC |

| 📍 Minimum spread | From 0.0 pips |

| 💴 Minimum Deposit AED | 367,30 AED or $100 |

| ☪️ Islamic Account | ✅Yes |

| ✔️ DFSA Regulation | None |

| 🆓 Demo Account | ✅Yes |

| 🎁 Bonuses for Dubai traders | ✅Yes |

| 💷 AED-based Account | None |

| 💶 AED Deposits Allowed | None |

Windsor Brokers No-Deposit Bonus

Windsor Brokers offers new traders access to a Free Account which is funded with a $30 sign-up bonus.

Windsor Brokers is a well-regarded forex and CFD broker in Dubai, primarily recognized for its competitive spreads, extensive range of educational resources for traders, and regulatory monitoring by the Cyprus Securities and Exchange Commission (CySEC).

The variation of spreads is contingent upon the specific account type offered by Windsor Brokers. Individuals who own a Prime account are allowed to engage in trading activities involving the EUR/USD currency pair with a spread of 1.5 pips. Conversely, individuals who possess a Zero account have the potential to attain a spread as little as zero.

Windsor Brokers Pros and Cons

The Pros of trading with Windsor Brokers will include:

- ✅ The provision of trading services without charging commissions for traders in Dubai.

- ✅ Technical indicators can be updated up to four times daily.

- ✅ With a professional background spanning more than three decades in the international markets, Windsor Brokers has a well-established standing within the industry.

The Cons of Trading with Windsor Brokers may include:

- ✅ Only one trading platform offered

How much is the sign-up bonus from Windsor Brokers?

Traders from Dubai will get access to a free $30 when they first sign up with Windsor Brokers.

Does Windsor Brokers offer an Islamic Account to traders in Dubai?

Yes, Windsor Brokers offers Dubai traders access to a swap-free Islamic account.

Admirals

Admirals is an established Forex Broker that offers access to first-class conditions and financial instruments. Clients can trade and invest in Stocks and ETFs, Forex pairs, CFDs on indices, commodities, and bonds.

Admirals Overview

| 🔎 Regulation | FCA, ASIC, CySEC, EFSA, JSC |

| 📌 Social Media Platforms | Facebook YouTube |

| 📍 DFSA Regulation | None |

| 📈 Trading Accounts | Trade MT5 Account, Invest MT5, Zero MT5, Bets MT5, Trade MT4, Zero MT4 |

| 📉 Trading Platform | MetaTrader 4 MetaTrader 5 Admirals Mobile App |

| 💴 Minimum Deposit in AED | 91,83 AED or USD25 |

| 📊 Trading Assets | ESG Trading Instruments Forex Cryptocurrency CFDs Commodities Indices Stocks ETFs Bonds Spread Betting |

| 💵 AED-based Account | None |

| 💶 AED Deposits Allowed | None |

| 🎁 Bonuses for Dubai traders | ✅Yes |

| 💹 Minimum spread | from 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

Admirals No-Deposit Bonus

The Admirals’ “Exclusive Bonus” program presents Dubai traders with a distinctive and advantageous opportunity.

The “Exclusive Bonus” confers advantages to traders by augmenting their transactional margin for 30 days after the acquisition. Traders have the chance to increase their earnings by engaging in higher-risk trades with larger margins.

The “Exclusive Bonus” serves to enhance traders’ margin utilization, albeit it is not intended as a compensatory measure for trade deficits. Traders must possess a comprehensive understanding of their trading tactics and employ rigorous risk mitigation techniques.

Admirals Pros and Cons

The Pros of Trading with Admirals will include:

- ✅ Admirals offer commission-free trading options and operate under robust regulatory frameworks in multiple countries worldwide.

- ✅ The broker welcomes traders from Dubai, regardless of their experience level or preferred trading strategies.

- ✅ There exists a wide array of markets, instruments, and leveraged products that are readily available for trading purposes. Additionally, trading platforms can be accessed conveniently from any device that has internet connectivity.

- ✅ Admirals provide their traders with the MetaTrader Supreme Edition.

- ✅ Dubai traders have access to advanced analytical tools and have access to a wide range of informational resources.

The Cons of trading with Admirals may include:

- ✅ Foreign trading inactivity, withdrawal, deposit, and account maintenance fees are charged to traders from Dubai

What platform does Admirals offer?

Admirals is one of the few brokers that offers the MetaTrader Supreme Edition.

Is it risky to use the bonus from Admirals?

Admirals is a reputable and regulated broker, but traders should always practice risk mitigation strategies when trading.

How to choose the best Forex no-deposit bonus brokers in Dubai

Dubai traders must evaluate the following components of a forex no deposit bonus broker to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Dubai traders must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirements, commissions and spreads, initial deposits, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Dubai traders must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Dubai traders must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Dubai traders must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Dubai trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

- ✅ eBooks

- ✅ Trading guides

- ✅ Trading knowledge on leveraged products

- ✅ A risk warning on complex instruments

- ✅ Educational videos

Research can include some of the following:

- ✅ Trading tools

- ✅ Commentary

- ✅ Status of International Markets

- ✅ Price movements

- ✅ Market sentiments

- ✅ Whether there is a volatile market

- ✅ Exchange Rates

Expert opinions and several other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Dubai

In this article, we have listed the best brokers that offer Forex no-deposit bonuses to Dubai traders. We have further identified the brokers that offer additional services and solutions to Dubai traders.

Best MetaTrader 4 / MT4 Forex Broker

Overall, Alpari is the best MT4 Forex broker in Dubai. Alpari is well recognized by financial professionals as a reputable market maker due to its exceptional track record. Alpari ensures that their trading latency remains consistently below one millisecond. Presently, the number of individuals utilizing Alpari exceeds 2 million.

Best MetaTrader 5 / MT5 Forex Broker

Overall, AvaTrade is the best MT5 Forex broker in Dubai. AvaTrade has established a strong standing as a dependable broker for Contracts for Difference (CFD) and Foreign Exchange (FX) trading. AvaTrade’s esteemed reputation is derived from its practice of exclusively engaging with highly reputable institutions in each regulatory jurisdiction to securely hold the funds of its clientele in segregated accounts.

Best Forex Broker for beginners

Overall, eToro is the best Forex broker for beginners in Dubai. The eToro Academy, the eToro Plus subscription package, and demo trading accounts are among the available resources for users to enhance their understanding of the platform.

Best Low Minimum Deposit Forex Broker

Overall, Oanda is the best low-minimum deposit Forex broker for traders in Dubai. The trading platform offered by Oanda is highly advanced and serves as a valuable tool for foreign exchange (FX) traders, regardless of their level of expertise.

Best ECN Forex Broker

Overall, XM is the best ECN forex broker in Dubai. XM prioritizes several key factors, including cost, client service, cash flow, and security.

Best Islamic / Swap-Free Forex Broker

Overall, Tickmill is the best Islamic / Swap-Free forex broker in Dubai. Tickmill is well regarded as a reputable and dependable brokerage firm. The brokerage firm under consideration is very suitable for a diverse range of investors due to its account flexibility, cost-effectiveness, and competitive spreads. At present, Tickmill offers multi-lingual accessibility and can be utilized in many contexts.

Best Forex Trading App

Overall, Exness offers the best trading app for traders in Dubai. The Exness Trader application offers a wide range of beneficial functions and features that prove to be highly advantageous for traders in Dubai. Candlestick charts, technical indicators, and quantitative tools are beneficial resources for inexperienced traders.

Best Forex Rebates Broker

Overall, FxPro is the Best Forex Rebates Broker in Dubai. FxPro is a trading platform that provides Straight Through Processing (STP) and Electronic Communication Network (ECN) access to its clientele. Retail traders participating in the foreign exchange market have the potential to generate monthly cash returns of up to 30%.

Best Lowest Spread Forex Broker

Overall, Pepperstone is the best lowest spread forex broker in Dubai. Pepperstone offers trading spreads commencing at 0.0 pips for transactions involving the United States dollar and the euro. Pepperstone Markets is widely regarded as one of the top brokerages in the industry due to its notable history of exceptional success.

Best Nasdaq 100 Forex Broker

Overall, IG is the best Nasdaq 100 forex broker in Dubai. Modern trading tools, a broad selection of products, and advantageous market circumstances have all contributed to IG’s ascent to the top 20 platforms in the city. IG distinguishes out among the many trustworthy online brokers serving the Dubai market because it is bound by strict laws and offers customers access to a broad range of assets.

Best Volatility 75 / VIX 75 Forex Broker

Overall, IC Markets is the best Volatility 75 / VIX 75 forex broker in Dubai. Dubai traders are now able to engage in transactions on global financial markets through the utilization of IC Markets’ sophisticated trading tools.

Best NDD Forex Broker

Overall, BDSwiss is the best NDD forex broker in Dubai. BDSwiss holds a prominent position in the worldwide market as a significant participant in the fields of CFD and FX services. The number of affiliate accounts is estimated to be approximately 16,000, with a monthly processing volume of up to €20 billion in foreign exchange operations.

Best STP Forex Broker

Overall, OctaFX is the best STP forex broker in Dubai. OctaFX has been the recipient of more than 28 accolades within the industry. OctaFX has achieved a reduction of approximately one-third in its trade expenses with the implementation of STP (Straight with Processing) and ECN (Electronic Communication Network) mechanisms.

Best Sign-up Bonus Broker

Overall, HFM is the best sign-up bonus broker in Dubai. Investors hold a favorable view of HFM’s trading platform owing to its competitive pricing structure and superior standards. The HFM website accommodates individuals with diverse degrees of proficiency in foreign currency trading by granting them access to a wide range of account types and asset markets.

Different types of Forex No Deposit Bonuses

A significant portion of foreign exchange brokers offer introductory incentives to clients in the form of a forex no-deposit bonus. The provision of this benefit is commonly extended to individuals who initiate trading accounts with the brokerage firm.

The broker may retain any profits generated from trading activities conducted using the welcome bonus, subject to fulfillment of their specified requirements.

The risk-free trading bonus is a form of no-deposit incentive that allows traders to engage in a predetermined number of trades without incurring any financial risk.

The broker will provide coverage for any losses that the trader may experience during risk-free trading. Foreign exchange (forex) trading is permissible through the utilization of a no-risk trading bonus, wherein any resulting gains can be withdrawn according to the restrictions and limitations stipulated by the broker.

Cashback bonuses are a form of no-deposit bonus in which traders receive a partial repayment of the funds they have lost throughout their trading activities. If a 10% payback incentive was implemented, a trader who experienced a $100 loss would receive a $10 return.

Upon satisfying the requirements set forth by the broker, it is permissible to withdraw any gains accrued through the utilization of the cashback incentive.

How to trade using a Forex No Deposit Bonus

Trading foreign currency on the forex market is a viable option for many people looking to boost their income or leave the workforce altogether.

High liquidity, round-the-clock availability, and the potential for large profits all contribute to Forex trading’s rising popularity.

No-deposit incentives are a common kind of advertising used by Forex brokers. Since these bonuses don’t necessitate a first investment from the trader, the broker is essentially giving the money away. While no-deposit bonuses in forex may seem too good to be true, there are ways to maximize your profit.

Choose a good broker

If you want to get the most out of a forex no deposit bonus, choosing a reliable broker is step one. Many brokers offer these bonuses, but not all of them are trustworthy.

Finding a broker who has been approved by a respected financial authority is essential. This will ensure the safety of your cash and the possibility to withdraw it once the requirements have been satisfied.

Read the terms and conditions

Verify the terms of any Forex no-deposit bonuses offered once you’ve decided on a reputable broker. Brokers have differing procedures regarding the withdrawal of bonus funds.

Each broker has its withdrawal policy, which may include a minimum number of lots traded, a waiting period, or a maximum withdrawal amount. Before you jump into trading, you should familiarize yourself with these conditions.

Use a trading strategy

When taking advantage of a no-deposit bonus, it is crucial to have a well-thought-out trading strategy. The incentive is like getting free money to invest, but you still need to be careful and disciplined.

Make a trading strategy that includes realistic profit targets and safe tradeoffs. Even though the bonus is free, you are still trading with your own money.

Be careful with leverage

You can increase the value of your forex no-deposit bonus by using leverage. Leverage allows traders to make greater transactions with smaller initial deposits.

When employing leverage, it is important to avoid overtrading and to proceed with prudence. High leverage magnifies both gains and losses, therefore vigilance is essential.

Keep your emotions in check when trading

Keep in mind that not all investments will be successful. Like any form of trade, there will inevitably be failed transactions. Don’t let your feelings influence your trading decisions; stick to your plan. Don’t try to make up for your losses by taking even more.

Finally, keep in mind that the primary goal of a no-deposit incentive is to bring in new business for the broker. It’s possible to make a profit with these bonuses, but that shouldn’t be the deciding factor when choosing a broker.

Consider the broker’s trading history, customer service, and reputation in the industry as a whole.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Kenyan investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

In Conclusion

Overall, Foreign exchange (Forex) trading in Dubai is dynamic and engaging because of the prevalence of no-deposit bonus brokers. Since these bonuses remove the monetary barrier to entry associated with exploring the market, brokers increasingly rely on them to bring in new business.

Frequently Asked Questions

What is the secret to successful Forex trading?

Having no money left in your trading account is a direct result of setting unrealistic goals for yourself. Your success in this market will depend greatly on the broker you select and the trading account you open with them.

Is there a 100% winning strategy in Forex trading?

Trading losses are necessary to maintain a competitive market and promote diversity in the foreign exchange (Forex) industry. Trend trading, range trading, swing trading, scalping, day trading, carry trading, and news trading are all common Forex trading methods.

What is the number one rule of Forex trading?

If your trade goes in the direction of the trend, you should move your stop losses to breakeven and keep the profit you’ve made. Trading with a rigorous stop loss and getting out of lost transactions before they become disasters is the best way to avoid these nightmares (your losses).

What is the weakness of Forex trading?

High risk. A highly leveraged trader in the foreign exchange market is extremely vulnerable to even modest changes in currency values due to the market’s greater tolerance for leverage than the equity market. No one can rely on specialists or professional portfolio managers. Foreign exchange (Forex) merchants are on their own to figure things out.

What makes Forex risky?

Because of the nature of leveraged trades, a tiny starting charge can lead to significant losses and illiquid assets. Furthermore, time differences and political difficulties can have a significant impact on financial markets and currencies.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai