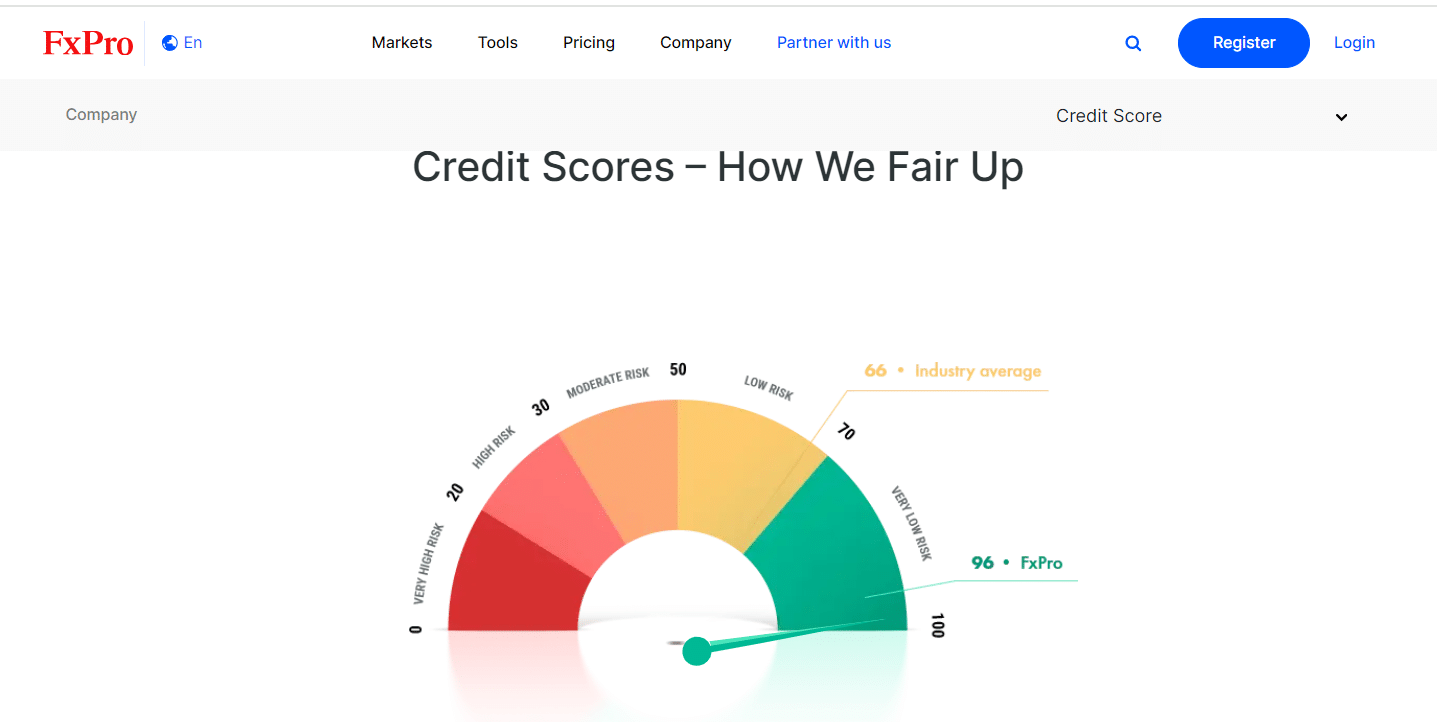

Overall, FxPro can be summarised as a low-risk, highly regulated, and competitive Forex Broker. FxPro offers an easy-to-use social copy trading platform with excellent customer support. FxPro has a trust score of 90 out of 99.

| 🔑Order Execution | 4/5 |

| 💰Commissions and Fees | 4/5 |

| 📈Range of Markets | 4/5 |

| 📉Variety of Markets | 4/5 |

| ⏱️Withdrawal Speed | 4/5 |

| 👥Customer Support | 5/5 |

| 📊Trading Platform | 4/5 |

| 🎓Education | 4/5 |

| 📒Research | 4/5 |

| 🚨Regulation | 5/5 |

| 📱Mobile Trading | 4/5 |

| 💯Trust Score | 90% |

FxPro Review – Analysis of Brokers’ Main Features

- ☑️ FxPro Overview

- ☑️ FxPro Detailed Summary

- ☑️ FxPro Advantages Over Competitors

- ☑️ Who will Benefit from Trading with FxPro?

- ☑️ FxPro Safety and Security

- ☑️ FxPro Affiliate Program Features

- ☑️ FxPro Minimum Deposit

- ☑️ FxPro Account Types and Features

- ☑️ FxPro Base Account Currencies and Basic Order Types

- ☑️ How to Open and Close an FxPro Account

- ☑️ FxPro MAM / PAMM Features

- ☑️ FxPro Trading Platforms

- ☑️ Which Markets Can You Trade with FxPro?

- ☑️ FxPro Fees, Spreads, and Commissions

- ☑️ FxPro Deposits and Withdrawals

- ☑️ FxPro Education and Research

- ☑️ FxPro Customer Support

- ☑️ FxPro VPS Review

- ☑️ FxPro Cashback Rebates Features and Conditions

- ☑️ FxPro Web Traffic Report

- ☑️ FxPro Geographic Reach and Limitations

- ☑️ Best Countries by Traders

- ☑️ FxPro vs RoboForex vs NinjaTrader – A Comparison

- ☑️ FxPro Alternatives

- ☑️ FxPro Awards and Recognition

- ☑️ Our Experience with FxPro

- ☑️ Recommendations according to our in-depth review of FxPro

- ☑️ FxPro Customer Reviews

- ☑️ Pros and Cons of Trading with FxPro

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

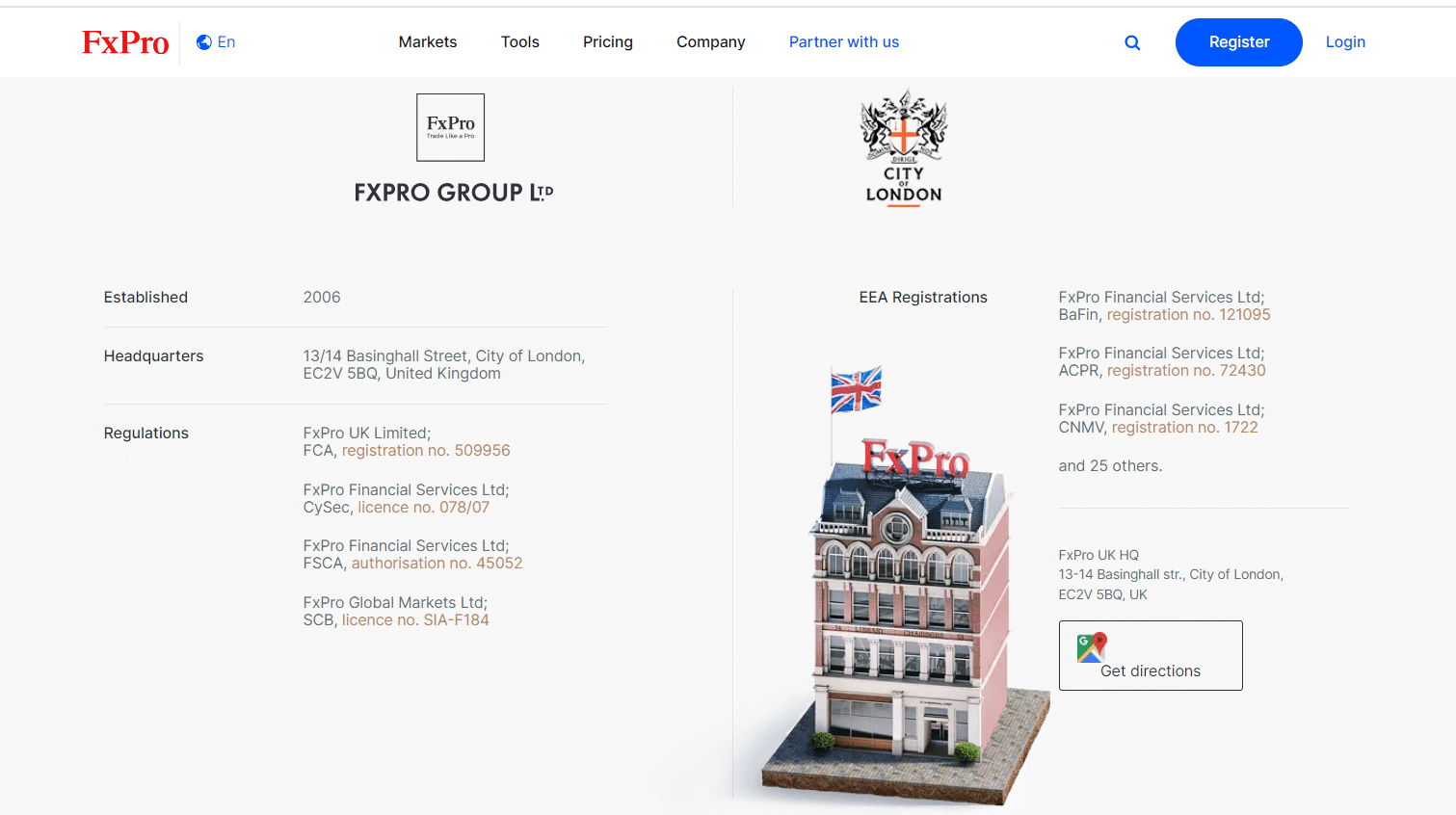

FxPro Overview

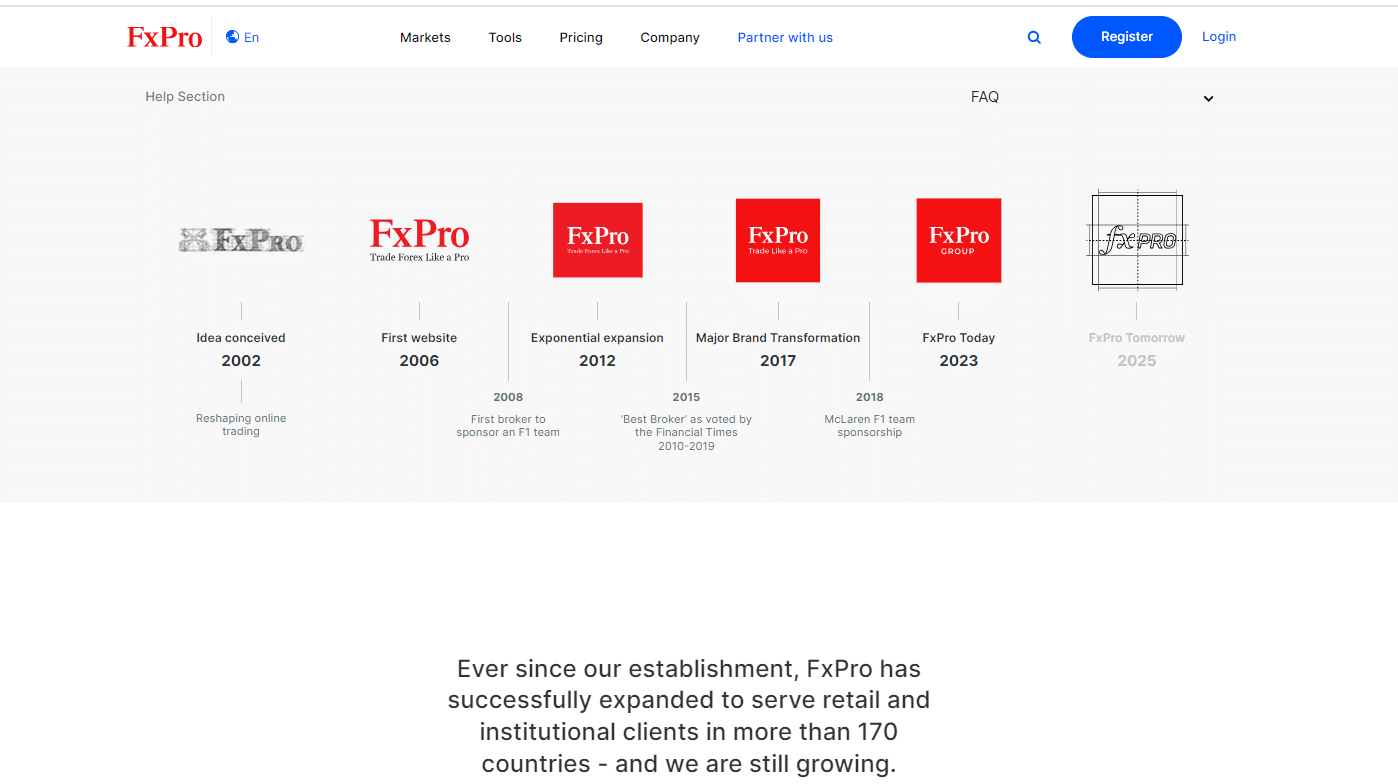

FxPro, founded in the United Kingdom in 2006, is a low-risk forex and CFD broker. It offers a variety of pricing options, including different account types and execution models. The broker is licensed in the United Kingdom, Cyprus, and South Africa. It recently moved to a new office in Dubai, UAE.

FxPro provides a highly regarded proprietary trading platform known for its ease of use and various analytic tools that enable traders to make informed decisions. Traders can also use popular platforms such as MT4, MT5, or cTrader.

Numerous awards, including the Most Innovative Trading Platform MENA 2024, recognize the broker’s excellence. FxPro has a Trust Score of 90 out of 99, indicating it is extremely low-risk.

FxPro offers several appealing features to Emirati traders. Establishing a local office in Dubai improves access to support and services. FxPro also provides Islamic accounts that follow Sharia law principles. These accounts charge no interest on overnight positions and have clear fee structures.

FxPro Detailed Summary

| 🔑Broker | 🥇FxPro |

| 🏠Headquartered | London, England |

| 🌎Global Offices | United Kingdom, Cyprus, South Africa, the Bahamas, Mauritius |

| 🚨Local Market Regulators in Dubai | Dubai Financial Services Authority (DFSA) |

| 🏷️Foreign Direct Investment in Dubai | 23 billion USD (2022) |

| 🔖Foreign Exchange Reserves in Dubai | 158 billion USD (July 2024) |

| 📍Local office in Dubai | ✅Yes |

| 👤Governor of SEC in Dubai | Khaled Mohamed Balama is the Governor of the Central Bank of the UAE |

| ➡️Accepts Dubai Traders | ✅Yes |

| 🎉Year Founded | 2006 |

| ☎️Dubai Office Contact Number | +971 (0) 4 424302 |

| 🖥️Social Media Platforms | Facebook X YouTube Telegram |

| 🚩Regulation | FCA, CySEC, SCB, FSCA, FSC |

| 1️⃣Tier-1 Licenses | Financial Conduct Authority (FCA) |

| 2️⃣Tier-2 Licenses | Cyprus Securities and Exchange Commission (CySEC) Financial Sector Conduct Authority (FSCA) |

| 3️⃣Tier-3 Licenses | The Securities Commission of the Bahamas (SCB) The Financial Services Commission (FSC) |

| 🔢License Number | United Kingdom – 509956 Cyprus – 078/07 Bahamas – SIA-F184 South Africa – FSP 45052 Mauritius – GB21026568 |

| 🖋️DFSA Regulation | None |

| 🗺️Regional Restrictions | The United States, Canada, Iran |

| ☪️Islamic Account | ✅Yes |

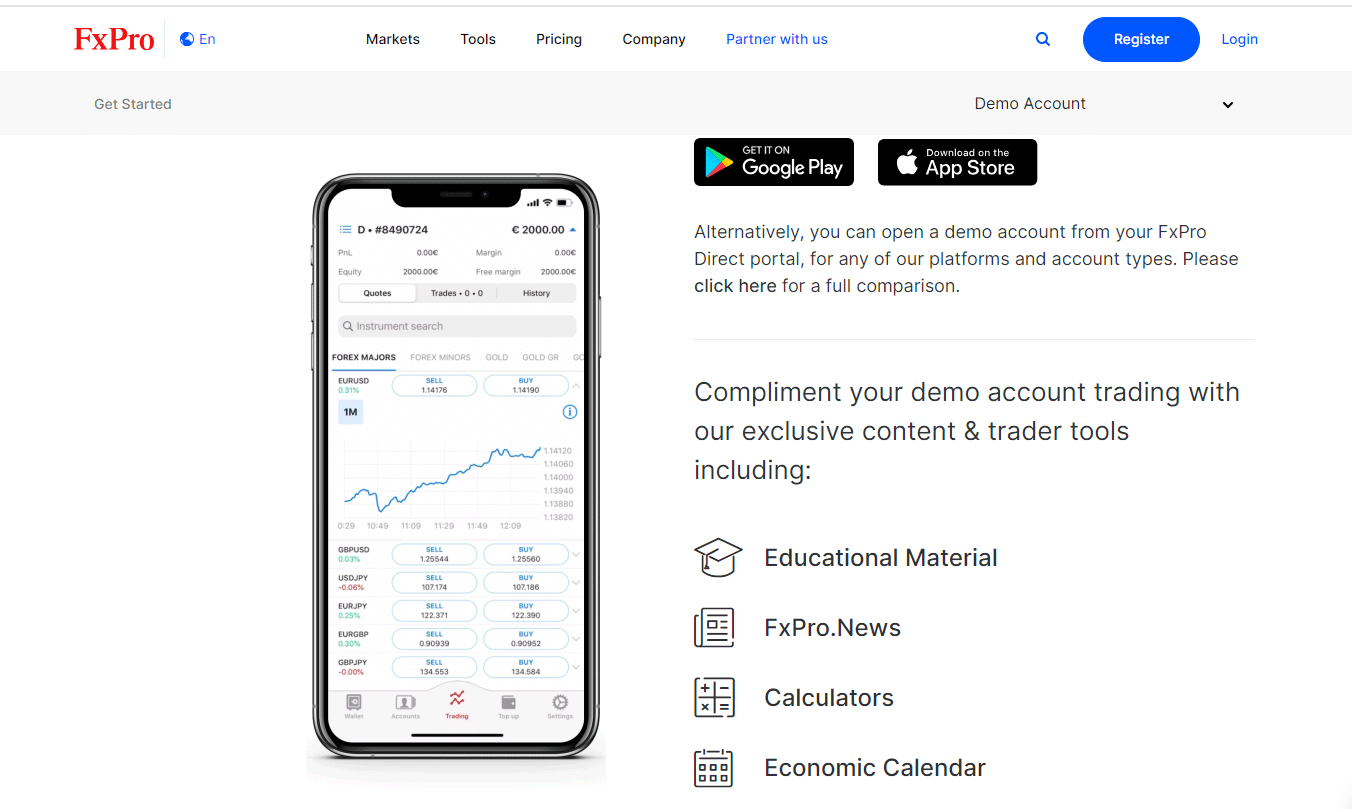

| 🆓Demo Account | ✅Yes |

| ⏲️Non-expiring Demo | None |

| ⌚Demo Duration | 180 days |

| 📈Retail Investor Accounts | 4 |

| 📉PAMM Accounts | Only MAM |

| 💧Liquidity Providers | Unknown |

| 👥Affiliate Program | ✅Yes |

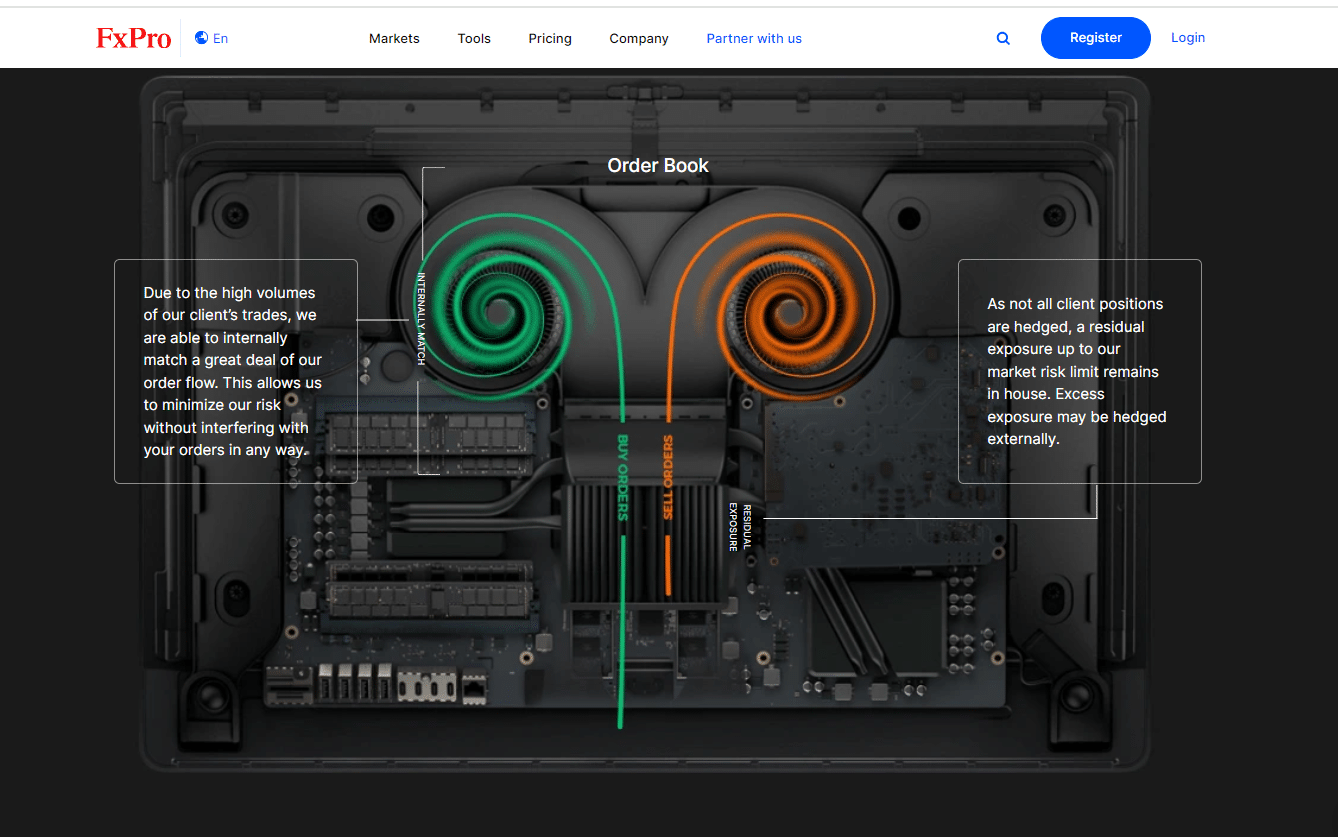

| 📒Order Execution | Market Execution |

| ✏️OCO Orders | None |

| ▶️One-Click Trading | ✅Yes |

| 💹Scalping | ✅Yes |

| #️⃣Hedging | ✅Yes |

| 🎓Expert Advisors | ✅Yes |

| 🗞️News Trading | ✅Yes |

| 📊Trading API | ✅Yes |

| 📈Starting spread | None |

| 💰Minimum Commission per Trade | $7 Round turn on Forex |

| ✴️Decimal Pricing | 5th decimal after the comma |

| 🖇️Margin Call | 100% |

| ⛔Stop-Out | 50% |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | Unlimited |

| 🪙Crypto trading offered | ✅Yes |

| 🗂️Offers an AED Account | None |

| 👤Dedicated Dubai Account Manager | None |

| 📌Maximum Leverage | 1:500 |

| 🚩Leverage Restrictions for Dubai | None |

| 💷Minimum Deposit (AED) | 367 AED ($100) |

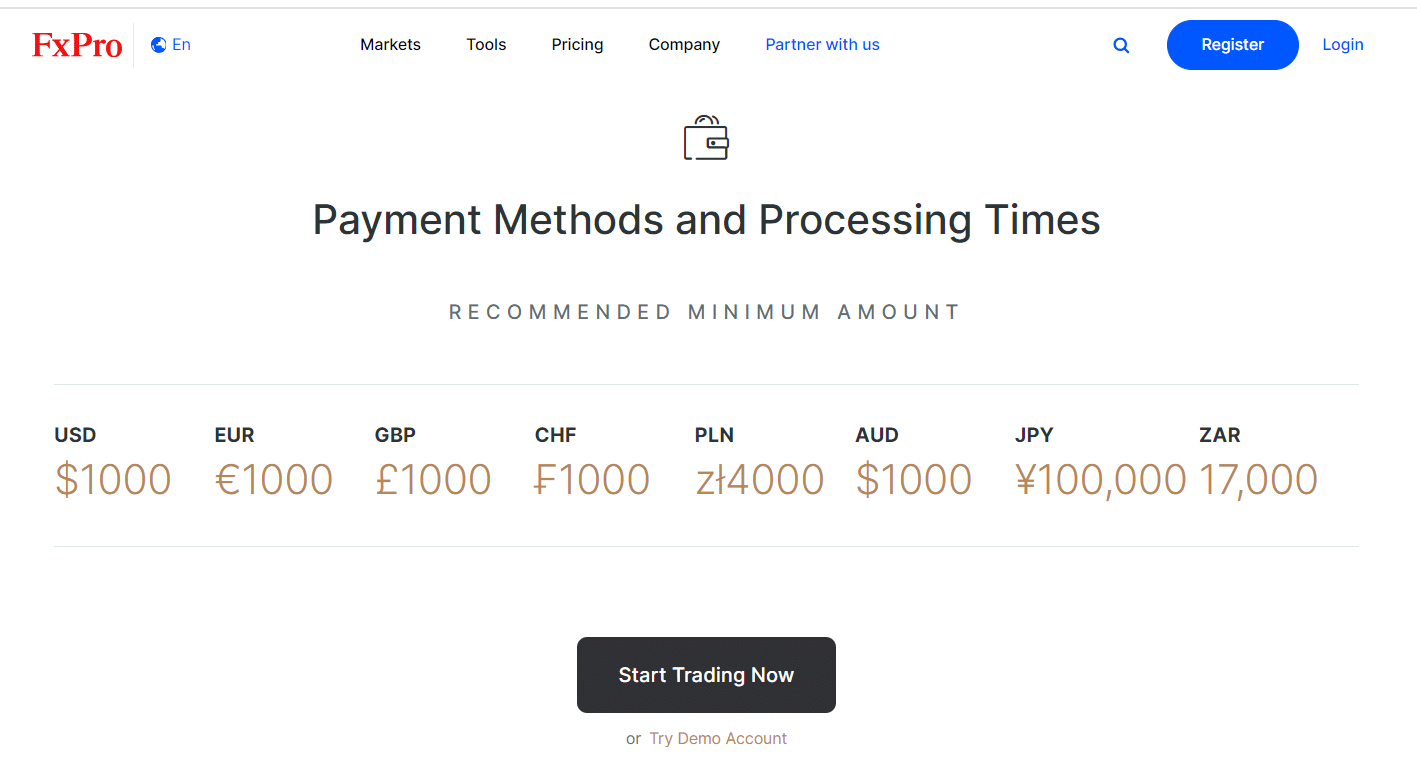

| 💵Deposit Currencies | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR |

| 💶AED Deposits Allowed | No |

| 💴Account Base Currency | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR |

| 📊Active Dubai Trader Stats | 49,000+ |

| ✳️Active Dubai-based FxPro customers | Unknown |

| 🔃Dubai Daily Forex Turnover | 13.1 billion USD |

| 💳Deposit and Withdrawal Options | Bank Transfers Credit/Debit Cards Neteller PayPal Skrill UnionPay |

| ⏰Minimum Withdrawal Time | 1 – 7 business days |

| ⏱️Maximum Estimated Withdrawal Time | 7 business days |

| ➡️Instant Deposits and Instant Withdrawals | Instant deposits |

| 🖇️Segregated Accounts with Emirati Banks | None |

| 📈Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader FxPro App |

| ⌚Trading Platform Time | GMT +03:00 |

| 👁️Observe DST Change | ✅Yes |

| 🌐DST Change Time zone | Eastern European Time (EET) |

| 💰Tradable Assets | Forex Futures Indices Shares Metals Energies Cryptocurrency CFDs |

| 💵Offers USD/AED currency pair | None |

| 📉USD/AED Average Spread | None |

| 📒Offers Emirati Stocks and CFDs | None |

| 💻Languages supported on the Website | English, Spanish, French, German, Italian, Polish, Czech, Hungarian, Swedish, Bulgarian, Finnish, Lithuanian, Danish, Croatian, Estonian, Norwegian, Romanian, Russian, Dutch, Portuguese, Indonesian, Malay, Emirati, Thai, Arabic, Korean, Chinese (Simplified), Chinese (Traditional), Mongolian, Japanese |

| 🔊Customer Support Languages | Multilingual |

| 🤝Copy Trading Support | None |

| ⏰Customer Service Hours | 24/5 |

| 📌Dubai-based customer support | None |

| 💰Bonuses and Promotions for Dubai Traders | ✅Yes |

| 💸Education for Emirati beginners | ✅Yes |

| 📝Proprietary trading software | ✅Yes |

| 👍Most Successful Trader in Dubai | Several – Yasser R, Ali A, Maaz A, Warren Takunda |

| 🫶Is FxPro a safe broker for Dubai Traders | ✅Yes |

| 🏆Rating for FxPro Dubai | 8/10 |

| 💯Trust score for FxPro Dubai | 90% |

FxPro Advantages Over Competitors

- ✅Emirati traders can access several free deposit and withdrawal options, making fund management easier.

- ✅FxPro has an excellent customer service team that responds quickly and accurately. They are available in a variety of languages, ensuring effective communication. Traders’ inquiries are answered quickly and accurately.

- ✅FxPro prioritizes its educational and research departments to provide traders with a dependable trading environment. Clients benefit significantly from ongoing research and development efforts. Traders can gain access to educational materials and multilingual assistance from specialist teams.

- ✅FxPro supports various trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. The desktop browser experience adheres to industry standards, and pricing is clear and transparent. There are also charting tools with various indicators and studies available.

- ✅FxPro’s YouTube channel features multilingual webinars as well as high-quality real-time news.

- ✅FxPro’s most competitive spreads are available on its cTrader platform, which provides commission-based pricing. This benefits traders from tight spreads, lowering their overall trading costs.

- ✅FxPro provides swap-free accounts for traders whose religious beliefs prohibit them from trading. These accounts charge no interest on overnight positions and have clear fee structures.

and many more!

Who will Benefit from Trading with FxPro?

- ✅FxPro does not charge commissions on most trades, making it ideal for commission-sensitive traders.

- ✅Given the broker’s extensive market options, which include numerous currency pairs and over 2,000 stock CFDs, experienced Forex and CFD traders.

- ✅Those who value a safe and reliable trading environment, as FxPro has a strong educational and research department.

- ✅Because of the broker’s multilingual webinars and high-quality real-time news offerings, multilingual traders.

- ✅Traders looking for a reputable and award-winning broker, particularly those who place a premium on fund security and maximum leverage.

- ✅Islamic traders, as FxPro provides swap-free accounts to adhere to religious beliefs.

- ✅Traders who want to improve their skills can use the broker’s free educational materials, forex trading tools, and demo accounts.

- ✅Traders who need deep liquidity and fast order execution because FxPro’s infrastructure is co-located and cross-fibre connected to Tier 1 providers.

Does FxPro offer a demo account for practice trading?

Yes, FxPro offers a demo account that enables traders to test their strategies and become familiar with the interface before engaging in real-money trading.

Can I use FxPro on my Mac?

Yes, Mac users can use the full complement of features and tools available on FxPro’s trading platforms.

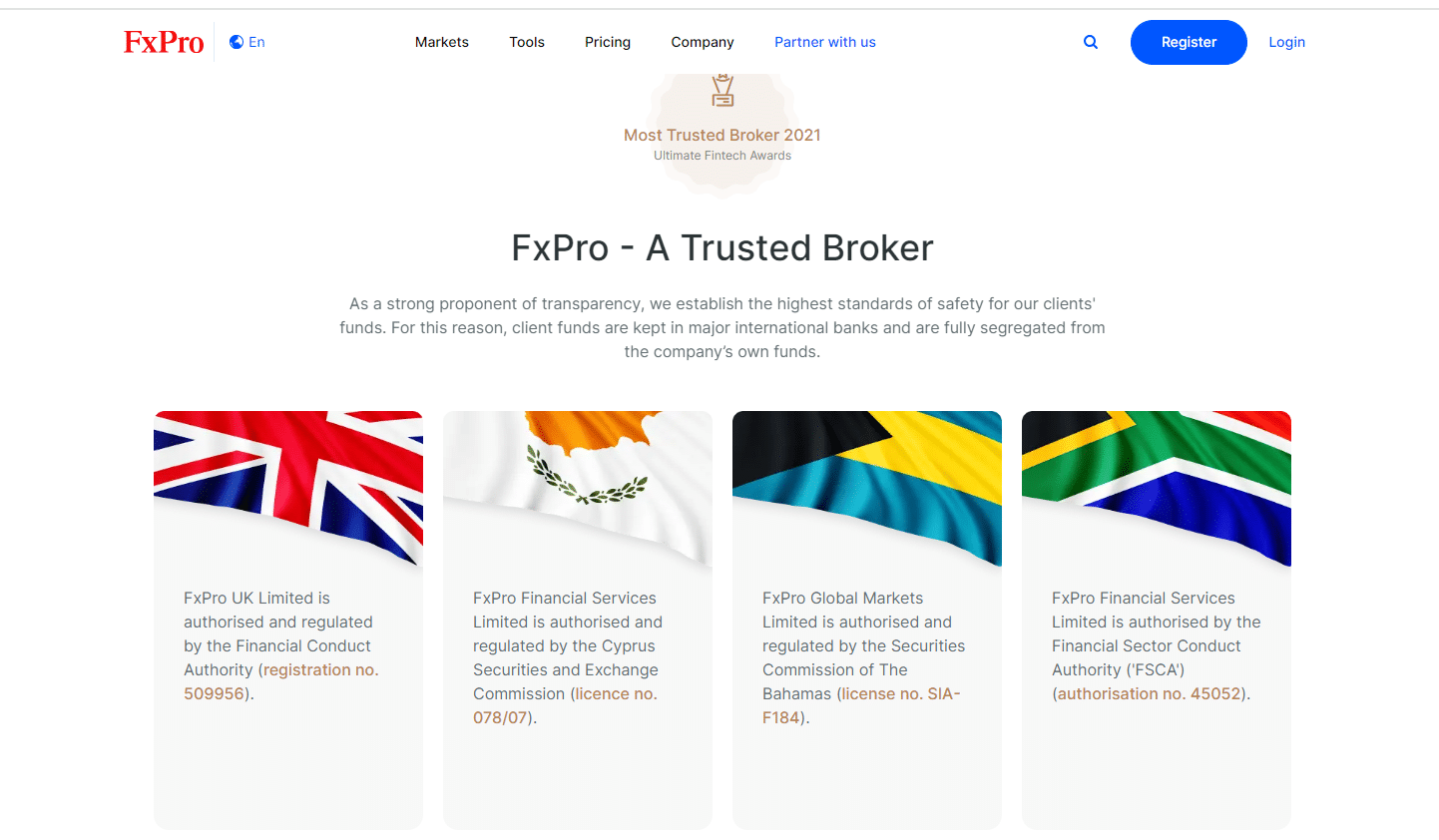

FxPro Safety and Security

FxPro Regulation in Dubai

FxPro is not currently regulated by the Dubai Financial Services Authority (DFSA). However, FxPro global regulations are listed in the table below:

| 🔑Registered Entity | 🌎Country of Registration | 🔢Registration Number | 🚨Regulatory Entity | 🎖️Tier | 🔎License Number/Ref |

| 1️⃣FxPro UK Limited | United Kingdom | 06925128 | FCA | 1 | 509956 |

| 2️⃣FxPro Financial Services Limited | Cyprus | HE 181344 | CySEC | 2 | 078/07 |

| 3️⃣FxPro Global Markets Limited | The Bahamas | N/A | SCB | 3 | SIA-F184 |

| 4️⃣FxPro Financial Services Limited | South Africa | HE181344 | FSCA | 2 | FSP 45052 |

| 5️⃣Prime Ash Capital Limited T/A FxPro | Mauritius | N/A | FSC | 3 | GB21026568 |

FxPro Protection of Client Funds

| 🔑Security Measure | 🔎Information |

| 🔒Segregated Accounts | ✅Yes |

| 🔏Compensation Fund Member | ✅Yes, ICF (does not cover Emirati traders) |

| 🔐Compensation Amount | 20,000 EUR |

| 🔓SSL Certificate | ✅Yes |

| 🗝️2FA (Where Applicable) | ✅Yes |

| 🔒Privacy Policy in Place | ✅Yes |

| 🔏Risk Warning Provided | ✅Yes |

| 🔐Negative Balance Protection | ✅Yes |

| 🔓Guaranteed Stop-Loss Orders | None |

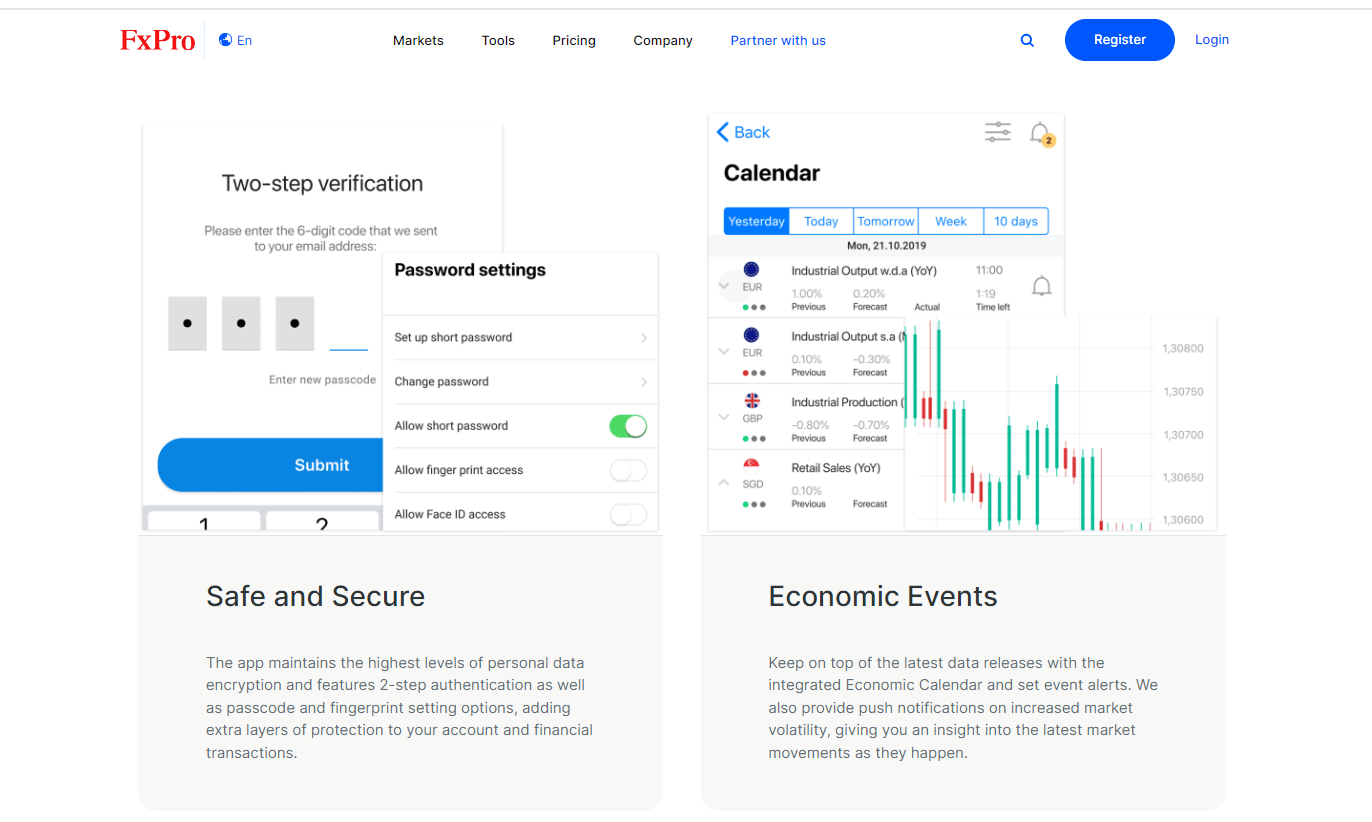

Security while Trading

- ✅FxPro‘s trading servers are strategically located and interconnected with Tier 1 providers, ensuring robust liquidity and reliable order execution—critical components of a secure trading environment.

- ✅FxPro Financial Services Ltd is overseen by several prestigious regulatory agencies, ensuring the broker’s adherence to stringent standards.

- ✅FxPro places a high value on the security of its clients’ funds. For added security, the broker keeps client funds separate from its own in separate bank accounts.

- ✅FxPro is deeply committed to safeguarding client assets, employing stringent security protocols, and adhering to regulatory guidelines to create a secure trading environment for its clients.

- ✅FxPro UK Limited is governed by the FCA and protects the FSCS, which covers qualified clients for up to £85,000 if the broker becomes insolvent.

- ✅FxPro has a good reputation in the industry, having won numerous awards and accolades for its emphasis on security and customer satisfaction.

Pros and Cons Regulation and Safety of Funds

| ✅Pros | ❎Cons |

| FCA and several other reputable entities regulate and oversee FxPro | Regardless of negative balance protection, Emiratis can still lose their invested capital using leverage |

| FxPro has a 90% trust score, thousands of positive reviews, and a track record of excellence in providing trading solutions | Emirati traders do not have investor protection |

| All client funds are kept in segregated accounts | FxPro is not regulated by DFSA in Dubai |

Does FxPro offer negative balance protection?

Yes, FxPro offers negative balance protection, ensuring customers’ accounts can never fall below zero and shielding them from disproportionate losses.

Does FxPro have a good reputation in the industry?

Yes, many traders choose FxPro as their preferred broker because of its solid reputation in the market, recognition for its services, and numerous awards.

FxPro Affiliate Program Features

The Affiliate Program at FxPro is useful for people and companies interested in making money from customer referrals. The Introducing Broker Program, Money Manager Program, and this program are the three main partnership programs that FxPro offers.

Furthermore, the Affiliate Program is especially well-liked because it pays out in commissions. The 60-day Affiliate Cookie Tracking Period offered by FxPro is one noteworthy aspect of the Affiliate Program.

Because of this, affiliates are still eligible to receive commissions for referrals made even if a customer enrolls and deposits money up to two months after clicking the affiliate link.

A wide range of potential customers find the platform appealing because it offers five different account types, which supports affiliates in their marketing initiatives.

FxPro provides its affiliates with various support services, such as Back Office Support, Trading Support, Dealing Support, Marketing Support, and Training Support. This guarantees that affiliates can access all the resources required for effective promotion.

Over 100 monthly awards and $3 million in partner pay-outs support FxPro’s reputation as a reputable platform, highlighting the firm’s dedication to enduring, fruitful partnerships.

There is a sizable earning potential. Depending on the client’s initial deposit, affiliates can make up to $1,100 for each client they refer. The earning potential increases with the number of customers an affiliate refers to.

According to the program’s revenue-sharing model, affiliates can receive up to 55% of the money that FxPro makes from each active trader they refer. This ensures that the affiliates profit directly from the referral traders’ success.

FxPro offers affiliates special promotional materials like website widgets and banners to help with marketing campaigns. These are made to draw prospective customers and increase conversion rates.

How to open an Affiliate Account with FxPro

To register an Affiliate Account, Emirati traders can follow these steps:

- ✅Go to the home page of FxPro and click “Sign Up.”

- ✅Your full name, address, and email address must be entered on the registration form.

- ✅When prompted to specify the kind of account you wish to open, select “Affiliate Account.”

- ✅Follow the on-screen instructions to complete your registration and submit your affiliate account application.

- ✅Please wait while FxPro reviews your application.

- ✅You will be given the information for your Affiliate Account after approval.

Start promoting FxPro’s services! Use these details to earn commissions from client recommendations.

What is the FxPro affiliate program?

The FxPro affiliate program is a collaboration between FxPro and people or organizations that market the broker’s services and make money by sending new customers their way.

What support does FxPro offer to its affiliates?

You can get help from the dedicated affiliate support team at FxPro with any questions or concerns. They can offer advice on marketing tactics, assist with campaign optimization, and provide general support to ensure your success as a FxPro affiliate.

What marketing materials are available for FxPro affiliates?

For their affiliates, FxPro offers a variety of marketing resources, such as banners, landing pages, and email templates. These resources are intended to assist you in promoting FxPro’s offerings and drawing in new customers.

How often will I receive my affiliate commissions?

Affiliate commissions are paid by FxPro every month.

FxPro Minimum Deposit

| 🔑Live Account | 💵Minimum Dep. |

| 🥇Standard | 367AED ($100) |

| 🥈Pro | 3,600AED ($1,000) |

| 🥉Raw+ | 3,600AED ($1,000) |

| 🏅ECN | 110,000AED / $30,000 (in 2 months) |

Is there a recommended initial deposit amount for FxPro?

While the minimum deposit is $100, FxPro recommends an initial deposit of $1,000 for the best trading experience.

How does FxPro’s minimum deposit compare to its competitors?

FxPro’s minimum deposit of $100 is competitive and compares favorably to its competitors.

FxPro Account Types and Features

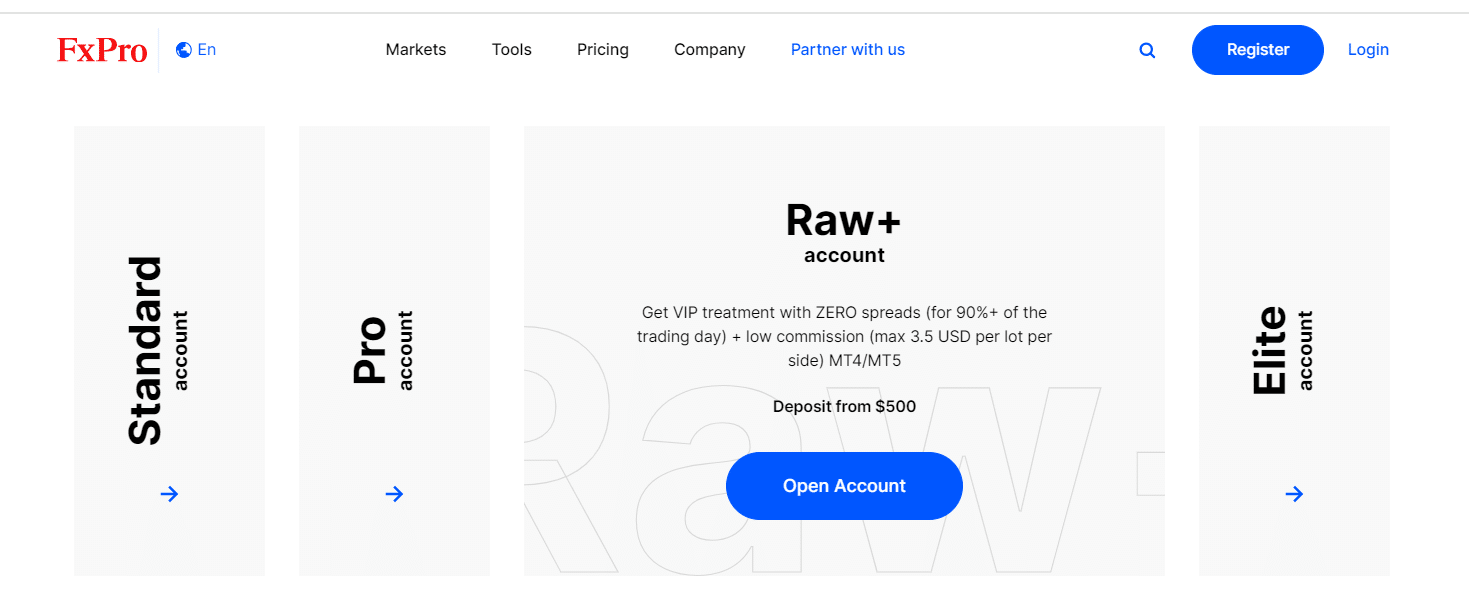

| 🔑Live Account | 💵Minimum Dep. | 📈Average Spread | 💰Commissions | 💶Average Trading Cost |

| 🥇Standard | $100 | 1.2 pips | Only the Spread | 12 USD |

| 🥈Pro | $1,000 | 0.6 pips | Only the Spread | 6 USD |

| 🥉Raw+ | $1,000 | 0.0 pips | $3.5 per side | 7 USD |

| 🥇ECN | $30,000 (in 2 months) | 0.0 pips | $3.5 per side | 7 USD |

FxPro Standard Account

The FxPro Standard Account is an excellent starting point for new traders or those who prefer a simple trading experience.

This account, which requires a minimum deposit of 367 AED ($100), has user-friendly interfaces and does not charge commission fees, relying solely on spreads for revenue.

Furthermore, the FxPro Standard Account offers a maximum leverage of 1:500 and trade sizes ranging from 0.01 lots to unlimited, making it ideal for those new to forex trading or looking to start with a smaller investment.

| 🔎Account Feature | ℹ️ Value |

| 💵Minimum Deposit | 367 AED ($100) |

| 📈Forex Spread | From 1.2 pips on EUR/USD, GBP/USD, USD/JPY |

| 💰Gold Spread | From 25 cents, with an average of 30 cents |

| 🪙Crypto Spread | From 30 USD, with an average of 40 USD |

| 💴Commission Fees | None; only the spread is charged |

| 📊Maximum Leverage | 1:500 |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | Unlimited |

FxPro Pro Account

FxPro’s Pro Account caters to more experienced traders, with advanced features and tools such as lower spreads starting at 0.6 pips on major currency pairs.

The Pro account, which requires a minimum deposit of 3,600 AED ($1,000), is intended for traders familiar with complex trading strategies and risk management techniques. Like the Standard Account, the Pro Account has a maximum leverage of 1:500 and no commission fees.

| 🔎Account Feature | ℹ️ Value |

| 💵Minimum Deposit | 3,600 AED ($1,000) |

| 📈Forex Spread | From 0.6 pips on EUR/USD, GBP/USD, USD/JPY |

| 💰Gold Spread | From 20 cents, with an average of 25 cents |

| 🪙Crypto Spread | From 15 USD, with an average of 20 USD |

| 💴Commission fees | None; only the spread is charged |

| 📉Maximum Leverage | 1:500 |

| ⬆️Minimum Trade Size | 0.01 lots |

| ⬇️Maximum Trade Size | Unlimited |

FxPro Raw+ Account

The FxPro Raw+ Account is designed for professional traders and institutional investors, with spreads starting at 0.0 pips. This account is ideal for high-volume traders willing to pay a $3.5 commission fee per side in exchange for razor-sharp spreads.

The minimum deposit is 3,600 AED ($1,000), and the maximum leverage and trade size options are the same as with the other accounts.

| 🔎Account Feature | ℹ️ Value |

| 💵Minimum Deposit | 3,600 AED ($1,000) |

| 📈Forex Spread | From 0.0 pips on EUR/USD, GBP/USD, USD/JPY |

| 💰Gold Spread | From 10 cents, with an average of 15 cents |

| 🪙Crypto Spread | From 15 USD, with an average of 20 USD |

| 💵Commission fees | From $3.5 per side |

| 📉Maximum Leverage | 1:500 |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | Unlimited |

FxPro ECN Account

The ECN Account from FxPro is intended for experienced traders looking for direct market access and the most professional trading conditions.

The ECN Account provides an electronic communication network that connects traders to liquidity providers, with spreads starting at 0.0 pips and a $3.5 per side commission fee. The minimum deposit for this account is 110,000 AED ($30,000) spread over two months.

| 🔎Account Features | ℹ️ Value |

| 💵Minimum Deposit | 110,000 AED / $30,000 (in 2 months) |

| 📈Forex Spread | From 0.0 pips on EUR/USD, GBP/USD, USD/JPY |

| 💰Gold Spread | From 10 cents, with an average of 15 cents |

| 🪙Crypto Spread | From 15 USD, with an average of 20 USD |

| 💷Commission fees | From $3.5 per side |

| 📉Maximum Leverage | 1:500 |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | Unlimited |

FxPro Demo Account

FxPro provides a comprehensive Demo Account for those who want to practice trading without risking their money. This account offers real-time pricing and up to $100,000 in virtual funds, allowing traders to test new strategies for up to 180 days risk-free.

FxPro Islamic Account

Muslim traders can open an Islamic Account, which is designed to comply with Islamic law by not paying or receiving interest. These swap-free accounts are ideal for traders religiously prohibited from incurring overnight or swap fees on leveraged positions.

Pros and Cons of FxPro Account Types and Features

| ✅Pros | ❎Cons |

| Beginners can easily start trading forex using the FxPro Standard Account | FxPro’s demo account is not unlimited |

| FxPro offers commission-free trading | More premium accounts require expensive initial deposits |

| There is a low and industry-standard $100 minimum deposit required for the Standard Account | FxPro does not currently offer a Micro or Cent Account to beginner Emirati traders |

What are the different account types offered by FxPro?

FxPro provides four live trading accounts: Standard, Pro, Raw+, and Elite.

What is special about FxPro’s Raw+ Account?

The Raw+ Account is ideal for high-volume traders, with spreads starting at 0.0 pips on EUR/USD.

FxPro Base Account Currencies and Basic Order Types

FxPro Base Account Currencies

The base account currencies available to Emiratis include the following:

- ✅USD

- ✅GBP

- ✅CHF

- ✅EUR

- ✅PLN

- ✅ZAR

- ✅AUD

- ✅JPY

FxPro Basic Order Types

- ✅Market Order – A market order can be either a buy or a sell order that executes at the current market price. This is the current price displayed on your price chart. If you place a market order, you will be immediately entered at the best available price.

- ✅Market orders are most effective when a trading opportunity requires prompt action. Click buy/sell at the market to enter the trade immediately.

- ✅Stop Order – A stop order can be either a buy or sell stop, depending on whether you wish to purchase above or below the market.

- ✅This is useful for trading breakouts or trend continuation strategies when you want the market to continue moving in the same direction.

Alternatively, if you believe the price will reverse when it reaches a certain price, you can place a limit order. Limit orders can be either buy or sell limits, depending on the market’s direction before your anticipated reversal. A sell limit is used to sell above the market, while a buy limit is used to purchase below the market.

How to Open and Close an FxPro Account

How to open anFxPro Account

To open an account with FxPro, Emiratis can follow these steps:

- ✅Visit the FxPro website.

- ✅Click the “Registration” button.

- ✅Once on the registration page, complete the registration form with your name, email address, and country of residence.

- ✅Choose the account type that corresponds to your trading preferences and select the account type that meets your trading needs best.

- ✅After choosing your account type, you must verify your identity by providing the required documentation.

- ✅Now, you must await verification of your application. This procedure typically requires approximately one day:

- ✅Typically, the verification of your application takes one day.

- ✅After your application has been accepted, you can fund your account and begin trading:

- ✅Deposit into your approved account.

Commence trading!

How long does it take to open a FxPro account?

The procedure for opening an account typically takes a few minutes. However, the verification procedure and the information provided during registration may affect the length of time.

How many trading accounts can I open in the FxPro App?

The number of trading accounts you can create in the FxPro app is not specifically capped. You can create multiple accounts with distinct settings on various FxPro platforms depending on your trading requirements.

How to Close an FxPro Account

To close a live trading account with FxPro, Emirati traders can follow these steps:

- ✅Sign in with your FxPro credentials.

- ✅Select the “Settings” tab.

- ✅Select ‘Account Close’

Follow the provided instructions to close your account successfully.

Can I close my FxPro account through the FxPro App?

Yes, you can ask for your FxPro account to be closed through the FxPro app by contacting customer support.

What should I do if I have pending withdrawals when closing my FxPro account?

When closing your FxPro account, contact FxPro customer support for advice and ensure your money is handled properly.

FxPro MAM / PAMM Features

FxPro provides a comprehensive Multi-Account Manager (MAM) solution for professional traders and money managers who manage multiple trading accounts simultaneously.

These MAM solutions are fully compatible with both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are popular among traders. Because of this compatibility, traders can easily incorporate FxPro’s MAM solutions into their existing trading systems and workflows.

The ability to manage multiple sub-accounts through a single master account is one of the standout features of FxPro’s MAM accounts. This simplifies trade execution and risk management across multiple client accounts, especially for money managers in charge of client funds.

Furthermore, MAM solutions provide robust reporting capabilities, enabling money managers to monitor subaccount performance, track commissions, and generate detailed reports. This level of transparency is critical for maintaining client trust and accountability.

FxPro offers a variety of allocation methods to supplement its MAM offerings, including percentage-based, lot-based, and equity-based allocations. These options enable money managers to distribute trades and profits among their clients in the manner that best suits their management strategy.

Finally, FxPro provides dedicated support to MAM solution users. This includes access to 24/7 customer service in multiple languages, ensuring that money managers have the resources and assistance they need to effectively manage their client’s accounts, including assistance with any technical or operational challenges that may arise.

Are there any fees associated with FxPro’s MAM and PAMM features?

Yes, the profits in the account are typically deducted from the performance or management fees that money managers may charge for their services.

Is there a demo version available for FxPro’s MAM and PAMM features?

Yes, FxPro provides a demo version of its MAM and PAMM features so users can test them and become familiar with the interface before investing money.

FxPro Trading Platforms

FxPro offers Emirati traders a choice between these trading platforms:

- ✅MetaTrader 4

- ✅MetaTrader 5

- ✅cTrader

- ✅FxPro App

FxPro MetaTrader 4

FxPro MetaTrader 4 (MT4) is frequently praised for its simplicity and ease of use, but its customizability, particularly in terms of its user interface and charting capabilities, receives less attention.

This feature is particularly useful for Emirati traders who want to align their trading environment with specific regional market hours or localized trading strategies.

Furthermore, MT4 supports “one-click trading” directly from charts, allowing for faster reaction times to market changes, which is critical for day traders or those trading volatile markets.

FxPro MetaTrader 5

FxPro MetaTrader 5 (MT5), like MT4, offers additional timeframes and technical indicators, but its integrated “MQL5 Wizard” is less well-known. This feature enables traders without programming experience to create a simple trading robot.

This tool can be valuable for Emirati traders who want to automate their strategies but lack coding expertise. Furthermore, MT5 includes a multi-threaded strategy tester that allows for faster back-testing of trading strategies, saving significant time.

FxPro cTrader

FxPro cTrader is known for its simple interface and advanced charting tools. Still, one of its less-publicized features is its “Cloud service,” which allows traders to securely save their entire workspace, including templates and indicators, online.

This is especially useful for Emirati traders who may be trading on multiple devices or in different locations, as it allows for a smooth transition between different trading setups.

Furthermore, cTrader includes a feature known as “Trailing Stops,” which can automatically adjust to market movements, giving traders a dynamic way to protect profits or limit losses.

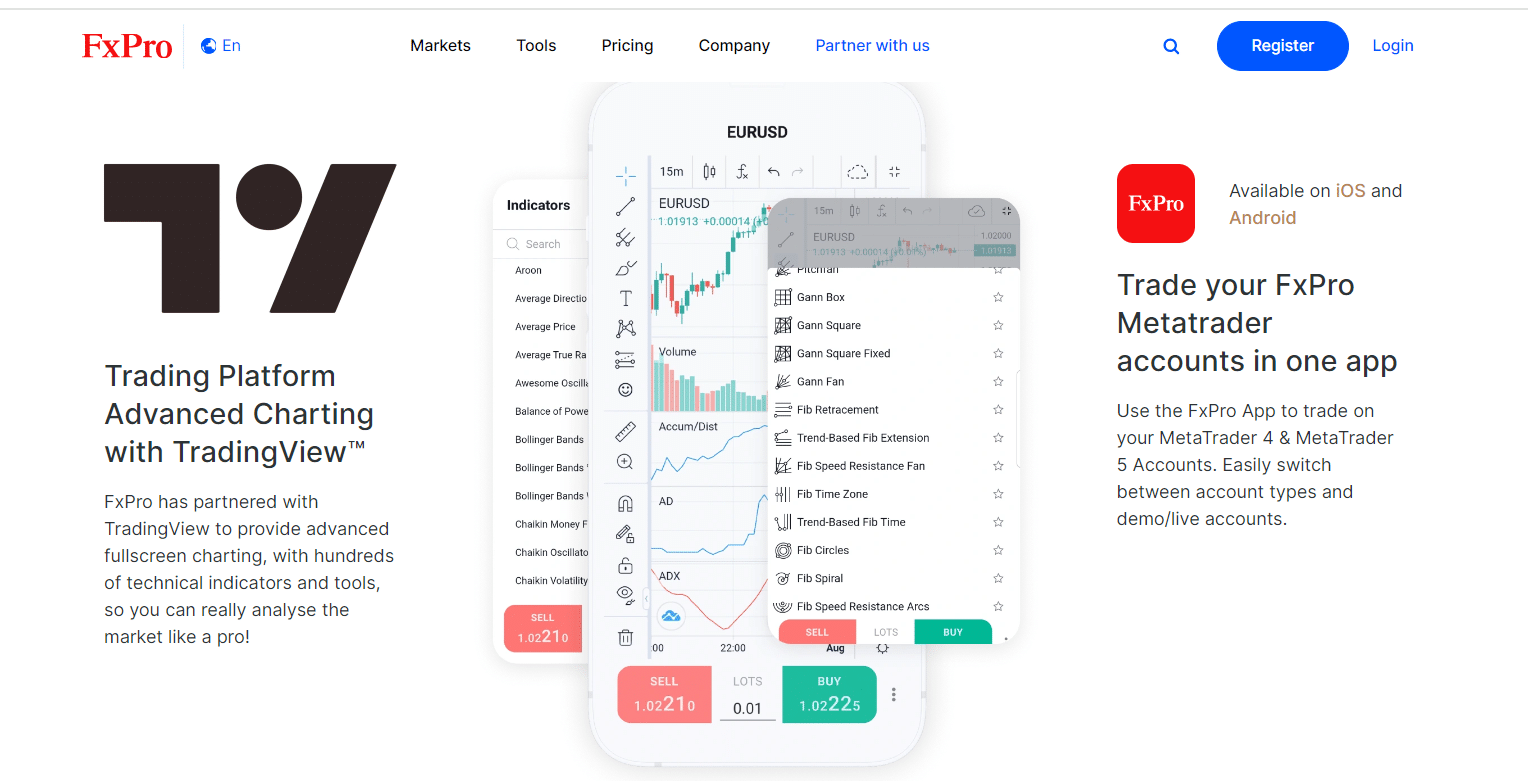

FxPro App

The FxPro App offers a mobile trading experience that goes above and beyond mere convenience. While most discussions revolve around its portability, the app also provides advanced charting options not commonly found in mobile applications, such as time frames ranging from one minute to one month.

This allows for a more in-depth analysis than expected from a mobile application. Furthermore, the app integrates seamlessly with all of FxPro’s other platforms, seamlessly transitioning between desktop and mobile trading environments.

Pros and Cons FxPro Trading Platforms

| ✅Pros | ❎Cons |

| Emirati traders can download the FxPro app for free from Google Play or the App Store | FxPro has not indicated whether it would create a desktop or web platform, limiting traders to mobile devices |

Do I need to download any software to use FxPro’s trading platforms?

No, you do not need to download any additional software to access FxPro’s trading platforms; you can do so directly from a web browser. For a more complete trading experience, you can also download the desktop versions of the platforms.

Can I customize the settings of FxPro’s trading platforms?

Yes, you can alter the settings of FxPro’s trading platforms to suit your trading preferences, including the chart types, timeframes, and indicators.

Which Markets Can You Trade with FxPro?

Emirati traders can expect the following range of markets from FxPro:

- ✅Forex

- ✅Futures

- ✅Indices

- ✅Shares

- ✅Metals

- ✅Energies

- ✅Cryptocurrency CFDs

Financial Instruments and Leverage offered by FxPro

| 🔑Instrument | 🅰️Number of Assets Offered | 🅱️Max Leverage Offered |

| 📈Forex | 70 | 1:500 |

| ⏩Futures | 21 | 1:50 – 1:100 |

| 📉Indices | 19 | 1:50 – 1:200 |

| 📊Shares | 2,000+ | 1:25 |

| 💰Metals | 8 | 1:50 – 1:200 |

| 💡Energies | 3 | 1:200 |

| 🪙Cryptocurrency CFDs | 30 | 1:20 |

Broker Comparison for a Range of Markets

| 🔑Broker | 🥇FxPro | 🥈RoboForex | 🥉NinjaTrader |

| 📈Forex | ✅Yes | ✅Yes | ✅Yes |

| 💎Precious Metals | ✅Yes | ✅Yes | None |

| 🚩ETFs | None | ✅Yes | None |

| 📍CFDs | ✅Yes | ✅Yes | None |

| 💹Indices | ✅Yes | ✅Yes | None |

| 📉Stocks | ✅Yes | ✅Yes | None |

| 🪙Cryptocurrency | ✅Yes | ✅Yes | None |

| 🔁Options | None | None | None |

| 💡Energies | ✅Yes | ✅Yes | None |

| 💵Bonds | None | None | None |

Pros and Cons FxPro Range of Markets

| ✅Pros | ❎Cons |

| Emiratis can trade over 2,000 CFDs on international stocks | Regardless of negative balance protection, traders can still lose all invested money |

| FxPro offers 70 forex pairs that can be traded, including major, minor, and exotics | FxPro has limited commodity CFDs |

Can I trade futures with FxPro?

Yes, FxPro gives you access to futures trading so you can predict how various assets’ prices will change in the future.

Can I trade all the available markets with a single FxPro account?

Yes, you can diversify your trading portfolio and seize different market opportunities by trading multiple markets with a single FxPro account.

FxPro Fees, Spreads, and Commissions

FxPro Spreads

FxPro earns most of its trading fees from the spread, the difference between the asking and bid prices. Spread rates are standardized for Emirati traders who use various types of FxPro accounts.

For example, the Standard Account has a spread of 1.2 pips on EUR/USD, whereas the Pro Account has a lower spread of 0.6 pips on the same currency pair.

FxPro Commissions

The FxPro Raw+ and ECN Accounts go even further, with spreads as low as 0 pips on many occasions. Traders are subject to a commission fee in these cases, which can be as low as $3.5 per side depending on the financial instrument being traded.

FxPro Overnight Fees, Rollovers, or Swaps

FxPro overnight fees, also known as rollovers or swaps, are another cost to consider for MetaTrader and cTrader traders.

These fees are displayed and apply when a trader holds a position overnight. The fee is calculated using the difference in overnight interest rates between the pair’s two currencies.

Emirati traders can learn more about these rates online and should incorporate them into their trading strategy, especially if they intend to hold positions for an extended period. Additionally, Dubai residents can estimate these costs using the FxPro Swap fee calculator tool.

FxPro Deposit and Withdrawal Fees

FxPro does not charge any fees for deposits or withdrawals. Traders should be aware, however, that payment providers may levy their own processing fees.

FxPro Inactivity Fees

Another consideration is inactivity fees. FxPro may levy fees on accounts that have not been used for a certain period. These fees are typically between $5 and $15. Finally, currency conversion fees apply when traders deposit funds in a currency other than their base account currency.

FxPro Currency Conversion Fees

FxPro currency conversion fees apply when traders deposit funds in a currency other than their base account currency.

Therefore, Emirati traders should be well-informed about these potential costs to manage their trading budget effectively.

Pros and Cons of FxPro Trading and Non-Trading Fees

| ✅Pros | ❎Cons |

| FxPro has a transparent fee schedule | FxPro charges wide spreads on commission-free accounts |

| FxPro does not charge any deposit or withdrawal fees | AED deposits and withdrawals could attract currency conversion fees |

| There are zero-pip spreads charged on some accounts | FxPro charges expensive inactivity fees |

| The commissions charged by FxPro are competitive compared to competitors | Third-party fees could apply to deposits and withdrawals |

What are the fees associated with trading on FxPro?

Depending on the account type and trading platform you select, FxPro offers competitive spreads and commissions. On their website, you can find comprehensive information about their prices.

Are there any hidden fees when trading with FxPro?

No, there are no hidden fees when trading with FxPro because they are open and transparent about their fees.

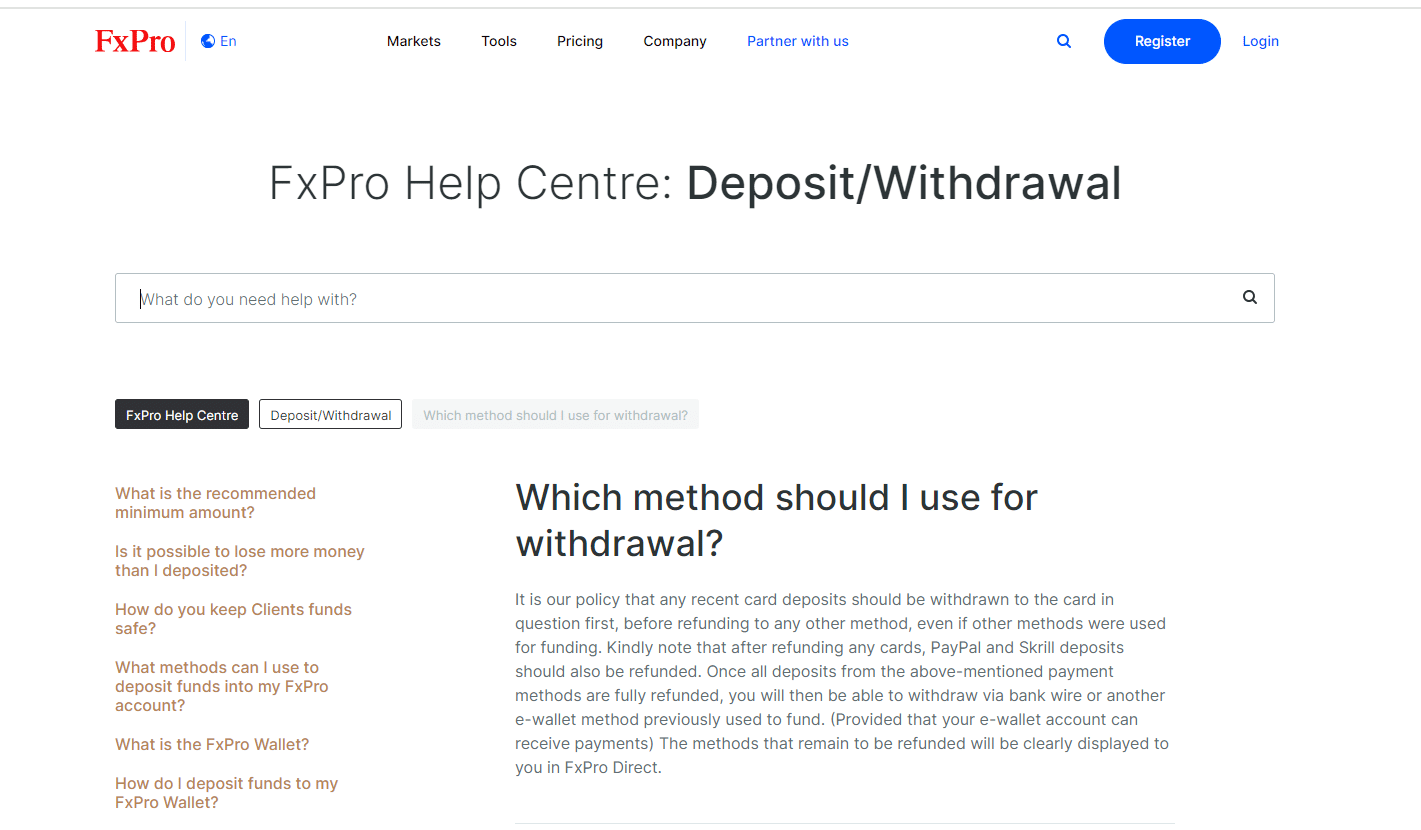

FxPro Deposits and Withdrawals

FxPro offers Emirati traders the following deposit and withdrawal methods:

- ✅Bank Transfers

- ✅Credit/Debit Cards

- ✅Neteller

- ✅PayPal

- ✅Skrill

and more!

How to make a Deposit with FxPro

To deposit funds to an account with FxPro, Emirati traders can follow these steps:

- ✅Sign in with your credentials.

- ✅Navigate to the “Deposit” section on your account dashboard or under the “Funds” section.

- ✅Choose your preferred payment method (options include bank transfer, credit/debit card, or digital wallets like Neteller or Skrill).

- ✅Input the desired deposit amount, ensuring it meets the minimum deposit requirements for your account type.

- ✅Follow the provided payment instructions, which may direct you to a secure payment portal or provide the necessary information to complete the transaction.

Once your payment is successfully processed, you will receive an email confirmation, and the deposited amount will be added to your FxPro account, ready for trading.

How long do FxPro Deposits take?

Deposits with FxPro can be instant or take up to three days, depending on the selected payment method.

How do I deposit funds to my FxPro Wallet?

Log into your FxPro Direct account, select “Wallet” or “Deposit Funds,” and then select your preferred payment method to add money to your FxPro Wallet.

What conversion rates does FxPro use for FxPro Wallet currency exchanges?

For currency exchanges, FxPro uses competitive market rates. Depending on the state of the market at the time, the exact rates might change.

How to Withdraw from FxPro

To withdraw funds from an account with FxPro, Emirati traders can follow these steps:

- ✅Log in to your FxPro account using your username and password.

- ✅Once inside your account, go to the section labeled “Withdraw.”

- ✅Select your preferred method for withdrawing funds from the available options.

- ✅Indicate the sum you wish to withdraw, keeping in mind any minimum withdrawal limits and potential fees.

- ✅You might need to furnish additional details, such as bank account numbers or e-wallet identifiers, to finalize the transaction based on your chosen withdrawal option.

After the Client Accounting Department at FxPro approves your withdrawal request, the withdrawal amount will be sent to your specified account or e-wallet, depending on your chosen method.

How long do FxPro Withdrawals take?

Withdrawals with FxPro take between 1 and 7 days.

What are the available currencies for my FxPro Wallet?

You can use your FxPro Wallet to store the following currencies: USD, EUR, GBP, PLN, AUD, JPY, CHF, and ZAR.

Are there any fees for withdrawing funds from FxPro?

No, while your payment provider may impose transaction or currency conversion charges, FxPro does not charge any withdrawal fees.

FxPro Deposit Currencies, Deposit and Withdrawal Processing Times

| 🔑Payment Method | 💴Deposit Currencies | 📝Deposit Processing | 🗂️Withdrawal Processing |

| 🏦Bank Transfers | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | 1 – 3 days | 3 – 7 days |

| 💳Credit/Debit Cards | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

| 🔢Neteller | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

| ▶️PayPal | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

| 🚩Skrill | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

| 📌UnionPay | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

Broker Comparison: Deposit and Withdrawals

| 🔑Broker | 🔑FxPro | 🥈RoboForex | 🥉NinjaTrader |

| ⏰Minimum Withdrawal Time | 1 business day | Up to 24 hours | Within 24 hours |

| ⏱️Maximum Estimated Withdrawal Time | 7 business days | Up to 3 working days | Between 5 to 7 working days |

| 💳Instant Deposits and Instant Withdrawals | ✅Yes, Deposits | ✅Yes, Skrill and Neteller | None |

Pros and Cons of FxPro Deposits and Withdrawals

| ✅Pros | ❎Cons |

| Flexible payment methods are available with FxPro | Instant withdrawals are not available, and bank transfers can take long |

| FxPro does not charge any deposit or withdrawal fees | FxPro does not provide local payment methods for Emiratis, and AED is not an accepted deposit or withdrawal currency |

How do I deposit funds into my FxPro account?

Go to your FxPro Direct account and click “Deposit.” Select the method, enter the quantity, and follow the directions to complete the deposit.

Are there any minimum or maximum deposit/withdrawal limits?

Yes, there are. The minimum and maximum deposit/withdrawal amounts vary depending on your account type and the payment method you have selected.

FxPro Education and Research

Education

FxPro offers the following Educational Materials to Emirati traders:

- ✅Online Courses

- ✅Fundamental Analysis Courses

- ✅Technical Indicator Courses

- ✅Trading Psychology

and more!

FxPro also offers Emirati traders the following additional Research and Trading Tools:

- ✅Economic Calendar

- ✅Forex News

- ✅Trading Calculators

- ✅Earnings Calculators

- ✅FxPro Market News

- ✅Technical Analysis through Trading Central

- ✅Trader’s Dashboard

- ✅FxPro Direct App

- ✅FxPro VPS

and more!

Research and Trading Tool Comparison

| 🔑Broker | 🥇FxPro | 🥈RoboForex | 🥉NinjaTrader |

| 🔢Economic Calendar | ✅Yes | ✅Yes | ✅Yes |

| 📈VPS | ✅Yes | None | ✅Yes |

| ▶️AutoChartist | None | None | None |

| 👁️Trading View | ✅Yes | None | ✅Yes |

| 📍Trading Central | ✅Yes | None | None |

| 📉Market Analysis | ✅Yes | ✅Yes | ✅Yes |

| 🗞️News Feed | ✅Yes | ✅Yes | ✅Yes |

| 💻Blog | ✅Yes | ✅Yes | ✅Yes |

Pros and Cons FxPro Education and Research

| ✅Pros | ❎Cons |

| FxPro caters to beginners by offering online courses, guides, and YouTube videos | There is a lack of comprehensive educational material on the FxPro website |

| VPS is available to eligible traders | The demo account is not unlimited |

Does FxPro provide market research and analysis?

To help traders stay current on the most recent market trends and events, FxPro provides daily market analysis, economic calendars, and real-time news updates.

Does FxPro offer any advanced trading courses?

No, they do not. Although FxPro does not directly offer advanced trading courses, its educational materials give traders a strong foundation to build their knowledge and skills.

FxPro Customer Support

| 🔑Customer Support | 🥇FxPro Customer Support |

| ⏰Operating Hours | 24/5 |

| 🌎Support Languages | Multilingual |

| 🔊Live Chat | ✅Yes |

| 💻Email Address | [email protected] |

| ☎️Telephonic Support | ✅Yes |

| 🏆The overall quality of FxPro Support | 5/5 |

Pros and Cons FxPro Customer Support

| ✅Pros | ❎Cons |

| FxPro offers multilingual customer support | Customer support is not offered 24/7 |

What are FxPro’s customer support working hours?

The customer service team at FxPro is accessible 24/5, which means they are reachable from Monday through Friday, all day long.

How long does FxPro’s customer support take to respond to inquiries?

FxPro strives to respond to customer inquiries right away. The precise response time may change depending on how complicated the problem is and how many support requests there are at the moment.

In our experience, you can count on receiving a prompt and enlightening response from the FxPro customer support staff.

FxPro VPS Review

With the help of its Virtual Private Server (VPS) service, FxPro offers its customers uninterrupted access to a remote server, ensuring smooth and continuous trading operations. Following are some highlights of FxPro’s VPS selections:

After making a payment, traders can quickly connect to the server thanks to the FxPro VPS’ simple setup. This accelerated setup procedure makes it easier to implement trading strategies quickly and guarantees seamless integration with the FxPro trading environment.

BeeksFX, a reputable VPS provider renowned for its quick and dependable server connectivity, powers the VPS service. This strong linkage reduces latency and slippage, giving traders a distinct advantage in the market.

FxPro’s VPS service ensures that traders can access their VPS from any location, provided they have a steady internet connection. It is available across 13 global data centers. The VPS service is more dependable and effective overall thanks to its widespread international accessibility, giving traders more assurance.

FxPro offers a variety of VPS plans with various specifications, such as CPU, RAM, and storage capacity, to meet the various needs of its trading clientele. This enables traders to pick a strategy that matches their unique trading goals.

Can I use FxPro VPS with my existing trading account?

Yes, you can use your current FxPro live trading account and FxPro VPS together. Once approved, you can request the VPS service through your FxPro Direct account and begin using it with your live trading account.

Is FxPro VPS available for demo accounts?

No, only live trading accounts are eligible to use FxPro VPS. The VPS service is not available for demo accounts.

FxPro Cashback Rebates Features and Conditions

For both Introducing Brokers (IBs) and individual traders, FxPro offers a robust cashback rebate program that applies to a range of account types, including MT4 Instant, MT4 Standard, MT4 Fixed, FxPro Edge MT5, and cTrader Accounts.

When trading volume exceeds $1 billion across all financial instruments, the commission for IBs can increase to 55% from its base rate of 40% of the spread.

During a given month, the total trading volume executed on FxPro’s various platforms, including MT4, MT5, FxPro Edge, and cTrader, determines rebates for specific traders.

For instance, the total volume for a trade would be 200,000 USD if a trader opened and closed a position of 1 lot (100,000 units) in USDJPY within a month.

The volume is converted using the average exchange rate from the previous day if the base currency is not USD. Each transaction’s commission is calculated as a percentage of the executed spread.

The formula used to determine the rebate for both opening and closing positions considers several factors, including the spread in cents, the percentage of the commission, the volume of the trade in lots, the symbol’s lot size, and the exchange rate from the US dollar.

In FxPro, commissions are divided into four levels according to trading volume:

- ✅If a trader’s trading volume is under $100 million, they are classified as trading at Level 1, where they are paid a 40% commission.

- ✅Level 2 offers a 45% commission and is reserved for traders with volumes between 100 million and 400 million.

- ✅The VIP level and a 50% commission are available to traders with trading volumes between $400 million and $1 billion.

- ✅Finally, traders reach the VVIP level, receiving a 55% commission, when their trading volume reaches $1 billion or more.

What are FxPro Cashback Rebates?

FxPro Cashback Rebates is a program that allows traders to earn cashback based on their trading volume. The rebates are added to the trader’s account and are available for withdrawal or trading.

Do FxPro Cashback Rebates expire?

No, cashback rebates from FxPro do not expire. The rebates traders accumulate over time are theirs to use whenever they please.

FxPro Web Traffic Report

| 🌎Global Rank | 85,124 |

| 🌐Country Rank | 92,692 |

| 📊Category Rank | 582 |

| 📌Total Visits | 1 million |

| 📈Bounce Rate | 60.85% |

| 📖Pages per Visit | 1.69 |

| ⏱️Average Duration of Visit | 00:01:44 |

| 📍Total Visits in the last three months | June – 676.3K July – 821.8K August – 1 million |

FxPro Geographic Reach and Limitations

FxPro Current Expansion Focus

FxPro is focused on traders in the United Kingdom, Asia, Africa, and Europe.

Countries not accepted by FxPro

FxPro does not accept clients from these countries:

- ✅The United States

- ✅Canada

- ✅Iran

Popularity among Emirati traders who choose FxPro

FxPro is one of the Top 20 forex and CFD brokers for Emirati traders.

Can I trade on FxPro’s platforms using my mobile device?

Yes, traders can access their accounts and trade while traveling with FxPro’s mobile trading platforms, which are available for iOS and Android devices.

What is the maximum leverage available for FxPro clients?

The highest leverage offered by FxPro is 1:500, though this varies depending on the type of account and the financial instrument being traded.

Best Countries by Traders

| 🌎Country | 📈Market Share |

| 🥇Russia | 13.6% |

| 🥈United Kingdom | 8.29% |

| 🥉South Africa | 7.68% |

| 🏅Brazil | 5.93% |

| 🎖️Thailand | 4.68% |

FxPro vs RoboForex vs NinjaTrader – A Comparison

| 🔑Broker | 🥇FxPro | 🥈RoboForex | 🥉NinjaTrader |

| 🖋️Regulation | FCA, CySEC, SCB, FSCA, FSC | IFSC | NFA |

| 📈Trading Platform | MetaTrader 4 MetaTrader 5 cTrader FxPro App | MetaTrader 5 MetaTrader 5 cTrader R StocksTrader RoboForex Terminal CopyFX App | NinjaTrader Desktop NinjaTrader Mobile CQG Mobile |

| 💴Withdrawal Fee | None | ✅Yes | ✅Yes |

| 🆓Demo Account | ✅Yes | ✅Yes | ✅Yes |

| 💵Min Deposit | 367 AED | 37 AED | 184 AED |

| 💹Leverage | 1:500 | 1:2000 | 1:50 |

| 📊Spread | 0.0 pips EUR/USD | 0.0 pips | 1.1 pips |

| 💰Commissions | $3.5 per side | $3 to $4 | From $0.09 |

| ⛔Margin Call/Stop-Out | 100%/50% | Stop-out 100% to 10% | None |

| 📝Order Execution | Market | Market | Instant, Market |

| 💶No-Deposit Bonus | None | ✅Yes | None |

| 🪙Cent Accounts | None | None | None |

| 📉Account Types | Standard Account Pro Account Raw+ Account ECN Account | Prime Account ECN Account R StocksTrader Account ProCent Account Pro Account | Forex Account Futures Account |

| 🚨DFSA Regulation | None | None | None |

| ✳️AED Deposits | None | Yes | None |

| ✴️AED Account | None | No | None |

| ⏰Customer Service Hours | 24/5 | 24/7 | 24/5 |

| 🚩Retail Investor Accounts | 4 | 5 | 2 |

| ☪️Islamic Account | ✅Yes | ✅Yes | ✅Yes |

| ⬇️Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| ⬆️Maximum Trade Size | Unlimited | 10,000 (Cent) | 100 lots |

| ⏱️Minimum Withdrawal Time | 1 business day | Up to 24 hours | Within 24 hours |

| ⌚Maximum Estimated Withdrawal Time | 7 business days | Up to 3 working days | Between 5 to 7 working days |

| 💳Instant Deposits and Instant Withdrawals | ✅Yes, Deposits | ✅Yes, Skrill and Neteller | None |

FxPro Alternatives

- 🥇 easyMarkets is a forex and CFD broker known for its user-friendly interface and unique features such as “dealCancellation,” which allows traders to undo losing trades for a small fee within an hour. The platform also provides fixed spreads, so trading costs remain constant regardless of market conditions. easyMarkets provides various educational resources and supports multiple trading platforms, including its easyMarkets platform and MetaTrader 4.

- 🥈Capital.com is a CFD trading platform distinguished by its use of artificial intelligence to offer customized trading insights and educational content. SmartFeed, one of its unique features, provides news and analysis based on your trading behavior and interests.

- 🥉 TD Ameritrade is a US-based brokerage firm offering various investment options, from stocks and options to forex and futures. It is distinguished by its highly customizable trading platform, thinkorswim, which provides advanced charting tools, real-time market data, and a plethora of technical indicators. The platform also offers a “paperMoney” feature, a simulated trading environment where traders can practice without risking real funds.

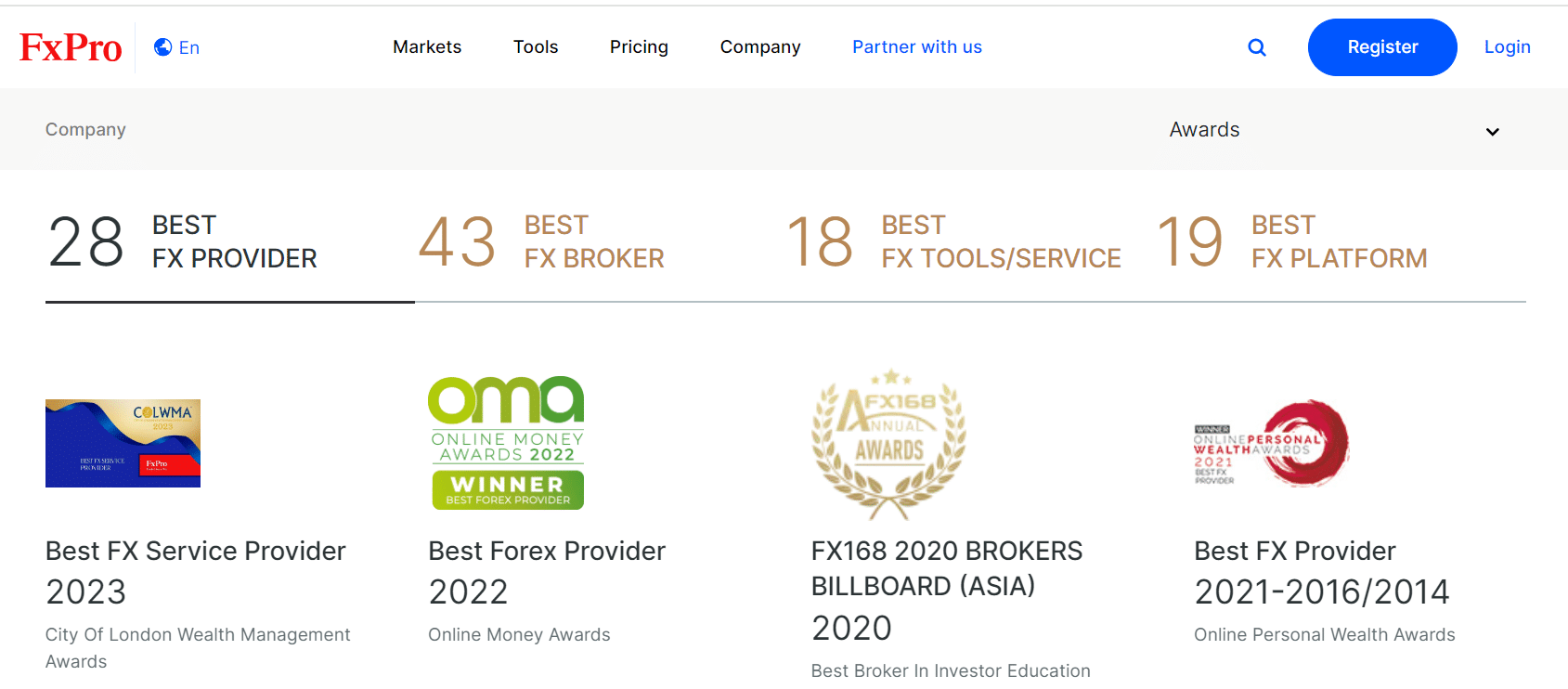

FxPro Awards and Recognition

FxPro received the following recent awards and recognition:

- ✅Best FX Service Provider in 2024, awarded during the City Of London Wealth Management Awards.

- ✅Best Trading Conditions APAC in 2024, awarded during the Ultimate Fintech Awards.

- ✅Best Online Broker Asia (2024), awarded by the Global Brands Magazine.

- ✅Best in Class of Algo Trading in 2024, awarded by ForexBrokers.com.

- ✅Best Trading Platform in 2024, awarded during the Online Money Awards.

- ✅Most Innovative Trading Platform MENA (2024), awarded by the Global Brands Magazine.

and more!

Our Experience with FxPro

We can confidently say that this broker accommodates traders of all skill levels, from novices to seasoned professionals, based on our extensive testing of FxPro.

With the various account types available, including Standard, Pro, Raw+, and ECN, traders can select a platform that fits their needs and experience.

We were particularly drawn to FxPro’s prominent sponsorships in various industries, including motorsports and yachting. These alliances serve as a testament to the company’s financial stability and its dedication to excellence, enhancing its credibility and trustworthiness.

FxPro Trading Platform

FxPro’s trading platform is user-friendly and packed with features, making it a dependable environment for trading. Due to its high degree of customization, traders can modify the platform to suit their particular requirements.

The wide variety of trading instruments offered, allowing for portfolio diversification, impressed us. Even in the Raw+ and ECN accounts designed for more seasoned traders, the platform consistently performs well and offers competitive spreads.

The user interface is simple, making it simple to execute trades, manage risks, and use various trading strategies. Another noteworthy aspect of the platform is its stability, which is crucial for high-frequency traders.

Quality of Customer Service

Our research revealed that the FxPro support team went above and beyond to help customers. They were quick to respond and showed a deep understanding of various trading aspects.

The customer service representatives are well-equipped to handle all inquiries, including account setup, trading difficulties, and general inquiries.

A layer of convenience is added by the availability of numerous customer support channels, such as live chat, email, and phone, ensuring that traders can easily get help.

FxPro provides exceptional customer service that meets and frequently exceeds industry standards, making it a solid choice for traders seeking a long-term brokerage relationship.

FxPro Response Time

| 🔑Support Channel | ⏰Average Response Time | ⏱️User-based Response Time |

| ☎️Phone | 5 minutes | 5 minutes |

| 1 working day | Same-day – 1 working day | |

| 🔊Live Chat | 6 minutes | 2 – 5 minutes |

| 📱Social Media | 10 minutes | 7 – 10 minutes |

| 👥Affiliate | 24 – 48 hours | 1 working day |

Recommendations according to our in-depth review of FxPro

- ✅While FxPro’s trading costs are generally low, some stock CFDs have relatively high costs. To make its services more accessible to traders in the Emirati market, FxPro might think about reducing its trading fees.

- ✅Expand the range of products offered by FxPro, which only offers forex and CFDs. Commodities, indices, and cryptocurrencies are just a few additional trading instruments that Emirati traders may find useful.

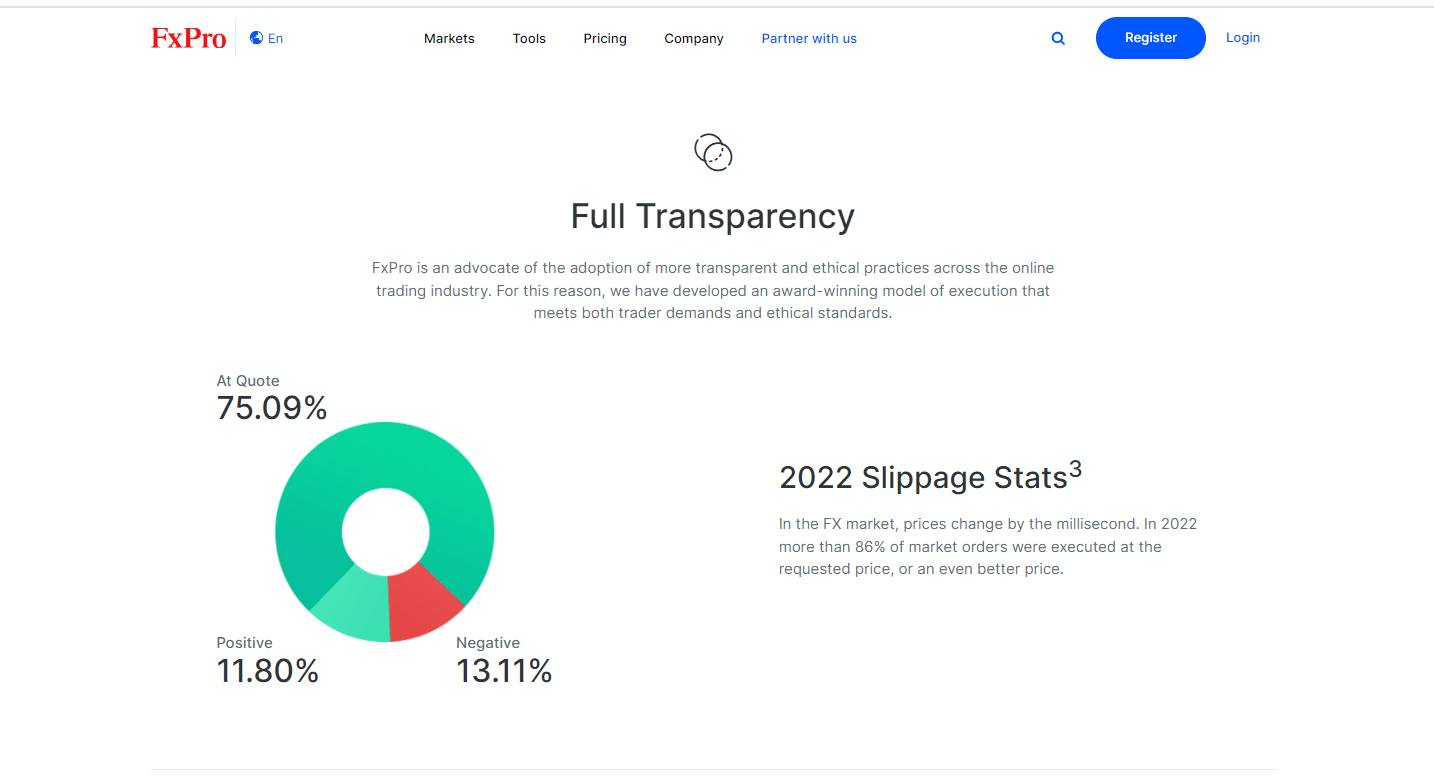

- ✅FxPro could show greater transparency by providing more details about its trading practices, such as order execution procedures and slippage percentages. Emirati traders could then make better decisions and develop a relationship of trust with the broker.

- ✅More educational resources could be made available by FxPro to aid Emirati traders in honing their trading abilities and knowledge, such as webinars, tutorials, and trading guides.

Finally, despite FxPro’s efficient customer service, which can be contacted in various languages and offers quick and pertinent answers, some traders have voiced concerns about the broker’s customer service. By offering quicker response times and more individualized support, FxPro could enhance its customer service.

FxPro Customer Reviews

🥇 Positive experience.

While I do not research this broker’s trading conditions extensively, my overall experience with FxPro has been positive. Observing the problems that other traders have with various brokers, I consider myself fortunate that FxPro’s trading conditions and tools work flawlessly, contributing to my profitability. – Majid Rais

🥈 Elite broker.

FxPro is undoubtedly an elite broker, possessing all the necessary characteristics. A review of client feedback reveals high satisfaction, adding to my admiration for the broker. – Aisha Mazrooei

🥉 Diverse options.

The wide range of trading instruments available is one of the benefits of trading with FxPro. FxPro provides the necessary options to diversify my portfolio and explore various markets, whether I want to trade in forex, commodities, indices, or cryptocurrencies. – Latifa Mazrooei

Pros and Cons of Trading with FxPro

| ✅Pros | ❎Cons |

| FxPro charges low and competitive spreads and commissions | FxPro offers a limited educational material portfolio |

| There are flexible retail accounts that cater to the needs and objectives of different traders | CFD trading with FxPro can be expensive compared to other brokers |

| There is a quick digital account opening and verification process on the FxPro website | Inactivity fees apply to dormant accounts |

| Emirati traders can expect localized support from FxPro’s Dubai office | There is no AED-denominated account |

| There are multiple language options on the website | FxPro has limited non-forex instruments |

In Conclusion

After careful analysis, we believe that FxPro offers new and seasoned traders an extensive and competitive trading experience. The broker offers a range of account types, platforms, and trading instruments to meet the diverse needs of its clients.

Furthermore, traders can feel secure and trusted thanks to FxPro’s robust regulatory framework, which includes licenses from reputable authorities.

One of FxPro’s standout features is its social trading platform, which enables users to communicate with a sizable trading community, exchange ideas, and even copy the trades of profitable users. New traders who want to pick the brains of more seasoned traders will find this feature especially helpful.

Additionally, traders can access tools through FxPro’s VPS service and trading signals to enhance their trading approaches and, perhaps, their overall performance.

The broker’s dedication to CSR is commendable because it actively supports numerous programs to enhance people’s access to food, education, and quality of life.

However, we acknowledge that customers have previously voiced their dissatisfaction with the broker’s support staff and the potential dangers of using leverage in trading.

Even though FxPro has worked to address these problems and offer a secure trading environment, traders should carefully consider their investment goals and experience level before engaging in any trading activities.

Overall, we can conclude that FxPro is a reputable broker that provides traders of all experience levels with a thorough and competitive trading environment.

The social trading platform, VPS service, and trading signals offered by the broker give traders the resources to enhance their trading performance and strategies.

However, before engaging in any trading activities, traders should be aware of potential risks and consider their investment objectives carefully.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Emirati investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Frequently Asked Questions

What does FxPro offer?

Forex and CFD trading is available through FxPro on currency pairs and five other asset classes. FxPro offers four retail trading accounts, access to tools, education, and powerful trading software.

What are the advantages of trading with FxPro?

Various pricing options are available from FxPro, including various account types and execution models. South Africa, Cyprus, Mauritius, and UK entities regulate the broker. With a Trust Score of 90 out of 99, FxPro is rated as being extremely low-risk.

Does FxPro have Nasdaq 100?

Yes, Nasdaq 100 is available on FxPro as a CFD on indices. In addition, traders can trade share CFDs listed on this popular index.

Is FxPro Safe or a Scam?

FxPro is a safe broker with a high trust score of 90%. Furthermore, FxPro is well-regulated globally.

What is FxPro’s commitment to corporate social responsibility?

FxPro actively backs numerous programs that enhance people’s access to food, education, and quality of life.

Is FxPro regulated?

Yes, FCA, CySEC, FSCA, FSC, and SCB regulate FxPro. However, FxPro is not regulated in Dubai by the DFSA.

How can I protect my online data when trading with FxPro?

FxPro advises using strong passwords, two-factor authentication, and keeping your computer and antivirus software updated to protect your online data.

How long does it take to withdraw from FxPro?

Withdrawals can take one to several working days, depending on the withdrawal method.

What are the potential risks of trading with FxPro?

Traders have voiced their worries about the broker’s customer support and the potential dangers of using leverage.

Does FxPro have VIX 75?

No, FxPro does not include the Volatility 75 index in its product portfolio.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai