Overall, AvaTrade can be summarised as a trustworthy Forex Broker with competitive trading fees. AvaTrade is regulated in Abu Dhabi making it a viable option for Emirati traders. AvaTrade has a trust score of 93 out of 99.

| 📈Order Execution | 4/5 |

| 💰Commissions and Fees | 5/5 |

| 💹Range of Markets | 5/5 |

| 📊Variety of Markets | 5/5 |

| ⏱️Withdrawal Speed | 3/5 |

| 🤝Customer Support | 5/5 |

| 📉Trading Platform | 5/5 |

| 🎓Education | 5/5 |

| 📖Research | 4/5 |

| ➡️Regulation | 5/5 |

| 📱Mobile Trading | 5/5 |

| 💯Trust Score | 93% |

AvaTrade Review – Analysis of Broker’s Main Features

- ☑️ AvaTrade Overview

- ☑️ AvaTrade Detailed Summary

- ☑️ Advantages that AvaTrade has over competitors

- ☑️ Who will Benefit from Trading with AvaTrade?

- ☑️ AvaTrade Safety and Security

- ☑️ AvaTrade Bonus Offers and Promotions

- ☑️ AvaTrade Affiliate Program Features

- ☑️ AvaTrade Minimum Deposit

- ☑️ AvaTrade Account Types and Features

- ☑️ AvaTrade Base Account Currencies and Basic Order Types

- ☑️ How to Open and Close an AvaTrade Account

- ☑️ AvaTrade MAM / PAMM Features

- ☑️ Social Trading with AvaTrade

- ☑️ AvaTrade Trading Platforms

- ☑️ Which Markets Can You Trade with AvaTrade?

- ☑️ AvaTrade Fees, Spreads, and Commissions

- ☑️ AvaTrade Deposits and Withdrawals

- ☑️ AvaTrade Education and Research

- ☑️ AvaTrade Customer Support

- ☑️ AvaTrade VPS Review

- ☑️ AvaTrade Cashback Rebates Features and Conditions

- ☑️ AvaTrade Web Traffic Report

- ☑️ AvaTrade Geographic Reach and Limitations

- ☑️ Best Countries by Traders

- ☑️ AvaTrade vs TD Ameritrade vs eToro – A Comparison

- ☑️ AvaTrade Awards and Recognition

- ☑️ AvaTrade Alternatives

- ☑️ Our Experience with AvaTrade

- ☑️ Recommendations according to our in-depth review of AvaTrade

- ☑️ AvaTrade Customer Reviews

- ☑️ Pros and Cons of Trading with AvaTrade

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

AvaTrade Overview

AvaTrade is a global forex and CFD broker that provides a diverse range of assets and trading platforms.

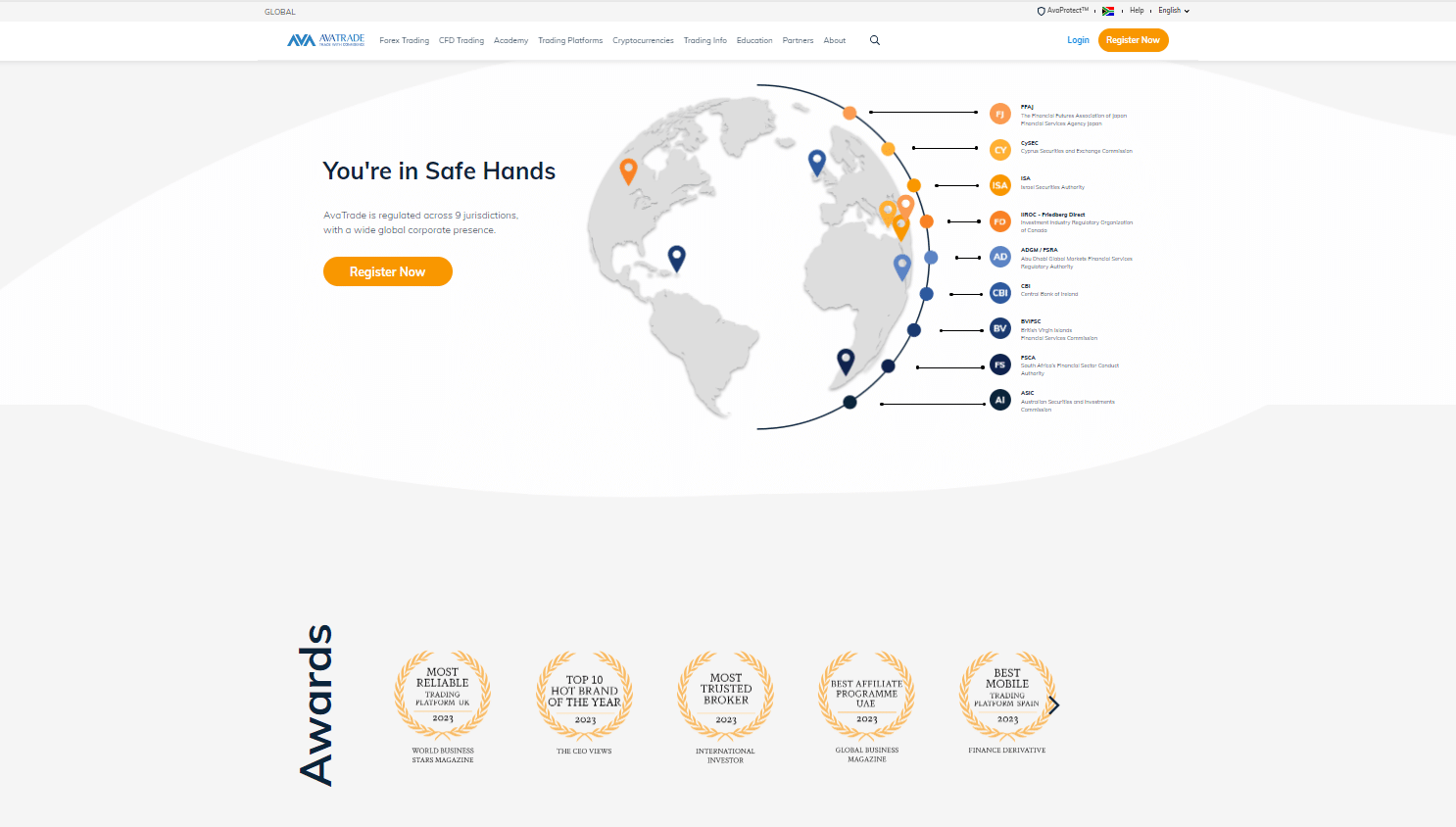

Some of the world’s best regulators oversee AvaTrade, including the Central Bank of Ireland, the Australian Securities and Investments Commission, and the Financial Services Agency of Japan.

AvaTrade is also regulated in Abu Dhabi, making it a viable option for Emirati traders. AvaTrade provides an Islamic swap-free account with no interest or Riba charged on open positions, significantly benefiting Emirati traders.

AvaTrade’s comprehensive trading suite offers powerful tools and on-target trading signals to help traders improve their skills and provides a wide range of user-friendly research and education tools, making it an excellent choice for traders looking to improve their skills.

Furthermore, inactivity fees are high, and forex trading fees are not among the lowest on the market however, AvaTrade’s customer service is excellent, especially for Arabic speakers.

AvaTrade Detailed Summary

| 🔑Broker | 🥇Avatrade |

| 🏠Headquartered | Dublin, Ireland |

| 🌎Global Offices | Australia, Ireland, South Africa, Japan, British Virgin Islands, UAE |

| 📈 | Dubai Financial Services Authority (DFSA) |

| 🌐Foreign Direct Investment in Dubai | 23 billion USD (2022) |

| 🗺️Foreign Exchange Reserves in Dubai | 158 billion USD (July 2024) |

| 📍Local office in Dubai | None |

| 👤Governor of SEC in Dubai | Khaled Mohamed Balama is the Governor of the Central Bank of the UAE |

| 📉Accepts Dubai Traders | ✅Yes |

| 🔢Year Founded | 2006 |

| ☎️Dubai Office Contact Number | None |

| 🖥️Social Media Platforms | X YouTube Telegram |

| 📊Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 🥇Tier-1 Licenses | Central Bank of Ireland (CBI) Australian Securities and Investment Commission (ASIC) Japanese Financial Services Authority (JFSA) Financial Futures Association of Japan (FFAJ) Investment Industry Regulatory Organization of Canada (IIROC) through Friedberg Mercantile |

| 🥈Tier-2 Licenses | Cyprus Securities and Exchange Commission (CySEC) Financial Sector Conduct Authority (FSCA) Israel Securities Authority (ISA) Abu Dhabi Global Market Financial Services Regulatory Authority (ADGM FRSA) Polish Financial Supervision Authority (KNF) |

| 🥉Tier-3 Licenses | British Virgin Islands Financial Service Commission (BVI FSC) |

| 🔢License Number | Ireland (C53877) Australia (406684) South Africa (45984) British Virgin Islands (SIBA/L/13/1049) Japan (JFSA 1662, FFAJ 1574) Abu Dhabi (190018) Cyprus (247/17) Israel (514666577) Poland (693023) Canada (Friedberg Mercantile) |

| 📈DFSA Regulation | None, but regulated by ADGM FRSA in Abu Dhabi |

| 📌Regional Restrictions | United States, Belgium, Syria, Iran, New Zealand, Cuba |

| ☪️Islamic Account | ✅Yes |

| 🔎Demo Account | ✅Yes |

| ⏲️Non-expiring Demo | None |

| ⏱️Demo Duration | 21 days |

| 📈Retail Investor Accounts | 1 |

| 💹PAMM Accounts | MAM Accounts |

| 💧Liquidity Providers | Currenex and other bank and non-bank entities |

| ▶️Affiliate Program | ✅Yes |

| 📝Order Execution | Instant |

| ℹ️ OCO Orders | None |

| ➡️One-Click Trading | ✅Yes |

| ✴️Scalping | ✅Yes |

| ✳️Hedging | ✅Yes |

| 🎖️Expert Advisors | ✅Yes |

| 📰News Trading | ✅Yes |

| 📉Trading API | ✅Yes |

| ⏰Starting spread | 0.9 pips EUR/USD |

| 🚩Minimum Commission per Trade | None; only the spread is charged |

| 🔍Decimal Pricing | 5th decimal pricing after the comma |

| 🖇️Margin Call | 50% on Retail 25% on AvaOptions Accounts |

| ⛔Stop-Out | 10% |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | Unlimited |

| 🪙Crypto trading offered | ✅Yes |

| 📊Offers an AED Account | None |

| 👤Dedicated Dubai Account Manager | None |

| 🗝️Maximum Leverage | 1:30 (Retail) 1:400 (Pro) |

| 🗂️Leverage Restrictions for Dubai | ✅Yes , based on trading experience |

| 💴Minimum Deposit (AED) | 367 AED ($100) |

| 💵Deposit Currencies | AUD, USD, GBP, EUR, CHF, JPY, ZAR |

| 💶AED Deposits Allowed | None |

| 💷Account Base Currency | ZAR, USD, GBP, or AUD |

| 📊Active Dubai Trader Stats | 49,000+ |

| 👥Active Dubai-based AvaTrade customers | Unknown |

| 🔃Dubai Daily Forex Turnover | 13.1 billion USD |

| 💳Deposit and Withdrawal Options | Wire Transfer Electronic Payment Gateways Credit Cards Debit Cards |

| ⏰Minimum Withdrawal Time | 24 to 48 Hours |

| ⏱️Maximum Estimated Withdrawal Time | Up to 10 days |

| ▶️Instant Deposits and Instant Withdrawals | None |

| 🏦Segregated Accounts with Emirati Banks | None |

| 📈Trading Platforms | AvaTrade WebTrader AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| ⏲️Trading Platform Time | GMT |

| 👁️Observe DST Change | ✅Yes |

| 🌎DST Change Time zone | Eastern Standard Time (EST) |

| 💎Tradable Assets | Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-traded funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals |

| 💵Offers USD/AED currency pair | None |

| 📊USD/AED Average Spread | None |

| 📉Offers Emirati Stocks and CFDs | None |

| 🖥️Languages supported on the Website | English, Chinese (Simplified), Chinese (Traditional), Turkish, Thai, Slovakian, Russian, Portuguese, Polish, German, Hungarian, French, and several others |

| 🔊Customer Support Languages | Multilingual |

| 🤝Copy Trading Support | ✅Yes |

| 👥Customer Service Hours | 24/5 |

| ❌Dubai-based customer support | None |

| 💰Bonuses and Promotions for Dubai Traders | ✅Yes |

| 🎓Education for Emirati beginners | ✅Yes |

| 💻Proprietary trading software | ✅Yes |

| 🏆Most Successful Trader in Dubai | Several – Yasser R, Ali A, Maaz A, Warren Takunda |

| 👍Is AvaTrade a safe broker for Dubai Traders | ✅Yes |

| 🎖️Rating for AvaTrade Dubai | 9/10 |

| 🏅Trust score for AvaTrade Dubai | 93% |

Advantages that AvaTrade has over competitors

AvaTrade has the following advantages over competitors:

- ✅AvaTrade does not charge account fees; deposits and withdrawals are free, lowering overall trading costs.

- ✅AvaTrade provides excellent customer service, with a special focus on Arabic-speaking clients.

- ✅AvaTrade is governed by prestigious regulatory bodies such as the Central Bank of Ireland, the Australian Securities and Investments Commission, and the Financial Services Agency of Japan.

- ✅AvaTrade offers diverse trading options, including forex and CFDs for stocks, indexes, commodities, and cryptocurrencies.

- ✅The platform accepts various deposit and withdrawal methods, all free of charge.

- ✅AvaTrade is regulated in Abu Dhabi, making it a trustworthy option for Emirati traders.

- ✅AvaTrade provides an Islamic account free of interest or Riba on open positions, aligning with Emirati traders’ financial ethics.

- ✅AvaTrade offers several user-friendly educational and research tools ideal for traders looking to improve their skills.

- ✅AvaTrade’s trading signals provide valuable perspectives on asset selection and suggested trade directions.

and many more!

Who will Benefit from Trading with AvaTrade?

- ✅Traders Seeking Platform Variety: AvaTrade provides multiple trading platforms, including MetaTrader 4 and 5 and the AvaTradeGO app, to meet the needs and skill levels of traders of all levels.

- ✅Beginner Traders AvaTrade is ideal for new traders due to its user-friendly interface, dedicated customer support, and extensive educational resources.

- ✅Professional and experienced traders: AvaTrade is suitable for seasoned traders looking to optimize their strategies and leverage market opportunities due to the availability of automated trading software and copy trading features.

- ✅Active Traders: With forex spreads starting at 0.9 pips, AvaTrade is a cost-effective option for active traders.

What makes AvaTrade highly regulated compared to competitors?

AvaTrade is one of the most heavily regulated online brokers, providing CFD trading and instilling traders with confidence and trust.

What educational resources does AvaTrade offer over competitors?

AvaTrade provides traders with excellent educational resources.

AvaTrade Safety and Security

AvaTrade Regulation in Dubai

AvaTrade is not regulated by the Dubai Financial Services Authority (DFSA). However, AvaTrade Middle East Ltd is regulated by ADGM in Abu Dhabi. Furthermore, below are more of AvaTrade’s global regulations:

| 🔑Registered Entity | 🌎Country of Registration | 📝Regulatory Entity | 📊Tier | 🔢License Number/Ref |

| 1️⃣ AVA Trade EU Ltd | Ireland | CBI | 1 | C53877 |

| 2️⃣ DT Direct Investment Hub Ltd. | Cyprus | CySEC | 2 | 247/17 |

| 3️⃣ AVA Trade EU Ltd | Poland | KNF | 2 | 693023 |

| 4️⃣ AVA Trade Ltd | British Virgin Islands | BVI | 3 | SIBA/L/13/1049 |

| 5️⃣ Ava Capital Markets Australia Pty Ltd | Australia | ASIC | 1 | 406684 |

| 6️⃣ Ava Capital Markets Pty | South Africa | FSCA | 2 | FSP 45984 |

| 7️⃣ Ava Trade Japan KK. | Japan | JFSA, FFAJ | 1 | JFSA 1662 FFAJ 1574 |

| 8️⃣ Ava Trade Middle East Ltd | UAE | ADGM | 2 | 190018 |

| 9️⃣ ATrade Ltd | Israel | ISA | 2 | 514666577 |

| 🔟 Friedberg Direct | Canada | IIROC | 1 | Friedberg Mercantile |

AvaTrade Protection of Client Funds

| 🔑Security Measure | ℹ️ Information |

| 🔒Segregated Accounts | ✅Yes |

| 🔏Compensation Fund Member | ✅Yes |

| 🔐Compensation Amount | 20,000 EUR |

| 🗝️SSL Certificate | ✅Yes |

| 🔑2FA (Where Applicable) | ✅Yes |

| 🔓Privacy Policy in Place | ✅Yes |

| 🔒Risk Warning Provided | ✅Yes |

| 🔏Negative Balance Protection | ✅Yes |

| 🔐Guaranteed Stop-Loss Orders | None |

Security while Trading

Security is important to AvaTrade, especially for Emirati traders.

Reputable regulators include the Central Bank of Ireland, the Australian Securities and Investments Commission, and the Financial Services Agency of Japan, among other reputable entities. AvaTrade is also regulated in Abu Dhabi, bolstering its appeal to Emirati traders.

To protect client data and transactions, AvaTrade uses strong online security measures that include SSL encryption and two-factor authentication to protect client accounts. Extended Validation (EV) SSL certificates, the highest level of SSL certification, are on AvaTrade’s website.

AvaTrade is committed to its financial well-being by separating client funds from broker funds. Client funds are segregated into separate accounts to prevent misuse. This ensures clients’ funds are safe even if AvaTrade goes bankrupt.

Pros and Cons Regulation and Safety of Funds

| ✅Pros | ❎Cons |

| AvaTrade is regulated in Abu Dhabi | Investor protection is not available in all regions |

| AvaTrade is a trusted broker with a long history of superior trading solutions | AvaTrade does not offer guaranteed stop-loss orders |

Is trading large amounts of money safe with AvaTrade?

Yes, when trading large amounts online, AvaTrade prioritizes the safety of customer funds.

How does AvaTrade ensure network security?

AvaTrade has implemented specific IT and network security measures to ensure the safety of its employees and clients.

AvaTrade Bonus Offers and Promotions

AvaTrade offers Emirati traders the following bonuses and promotions:

- ✅Referral Bonus

The Referral Bonus scheme can be a lucrative opportunity for Emirati traders, who stand to reap sizable financial rewards. They can take advantage of this attractive deal by recommending the AvaTrade platform to their loved ones.

Once the recommended person funds their live account with at least $500 or more, they will qualify for a referral bonus between $50 and $250.

Additionally, the sum an Emirati trader earns depends on how much money their referred acquaintance initially deposits into said verified live account.

When will I receive my AvaTrade welcome bonus?

AvaTrade does not currently offer a welcome bonus.

How are AvaTrade’s bonus prices calculated?

AvaTrade calculates bonus prices based on specific terms and conditions.

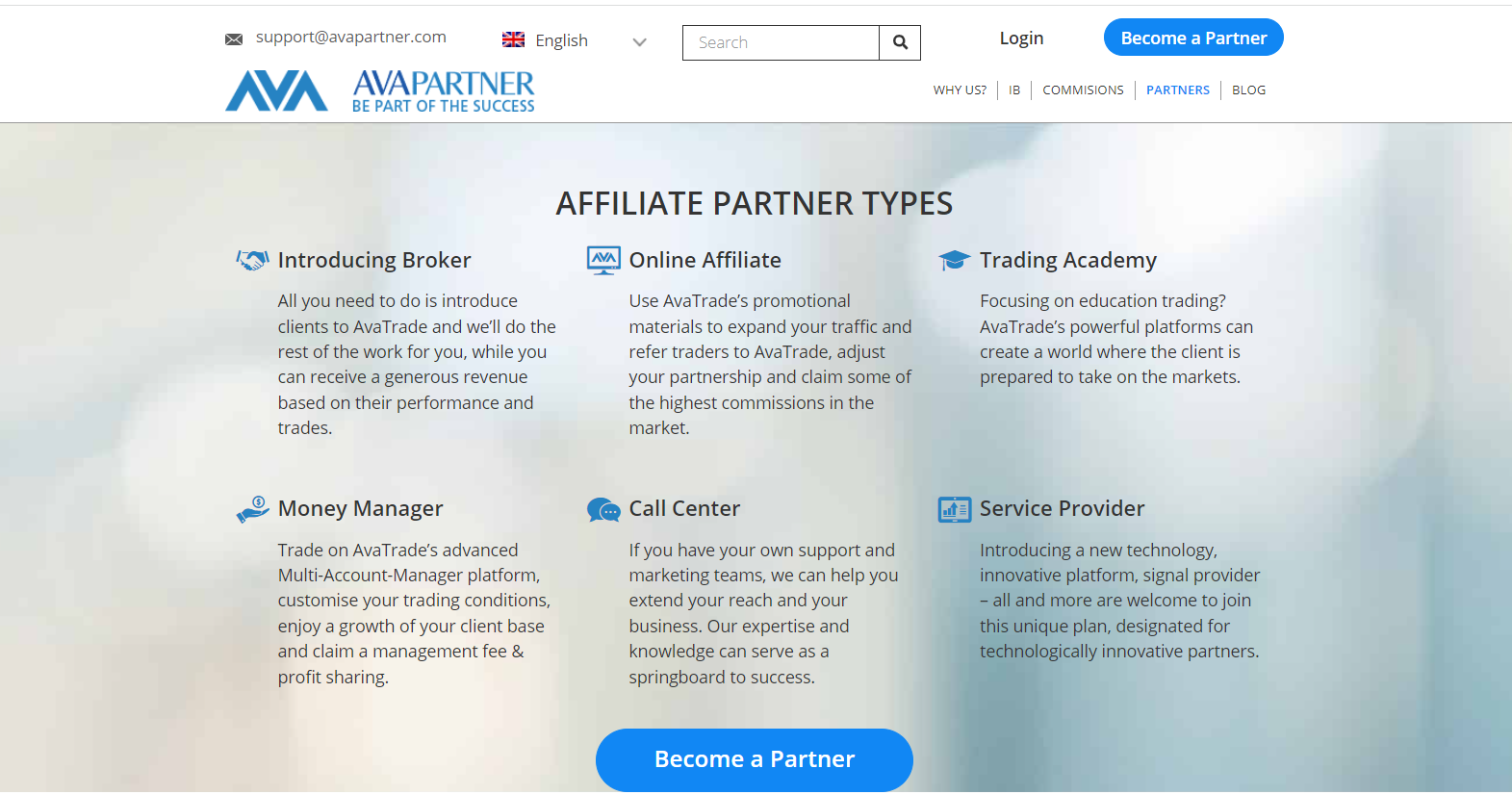

AvaTrade Affiliate Program Features

Individuals and businesses can earn commissions by referring clients to AvaTrade’s trading platform through the Affiliate Program. When an affiliate joins the program, they are assigned a dedicated account manager who provides ongoing support and guidance, ensuring a fruitful partnership.

AvaTrade offers a variety of payment methods, including bank transfers, PayPal, and Skrill, allowing affiliates to receive their commissions in the most convenient way for them.

The program is also intended to assist affiliates with their marketing efforts. To assist affiliates in effectively promoting the platform, AvaTrade provides a variety of marketing materials and support, such as banners, landing pages, and email templates.

Furthermore, the program allows affiliates to create personalized referral links, allowing them to track their referrals and commissions more accurately.

The competitive commission structure of AvaTrade’s Affiliate Program distinguishes it. Affiliates can earn up to $600 per referral, determined by the referred client’s trading volume.

AvaTrade provides advanced tracking and reporting tools to inform affiliates about their performance, allowing real-time insights into referrals and earnings.

Individuals or businesses interested in becoming affiliates must register for the program and agree to its terms and conditions. Once approved, they can immediately begin promoting AvaTrade’s various trading platforms.

The program has no minimum referral requirements or fees, making it available to affiliates worldwide. Overall, AvaTrade’s Affiliate Program is designed to be a win-win situation, with strong support, flexible payment options, and competitive commissions.

How to open an Affiliate Account with AvaTrade

To register an Affiliate Account, Emirati traders can follow these steps:

- ✅Go to the AvaTrade website and select the “Partners” option from the top menu.

- ✅Choose “Become a Partner” from the drop-down menu.

- ✅Fill in your personal information on the registration form, such as your name, email address, and phone number.

- ✅Select your preferred base currency and a username and password for your account.

- ✅Choose the type of collaboration you want to form, such as Introducing a Broker or Affiliate.

- ✅Review and accept the terms and conditions before submitting your application by clicking the “Register” button.

- ✅When your application is approved, you will receive an email with your login information and instructions for logging into your Affiliate Account.

Finally, log in to your Affiliate Account to gain access to marketing materials, track referrals, and track commissions.

What are the requirements to become an affiliate?

Specific requirements are not readily available, but an Affiliate Manager will review your account information upon registration.

Is there an FAQ section for AvaTrade affiliates?

Yes, AvaPartner offers an affiliate-specific FAQ section.

AvaTrade Minimum Deposit

| 🔑Live Account | 💵Minimum Dep. |

| 🥇Standard Account | 367 AED / $100 |

| 🥈Islamic Account | 367 AED / $100 |

| 🥉Professional Account | 367 AED / $100 |

What is the minimum deposit required to open an AvaTrade account?

$100 is the minimum deposit required to open an AvaTrade account.

What payment methods can be used for the minimum deposit?

The minimum deposit can be made via Credit Card, Wire Transfer, or E-wallets.

AvaTrade Account Types and Features

| 🔑Live Account | 💴Minimum Dep. | 📈Average Spread | 💵Commissions | 💶Average Trading Cost |

| 🥇Standard Account | $100 | 0.9 pips | None | 9 USD |

| 🥈Islamic Account | $100 | 0.9 pips | None | 9 USD |

| 🥉Professional Account | $100 | 0.6 pips | None | 12 USD |

Retail Investor Account

AvaTrade has developed the Standard Retail Account for Emirati traders looking to enter global markets. This account is intended for traders and intermediate investors and includes various features tailored to their needs.

The Standard Retail Account has some of the following features:

| 🔑Account Features | 💰Value |

| 💵Minimum Deposit Requirement | 100 units in ZAR, USD, GBP, or AUD, equal to 2.4 million AED |

| 💶Base Account Currency Options | ZAR, USD, GBP, or AUD |

| ⬆️Maximum Leverage | 1:30 (Retail) 1:400 (Professional) |

| 📊Range of Markets Offered | More than 1,260 tradable instruments |

| 💻Trading Platforms | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 💰Commissions on trades | None |

| 📉Average spreads | From 0.9 pips EUR/USD |

| 💹Margin Requirements | From 0.25% when using leverage of 1:400 |

| 👥Customer Support Channels | Social Platforms Email Request Telephone Live Chat |

| ▶️Trading Strategies Allowed | All |

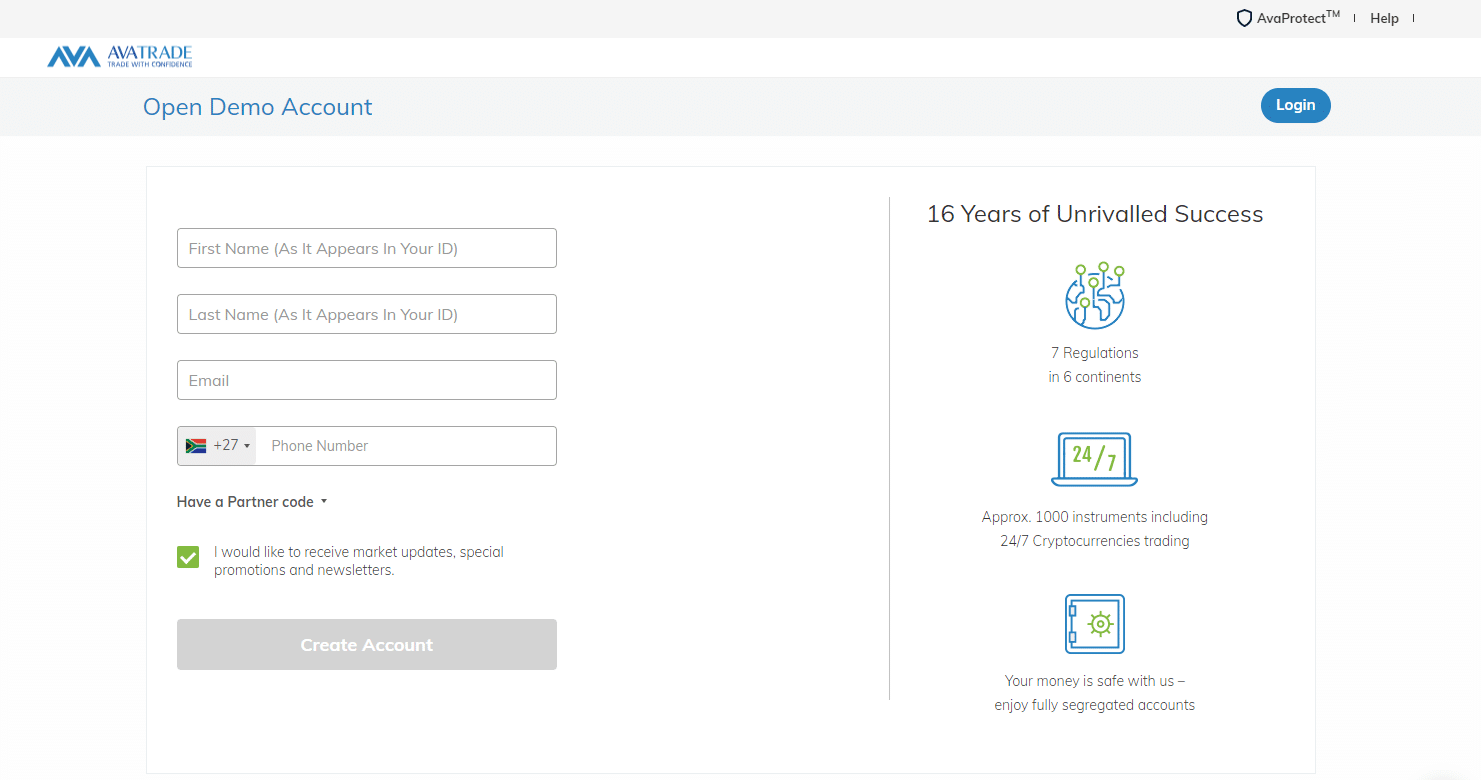

AvaTrade Demo Account

With a free demo account, AvaTrade enables Emirati traders to engage in risk-free learning and platform testing. This feature benefits beginners by allowing them to gain experience without financial risks.

This educational tool is designed solely for learning purposes and includes a virtual fund of up to $100,000.

With such a large sum, traders can experiment with different strategies and explore different markets on AvaTrade’s platform without fear of potential losses associated with live trading.

This preparatory phase ultimately equips these Emirati traders before they embark on actual live trading ventures using real funds if they choose to do so – ensuring they have substantial knowledge before engaging in investment activities involving genuine cash resources.

AvaTrade Islamic Account

The AvaTrade Islamic Account is a specialized solution for Emirati Muslim traders who follow Sharia law principles.

This distinct account type ensures religious tenet compliance by eliminating interest and swap fees per Riba regulations. Traders using an Islamic account can hold positions for up to five days without incurring rollover fees.

AvaTrade also provides halal trading opportunities on Islamic accounts for gold, silver, oil, and stock indices.

AvaTrade Professional Account

AvaTrade’s Pro account, which is only available to accredited Emirati traders, provides several advantages, the most notable of which are reduced spreads and the absence of trading fees.

Compared to the Standard account’s average EUR/USD spread of 0.9 pips, the Pro account’s average EUR/USD spread of 0.6 pips significantly increases its appeal among traders.

Pro account holders can integrate with DupliTrade or ZuluTrade to expand their trading capabilities.

The following requirements must be met to qualify for an AvaTrade Professional Account:

- ✅At least twelve months of continuous participation in the relevant financial market, including ten CFD, Forex, or spread betting transactions in the previous four quarters.

- ✅At least one year of financial services experience is required.

- ✅Maintain a minimum investment portfolio of €500,000 (or equivalent in other currencies), which includes cash and financial instruments.

Pros and Cons of AvaTrade Account Types and Features

| ✅Pros | ❎Cons |

| There is an Islamic Account for Muslim traders | AvaTrade does not offer a choice between retail accounts |

| AvaTrade offers a professional account to experienced traders with low and competitive fixed spreads | AvaTrade’s demo account only lasts 21 days |

| There is a free demo account offered across platforms | AvaTrade’s spreads on the retail account are wide |

Is there a demo account available?

Yes, AvaTrade offers demo accounts for traders to practice and become familiar with the platform’s features.

What is the AvaTrade standard account best suited for?

Standard accounts are ideal for infrequent traders.

AvaTrade Base Account Currencies and Basic Order Types

AvaTrade Base Account Currencies

The base account currencies available to Emiratis include the following:

- ✅ZAR

- ✅USD

- ✅GBP

- ✅AUD

AvaTrade Basic Order Types

- ✅Market Order – A market order can be either a buy or a sell order that executes at the current market price. This is the current price displayed on your price chart. If you place a market order, you will be immediately entered at the best available price.

- ✅Market orders are most effective when a trading opportunity requires prompt action. Click buy/sell at the market to enter the trade immediately.

- ✅Stop Order – A stop order can be either a buy or sell stop, depending on whether you wish to purchase above or below the market.

- ✅This is useful for trading breakouts or trend continuation strategies when you want the market to continue moving in the same direction.

- ✅Limit Order – Alternatively, if you believe the price will reverse when it reaches a certain price, you can place a limit order.

Furthermore, limit orders can be either buy or sell limits, depending on the market’s direction before your anticipated reversal. A sell limit is used to sell above the market, while a buy limit is used to purchase below the market.

How to Open and Close an AvaTrade Account

How to Open an AvaTrade Account

To open an account with AvaTrade, Emiratis can follow these steps:

- ✅Go to the AvaTrade website and click “Register” in the upper right.

- ✅Select the account type you want to open, such as a demo or live trading account.

- ✅Fill out the registration form with your name, email address, and phone number.

- ✅Select a username, password, and base currency for your account.

- ✅Review and accept the terms and conditions before clicking the “Register” button to submit your application.

- ✅If you choose to open a live trading account, you must provide a copy of your ID or passport and proof of address.

- ✅After your account is approved, you can fund it using a credit card, bank transfer, or e-wallet, among other methods.

Begin trading! After funding your account with the $100 minimum deposit, you can start trading on AvaTrade’s platforms, which gives you access to a wide range of markets such as forex, stocks, commodities, and cryptocurrencies.

Is there a video guide for opening an AvaTrade account?

Yes, AvaTrade offers a video tutorial on how to open a trading account.

What can I do with an AvaTrade Live Account?

A Live Account with AvaTrade enables you to trade multiple asset types and provides multiple features.

How to Close an AvaTrade Account

To close a live trading account with AvaTrade, Emirati traders can follow these steps:

- ✅To access your AvaTrade account, enter your username and password.

- ✅Select the “My Account” tab in the top right corner of the screen.

- ✅From the drop-down menu, select “Account Status.”

- ✅Click the “Close Account” button at the bottom of the page.

- ✅A window will appear asking for confirmation that you want to close your account. Click the “Close Account” button to continue.

- ✅Before closing your account, you must close any open positions or pending orders.

- ✅Once you have closed your positions and orders, your account balance will be transferred to your designated withdrawal method.

Once your balance has been transferred, your account will be closed, and you will no longer have access to AvaTrade’s trading platform.

Do I need to withdraw my funds before closing the account?

Yes, if there are still funds in your account, log in to “My Account” and follow the withdrawal instructions.

Is there a fee for closing an AvaTrade account?

No, AvaTrade does not charge account closure fees.

AvaTrade MAM / PAMM Features

Traders who manage multiple client accounts can utilize AvaTrade’s Multi-Account Manager (MAM) and Percentage Allocation Management Module (PAMM) accounts.

These tools empower traders to assign trades to sub-accounts based on equity, balance, or percentage criteria for customized trading strategies tailored to each client.

Moreover, the number of sub-accounts that portfolio managers can handle is unlimited – making it easy for them to scale their operations effortlessly.

Additionally, MAM/PAMM features compatibility with Expert Advisors, allowing automated trading strategies and helping in maximizing efficiency during transactions.

AvaTrade provides bespoke risk management through personalized, customizable terms based on individual preferences and unique parameters assigned to each account.

Its real-time reporting features are tailored for trade-related activities and offer comprehensive performance metrics insights that empower decision-makers with well-informed perspectives when carefully managing such concerns.

What is AvaTrade MAM?

AvaTrade’s Multi-Account Manager (MAM) software allows users to manage multiple accounts from a single interface.

What are the Key Features of AvaTrade MAM?

AvaTrade MAM provides excellent liquidity and permits trading subgroups for various trading strategies.

Social Trading with AvaTrade

AvaTrade offers a social trading platform that is unique and interactive, aimed at fostering connections between traders who are part of an inclusive investor community.

Individuals can conduct social trading through this system, which automatically replicates trades executed by highly skilled and successful traders. This novel feature promotes democratization in trade; even inexperienced people easily benefit from experts’ expertise.

Top-performing trader records are available on the AvaTrade social trading platform, thus providing vital insights into effective strategies leading newbies towards more informed decisions about their chosen mentors.

Moreover, risk management tools have been incorporated within its functionalities, allowing for precise regulation of risks involved during transactions made on it.

What is AvaSocial?

AvaSocial is a platform that takes social trading to the next level, allowing traders to discover successful mentor hero traders.

How can I copy other traders’ positions on AvaSocial?

Find a trader you like and follow them to copy their trades; you will receive a notification whenever they open a position.

AvaTrade Trading Platforms

AvaTrade offers Emirati traders a choice between these trading platforms:

- ✅MetaTrader 4 and 5

- ✅AvaTradeGO

- ✅AvaSocial

- ✅AvaTrade Web

- ✅ZuluTrade

- ✅DupliTrade

- ✅AvaOptions

AvaTrade MetaTrader 4 and 5

While MetaTrader 4 and 5 are industry standards, AvaTrade improves on the experience by incorporating advanced charting tools and risk management features frequently overlooked in standard discussions.

These platforms also support algorithmic trading, allowing traders to automate complex strategies beyond simple entry and exit rules.

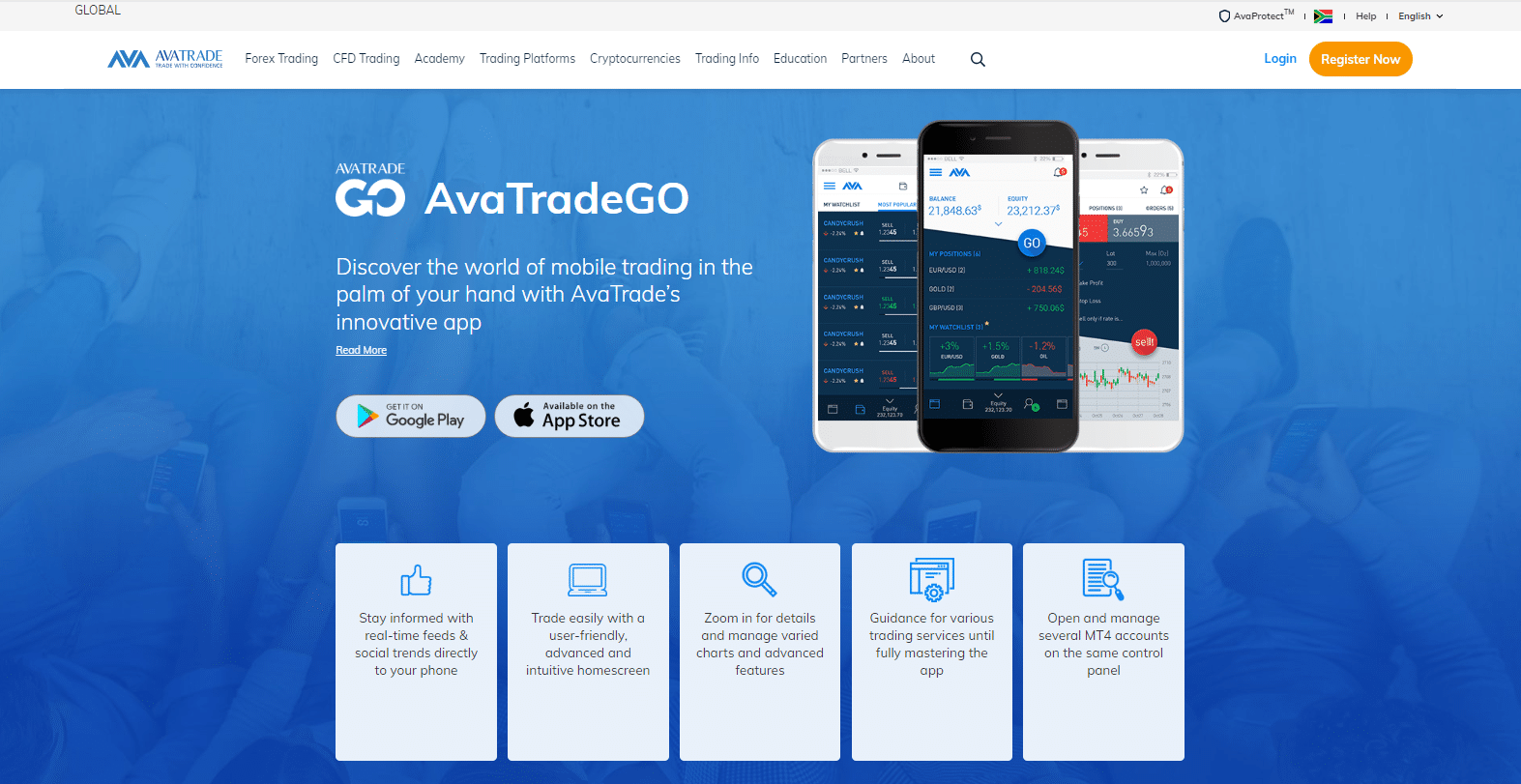

AvaTradeGO

AvaTrade’s mobile app, AvaTradeGO, is more than just another trading app. It includes a “Market Trends” feature that lets traders gauge market sentiment directly from the mobile interface.

This unique feature provides real-time insights into trader behavior, giving you a competitive advantage in decision-making.

AvaTrade’s AvaSocial

Another standout is AvaSocial, which combines social trading and community engagement. While many platforms provide copy trading, AvaSocial goes above and beyond by allowing traders to engage in discussions, share strategies, and create trading communities.

This promotes a collaborative trading environment, which is uncommon on other platforms.

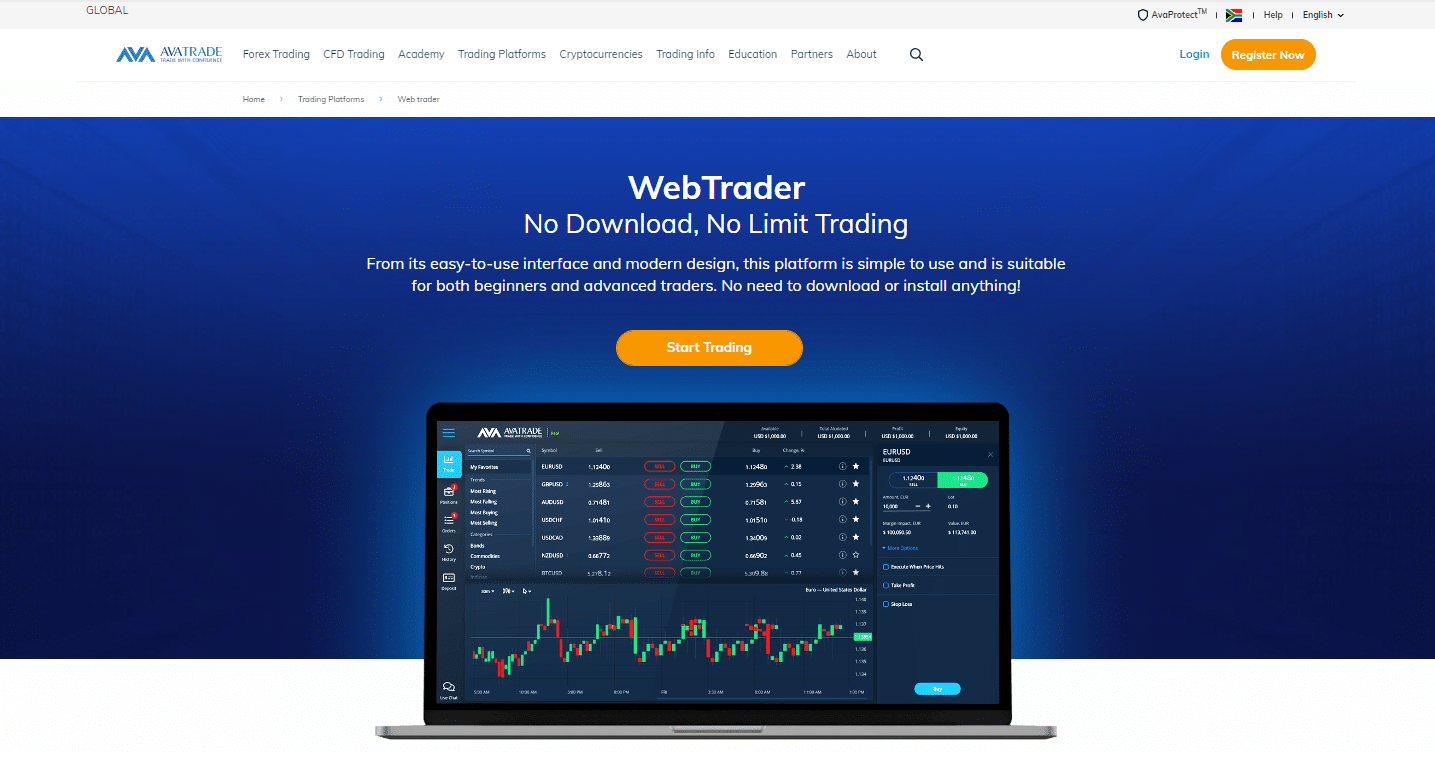

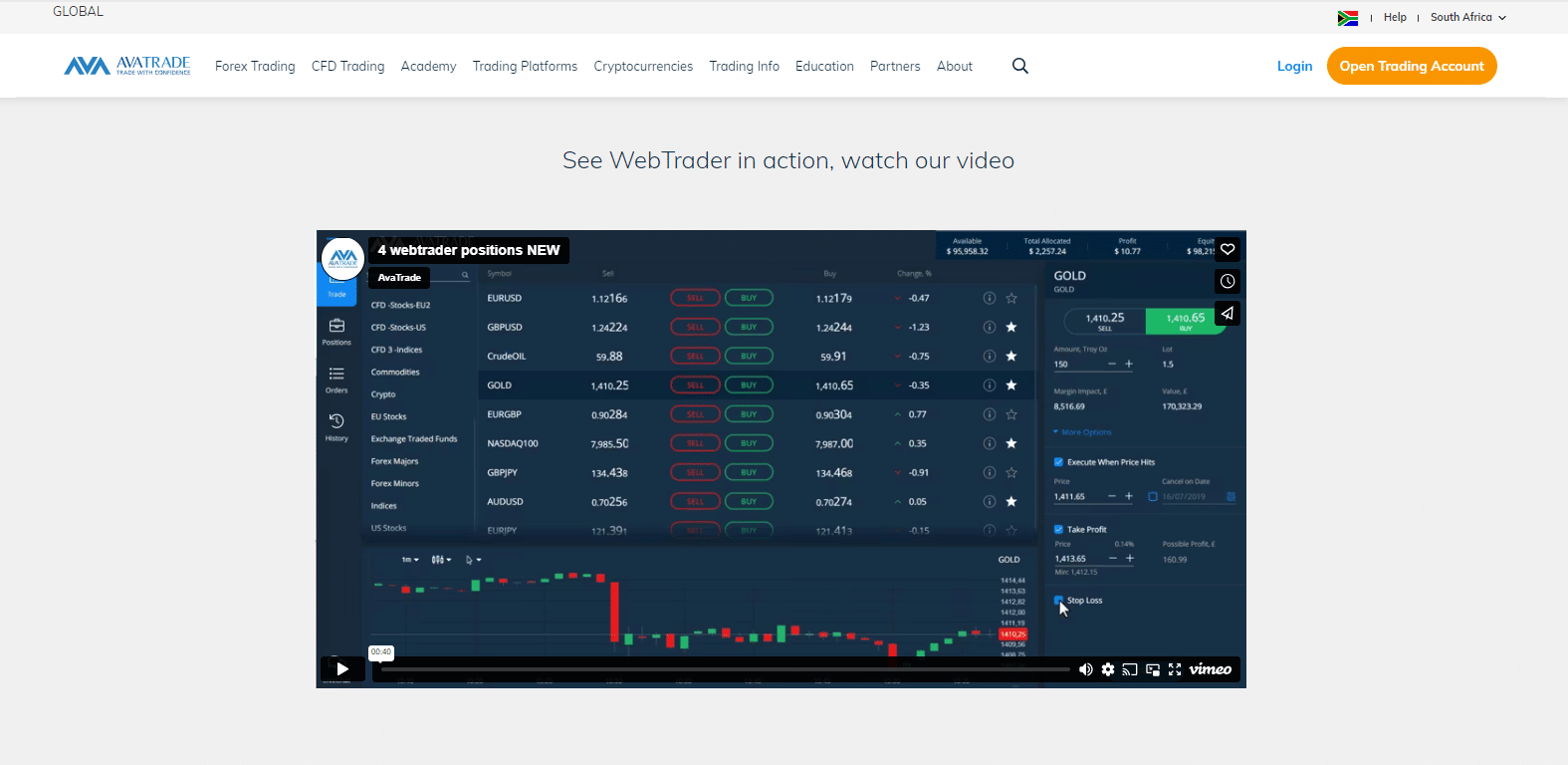

AvaTrade Web

The AvaTrade Web platform provides a streamlined trading experience that does not require downloads or installations.

Its focus on accessibility and user experience sets it apart, with a customizable dashboard that can be tailored to individual trading styles. It is not just about executing trades but also about fostering an environment in which traders can manage their portfolios intuitively.

AvaTrade’s ZuluTrade and DupliTrade

Although ZuluTrade and DupliTrade are platforms for automated and copy trading, AvaTrade’s integration adds risk management and customization layers.

Traders can set specific risk parameters and customize the proportion of their capital allocated to various copied strategies, providing a level of control frequently lacking in other automated trading platforms.

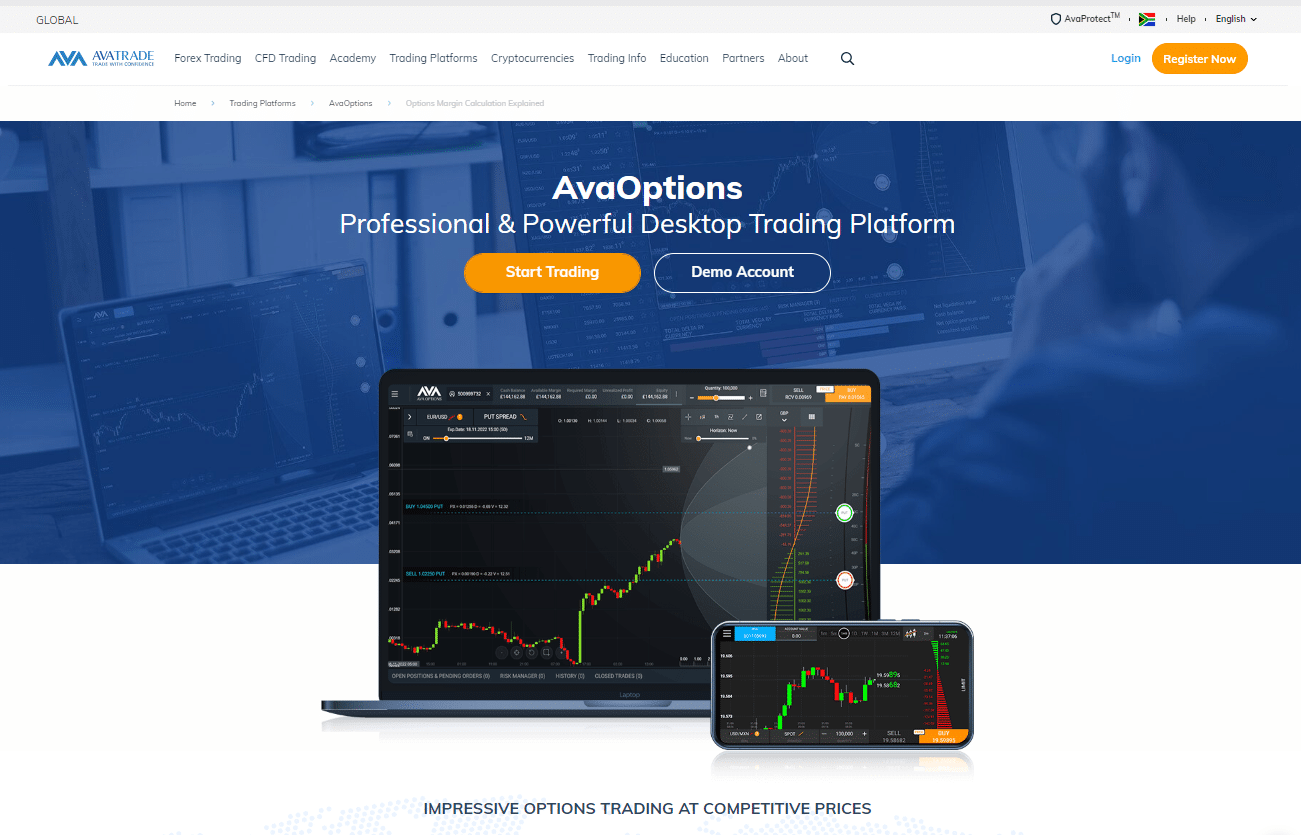

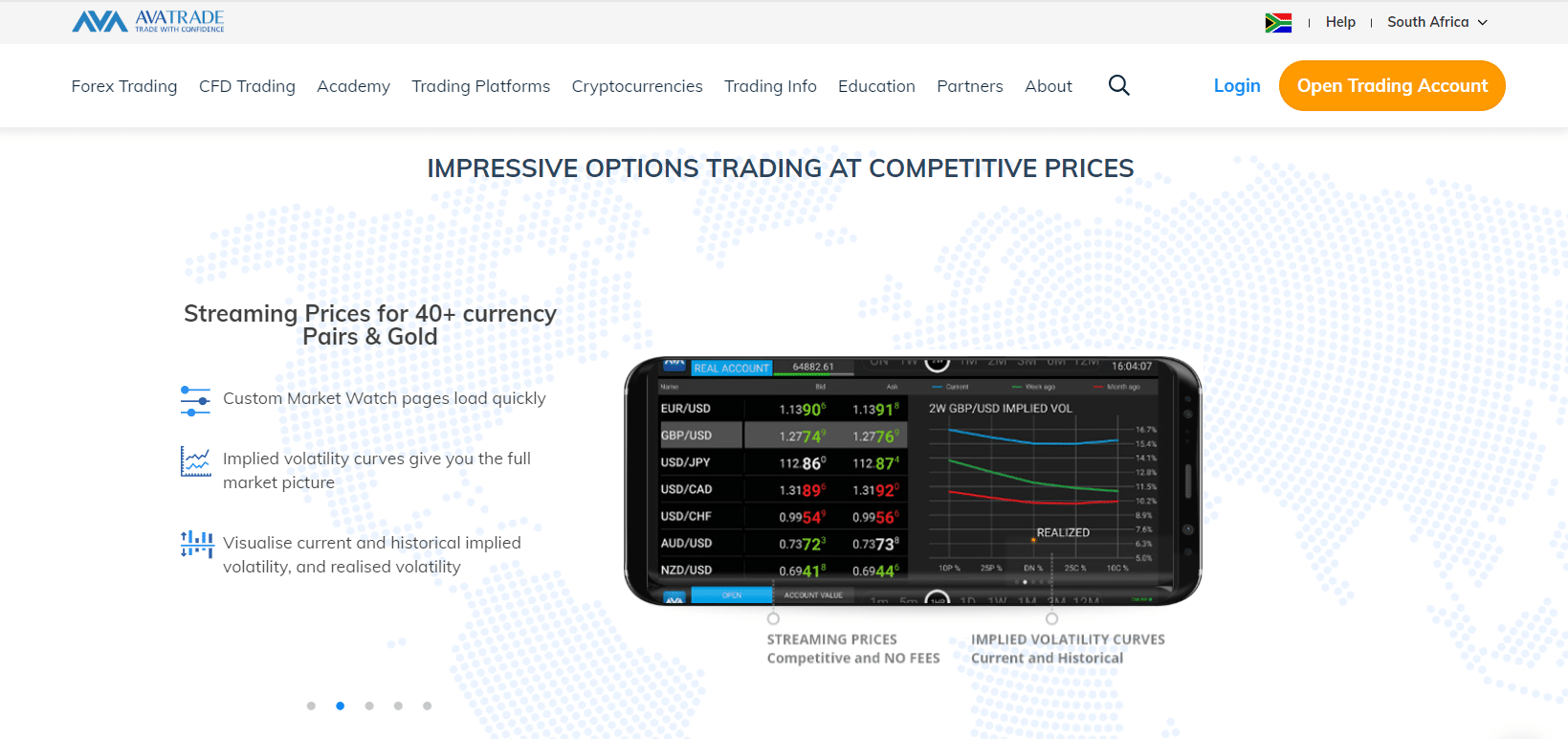

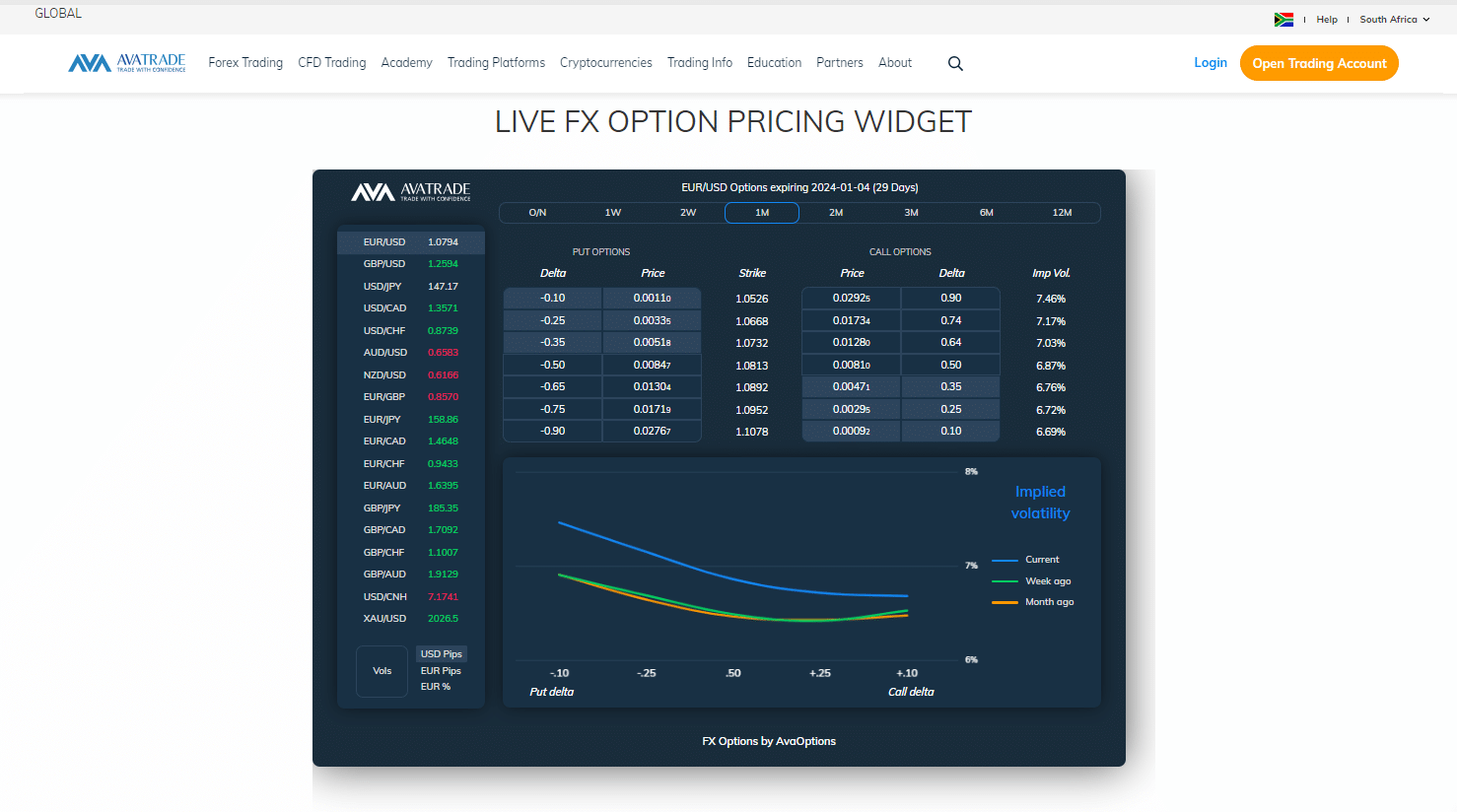

AvaTrade’s AvaOptions

AvaTrade’s AvaOptions caters not only to options traders but also to risk-averse investors seeking hedging solutions. The platform provides a variety of complex options strategies, such as straddles and collars, that are frequently overlooked in mainstream options trading discussions.

Pros and Cons AvaTrade Trading Platforms

| ✅Pros | ❎Cons |

| AvaTrade offers Emiratis access to exceptional and feature-rich platforms | AvaTrade’s product portfolio is not equally distributed across platforms |

Are there any restrictions on who can use AvaTrade’s platforms?

AvaTrade’s platforms are generally accessible to all traders, though there may be restrictions based on jurisdiction.

Is AvaTrade MetaTrader 4 available on mobile devices?

Yes, AvaTrade MetaTrader 4 offers a mobile app for iOS and Android devices.

Which Markets Can You Trade with AvaTrade?

Emirati traders can expect the following range of markets from AvaTrade:

- ✅Forex

- ✅Stocks

- ✅Commodities

- ✅Cryptocurrencies

- ✅Treasuries

- ✅Bonds

- ✅Indices

- ✅Exchange-traded funds (ETFs)

- ✅Options

- ✅Contracts for Difference (CFDs)

- ✅Precious Metals

Financial Instruments and Leverage offered by AvaTrade

| 🔑Instrument | 🅰️Number of Assets Offered | 🅱️Maximum Leverage Offered |

| 📈Forex | 55 | 1:400 |

| 💴Precious Metals | 5 | 1:200 |

| 📉ETFs | 59 | 1:20 |

| 📊Indices | 33 | 1:200 |

| 💹Stocks | 625 | 1:10 |

| 🪙Cryptocurrency | 20 | 1:25 |

| ✴️Options | 53 | 1:100 |

| 💡Energies | 5 | 1:200 |

| 📝Bonds | 2 | 1:20 |

| 📌FXOptions | 24 | 1:100 |

Broker Comparison for a Range of Markets

| 🔑Broker | 🥇AvaTrade | 🥈TD Ameritrade | 🥉eToro |

| 📈Forex | ✅Yes | ✅Yes | ✅Yes |

| 💴Precious Metals | ✅Yes | None | ✅Yes |

| 📉ETFs | ✅Yes | ✅Yes | ✅Yes |

| 📊CFDs | ✅Yes | None | ✅Yes |

| 💹Indices | ✅Yes | None | ✅Yes |

| 📝Stocks | ✅Yes | ✅Yes | ✅Yes |

| 🪙Cryptocurrency | ✅Yes | ✅Yes | ✅Yes |

| 📌Options | ✅Yes | ✅Yes | None |

| 💡Energies | ✅Yes | None | ✅Yes |

| 💵Bonds | ✅Yes | ✅Yes | None |

Pros and Cons of AvaTrade’s Range of Markets

| ✅Pros | ❎Cons |

| AvaTrade has an impressive product portfolio that includes Forex and CFDs | Leverage restrictions apply to retail accounts |

| Retail traders can use leverage up to 1:200 on major instruments | AvaTrade does not distribute instruments equally across platforms, with 1,260 instruments available on MT5, while other platforms have access to 300+ |

Does AvaTrade offer trading on indices?

Yes, clients can trade US, European, and Asian indices with AvaTrade.

Can I trade CFDs on popular assets with AvaTrade?

Yes, CFDs on popular assets such as stocks, indices, commodities, currencies (Forex), ETFs, and cryptocurrencies can be traded.

AvaTrade Fees, Spreads, and Commissions

AvaTrade Spreads

AvaTrade adds a markup to their fixed spreads to cover trade facilitation-related broker fees, which ensures full transparency. As a Market Maker brokerage firm, AvaTrade uses its proprietary execution techniques for executing orders only.

AvaTrade offers traders access to the interbank market by obtaining significant positions from several liquidity providers.

Emirati traders should anticipate regular spreads to fall within these ranges:

| 🔑Instrument | 📈Average Spreads |

| 1️⃣EUR/USD | 0.9 pips |

| 2️⃣Stock CFDs | 0.13% |

| 3️⃣Crude Oil | 0.029 pips |

| 4️⃣FXOptions | 0.9 pips |

| 5️⃣Crypto CFDs | 0.02 pips (BTC/USD) |

| 6️⃣Indices | 0.03 pips |

| 7️⃣ETFs | 0.13% |

| 8️⃣Bonds | 0.03 pips (Over-Market) |

AvaTrade Commissions

Emirati traders are provided with a commission-free trading atmosphere by AvaTrade. AvaTrade does not charge commissions separately but incorporates a premium in its fixed spreads.

This approach ensures an open and comprehensive trading environment, eliminating the need for extra commission-related charges.

AvaTrade Overnight Fees

AvaTrade’s overnight trading fees differ depending on the type of position (long or short), position size, type of traded financial asset, and general market conditions throughout its duration. To calculate overnight charges, multiply the total trade value with the applicable rate.

The below examples highlight potential fluctuations in overnight trading fees:

| 🔑Instrument | ➡️Long (Buy) Swap | ▶️Short (Sell) Swap |

| EUR/USD | 0.0% | -0.0083% |

| Stocks | -0.0025% | -0.0308% |

| Gold | -0.0006% | -0.0266% |

| Silver | -0.0006% | -0.0266% |

| FXOptions – EUR/USD | -0.009041% | 0.0% |

| Nasdaq | -0.0006% | -0.0266% |

| BTC/USD | -0.0610% | -0.0333% |

| VIX 75 / Volatility 75 | -0.0025% | -0.0308% |

AvaTrade Deposit and Withdrawal Fees

AvaTrade has a policy of not charging deposit or withdrawal fees for any of the supported deposit or withdrawal methods.

AvaTrade Inactivity Fees

Accounts that remain without trading activity for three consecutive months are subject to an inactivity fee by AvaTrade.

A monthly charge of $50 will be applied if no trades have been made during this time frame. Traders need to note that the fee increases to $100 after 12 continuous months of dormancy.

AvaTrade Currency Conversion Fees

Currency conversion costs should be taken into account by traders. In cases where funds are deposited in a non-approved deposit or base currency, such as AED, there may be associated fees for currency conversion.

These fees arise when the deposited funds need to be converted into the designated currency of the account.

Pros and Cons AvaTrade Trading and Non-Trading Fees

| ✅Pros | ❎Cons |

| AvaTrade has a transparent fee schedule with fixed spreads and zero commission fees | AvaTrade’s inactivity fees are expensive |

| AvaTrade offers free deposits and withdrawals | AvaTrade’s fixed spreads are wide |

What is the starting spread for AvaTrade?

Spread and commission fees for AvaTrade begin at $100, with spreads beginning at 0.6 pips (Pro Account on EUR/USD).

What is the average cost for major currency pairs with AvaTrade?

The average cost for major currency pairs is about 1.5 pips, or $15.

AvaTrade Deposits and Withdrawals

AvaTrade offers Emirati traders the following deposit and withdrawal methods:

- ✅Bank Wire Transfer

- ✅Credit/Debit Card

- ✅PayPal

- ✅WebMoney

- ✅Neteller

- ✅Skrill

How to make a Deposit with AvaTrade

To deposit funds to an account with AvaTrade, Emirati traders can follow these steps:

- ✅Enter your login credentials to access your AvaTrade account.

- ✅In the upper right corner of the screen, click “Deposit.”

- ✅Choose your preferred payment method from the available options, such as credit card, bank transfer, or e-wallet.

- ✅Enter the deposit amount and select your preferred currency.

- ✅Follow the instructions of the payment method to complete the transaction.

Once your deposit has been confirmed, the funds will be credited to your AvaTrade account, and you can begin trading on the platform.

How long do AvaTrade Deposits take?

Deposits made through credit/debit cards, e-wallets, and online payment systems are usually processed within one day. However, bank transfers can take up to 10 business days to be credited into your account.

What deposit methods are available with AvaTrade?

AvaTrade offers a variety of deposit options, such as major credit cards and wire transfers.

Is there a minimum deposit requirement?

Yes, a $100 minimum deposit is required to start trading with AvaTrade.

How to Withdraw from AvaTrade

To withdraw funds from an account with AvaTrade, Emirati traders can follow these steps:

- ✅Enter your login credentials to access your AvaTrade account.

- ✅Click the “Withdraw” button in the top right corner of the display.

- ✅Choose your preferred withdrawal method from the available options, such as credit card, bank transfer, or e-wallet.

- ✅Enter the withdrawal amount and select your preferred currency.

- ✅To complete the transaction, follow the withdrawal method’s provided instructions.

Once the withdrawal is confirmed, the funds will be transferred to your specified account.

How long do AvaTrade Withdrawals take?

Withdrawals from AvaTrade can take 24 hours to 10 days, depending on your preferred withdrawal method.

Is AvaTrade a reliable broker for withdrawals?

Yes, AvaTrade is regarded as a trustworthy broker for withdrawals, as at least one top-tier regulator regulates it.

Are there any fees for withdrawals?

No, withdrawals are free, but checking for any additional fees is advisable.

AvaTrade Deposit Currencies, Deposit and Withdrawal Processing Times

| 🔑Payment Method | 📈Deposit Processing | 📉Withdrawal Processing |

| 🏦Bank Wire Transfer | Up to 10 days | Up to 10 days |

| 💳Credit/Debit Card | 24 – 48 Hours | 24 – 48 hours |

| 💷PayPal | 24 – 48 Hours | 24 – 48 hours |

| 💻WebMoney | 24 – 48 Hours | 24 – 48 hours |

| 💵Neteller | 24 – 48 Hours | 24 – 48 hours |

| ▶️Skrill | 24 – 48 Hours | 24 – 48 hours |

Broker Comparison – Deposit and Withdrawals

| 🔑Broker | 🥇AvaTrade | 🥈TD Ameritrade | 🥉eToro |

| ⬇️Minimum Withdrawal Time | 24 to 48 Hours | 5 minutes | Instant |

| ⬆️Maximum Estimated Withdrawal Time | Up to 10 days | 7 working days | Up to 10 Working Days |

| ➡️Instant Deposits and Instant Withdrawals | None | None | ✅Yes |

Pros and Cons AvaTrade Deposits and Withdrawals

| ✅Pros | ❎Cons |

| AvaTrade supports reliable payment methods for deposits and withdrawals | AvaTrade has limited payment methods for deposits and withdrawals |

| Emirati traders can choose from a few options to deposit and withdraw funds | Payment providers might still charge processing fees on AvaTrade deposits and withdrawals |

| AvaTrade’s deposits and withdrawals are free | AvaTrade does not have instant deposits or withdrawals |

How do I deposit into my AvaTrade account?

Log into your trading account, navigate to the withdrawal section, and follow the instructions.

Are there any restrictions on withdrawals from AvaTrade?

Yes, due to anti-money laundering regulations, only certain withdrawal methods are permitted.

AvaTrade Education and Research

Education

AvaTrade offers the following Educational Materials to Emirati traders:

- ✅Educational Videos

- ✅Trading guides

- ✅Trading Rules

- ✅Market Terms

- ✅Order Types

- ✅Trading Strategies

- ✅Trading Ideas

- ✅Trader’s Blog

and more!

AvaTrade also offers Emirati traders the following additional Research and Trading Tools:

- ✅Technical Analysis Indicators

- ✅Economic Indicators

- ✅Economic calendar

- ✅Trading Strategies

- ✅AvaProtect Risk Management

- ✅Trading Central

- ✅Trading Calculators

- ✅Earnings Releases

and more!

Research and Trading Tool Comparison

| 🔑Broker | 🥇AvaTrade | 🥈TD Ameritrade | 🥉eToro |

| 🔢Economic Calendar | ✅Yes | ✅Yes | None |

| 📈VPS | ✅Yes | None | None |

| 📊AutoChartist | None | None | None |

| 👁️Trading View | None | None | ✅Yes |

| 📍Trading Central | ✅Yes | None | None |

| 📉Market Analysis | ✅Yes | ✅Yes | ✅Yes |

| 🗞️News Feed | ✅Yes | ✅Yes | ✅Yes |

| 🖥️Blog | ✅Yes | ✅Yes | ✅Yes |

Pros and Cons of AvaTrade Education and Research

| ✅Pros | ❎Cons |

| AvaTrade offers a range of trading tools and research | AvaTrade does not distribute the same number of financial instruments across all accounts |

| AvaTrade has the best selection of educational material for beginners | The AvaTrade demo account is only available for 21 days after registration |

Is there a beginner’s guide for trading with AvaTrade?

Yes, AvaTrade provides a “Trading for Beginners” section that explains key technical terms and intelligent trading strategies.

How can I learn about AvaTrade CFD trading?

AvaTrade offers a comprehensive guide on beginning trading CFDs, managing risks, and discovering lucrative opportunities.

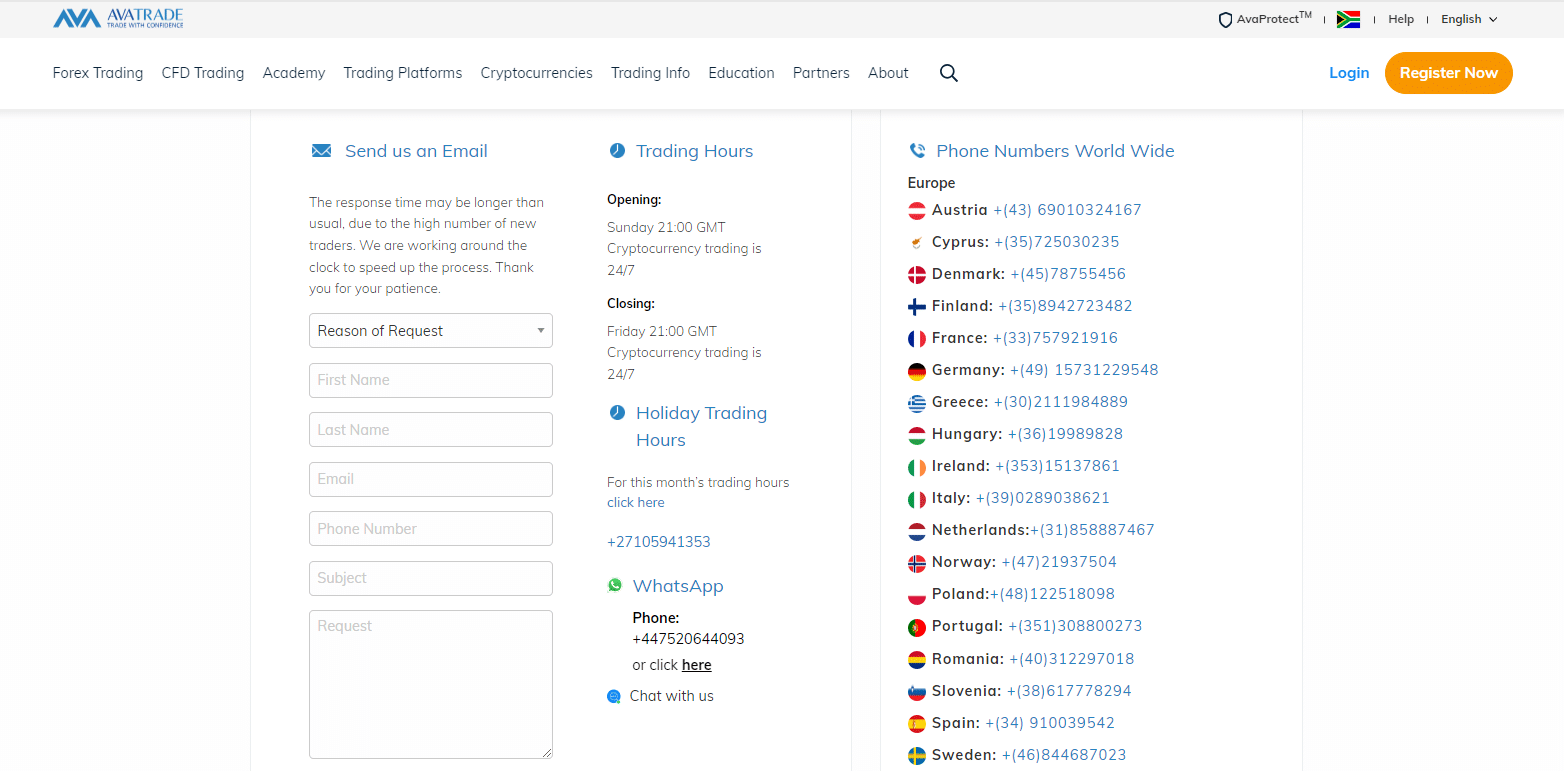

AvaTrade Customer Support

| 🔑Customer Support | 🥇AvaTrade Customer Support |

| ⏰Operating Hours | 24/5 |

| 🔊Support Languages | Multilingual |

| 👥Live Chat | ✅Yes |

| ☎️Telephonic Support | ✅Yes |

| 🏆The overall quality of AvaTrade Support | 5/5 |

Pros and Cons AvaTrade Customer Support

| ✅Pros | ❎Cons |

| AvaTrade has a live chat option on the website | There is no customer support over weekends or on public holidays |

How can I contact AvaTrade’s customer support?

AvaTrade offers Customer Service in over fourteen languages via email, phone, WhatsApp, and chat.

How do I get technical help from AvaTrade?

Visit AvaTrade’s FAQ & Help Centre or contact their support team for technical issues.

AvaTrade VPS Review

AvaTrade provides a Virtual Private Server (VPS) to traders who require a reliable trading platform to capitalize on market opportunities. This data center-hosted dedicated server is globally accessible and has an impressive 99.9% uptime, ensuring traders can rely on a continuously accessible platform.

Compatibility is another of AvaTrade’s VPS’s strong points. Integration with MetaTrader 4 and 5 platforms is seamless, and installation is straightforward.

In addition, the VPS is compatible with Expert Advisors (EAs), automated trading systems that can execute trades on behalf of a trader, thereby enhancing its utility.

The VPS service is not free, but AvaTrade offers flexible plans and pricing options that vary based on the features and functionalities of the chosen VPS provider.

As an introductory offer, traders can receive $0.99 for seven days of full VPS service access, allowing them to test the waters before committing to a longer-term plan.

Is AvaTrade’s VPS low latency?

Yes, AvaTrade’s VPS is designed to provide trading servers with low latency.

Is AvaTrade’s VPS service available 24/7?

Yes, the VPS service is designed to run a Forex trading platform continuously around the clock.

AvaTrade Cashback Rebates Features and Conditions

AvaTrade provides a cashback rebates program to increase traders’ profitability by returning a portion of transaction costs incurred during trading. These rebates effectively lower the spread, increasing the trader’s net gains.

The cashback rebates are distributed monthly and available across various account types and trading instruments.

Traders can set their minimum payment threshold, allowing them to accumulate and withdraw rebates less frequently if desired. Rebates on certain trading instruments can be as high as 20% of the spread or up to 0.35 pip.

AvaTrade’s partners benefit from the cashback rebates program, in addition to individual traders. Partners receive a portion of the transaction costs from trades executed by their referred clients, regardless of the outcome of the trade.

As the trading volume of their referred clients grows, partners can increase their earnings through escalating cashback potential.

How much can I earn in AvaTrade’s Cashback?

AvaTrade offers cashback Forex rebates of up to 20% or 0.35 pips per standard lot traded on MetaTrader 4 with the Retail Standard account.

How does AvaTrade Cashback work?

AvaTrade Cashback is a rebate program that returns a portion of your trading fees for every trade you execute.

AvaTrade Web Traffic Report

| 🌎Global Rank | 2,213,375 |

| 🗺️Country Rank | 27,056 |

| Category Rank | 311 |

| 📍Total Visits | 41.4K |

| 📊Bounce Rate | 53.48% |

| 📖Pages per Visit | 0.98 |

| ⏱️Average Duration of Visit | 00:03:21 |

| 🏡Total Visits in the last three months | June – 35K July – 40.9K August – 41.4K |

AvaTrade Geographic Reach and Limitations

AvaTrade’s Current Expansion Focus

AvaTrade is expanding globally in Australia, Europe, Africa, Asia, etc.

Countries not accepted by AvaTrade

AvaTrade does not accept clients from these countries:

- ✅United States

- ✅Belgium

- ✅New Zealand

- ✅Cuba

- ✅Iran

- ✅Syria

Popularity among Emirati traders who choose AvaTrade

AvaTrade is one of the Top 25 Brokers for Emirati traders.

Does AvaTrade have multiple offices worldwide?

Yes, AvaTrade has offices worldwide to serve its global clientele.

Are all AvaTrade features available in every country?

No, there may be restrictions on certain features and financial instruments based on the country’s regulations.

Best Countries by Traders

| 🌎Country | 📈Market Share |

| 🥇South Africa | 31.69% |

| 🥈Turkey | 2.66% |

| 🥉Namibia | 2.49% |

| 🏅Colombia | 2.27% |

| 🎖️Mexico | 2.23% |

AvaTrade vs TD Ameritrade vs eToro – A Comparison

| 🔑Broker | 🥇AvaTrade | 🥈TD Ameritrade | 🥉eToro |

| 📈Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | FINRA, CFTC, SEC, SFC | CySEC, FCA, ASIC, FSA, NFA, FinCEN, FINRA, SIPC, |

| 📉Trading Platform | AvaTrade WebTrader AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade | TD Ameritrade thinkorswim | eToro proprietary platform |

| 💵Withdrawal Fee | None | None | ✅Yes |

| 🆓 Demo Account | ✅Yes | ✅Yes | ✅Yes |

| ⬇️Min Deposit | 367 AED | 4 AED | 735 AED |

| ✳️Leverage | 1:30 (Retail) 1:400 (Pro) | 1:2 | 1:30 (Retail) 1:400 (Professional) |

| 🔢Spread | Fixed, from 0.9 pips | None | From 1 pip |

| 💴Commissions | None | From $0 | None |

| ⛔Margin Call/Stop-Out | 25% - 50% (M) 10% (S/O) | None | None indicated |

| 📝Order Execution | Instant | None | Market/Instant |

| 💰No-Deposit Bonus | None | None | None |

| 🪙Cent Accounts | None | None | None |

| 📊Account Types | Standard Live Account Professional Account Option | Standard Accounts Retirement Accounts Education Accounts Specialty Accounts Managed Profiles Margin Trading Account | Retail Account Professional Account |

| 🖋️DFSA Regulation | None | None | None |

| ➡️AED Deposits | None | None | None |

| 💷AED Account | None | None | None |

| 👥Customer Service Hours | 24/5 | 24/7 | 24/6 |

| 💳Retail Investor Accounts | 1 | 2 | 1 |

| ☪️Islamic Account | ✅Yes | None | ✅Yes |

| 📌Minimum Trade Size | 0.01 pips | 0.01 lots | 0.01 lots |

| 📍Maximum Trade Size | Unlimited | None indicated; it depends on the account balance | Depends on the instrument and account balance |

| ⏱️Minimum Withdrawal Time | 24 to 48 Hours | 5 minutes | Instant |

| ⏰Maximum Estimated Withdrawal Time | Up to 10 days | 7 working days | Up to 10 Working Days |

| 💶Instant Deposits and Instant Withdrawals | None | None | ✅Yes |

AvaTrade Awards and Recognition

AvaTrade received the following awards and recognition:

- ✅Top 10 Hot Brands of the Year (2024) – The Ceoviews.

- ✅Most Trusted Broker (2024) – International Investor.

- ✅Best Mobile Trading Platform in Spain (2024) – Finance Derivative.

- ✅Best Affiliate Program UAE in 2024 – awarded by the Global Business Review Magazine.

and many more!

AvaTrade Alternatives

- 🥇InstaForex caters to Emirati traders with localized services, including customer support in Arabic and Islamic swap-free accounts. InstaForex also offers a variety of trading instruments, from forex to commodities, appealing to diverse trading interests in the UAE.

- 🥈IronFX stands out for its robust regulatory framework, being regulated by multiple authorities, which adds an extra layer of security for Emirati traders. IronFX also offers various account types, including a bespoke Islamic account.

- 🥉Windsor Brokers provides an extensive educational platform, ideal for Emirati traders looking to enhance their trading skills. Windsor Brokers also offers a range of asset classes, including futures and options, broadening the scope for local investors.

Our Experience with AvaTrade

According to our analysis of various AvaTrade reviews and user comments, the overall experience is positive. AvaTrade is a regulated broker that provides diverse trading instruments such as forex, stocks, commodities, and cryptocurrencies.

The simple platform offers advanced features such as charting tools, risk management options, and social trading capabilities.

One of its most notable features is the demo account, which is especially useful for beginners who want to practice without financial risk. AvaTrade also provides competitive spreads and fees and multiple payment methods for easy transactions.

However, some users have reported performance issues during periods of high market volatility and found the verification process to be time-consuming. Despite these disadvantages, we recommend AvaTrade to traders looking for a regulated platform with diverse trading options and low fees.

AvaTrade Trading Platform

The AvaTrade platform, in our opinion, is simple and includes advanced charting, risk management, and social trading capabilities. One of the platform’s most notable features is its customizable trading interface, which allows traders to personalize their trading experience.

Furthermore, the platform offers a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies, making it appropriate for traders with various trading styles and preferences.

AvaTrade’s platform also includes a mobile app, AvaTradeGO, that allows traders to manage their accounts and trade on the go. The app is useful and efficient because it provides traders with real-time market data, advanced charting tools, and risk management features.

However, during periods of high volatility, some users have reported platform performance issues, which can result in slippage and order execution delays. Additionally, some users have reported issues with the platform’s stability and reliability, which can harm their trading experience.

Quality of Customer Service

AvaTrade offers a variety of customer support channels, including email, phone, and live chat, making it easy for traders to get in touch with their support team. One of AvaTrade’s most notable features is its multilingual support team, which can assist traders in various languages.

Furthermore, AvaTrade’s support team is knowledgeable and responsive, promptly and helpfully responding to traders’ inquiries and issues. The availability of educational resources such as webinars, video tutorials, and trading guides is another benefit of AvaTrade’s customer service.

These resources can help traders improve their trading skills and knowledge, boosting their confidence and success in the market.

However, some users have complained about the response time of AvaTrade’s support team, which can be slow during peak periods. Additionally, some users have expressed dissatisfaction with the verification process, which can be time-consuming and require additional documentation.

AvaTrade Response Time

| 🔑Support Channel | ⏰Average Response Time | ⏱️User-based Response Time |

| ☎️Phone | 5 minutes | 2 – 5 minutes |

| 1 working day | Same-day | |

| 🔊Live Chat | 5 – 10 minutes | 2 – 5 minutes |

| 📱Social Media | 1 hour | 2 – 5 minutes |

| 👥Affiliate | 1 working day | Same-day |

Recommendations according to our in-depth review of AvaTrade

- ✅AvaTrade’s retail account pricing is comparable to the average in the industry but lags behind industry leaders. To attract more customers, they could work on offering competitive pricing.

- ✅While the web platform is user-friendly, it lacks features such as two-factor authentication and price alerts. Enhancing the platform’s security and functionality could enhance user experience.

- ✅While AvaTrade’s mobile charts are good, they can be enhanced. Small enhancements to this area could enhance the mobile commerce experience for users.

- ✅The product portfolio of AvaTrade is limited to forex, various CFDs (for stocks, indexes, commodities, etc.), and cryptocurrencies. Their product offering may appeal to a broader range of customers if they diversify it.

- ✅The desktop platform of AvaOptions is slow to load and has an outdated design that does not match its mobile counterparts’ sleek, responsive design. Enhancing the desktop platform’s performance and aesthetics could enhance the user experience.

- ✅Currently, the AvaTradeGO mobile app is only available in English. The addition of multilingual support could serve an international audience.

Finally, AvaTrade imposes substantial inactivity fees. If fees are lowered, customers who trade less frequently may find their offer more enticing.

AvaTrade Customer Reviews

🥇 Great assistance.

AvaTrade provided invaluable assistance with account setup and comprehensive resources to help me become acquainted with the platform’s functionalities. – Hamad Nuaimi

🥈 Positive experience.

My experience with AvaTrade has been extremely positive. The platform provides a wide range of trading instruments and allows for simple withdrawals with no post-refund complications. – Laila Shamsi

🥉 Very user-friendly!

The account management representative gave precise instructions, instilling confidence in trading with this company. The demo version of the platform was also very user-friendly, with all of the necessary trading tools readily visible. – Saif Dahmani

Pros and Cons of Trading with AvaTrade

| ✅Pros | ❎Cons |

| Quality regulators like the Central Bank of Ireland, the Australian Securities and Investments Commission, and the Financial Services Agency of Japan oversee | Only forex, CFDs, and cryptos are offered |

| Emirati traders benefit from AvaTrade’s Islamic swap-free account | Inactivity fees are high |

| Forex, CFDs, and cryptos are available on AvaTrade. | Forex trading fees are uncompetitive |

| AvaTrade’s trading signals provide traders with a complete picture of the asset and trade direction | The minimum deposit is higher than other brokers |

| AvaTrade is regulated in Abu Dhabi | AvaOptions’ desktop platform is slow to load and lacks the sleek, responsive design of its mobile counterpart |

| Free deposit and withdrawal options are available | Slow customer service efficiencies and response time |

| AvaTrade’s diverse and easy-to-use research and education tools are ideal for traders looking to improve | At least 351 of AvaTrade’s 1,260 symbols are on hold for MetaTrader and WebTrader |

In Conclusion

In our experience, AvaTrade positions itself as a comprehensive and well-regulated broker with a wide range of assets and trading platforms.

Several reputable authorities regulate it, including the Central Bank of Ireland, the Australian Securities and Investments Commission, and the Financial Services Agency of Japan.

Furthermore, its regulation in Abu Dhabi makes it a viable option for Emirati traders, and the availability of an Islamic swap-free account adds to this. In addition, AvaTrade prioritizes security by using SSL encryption and two-factor authentication and segregating client funds to ensure their safety.

There are, however, some constraints to consider. The minimum deposit is relatively high, and AvaTrade charges significant inactivity fees, which may deter some traders.

While customer service is excellent, the financial aspects of the platform could be improved to make it more accessible to traders with varying budgets.

AvaTrade’s trading platforms include unique features such as AvaProtect, Risk Manager, and social and copy trading options, which makes it a versatile choice for traders.

Furthermore, the Trading Signals feature and Virtual Private Server (VPS) enhance the trading experience by adding layers of functionality and reliability. Another commendable feature is the cashback rebates program, intended to boost profitability while lowering trading costs.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Emirati investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Frequently Asked Questions

Is AvaTrade Safe or a Scam?

AvaTrade is a trustworthy broker for Dubai-based traders. Multiple jurisdictions govern it, which increases its safety and dependability.

Where can I find quick answers on AvaTrade’s website?

You can find instant answers on the AvaTrade website by entering your question in the search box. For better results, enter multiple keywords and ask a question.

Does AvaTrade have Nasdaq 100?

Yes, AvaTrade offers Nasdaq 100 contracts for difference and US TECH 100 shares.

Does AvaTrade have VIX 75?

Yes, AvaTrade provides access to the Volatility Index for Emirati traders.

How do I apply to become a professional trader with AvaTrade?

To apply to become a professional trader, you must meet certain requirements, such as possessing a certain amount of trading experience and capital. Fill out the professional trader application form on AvaTrade’s website to apply.

What trading platforms does AvaTrade offer?

AvaTrade provides numerous trading platforms, such as MetaTrader 4 and 5, AvaTradeGO, AvaSocial, AvaTrade Web, ZuluTrade, DupliTrade, and AvaOptions.

Is AvaTrade regulated?

Yes, AvaTrade is effectively regulated in several regions. AvaTrade is governed by CBI, BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, and IIROC regulations.

Does AvaTrade offer an Islamic account?

Yes, AvaTrade offers an Islamic swap-free account in which no interest or Riba is charged on open positions, which is a feature of interest to Emirati traders.

How long does it take to withdraw from AvaTrade?

AvaTrade withdrawals may take several hours or days, depending on the payment method.

What education and research tools does AvaTrade offer?

AvaTrade’s extensive and user-friendly research and education tools make it an excellent option for traders seeking to enhance their abilities. The research and education tools provided by AvaTrade consist of webinars, eBooks, video tutorials, and market analysis.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai