FXGT.com Review

FXGT.com Review shows that it is a regulated broker that offers Emirati traders a 30 USD No-deposit bonus when they sign up. FXGT.com is a well-known broker offering copy and crypto trading to all Emirati traders.

- Maryke Myburgh

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 5

Regulators

SFSA, FSCA, CySEC

Trading Platform

MT4, MT5

Crypto

Yes

Total Pairs

0

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overview

It is a Cyprus-based brokerage platform that began operations in 2020 and has since expanded to South Africa and Seychelles.

The broker caters to a diverse international clientele, including Emirati traders, offering account options in major fiat currencies and a wide range of digital assets like Bitcoin, Ethereum, and Ripple.

However, it does not directly support the Emirati Dirham (AED), so traders typically use other base currencies. FXGT.com is known for its commitment to following regulations and ensuring platform security, holding licenses from trusted institutions like the FSCA and CySEC.

In addition, FXGT.com offers advanced trading technology and customer support in multiple languages, with platforms like MetaTrader 4 and MetaTrader 5 providing powerful tools and analytics.

Despite its short history, it has expanded its range of trading instruments, offering traditional forex pairs, synthetic cryptocurrencies, and newer assets like DeFi tokens and NFTs.

The platform is known for its commitment to technological advancement in trading, offering a no-deposit bonus exclusively for Emirati clients.

Emiratis interested in entering financial markets, particularly forex and digital currencies, might find FXGT.com’s blend of technology, customer support, and global outlook attractive.

What sets FXGT.com apart from other brokers?

It stands out for its unique trading platforms, an extensive selection of assets, including cryptocurrencies and NFTs, and dedication to offering 24-hour client service.

Can Emirati traders get customer care in their language on FXGT.com?

Yes, the broker provides 24/7 customer service in many languages, including English, Arabic, and others, to meet the different requirements of Emirati traders.

FXGT.com Review At a Glance

| 🗓Established Year | 2020 |

| 🪪Regulation and Licenses | FSCA, CySEC, VFSA, FSA |

| 🌟Ease of Use Rating | 4/5 |

| 💰Bonuses | Yes, $30 No-Deposit Bonus, Loyalty Bonus, VPS Sponsorship Program |

| ⏰Support Hours | 24/7 |

| 📊Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 📈Account Types | Mini, Standard+, Pro, ECN |

| 💸Base Currencies | BTCH, ETH, USDT, ADA, XRP, EUR, USD, ZAR |

| 📊Spreads | From 0.0 pips |

| 📈Leverage | 1:1000 |

| 💳Currency Pairs | 41; major, minor, exotic pairs |

| 💰Minimum Deposit | 18 AED / 5 USD |

| 💸Inactivity Fee | Yes |

| 🗣Website Languages | English, Arabic, Japanese, Thai, Vietnamese, Malay, Turkish |

| ⚖️Fees and Commissions | Spreads from 0.0 pips, commissions from $6 on Forex, $5 on metals, and 0.1% on crypto |

| 📚Affiliate Program | Yes |

| 🏛️Banned Countries | United States, Russia, Canada, Iran, and North Korea |

| 💻Scalping | Yes |

| 🔎Hedging | Yes |

| ✴️Trading Instruments | Forex, cryptocurrencies, synthetic cryptocurrencies, precious metals, energies, indices, stocks, DeFi Tokens, NFTs |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

It prioritizes the security of Emirati traders’ funds and sensitive information despite not being locally regulated in Dubai.

Furthermore, FXGT.com adheres to international regulatory standards and implements robust security measures. It separates client funds from its operational finances, ensuring their safety.

They use advanced encryption technology to protect clients’ personal and trading data, stored on secure servers with firewalls.

Negative balance protection prevents Emirati traders from losing more than they have deposited, preventing deficits. FXGT.com’s partnerships with Tier 1 Banks demonstrate its commitment to financial stability and risk management.

Additionally, Emirati traders benefit from comprehensive liability insurance coverage, providing additional peace of mind.

FXGT.com Regulation in Dubai

The broker is not currently regulated by the DFSA in Dubai. However, FXGT.com’s global regulations are listed in the table below.

| 🏛️Registered Entity | 🌎Country of Registration | 🪪Registration Number | ⚖️Regulatory Entity | 📊Tier | 🖺License Number/Ref |

| 360 Degrees Markets Ltd | Seychelles | 8421720-1 | FSA | 3 | SD019 |

| GT IO Markets (Pty) Ltd | South Africa | 2015/059344/07 | FSCA | 2 | FSP 48896 |

| GT Global Markets Ltd | Vanuatu | – | VFSC | 3 | 700601 |

| TEC International (Cyprus) Ltd | Cyprus | HE 389575 | CySEC | 2 | 382/20 |

| 🛡️Security Measure | 📜Information |

| Segregated Accounts | Yes |

| Compensation Fund Member | Liability Insurance |

| Compensation Amount | 1,000,000 EUR |

| SSL Certificate | Yes |

| 2FA (Where Applicable) | Yes |

| Privacy Policy in Place | Yes |

| Risk Warning Provided | Yes |

| Negative Balance Protection | Yes |

| Guaranteed Stop-Loss Orders | No |

What risk management tools does FXGT.com provide for traders in Dubai?

They provide traders with powerful risk management features like stop-loss orders and negative balance protection.

Are FXGT.com’s investment procedures clear to Dubai investors?

Yes, they maintain transparency in its trading activities and financial reporting, which is available to investors in Dubai.

Awards and Recognition

After conducting a thorough analysis of FXGT.com, we discovered the following accolades and acknowledgments:

- “Best Global Trading Conditions” received in 2024 from Brokers View.

- “Best Broker Award” granted in 2023 by AtoZ Markets.

- “Best Hybrid Broker” was awarded in 2022 during the Ultimate Fintech Awards.

Account Types

| Bronze | Silver | Gold | Premium | |

| ⚖️Availability | All; ideal for beginners | All; ideal for casual traders | All; ideal for experienced traders | All; ideal for scalpers, day, and algorithmic traders |

| 📈Markets | • Forex • Equity Indices • Precious Metals • Energies • Stocks • Cryptocurrency • GTi12 Index | • Forex • Equity Indices • Precious Metals • Energies • Stocks • Cryptocurrency • GTi12 Index • Synthetic Cryptocurrencies | • Forex • Equity Indices • Precious Metals • Energies • Stocks • Cryptocurrency • GTi12 Index • Synthetic Cryptocurrencies • DeFi Tokens • NFTs | • Forex • Equity Indices • Precious Metals • Energies • Stocks • Cryptocurrency • GTi12 Index • Synthetic Cryptocurrencies |

| 💳Commissions | None; only the spread is charged | None; only the spread is charged | None; only the spread is charged | From 0.1% – $6 |

| 💻Platforms | All | All | All | All |

| 📊Trade Size | 0.01 – 500 lots | 0.01 – 200 lots | 0.01 – 200 lots | 0.01 – 200 lots |

| 📈Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 |

| 💰Minimum Deposit | 18 AED / 5 USD | 18 AED / 5 USD | 18 AED / 5 USD | 18 AED / 5 USD |

Mini Account

The Mini Account is ideal for new Emirati traders, offering a small initial deposit of 18 AED and no commission fees. It offers access to various trading options like forex, indices, metals, energies, stocks, and cryptocurrencies, making portfolio building easy.

The account’s reasonable spreads make trading less intimidating and more approachable for Emirati beginners, making it an ideal choice for those new to the financial markets.

Standard+ Account

The Standard+ Account is a suitable choice for casual traders in the UAE, offering synthetic cryptocurrencies, a 1:1000 leverage, no commission costs, and low average spreads. It provides a low-complicated way to diversify portfolios without complicating trades.

Furthermore, the bonus programs available to the Standard+ Account can enhance trading journeys and investment strategies, making it an ideal choice for those looking to diversify their portfolio.

Pro Account

The Pro Account is designed for experienced Emirati traders seeking advanced trading experiences. It requires a low deposit and offers access to various instruments, including exclusive assets like DeFi Tokens and NFTs.

With tight average spreads and no commission fees, it is ideal for Dubai traders with market knowledge and a comprehensive selection of financial products.

ECN Account

The ECN Account is designed for Emirati traders using scalping strategies. It connects with electronic communication networks for swift order execution.

With spreads as low as 0.0 pips and commission rates ranging from 0.1% to $6, it offers optimal conditions for large trade volumes. Furthermore, the ECN account offers Emiratis high leverage and a competitive edge for traders.

Demo Account

Their Demo Account is a valuable tool for Emirati traders, providing a risk-free platform to refine their trading strategies.

In addition, FXGT.com offers virtual funds to navigate real market conditions, allowing Emirati beginners and experienced investors to practice, experiment with new tactics, and build confidence without financial risk.

Islamic Account

Their Islamic Account caters to Emirati traders adhering to Islamic finance principles by eliminating swap interests and ensuring compliance with Sharia law.

This account enables trading in forex and other asset classes, showcasing FXGT.com’s commitment to inclusivity and recognizing diverse cultural and religious backgrounds. It offers tailored trading solutions, ensuring all traders can invest in a manner aligned with their values and beliefs.

Does FXGT.com provide a Demo account for the Mini account type?

Yes, it offers a Demo account for all accounts, including the Mini account, enabling Emirati traders to practice trading methods without risking real funds.

What is the trade size range for the Pro account on FXGT.com?

The Pro account provides a trade size ranging from 0.01 to 200 lots, responding to the demands of experienced traders with bigger trading volumes.

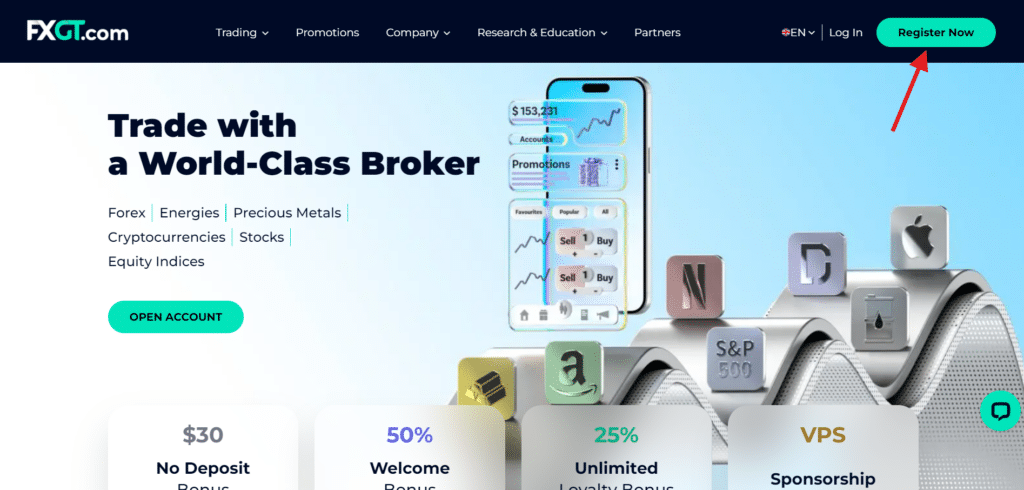

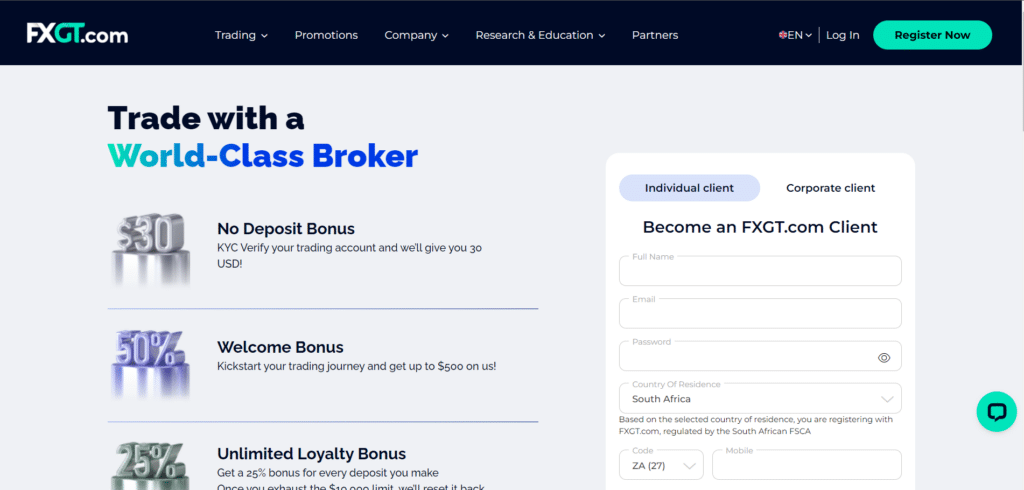

How To Open a FXGT.com Account

To register an account with FXGT.com, follow these steps:

To begin the account registration procedure, go to FXGT.com and click the ‘Sign Up’ or ‘Register’ option.

Complete the registration form with your personal information, ensuring all data is correct and current.

Check your email for a confirmation from FXGT.com, then click the verification link to validate your email address and move on to the next stage.

Once your email has been authenticated, return to the FXGT.com website to accept the Ts and Cs and complete the obligatory Know Your Customer (KYC) process by submitting the required proof of identification and address documentation.

Wait for FXGT.com to validate the provided documents and approve your account; this procedure normally takes a few days, and you will be contacted when your account is available.

To deposit funds, go to the ‘Deposit’ area of your account dashboard, choose a deposit method accepted in the UAE, and follow the steps to add funds to your trading account.

Can Emirati traders start trading immediately after registering on FXGT.com?

Emirati traders may start trading on FXGT.com after their account has been validated. FXGT.com offers a 30 USD No-Deposit Bonus that lets Emiratis start trading before depositing funds.

Can Emirati traders register numerous accounts on FXGT.com?

Yes, Emirati traders can register several accounts on FXGT.com, enabling them to easily separate trading techniques or manage various trading portfolios.

Broker Comparison

| FXGT.com | Exness | FXOpen | |

| 🔎Regulation | FSCA, CySEC, VFSA, FSA | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA | ASIC, FCA, CySEC |

| 💻Trading Platform | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • Exness App • Exness Terminal | • MetaTrader 4 • MetaTrader 5 • TickTrader |

| 💳Withdrawal Fee | No | No | Yes |

| ✅Demo Account | Yes | Yes | Yes |

| 💰Min Deposit | 18 AED ($5) | From 37 AED ($10) depending on the payment system | 4 AED ($1) |

| 📊Leverage | 1:1000 | Unlimited | 1:500 |

| 📈Spread | From 0.0 pips | Variable, from 0.0 pips | From 0.0 pips |

| 💸Commissions | • $6 on Forex • $5 on Precious Metals • 0.1% on Crypto Assets | From $0.1 per side per lot | From $1.5 |

| ➡️Margin Call/Stop-Out | • 50% – 70% (M) • 20% – 40% (SO) | 60%/0% | • M – 100% – 20% • S/O – 50% – 10% |

| 📜Order Execution | Market | Market | Instant, Market |

| ❌No-Deposit Bonus | Yes | No | No |

| 🪙Cent Accounts | Yes, Mini | Yes | Yes, Micro |

| 🖺Account Types | • Mini Account • Standard+ Account • Pro Account • ECN Account | • Standard Account • Standard Cent Account • Raw Spread Account • Zero Account • Pro Account • Social Standard • Social Pro | • Micro Account • STP Account • ECN Account • Crypto Account • PAMM STP • PAMM ECN • PAMM Crypto |

| 🏛️DFSA Regulation | No | No | No |

| 💳AED Deposits | No | Yes | No |

| 🖺AED Account | No | Yes | No |

| 📞Customer Service Hours | 24/7 | 24/7 | 24/5 |

| 🖺Retail Investor Accounts | 4 | 7 | 4 retail, 3 PAMM |

| ☪️Islamic Account | Yes | Yes | Yes |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Trade Size | 200 lots | Unlimited | Unlimited |

| ⏰Minimum Withdrawal Time | Instant | 24 hours | Instant |

| ⏲️Maximum Estimated Withdrawal Time | 1 – 5 Business Days | 3 days | 2 – 5 Days |

| 💰Instant Deposits and Instant Withdrawals? | Yes, Both | No | Yes |

Min Deposit

USD 5

Regulators

SFSA, FSCA, CySEC

Trading Platform

MT4, MT5

Crypto

Yes

Total Pairs

0

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Trading Instruments & Products

FXGT.com offers the following trading instruments and products:

- Cryptocurrencies – FXGT.com provides Emirati traders with 24 cryptocurrencies, including popular Bitcoin and Ethereum, enabling them to capitalize on market fluctuations.

- Indices – The platform offers UAE traders a range of indices tracking leading companies across various sectors, providing a comprehensive view of market trends without investing directly in individual stocks.

- Stocks – FXGT.com allows Emirati traders to profit from stock price changes without owning stocks, using a contract-for-difference model to speculate on 50 stock CFDs.

- Energies – FXGT.com enables Emirati traders to trade in energy markets, including oil and gas, influenced by geopolitical events and global supply and demand changes.

- Synthetic Cryptocurrencies – FXGT.com provides synthetic cryptocurrencies that mimic real price movements, allowing Emirati traders to access crypto markets without directly owning the digital assets.

- Precious Metals – Emirati traders can diversify their portfolios by trading precious metals like gold and silver on FXGT.com, often sought after as safe-haven assets during economic uncertainty.

- DeFi Tokens – FXGT.com offers Emirati traders access to 9 DeFi tokens, part of the emerging decentralized finance sector, reshaping traditional financial services.

- NFTs – FXGT.com introduces a new asset class for Emirati traders, offering 5 different Non-Fungible Tokens (NFTs) trading, combining financial investment with digital collectibles and ownership.

- Forex – The platform provides a comprehensive forex trading environment with 41 currency pairs, enabling Emirati traders to participate in global currency markets and capitalize on the volatility and liquidity of forex trading.

Does FXGT.com provide trading in cryptocurrency for Emirati traders?

Yes, FXGT.com gives Emirati traders access to numerous cryptocurrencies, including Bitcoin, Ethereum, Ripple, and others, allowing them to participate in the burgeoning digital asset market.

Can Emirati traders access DeFi tokens on FXGT.com?

Yes, FXGT.com gives Emirati traders a range of DeFi (Decentralized Finance) tokens, enabling them to study new trends in the decentralized financial ecosystem and perhaps capitalize on breakthrough blockchain ventures.

Trading Platforms and Software

MetaTrader 4

MetaTrader 4, also known as MT4, is a popular trading platform on FXGT.com, offering a stable and adaptable environment for UAE traders. It is versatile and can work with various trading instruments, including major indices and energy commodities.

Furthermore, MT4’s high performance and tight spreads enable precise trade execution, even in volatile markets. Its advanced charting and analysis tools allow traders to tailor their strategies to FXGT.com’s account types, such as Mini, Standard+, Pro, or ECN accounts.

FXGT.com provides multilingual support in English and Arabic, ensuring Emirati traders can access platform help and assistance in their preferred language. Overall, MT4 is a standout feature for traders in the UAE.

MetaTrader 5

MetaTrader 5, or MT5, is a next-generation trading platform by FXGT.com, offering advanced features to meet modern traders’ needs. It supports a wider range of trading instruments, including NFTs and DeFi tokens, and offers real-time data streaming and detailed historical analysis.

MT5 is particularly beneficial for traders using FXGT.com’s ECN account, which benefits from its sophisticated order management system.

UAE traders can access deep liquidity through FXGT.com, enabling rapid order execution. Despite its advanced features, MT5’s user interface remains accessible, and FXGT.com offers 24/7 customer support.

Overall, MT5 is a compelling, flexible, and forward-looking platform for traders seeking a comprehensive trading environment with both traditional trading and innovative financial products.

Can Emirati traders utilize automated trading tools on FXGT.com?

Yes, they offers Expert Advisors (EAs) on MetaTrader 4 and MetaTrader 5, enabling Emirati traders to automate their trading strategies and execute trades based on pre-defined criteria without user involvement.

Are mobile trading alternatives accessible for Emirati traders on FXGT.com?

Yes, It provides mobile trading applications compatible with Android and iOS smartphones, allowing Emirati traders to access their accounts, monitor markets, and execute trades.

Min Deposit

USD 5

Regulators

SFSA, FSCA, CySEC

Trading Platform

MT4, MT5

Crypto

Yes

Total Pairs

0

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Spreads and Fees

Spreads

It offers a spread structure tailored to Emirati traders’ diverse trading strategies, starting from 0.0 pips on certain currency pairs.

This tight-spread framework is cost-effective, especially for ECN accounts focusing on high-frequency and high-volume trading.

In addition, Spreads vary across account types, catering to different experience levels and trading intensity.

Overall, FXGT.com maintains competitive spreads even during market volatility, but traders should be aware of potential fluctuations during economic events or off-peak trading hours.

Commissions

FXGT.com offers a zero-commission trading environment for most account types, but for ECN accounts, a commission fee is applied based on trade complexity. These rates maintain transparency and fairness, allowing traders to understand potential costs.

Overnight Fees

FXGT.com also imposes overnight fees for positions held open past the daily closing time, reflecting the cost of carrying a position overnight.

These fees, standard in the industry, can impact trade profitability. Emirati traders should consider these fees, as they can impact the overall profitability of trades.

Furthermore, FXGT.com provides detailed information on these fees, allowing traders to plan their trades with a comprehensive understanding of potential costs.

Deposit and Withdrawal Fees

FXGT.com offers Emiratis a favorable deposit and withdrawal policy, allowing them to move funds freely without broker fees.

However, Emiratis should know that payment providers or financial institutions still impose fees, especially for currency conversions or international transfers, which can impact their trading expenses.

Inactivity Fees

FXGT.com charges inactivity fees for inactive accounts for over 90 days, urging Emiratis to use their accounts or reconsider keeping them open. To avoid these fees, Emirati traders must maintain some level of account activity within the specified timeframe, avoiding any charges.

Currency Conversion Fees

Emirati traders should know currency conversion fees, as FXGT.com does not directly support AED as a base currency. Based on current exchange rates, these fees can affect trading costs and profits.

Therefore, Emiratis should be mindful of these fees when transacting in currencies other than their account’s base currency.

Does FXGT.com charge commission fees on transactions for Emirati traders?

Yes, FXGT.com charges fees on some account types, such as the ECN account, with commission rates altering depending on transaction complexity and asset transacted, offering transparency in trading costs for Emirati traders.

Are there any extra costs involved with trading on FXGT.com for Emirati customers?

Emirati traders on FXGT.com will face overnight fees for positions held overnight, inactivity fees for inactive accounts, and currency conversion fees for transactions involving currencies other than the account’s base currency.

Leverage and Margin

Emirati traders can leverage their trading capabilities with a small initial deposit, potentially accessing leverage ratios of up to 1:1000 on major forex pairs.

However, higher leverage can magnify potential profits and losses. FXGT.com uses a dynamic leverage model, adjusting leverage based on the trader’s position size.

As a trader’s position size increases, the applicable leverage decreases, mitigating risks associated with larger positions.

Furthermore, the FXGT.com platform maintains transparency regarding margin requirements, outlining collateral for opening and maintaining positions.

Emiratis must know that margin requirements vary depending on account type and selected trading instruments. FXGT.com monitors leverage applied to clients’ positions, making adjustments as needed based on market conditions and individual trading activity.

In addition, as part of FXGT.com’s comprehensive offer, Emirati traders receive timely notifications about changes to trading conditions. They are encouraged to stay updated on product specifications and leverage guidelines to avoid margin calls or stop-outs.

What leverage options does FXGT.com provide for Emirati traders?

FXGT.com provides leverage of up to 1:1000 for Emirati traders, enabling them to magnify their trading positions and perhaps boost profits with a lower initial commitment.

How does leverage influence margin requirements on FXGT.com for Emirati traders?

Leverage significantly impacts margin requirements on FXGT.com, with larger leverage ratios needing lower margin amounts for Emirati traders to start and hold positions, allowing effective capital use and risk management.

Deposit & Withdrawal Options

| 💰Payment Method | 🌎Country | 💳Currencies Accepted | ⏰Processing Time |

| 💳Debit Card | All | USD, EUR, ZAR | Instant – 5 days |

| 🏦Credit Card | All | USD, EUR, ZAR | Instant – 5 days |

| 💱Cryptocurrency Payments | All | BTC, ETH, XRP, ADA, USDT ERC20, USDT TRC20 | 1 minute – 48 hours |

| 💵Sticpay | All | EUR, USD | Instant – 48 hours |

| 🤑Neteller | All | EUR, USD, ZAR | Instant |

| 💻Skrill | All | USD, ZAR | Instant |

| 💻Online Naira | Nigeria | EUR, USD | Instant |

| 💰Perfect Money | All | EUR, USD | Instant |

| 💸Local Banks | All | EUR, USD, ZAR, NAD | Instant |

| 🖰ZotaPay | All | USD | Instant |

| 🖯FasaPay | All | USD | Instant |

| 🔀Bank Wire Transfer | South Africa | ZAR | 2 to 5 working days |

| Binance Pay | All | USDT | Instant |

Deposits

How to Deposit using Bank Wire Step by Step

- Access your account on FXGT.com and look for the ‘Deposit’ option on the dashboard.

- Choose ‘Bank Wire Transfer’ from the deposit methods.

- com will give you their banking information; keep track of the bank account number and SWIFT code.

- Use this data to make a wire transfer through your bank’s online portal or in person.

How to Deposit using Credit or Debit Card Step by Step

- After logging into your FXGT.com account, navigate to the ‘Deposit’ option.

- Choose a credit or debit card from the list of deposit options.

- Enter your card information, including the card number, expiration date, CVV code, and deposit amount.

- Confirm the information and complete any extra verification steps requested by your bank.

How to Deposit using Cryptocurrency Step by Step

- Log into your FXGT.com account and go to the ‘Deposit’ option.

- Select the cryptocurrency option and select your desired coin to deposit.

- com will produce a unique wallet address; copy it.

- Open your crypto wallet, enter the broker’s address, specify the amount, and complete the transfer.

How to Deposit using e-Wallets or Payment Gateways Step by Step

- Sign into your FXGT.com account and navigate to the ‘Deposit’ section.

- Select the e-wallet or payment gateway that you like.

- Enter the deposit amount, and you will be led to the payment service’s portal.

- Log into your payment service account, confirm the payment information, and authorize the transfer.

Withdrawals

How to Withdraw using Bank Wire Step by Step

- On your FXGT.com account, navigate to the ‘Withdrawal’ area.

- Select ‘Bank Wire Transfer’ as your withdrawal option.

- Fill out the form with your banking information, account number, and SWIFT code.

- Enter the amount you want to withdraw and submit the request for processing.

How to Withdraw using Credit or Debit Cards Step by Step

- Go to the ‘Withdrawal’ area of your FXGT.com account dashboard.

- Choose to withdraw funds to your credit or debit card.

- Input the amount you want to withdraw, considering any card limits.

- Submit your request, and the funds should be restored to your card within the regular processing timeframe.

How to Withdraw using Cryptocurrency Step by Step

- Access the withdrawal area of your FXGT.com trading account.

- Select the cryptocurrency withdrawal option and the coin type.

- Please provide your wallet address for getting the funds.

- Enter the amount you wish to withdraw in crypto and complete the transaction.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

- Log into your FXGT.com account and navigate to the ‘Withdrawal’ area.

- Choose your preferred e-wallet or payment gateway from the available options.

- Enter the amount you want to withdraw and any further information.

- Review the transaction and confirm your withdrawal request.

What payment methods are available for Emirati traders to deposit money on FXGT.com?

Emirati traders can deposit money on FXGT.com using numerous payment options, including debit/credit cards, cryptocurrencies (BTC, ETH, XRP, ADA, USDT), e-wallets (Neteller, Skrill, SticPay), and bank wire transfers.

Can Emirati traders withdraw funds using the same method they used to deposit at FXGT.com?

Yes, per FXGT.com’s strict AML policy, Emirati traders must withdraw funds from FXGT.com using the same method they used to deposit.

Educational Resources

Comprehensive Glossary

It provides a comprehensive glossary for Emirati traders containing various trading terms and financial jargon. This resource is particularly useful for beginner traders, helping them navigate the complex trading world.

By providing a solid understanding of key terms, FXGT.com ensures clients can better comprehend market commentary, utilize educational materials effectively, and make informed trading decisions.

eBooks

The broker provides a range of eBooks tailored to Emirati traders’ learning needs, covering topics from trading basics to risk management and trading psychology.

These digital books offer clear step-by-step instructions and strategic trading insights, making them beneficial for self-paced traders.

Furthermore, the eBook format allows UAE traders to study and enhance their trading skills at their convenience, complementing the dynamic nature of forex and cryptocurrency markets that FXGT.com caters to.

Does FXGT.com provide tailored educational support for Emirati traders?

While FXGT.com mainly offers self-paced educational tools, Emirati traders get customized help via dedicated customer service channels, providing assistance and coaching suited to their unique learning requirements and goals.

Are FXGT.com educational materials accessible in multiple languages for Emirati traders?

Yes, FXGT.com provides educational materials in several languages, including English, Arabic, Japanese, Thai, Vietnamese, Malay, and Turkish, providing accessibility and inclusion for Emirati traders from varied linguistic backgrounds.

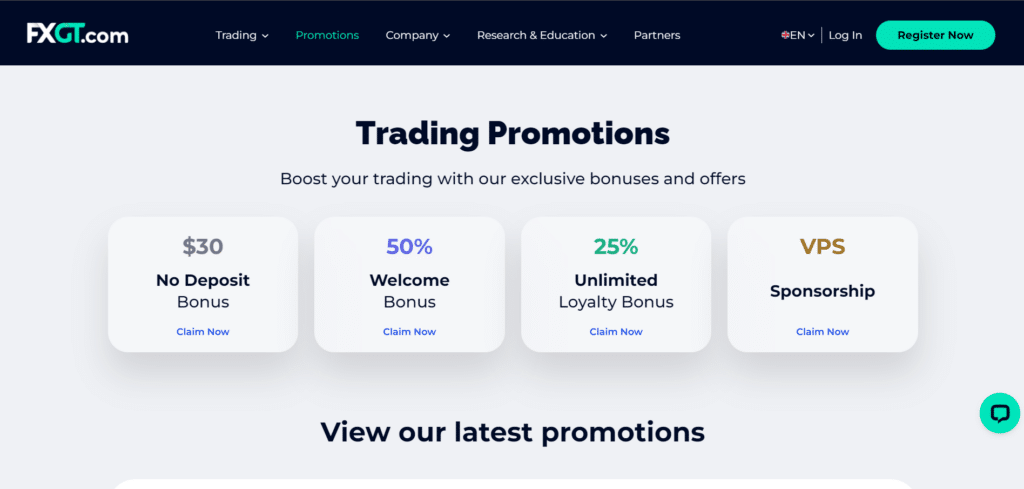

Bonuses and Promotions

The broker offers Emirati traders a range of bonuses and promotions that can enhance their overall trading experience, including the following:

- $30 No-deposit bonus – The $30 no-deposit incentive offered by FXGT.com is a fantastic chance for Dubai traders to try out the market without putting any money on the line. New traders interested in trying out the platform will find this bonus helpful.

- VPS Sponsorship – The VPS sponsorship program is critical for Dubai traders who use automated trading systems. It provides the essential infrastructure for quick execution and minimal delays, resulting in seamless trading experiences.

- 25% Loyalty Bonus – In addition to the no-deposit incentive, FXGT.com provides a 25% loyalty bonus on all future deposits, ensuring continued assistance for active traders looking to maximize their trading potential.

However, we urge traders to carefully read the terms and conditions to understand the qualifying bonus requirements and the withdrawal procedure. For example, traders normally trade two GT lots to withdraw gains from the no-deposit incentive.

Is there a specific first-time deposit incentive for Dubai clients at FXGT.com?

Yes. New clients from Dubai can benefit from a unique first-time deposit $30 no-deposit bonus, frequently greater during promotional seasons on FXGT.com.

How can Dubai traders take part in FXGT.com rebate programs?

Dubai traders may join FXGT.com rebate programs by signing up through their client portal and actively trading to earn rebates of up to $4 per lot on the Bronze tier of the program.

Affiliate Programs

Features

The FXGT.com affiliate program presents a unique opportunity for people (especially traders and influencers on various platforms) to generate income, which is particularly enticing in a vibrant and multicultural city like Dubai.

Furthermore, our research shows that this program could be highly compatible with Dubai’s diverse and technologically inclined population.

This platform offers a wide range of tools for tracking and analyzing real-time statistics, allowing for effective management and improvement of affiliate efforts.

Furthermore, in our experience, the program is perfectly suited for Dubai’s multicultural setting, by offering multilingual support across several channels, letting affiliates effectively engage and promote FXGT.com in various languages.

This program stands out in Dubai’s competitive forex trading arena due to its high commission rates and performance-based revenue model, making it a particularly profitable option.

In addition, we also found that it provides promotional materials that meet the high standards expected in Dubai, thereby enhancing its effectiveness. These resources are valuable because they let affiliates attract a discerning audience with high-quality content.

How to Register an Affiliate Account with FXGT.com Step-by-Step

To become an affiliate with FXGT.com, you can follow these steps:

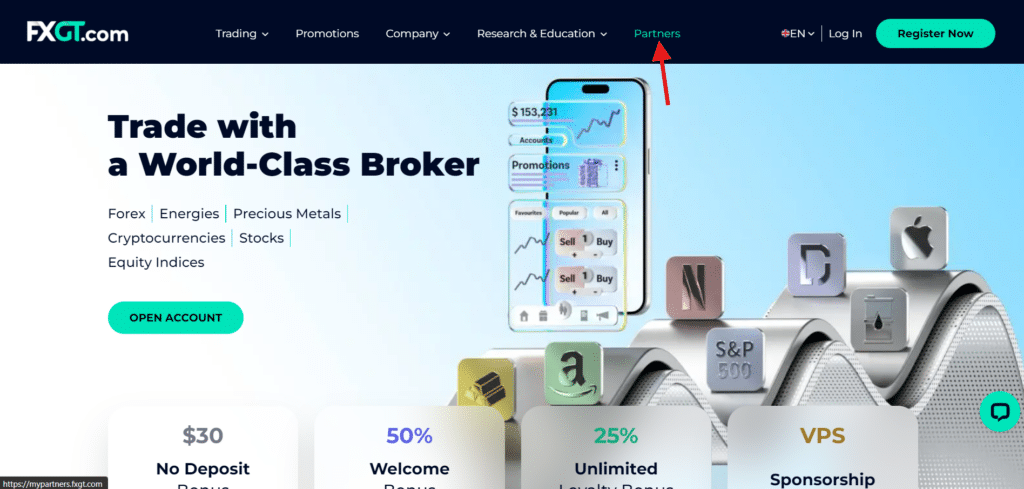

👉Step 1 – Register as an Affiliate

Visit the FXGT website and click the “Partner” option on the top toolbar. You can find a comprehensive overview of the FXGT Partner Program and its advantages here.

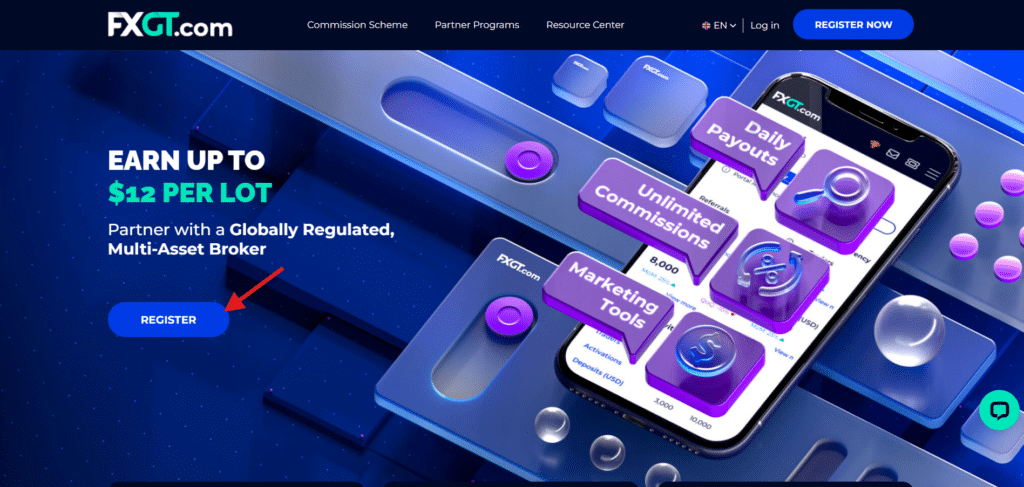

👉Step 2 – Select Register

Click the “Register” button to be redirected to the online application.

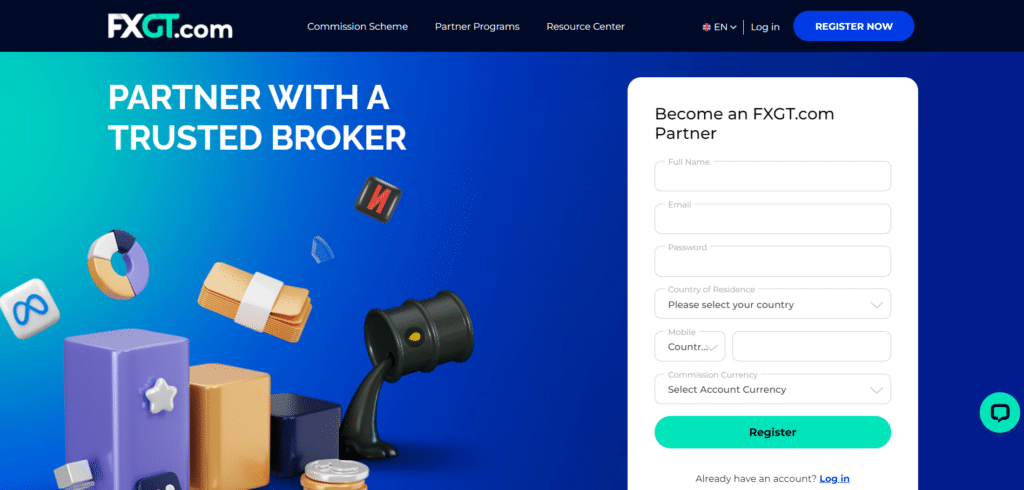

👉Step 3 – Complete Form

The Registration Form might require the following information:

Your full name as it appears on your Emirates ID, along with a valid email address where you can be reached. Additionally, choose a strong password for your affiliate account. Choose “United Arab Emirates” from the list of countries. Enter “Dubai” or the name of your specific city in the city field. Then, complete the remaining form fields by providing your contact information.

Read the FXGT Partner Agreement and Terms & Conditions. These documents provide a comprehensive overview of the rights and responsibilities of affiliates. After carefully reviewing the agreements, check the box to confirm that you accept these agreements. Click on the “Submit” button, and your application will be submitted to FXGT for review.

What are the advantages of joining the FXGT.com affiliate program in Dubai?

It provides affiliates in Dubai with reasonable commission rates, extensive support, and specialized marketing tools.

How does FXGT.com monitor referrals from affiliates in Dubai?

The broker offers cutting-edge monitoring technology to monitor and correctly credit referrals generated by Dubai-based affiliates.

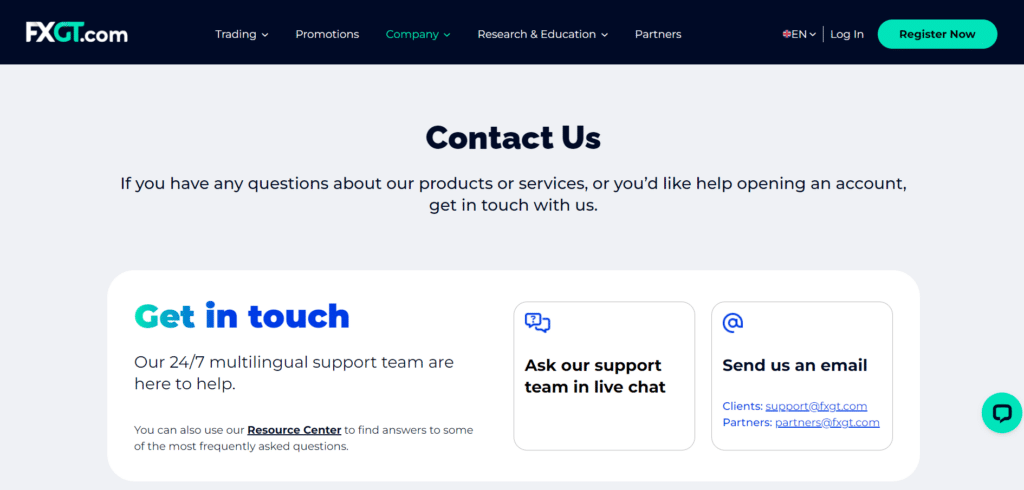

Customer Support

| 🤝Customer Support | 🪪CMTrading Customer Support |

| ⌛Operating Hours | 24/7 |

| 🗣️Support Languages | Multilingual |

| 🎙️Live Chat | Yes |

| 💻Email Address | [email protected] |

| 📞Telephonic Support | Yes |

| ⭐The overall quality of CMTrading Support | 5/5 |

FXGT.com Response Time

| 📺Support Channel | ⏰Average Response Time | ⏲️User-based Response Time |

| 📞Phone | 2 – 5 minutes | 4 – 6 minutes |

| 24 hours | Same-day | |

| 🗣️Live Chat | 5 minutes | 3 – 4 minutes |

| 📱Social Media | 5 minutes | 5 minutes |

| 🪪Affiliate | 24 – 48 hours | 24 – 48 hours |

Does FXGT.com offer Arabic-language support for Dubai clients?

Yes, it offers customer service in Arabic to meet the linguistic demands of clients in Dubai.

How quickly does FXGT.com reply to requests from customers in Dubai?

They typically reply to client requests from Dubai within a few minutes to hours, offering timely help depending on the communication channel. However, we found that FXGT.com strives to ensure prompt responses.

Social Responsibility

It does not currently provide any information regarding CSR initiatives or projects.

Min Deposit

USD 5

Regulators

SFSA, FSCA, CySEC

Trading Platform

MT4, MT5

Crypto

Yes

Total Pairs

0

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Conclusion

According to our findings after evaluating FXGT.com for Emirati traders, we found that FXGT.com is a popular platform for those who want a variety of financial options, including forex and CFDs.

FXGT.com offers competitive leverage, with ratios of up to 1:1000 on major forex pairs, making it an attractive choice for traders. The platform offers various accounts, including an Islamic account, popular trading platforms like MetaTrader 4 and 5, and round-the-clock customer support.

However, our research shows some drawbacks for Emirati traders, such as the absence of direct support for the UAE dirham (AED), inactivity fees, and high leverage, which can lead to greater profits and increased financial risks.

Despite these issues, FXGT.com maintains high standards of regulation and security, ensuring the safety and segregation of client funds.

Furthermore, FXGT.com partners with reputable banks and offers negative balance protection, providing a secure trading environment.

Overall, we can conclude that FXGT.com offers a comprehensive and dynamic trading experience that suits the needs and preferences of Emirati traders if they carefully navigate its features and policies.

Our Insight

FXGT.com presents itself as an easy-to-use portico for all trader levels suggesting a combination of assets like forex and stocks while highlighting the tight spreads and account types for diversified needs. Lately, they have become the “Best Hybrid Broker,” meaning that they are quite promising; nevertheless, it is worth examining their regulatory status and fees before starting to trade.

FXGT.com Pros and Cons

| ✅Pros | ❌Cons |

| Emirati traders can choose an FXGT.com account that suits their unique trading objectives and needs | FXGT.com is not regulated in Dubai by the DFSA |

| Beginners can register a Mini Account to start trading dynamic financial markets with low risk | FXGT.com does not offer AED-denominated accounts, deposits, or withdrawals |

| Emiratis can choose from several free deposit and withdrawal methods | An inactivity fee applies to dormant accounts |

| FXGT.com implements robust security measures to protect Emirati traders | The dynamic leverage model might be confusing to beginner traders |

| Several markets can be traded, including NFTs and Synthetic Indices, which are scarce among CFD and Forex brokers | High leverage can lead to monetary loss regardless of negative balance protection |

| Emirati traders pay a low 18 AED minimum deposit to start trading with FXGT.com | |

| Several advanced trading tools allow Emiratis to refine their trading strategies | |

| There is a 30 USD No-deposit bonus offered to newly registered Emirati traders |

You might also like: BDswiss Review

You might also like: AvaTrade Review

You might also like: Exness Review

You might also like: CMTrading Review

You might also like: Alpari Review

Frequently Asked Questions

Can I open an FXGT.com account from Dubai?.

Yes, FXGT.com accepts customers from Dubai.

Is FXGT.com a safe broker?

Yes, even though the DFSA in Dubai does not regulate FXGT.com, it is a safe broker for Emiratis. FXGT.com is well-regulated, has strict KYC and AML policies, and uses several robust security tools and measures to safeguard Emiratis and their funds.

Does FXGT.com provide Islamic accounts in Dubai?

Yes, FXGT.com recognizes the importance of Shariah-compliant trading and offers swap-free Islamic accounts to clients in Dubai.

What can I trade with FXGT.com?

You can trade unique instruments like NFTs and Synthetic Indices, commodities, forex, shares, crypto CFDs, metals, energies, and indices.

Can Emirati traders get any account opening bonuses on FXGT.com?

Yes, FXGT.com improves the trading experience for Emirati traders by providing a $30 no-deposit bonus for new accounts, as well as additional loyalty benefits and incentives, to let them start trading right away.

What is FXGT.com’s minimum deposit?

The minimum deposit to register an account with FXGT.com is 18 AED or $5.

Can I finance my FXGT.com account with UAE Dirhams (AED)?

No, FXGT.com does not accept AED deposits, but does accept USD, EUR, ZAR, and other cryptocurrencies.

What sorts of accounts does FXGT.com provide to support various trading strategies?

Emirati traders can select from various account types on FXGT.com, including Mini, Standard+, Pro, and ECN accounts, each targeted to different degrees of trading expertise and strategic approaches, ranging from novice to professional.

How long does FXGT.com’s withdrawal take?

Neteller withdrawals to an FXGT.com account are instant, while other withdrawal methods take up to 48 hours, much faster than most brokers offer.

How does FXGT.com protect Emirati traders’ financial interests from market volatility?

FXGT.com protects Emirati traders’ financial interests with methods like as negative balance protection, which ensures Emiratis do not lose more than their deposited funds, and segregated accounts to preserve clients’ wealth.

Where is FXGT.com based?

FXGT.com’s head office is in Cyprus, but the broker has offices in South Africa and Seychelles.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai