Overall, HFM can be summarized as a trustworthy and highly regulated Forex Broker with competitive trading fees. HFM offers diverse trading instruments and excellent customer support. HFM has a trust score of 85 out of 99.

| 📝Order Execution | 4/5 |

| 💵Commissions and Fees | 4/5 |

| 📈Range of Markets | 4/5 |

| 📊Variety of Markets | 4/5 |

| ⏰Withdrawal Speed | 4/5 |

| 🤝Customer Support | 4/5 |

| 📉Trading Platform | 4/5 |

| 🎓Education | 3/5 |

| 📖Research | 4/5 |

| 🚨Regulation | 5/5 |

| 📱Mobile Trading | 5/5 |

| 💯Trust Score | 85% |

HFM Review – Analysis of Broker’s Main Features

- ☑️ HFM Overview

- ☑️ HFM Detailed Summary

- ☑️ HFM Advantages Over Competitors

- ☑️ Who will Benefit from Trading with HFM?

- ☑️ HFM Safety and Security

- ☑️ HFM Bonus Offers and Promotions

- ☑️ HFM Affiliate Program Features

- ☑️ HFM Minimum Deposit

- ☑️ HFM Account Types and Features

- ☑️ HFM Base Account Currencies and Basic Order Types

- ☑️ How to Open and Close an HFM Account

- ☑️ HFM MAM / PAMM Features

- ☑️ Social Trading with HFM

- ☑️ HFM Trading Platforms

- ☑️ Which Markets Can You Trade with HFM?

- ☑️ HFM Fees, Spreads, and Commissions

- ☑️ HFM Deposits and Withdrawals

- ☑️ HFM Education and Research

- ☑️ HFM Customer Support

- ☑️ HFM VPS Review

- ☑️ HFM Cashback Rebates Features and Conditions

- ☑️ HFM Web Traffic Report

- ☑️ HFM Geographic Reach and Limitations

- ☑️ Best Countries by Traders

- ☑️ HFM vs JustMarkets vs FXCM – A Comparison

- ☑️ HFM Alternatives

- ☑️ HFM Awards and Recognition

- ☑️ Our Experience with HFM

- ☑️ Recommendations according to our in-depth review of HFM

- ☑️ HFM Customer Reviews

- ☑️ Pros and Cons of Trading with HFM

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

HFM Overview

HFM Forex and CFD Broker is a leading provider of financial services to traders in the United Arab Emirates, particularly in Dubai. HFM was founded to provide a reliable trading platform, and it has carved a niche for itself in the competitive world of forex and CFD trading.

Multiple financial authorities regulate the broker, ensuring a safe and transparent trading environment for its clients. One of its distinguishing features is its user-friendly trading interface, intended for novice and experienced traders.

The platform provides diverse trading instruments, such as forex pairs, commodities, indices, and cryptocurrencies, allowing traders to diversify their investment opportunities.

Another noteworthy feature is HFM’s educational resources. The broker provides a comprehensive suite of educational materials, such as webinars, eBooks, and tutorials, to improve its clients’ trading skills.

HFM also excels at customer service, providing support 24 hours a day, five days a week via live chat, email, and phone. This is critical for traders in different time zones, including those in Dubai, because it ensures that assistance is available whenever required.

Furthermore, the broker provides competitive spreads and low transaction costs, an important benefit for traders looking to maximize their profits. Regarding technology, HFM provides a cutting-edge trading platform compatible with a wide range of devices, including desktops, tablets, and smartphones.

HFM Detailed Summary

| 🔑Broker | 🥇HFM |

| 🏠Headquartered | Cyprus |

| 🌎Global Offices | Seychelles, South Africa, Dubai, UK, Kenya |

| 🌐Local Market Regulators in Dubai | Dubai Financial Services Authority (DFSA) |

| 🗺️Foreign Direct Investment in Dubai | 23 billion USD (2022) |

| 💱Foreign Exchange Reserves in Dubai | 158 billion USD (July 2024) |

| 📌Local office in Dubai | ✅Yes |

| 👤Governor of SEC in Dubai | Khaled Mohamed Balama is the Governor of the Central Bank of the UAE |

| 📍Accepts Dubai Traders | ✅Yes |

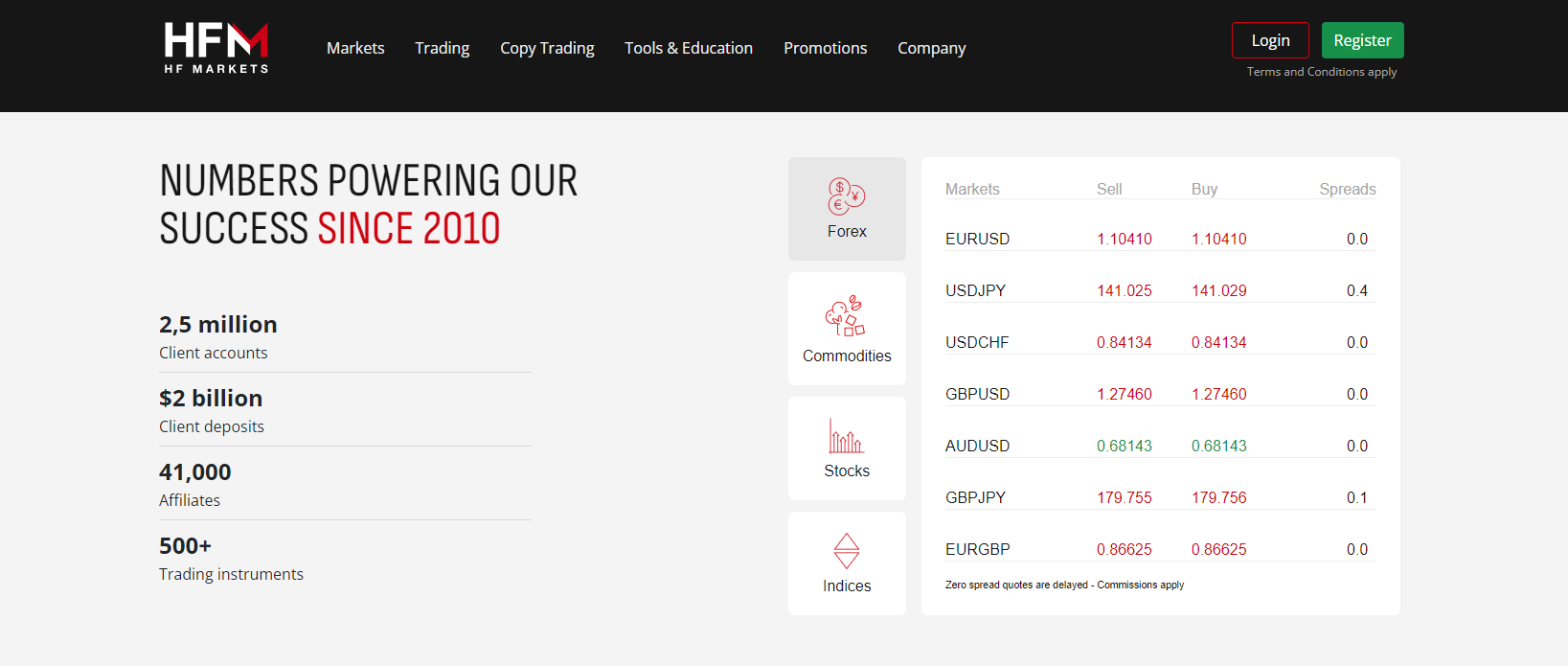

| 🎉Year Founded | 2010 |

| ☎️Dubai Office Contact Number | +971-4-2366841 |

| 💻Social Media Platforms | Facebook X Telegram YouTube |

| 🚨Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 🥇Tier-1 Licenses | Financial Conduct Authority (FCA) |

| 🥈Tier-2 Licenses | Financial Sector Conduct Authority (FSCA) Cyprus Securities and Exchange Commission (CySEC) Capital Markets Authority (CMA) Dubai Financial Services Authority (DFSA) |

| 🥉Tier-3 Licenses | Financial Services Authority (FSA) Financial Services Commission (FSC) |

| 🔢License Number | South Africa – FSP 46632 Cyprus – 183/12 Dubai – F004885 Seychelles – SD015 United Kingdom – 801701 Mauritius – 094286/GBL Kenya – CMA license 155 |

| 🌎Global Registrations | France ACPR – 53684 Germany BaFin – 132342 Hungary MNB – K8761153 Italy CONSOB– 3673 Norway – FT00080085 Spain CNMV – 3427 Sweden FI – 31987 Austria FMA Bulgaria FSC Croatia HANFA Czech Republic CNB Denmark Finanstilsynet Estonia FSA Finland FSA Greece HCMC Iceland FME Central Bank of Ireland Latvia FKTK Liechtenstein FMA Lithuania LietuvosBankas Luxembourg CSSF Malta MFSA Netherlands AFM Poland KNF Portugal CMVM Romania ASF Slovakia NBS Slovenia ATVP |

| 📝DFSA Regulation | ✅Yes |

| 🚩Regional Restrictions | The United States, Canada, Sudan, North Korea, and Syria |

| ☪️Islamic Account | ✅Yes |

| 🆓Demo Account | ✅Yes |

| 🖋️Non-expiring Demo | ✅Yes |

| ⏰Demo Duration | Unlimited |

| 📈Retail Investor Accounts | 4 |

| 📉PAMM Accounts | ✅Yes |

| 💧Liquidity Providers | Barclays UK, BNP Paribas, and others |

| 👥Affiliate Program | ✅Yes |

| 📝Order Execution | Market |

| 🗂️OCO Orders | None |

| ▶️One-Click Trading | ✅Yes |

| ✳️Scalping | ✅Yes |

| 🧱Hedging | ✅Yes |

| 🔖Expert Advisors | ✅Yes |

| 🗞️News Trading | ✅Yes |

| 📊Trading API | ✅Yes |

| 📈Starting spread | 0.0 pips |

| 💰Minimum Commission per Trade | From $6 per round turn on Forex |

| 💴Decimal Pricing | 5th Decimal after the comma |

| ➡️Margin Call | Between 40% to 50% |

| ⛔Stop-Out | Between 10% and 20% |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | 60 lots |

| 🪙Crypto trading offered | ✅Yes |

| 📖Offers an AED Account | None |

| 👤Dedicated Dubai Account Manager | None |

| 📒Maximum Leverage | 1:2000 |

| ✂️Leverage Restrictions for Dubai | None |

| 💶Minimum Deposit (AED) | 0 AED ($0) |

| 💱Deposit Currencies | USD, AED, EUR, GBP, CHF, JPY, NZD, CAD, ZAR, and more. |

| 💷AED Deposits Allowed | ✅Yes |

| 📈Account Base Currency | EUR, USD, NGN, ZAR |

| 📊Active Dubai Trader Stats | 49,000+ |

| 🔎Active Dubai-based HFM customers | Unknown |

| 💹Dubai Daily Forex Turnover | 13.1 billion USD |

| 🔁Deposit and Withdrawal Options | Bank Wire Transfer Electronic Transfer Credit Card Debit Card Skrill |

| ⏱️Minimum Withdrawal Time | 10 Minutes |

| ⏰Maximum Estimated Withdrawal Time | 10 business days |

| 💸Instant Deposits and Instant Withdrawals | None |

| 🏦Segregated Accounts with Emirati Banks | None |

| 📈Trading Platforms | MetaTrader 4 MetaTrader 5 HF App |

| ⌚Trading Platform Time | UTC +02h00 |

| 👁️Observe DST Change | ✅Yes |

| 🌐DST Change Time zone | Eastern European Time (EET) |

| 💎Tradable Assets | Forex Precious Metals Energies Indices Shares Commodities Cryptocurrencies Bonds Stocks DMA ETFs |

| 💵Offers USD/AED currency pair | None |

| ⏲️USD/AED Average Spread | None |

| 📉Offers Emirati Stocks and CFDs | None |

| 🖥️Languages supported on the Website | English, Portuguese, Spanish |

| 🔊Customer Support Languages | Multilingual |

| 👥Copy Trading Support | ✅Yes |

| 🕰️Customer Service Hours | 24/5 |

| 📍Dubai-based customer support | None |

| 💰Bonuses and Promotions for Dubai Traders | ✅Yes |

| 🎓Education for Emirati beginners | ✅Yes |

| 💻Proprietary trading software | ✅Yes |

| 🥇Most Successful Trader in Dubai | Several – Yasser R, Ali A, Maaz A, Warren Takunda |

| 👍Is HFM a safe broker for Dubai Traders | ✅Yes |

| 🏆Rating for HFM Dubai | 9/10 |

| 💯Trust score for HFM Dubai | 85% |

HFM Advantages Over Competitors

HFM has the following advantages over competitors:

- ✅HFM provides traders with various trading tools and services, such as economic calendars, trading calculators, and VPS hosting, to help them make informed decisions and improve their trading experience.

- ✅Using industry-leading platforms such as MetaTrader 4 and MetaTrader 5, HFM distinguishes itself from competitors by providing an intuitive user interface combined with advanced trading features.

- ✅HFM offers a wide range of account types and an unrivaled selection of trading assets.

- ✅HFM offers flexible leverage options up to a maximum of 1:2000, allowing traders to increase their potential profits even with a small investment.

- ✅HFM ensures that trading orders are executed instantly, allowing traders to enter and exit the market at their preferred price points, which is critical for effective trading.

- ✅With highly favorable trading conditions and spreads as low as 0 pips, HFM creates an environment where traders can maximize their profit potential.

- ✅HFM is licensed by multiple regulatory bodies, including CySEC, FCA, DFSA, FSCA, and FSA, and is owned by the HF Markets Group.

- ✅With insurance coverage of up to $5,000,000, HFM provides traders with an extra layer of financial security, giving them a distinct advantage over many competitors.

- ✅HFM allows traders to supplement their income by copy trading or investing in PAMM accounts. The lack of a minimum deposit requirement makes HFM accessible to traders with various financial constraints, providing inclusivity often lacking in the industry.

and more!

Who will Benefit from Trading with HFM?

- ✅HFM’s Pro and Premium accounts, high leverage, and advanced trading tools will benefit professional and seasoned traders.

- ✅Those looking to diversify their investment portfolio will appreciate HFM’s wide range of products, including CFDs on various asset classes.

- ✅With the Cent account and educational resources, novice traders can start trading with a low barrier to entry and learn about the financial markets.

- ✅HFM’s Swap-free accounts will benefit Emirati traders who follow Islamic finance principles.

- ✅Affiliate marketers can supplement their income through HFM’s affiliate and sub-affiliate programs.

How does HFM’s bonus system stand out?

HFM provides a variety of bonuses, including a Virtual to Real Demo Contest and a Boosted Balance Bonus, which are uncommon among brokers.

What unique educational resources does HFM offer?

In collaboration with PSG, their sponsored football team, HFM offers an eight-step guide for traders to improve their trading skills.

HFM Safety and Security

HFM Regulation in Dubai

The Dubai Financial Services Authority (DFSA) regulates HFM under license number F004885. Furthermore, HFM global regulations are listed in the table below:

| 🔑Registered Entity | 🌎Country of Registration | 🔢Registration Number | 🚨Regulatory Entity | 🥇Tier | 🖋️License Number/Ref |

| 1️⃣HF Markets SA (PTY) Ltd | South Africa | 2015/341406/07 | FSCA | 2 | FSP 46632 |

| 2️⃣HF Markets (Europe) Ltd | Cyprus | HE 277582 | CySEC | 2 | 183/12 |

| 3️⃣HF Markets (Seychelles) Ltd | Seychelles | 8419176-1 | FSA | 3 | SD015 |

| 4️⃣HF Markets Ltd | Mauritius | 094286/GBL | FSC | 3 | 094286/GBL |

| 5️⃣HF Markets (DICF) Ltd | Dubai | N/A | DFSA | 2 | F004885 |

| 6️⃣HF Markets (UK) Ltd | United Kingdom | 11118651 | FCA | 1 | 801701 |

| 7️⃣HFM Investments Limited | Kenya | N/A | CMA | 2 | 155 |

HFM Protection of Client Funds

| 🔑Security Measure | ℹ️ Information |

| 🔒Segregated Accounts | ✅Yes |

| 🔓Compensation Fund Member | ✅Yes |

| 🔐Compensation Amount | 5 million EUR |

| 🔏SSL Certificate | ✅Yes |

| 🗝️2FA (Where Applicable) | ✅Yes |

| 🔒Privacy Policy in Place | ✅Yes |

| 🔓Risk Warning Provided | ✅Yes |

| 🔏Negative Balance Protection | ✅Yes |

| 🔐Guaranteed Stop-Loss Orders | None |

HFM Security while Trading

HFM prioritizes ensuring a secure trading environment for its clients. Multiple financial authorities regulate the broker, including CySEC, FCA, DFSA, FSCA, and the FSA.

This strong regulatory framework demonstrates HFM’s commitment to following industry standards and best practices in financial security.

Furthermore, HFM provides substantial insurance coverage of up to $5,000,000, providing traders with additional financial protection. MetaTrader 4 and MetaTrader 5 trading platforms are outfitted with advanced encryption technologies to protect data and financial transactions.

These measures work together to provide a safe trading environment, allowing traders to concentrate on their investment strategies rather than worrying about the safety of their funds.

Pros and Cons of Regulation and Safety of Funds

| ✅Pros | ❎Cons |

| HFM is regulated globally and has multiple licenses in countries | High leverage can lead to loss of capital regardless of negative balance protection |

| There is investor protection of up to 5 million EUR, more than offered by other brokers | Investor protection is restricted to certain regions |

Is my money insured with HFM?

Yes, HFM keeps client funds in separate accounts but does not publicly disclose information about insurance on those funds.

Does HFM comply with AML policies?

Yes, HFM follows anti-money laundering (AML) policies.

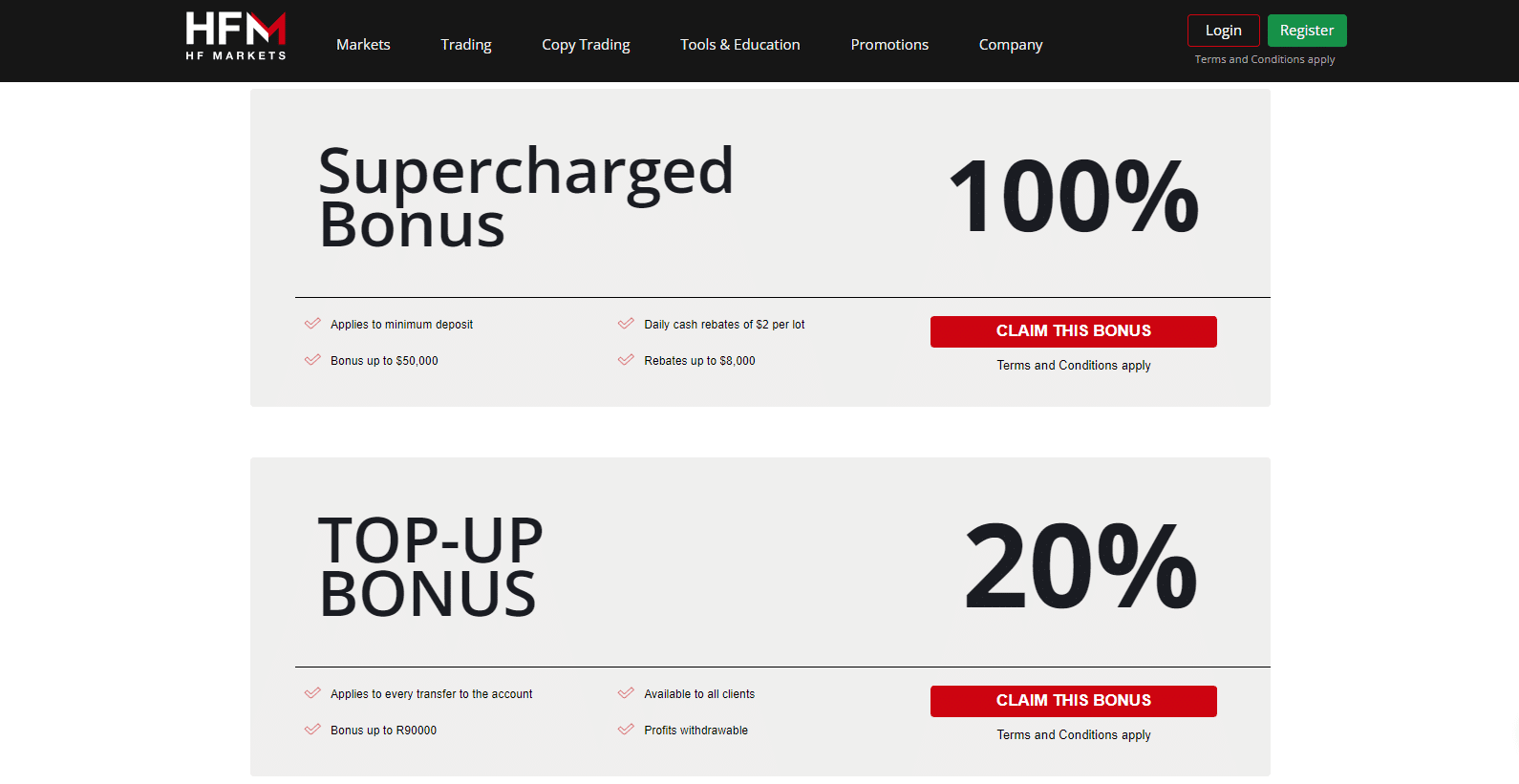

HFM Bonus Offers and Promotions

HFM offers Emirati traders the following bonuses and promotions:

- ✅As part of the HFM Trading Rewards Loyalty Program, you can trade often and earn HFM Bars. As you move up the reward levels (Red, Silver, Gold, and Platinum), you can turn your Bars into real cash or useful trading services to help you on your trading journey.

- ✅Stay tuned to HFM’s social media platforms for a chance to win high-end gadgets like the PlayStation 5, iPhone 14 Pro Max, and GoPro Hero 11. This promotion makes things more interesting and allows traders to win tech prizes that fit their lifestyles.

- ✅In HFM’s “Virtual to Real” Demo Contest, you can show off your trading skills and compete for real cash prizes without risking real money. With this contest, you can use the trading skills you have learned online to make money in the real world.

- ✅HFM’s Boosted Balance Bonus gives you more trading power. This tempting offer gives you a 20% bonus on every deposit, giving you more money to trade with. Also, you can take out all of the money you make from this bonus.

- ✅Show off your trading skills to win $1,000 cash and a prestigious obelisk trophy. The winner also gets a coveted spot in the HFM Hall of Fame, and the top 10 traders get special recognition on the HFM Traders Awards page.

- ✅As a thank you to its loyal traders and business partners, HFM gives them exclusive branded items. This project will help the brokerage get closer to the people in its area.

What types of bonuses does HFM offer?

HFM offers a Virtual to Real Demo Contest, a Boosted Balance Bonus, and a $1,000 Monthly Cash Prize.

Do I need to deposit to claim an HFM bonus?

Yes, some bonuses, such as the Boosted Balance Bonus, necessitate a deposit.

HFM Affiliate Program Features

The affiliate program at HFM is not a one-size-fits-all solution. It is designed to accommodate various types of collaborations. The program includes features as listed below:

- ✅Whether you are a fund manager looking to introduce brokers, consider white labeling, or affiliate online, the program offers a partnership model tailored to your specific needs and objectives.

- ✅HFM provides its affiliates with various marketing materials to facilitate effective promotion. These include eye-catching banners, conversion-optimized landing pages, and other promotional assets.

- ✅The HFM Affiliates program is distinguished by its unwavering commitment to partner support. A dedicated affiliate support team can answer any questions or concerns, allowing affiliates to optimize their marketing strategies and maximize their earning potential.

- ✅The HFM Affiliate Program is a market leader, distinguished by its lucrative commission structure and extensive support system.

- ✅The program provides an appealing commission structure that is directly proportional to the trading volume of the clients you refer. Affiliates can earn up to 60% of net spreads and up to $15 per lot of net revenue their clients generate.

- ✅The program allows commissions to be withdrawn via various methods, including web money, alert pay, and bank checks.

How to open an Affiliate Account with HFM

To register an Affiliate Account, Emirati traders can follow these steps:

- ✅The first step is to visit the website for HFM Affiliates. You can accomplish this by clicking the link provided.

- ✅Click the “Become a Partner Now” button on the website to initiate the application process.

- ✅Fill in your personal information, such as your name, email address, phone number, and website URL, if you have one, in the application form.

- ✅After submitting the form, you must wait for the HFM Affiliates team to evaluate your application and grant approval.

Finally, upon acceptance, you will gain access to various marketing resources and tools designed to assist you in promoting HFM and earning commissions.

Is there an approval process to become an HFM affiliate?

Yes, you must wait for approval from the HFM Affiliates team after submitting the application form.

What commission rates are offered to HFM affiliates?

Affiliates can earn up to 60% of net spreads and a maximum of $15 per lot.

HFM Minimum Deposit

| 🔑Live Account | 💵Minimum Dep. |

| 🥇Cent | 0 AED / $0 |

| 🥈Premium | 0 AED / $0 |

| 🥉Zero | 0 AED / $0 |

| 🏅Pro | 367 AED / $100 |

Are there any fees for not meeting the minimum deposit?

No, there are no fees. HFM does not have a minimum deposit requirement on the Cent, Premium, or Zero Accounts. However, if you fail to meet the Pro Account minimum deposit of $100, you cannot trade.

Can I change the account type after making a minimum deposit?

Yes, you can usually change the account type, though you may need to adjust your deposit to meet the requirements of the new account.

HFM Account Types and Features

| 🔑Live Account | 💰Minimum Dep. | 📈Average Spread | 🪙Commissions | 📉Average Trading Cost |

| 💵Cent | $0 | 1.2 pips | None | 12 USD (Cents) |

| 💶Premium | $0 | 1.2 pips | None | 12 USD |

| 💷Zero | $0 | 0.0 pips | 6 USD | 6 USD |

| 💴Pro | $100 | 0.5 pips | None | 5 USD |

HFM Cent Account

Designed specifically for Emirati traders, the HFM Cent account provides a unique opportunity to engage in prudent trading. The package contains swap-free options and Cent lots that are ideal for strategic position sizing; it was designed with the needs of local traders in mind.

Trading has never been easier than it is now that 0.01 Standard lot sizes or trades worth 1,000 units are available on our highly efficient cent accounts; in addition, novices are exceptionally protected from financial penalties by utilizing a low margin requirement.

| 🔑Account Feature | ℹ️ Value |

| 💴Minimum Deposit | 0 AED ($0) |

| 📈Spreads | 1.2 pips EUR/USD |

| 💻Trading Platform | MetaTrader 4, MetaTrader 5, HF App |

| 💰Trading Instruments | 50+ Forex Pairs and Gold |

| 🚩Execution | Market Execution |

| 💹Maximum Leverage Ratio | 1:2000 |

| ⬇️Minimum Trade Size | 0.01 lot |

| ⬆️Maximum Trade Size | 7 Standard Lots (100,000 base currency) |

| 📝Maximum Open Orders | 150 lots (Simultaneous) |

| 🗂️Margin Call (%) | 40% |

| ⛔Stop-Out (%) | 10% |

| 💵Account Base Currency | USD, ZAR, NGN |

| 👤Personal Account Manager | ✅Yes |

| 💷Commission Charges | None |

| 💶Bonuses Offered | Flexible bonus offering |

HFM Premium Account

Tailored to meet the needs of Emirati retail traders, the HFM Premium account boasts customized features that cater to their preferences. These include swap-free trading options, decreased spreads, and no mandates for minimum deposits or transaction commissions.

By opting for this type of account, Emirati retail traders can experience seamless and trouble-free trading functionalities.

Furthermore, they are equipped to become a part of international financial markets under favorable circumstances whilst being given flexibility in selecting their preferred platform which suits them best.

| 🔑Account Feature | ℹ️ Value |

| 💴Minimum Deposit | 0 AED ($0) |

| 📈Spreads | From 1.2 pips EUR/USD |

| 🖥️Trading Platform | MetaTrader 4, MetaTrader 5, HF App |

| 🪙Trading Instruments | All |

| 💹Execution | Market |

| 🚩Maximum Leverage Ratio | 1:2000 |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | 60 lots |

| 📝Maximum Open Orders | 500 |

| 🗂️Margin Call (%) | 50% |

| ⛔Stop-Out (%) | 20% |

| 💵Account Base Currency | Depends on the region |

| 👤Personal Account Manager | ✅Yes |

| 💵Commission Charges | None |

| 💰Bonuses Offered | None |

| 🖋️Personalized Services | None |

| 🔃Swap Free Available | ✅Yes |

HFM Zero Account

The HFM Zero Account is an innovative trading solution designed to usher in a new era in the Dubai foreign exchange market.

This account type is distinguished using RAW super-tight spreads from reputable liquidity providers, which are transparent and eliminate hidden markups, thereby promoting trade fairness and competition.

In addition, traders can benefit from commissions as low as $0.03 per 1k lot, further enhancing the cost-effectiveness of this account option.

| 🔑Account Feature | ℹ️ Value |

| 💵Minimum Deposit | 0 AED ($0) |

| 📈Spreads | From 0.0 pips EUR/USD |

| 🖥️Trading Platform | MetaTrader 4, MetaTrader 5, HF App |

| 📉Trading Instruments | All |

| 📝Execution | Market |

| 💹Maximum Leverage Ratio | 1:2000 |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | 60 lots |

| 🗂️Maximum Open Orders | 500 |

| 🖋️Margin Call (%) | 50% |

| ⛔Stop-Out (%) | 20% |

| 💷Account Base Currency | Depends on the region |

| 👤Personal Account Manager | ✅Yes |

| 💴Commission Charges | From $6 per round turn on Forex |

| 💰Bonuses Offered | None |

| 📒Personalized Services | ✅Yes |

| 🔃Swap Free Available? | ✅Yes |

HFM Pro Account

The HFM Pro Account is designed to meet the needs of skilled Dubai-based traders who seek to improve their trading activities. This type of account is distinguished by its extremely low spreads, leverage of up to 1:2000, and absence of commissions.

Together, these advantages contribute to a superior trading experience for seasoned Emirati traders by enabling them to maximize their potential and optimize their trading strategies.

In addition, the swap-free feature of the Pro Account provides added flexibility and convenience, allowing Emirati traders to maximize their trading results without being burdened by swap fees.

| 🔑Account Feature | ℹ️ Value |

| 💷Minimum Deposit | 1367 AED ($100) |

| 📈Spreads | From 0.05 pips EUR/USD |

| 💻Trading Platform | MetaTrader 4, MetaTrader 5, HF App |

| 📉Trading Instruments | All |

| 💹Execution | Market |

| 🖋️Maximum Leverage Ratio | 1:2000 |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | 60 lots |

| 📝Maximum Open Orders | 500 |

| 📊Margin Call (%) | 50% |

| ⛔Stop-Out (%) | 20% |

| 💵Account Base Currency | Depends on the region |

| 👤Personal Account Manager | ✅Yes |

| 💴Commission Charges | None |

| 💰Bonuses Offered | None |

| 📖Personalized Services | ✅Yes |

| 🔃Swap Free Available | ✅Yes |

HFM Demo Account

The HFM Demo Account is invaluable for novice and experienced traders. It provides a trading environment that resembles actual market conditions, allowing traders to test their strategies and evaluate the broker’s offerings without incurring any financial risk.

Unlimited usage is one of its distinguishing characteristics, allowing traders to learn and practice at their own pace. The demo account provides access to over 150 tradable assets, such as forex, commodities, indices, and stocks.

Opening an HFM Demo Account is a simple process requiring registering on the HFM website. After registering, traders can access the demo account from their dashboard without making a deposit or committing any funds.

This free account is a great way for traders to become acquainted with HFM’s trading platforms, namely MetaTrader 4 and MetaTrader 5, and to evaluate key trading conditions such as spreads, leverage, and execution speed.

HFM Islamic Account

The HFM Islamic Account is a specialized trading account designed for traders who follow Islamic finance principles and wish to trade per Shariah law.

The Islamic account, available in three different trading account levels—Micro, Premium, and Zero Spread—allows traders to participate in financial markets while avoiding interest charges, which are not permitted under Islamic finance.

One of the account’s distinguishing features is its extended swap-free status, provided by default.

This allows traders to hold positions overnight without incurring swap or rollover charges, making it an ideal choice for those who trade long-term or prefer to hold positions for extended periods.

The HFM Islamic Account is on par with the broker’s regular trading accounts in terms of trading assets and platform access. Traders can choose from more than 150 tradeable assets, including forex, commodities, indices, and stocks.

They can also use the advanced MetaTrader 4 and MetaTrader 5 platforms, which include various features and tools designed to improve the trading experience.

HFM Professional Account

HFM offers a Professional Account under its retail trading accounts.

Pros and Cons of HFM Account Types and Features

| ✅Pros | ❎Cons |

| HFM’s account types are versatile and are suited to different types of traders | Emirati traders cannot register an AED-denominated account |

What types of accounts does HFM offer?

HFM provides some account types, including Cent, Premium, Zero, and Pro accounts, each with its features and benefits.

Are HFM demo accounts available?

Yes, HFM provides demo accounts for traders to practice and test strategies.

HFM Base Account Currencies and Basic Order Types

HFM Base Account Currencies

The base account currencies available to Emiratis include the following:

- ✅USD

- ✅EUR

- ✅NGN

- ✅ZAR

HFM Basic Order Types

- ✅Market Order – A market order can be either a buy or a sell order that executes at the current market price. This is the current price displayed on your price chart. If you place a market order, you will be immediately entered at the best available price.

- ✅Market orders are most effective when a trading opportunity requires prompt action. Click buy/sell at the market to enter the trade immediately.

- ✅Stop Order – A stop order can be either a buy or sell stop, depending on whether you wish to purchase above or below the market.

- ✅This is useful for trading breakouts or trend continuation strategies when you want the market to continue moving in the same direction.

Alternatively, if you believe the price will reverse when it reaches a certain price, you can place a limit order. Limit orders can be either buy or sell limits, depending on the market’s direction before your anticipated reversal. A sell limit is used to sell above the market, while a buy limit is used to purchase below the market.

How to Open and Close an HFM Account

How to Open an HFM Account

To open an account with HFM, Emiratis can follow these steps:

- ✅To open a live account, visit the HFM website or click this link.

- ✅Select your preferred entity for account creation.

- ✅Fill out your personal information, such as your country of residence, full name, phone number, email address, and date of birth.

- ✅Make a strong password (8-15 characters long, including numbers and uppercase and lowercase letters).

- ✅Examine and agree to the terms and conditions.

- ✅To proceed, click the “Register” button.

- ✅To verify your email address, check your inbox and click the “Activate Account” button.

- ✅Fill out your profile by including your birth country, title, address, and communication preferences.

- ✅Choose a trading account type that meets your requirements.

- ✅Funds can be deposited into your account using any available payment method (bank transfer, credit/debit card, e-wallets).

- ✅Verify your account by providing the required documents, such as a copy of your ID and proof of address.

Once your account has been verified, you can log in and access the trading platform to begin trading.

Can I open multiple accounts with HFM?

Yes, you can open multiple accounts, subject to certain conditions.

Can I start trading immediately after my account is verified?

Yes, you can begin trading once your account has been verified.

How to Close an HFM Account

To close a live trading account with HFM, Emirati traders can follow these steps:

- ✅Start by connecting with HFMD. You can request your account’s closure by calling or emailing them.

- ✅After contacting HFM, closing all open positions in your account is imperative. This step ensures no pending transactions could affect your account balance.

- ✅Prepare and submit an official request to HFM to close the account once all open positions have been filled. This request must contain essential information such as your name, account number, and the reason for closing the account.

Consider that HFM may require a few days to process your request to close the account. Therefore, wait until you receive confirmation from HFM that your account has been successfully closed.

Can I transfer my HFM account to another person instead of closing it?

No, accounts cannot be transferred to another person.

Do I need to pay inactivity fees before closing my HFM account?

Yes, Any outstanding inactivity fees must be paid before the account can be closed.

HFM MAM / PAMM Features

Through its PAMM (Percentage Allocation Management Module) and MAM (Multi-Account Manager) systems, HFM caters to traders who prefer to invest in the financial markets without directly executing trades.

The PAMM system is a form of pooled money forex trading in which trading account assets are transferred to the management of a selected trustee for market operations.

It has a relatively low minimum deposit requirement for PAMM accounts, at $250, and offers a maximum leverage of 1:300. Spreads in the PAMM system begin at a minimum of 0.3 pips.

The MAM system, on the other hand, is designed for professional traders and money managers who wish to monitor multiple accounts via a single interface.

This system offers features like complete manager trade security, maximum account control, and automation processes, making it a robust tool for advanced trading.

What is the maximum leverage for HFM MAM accounts?

HFM MAM accounts have a maximum leverage of 1:300.

Can I use Expert Advisors (EAs) with an HFM MAM/PAMM account?

Yes, Expert Advisors can be used with MAM/PAMM accounts.

Social Trading with HFM

HFM has a social copy trading feature called HFCopy that allows traders to interact by sharing trades and discussing strategies. The tool aims to foster a collaborative trading environment in which traders can collaborate to navigate the complexities of financial markets.

HFCopy is a powerful trading tool that provides traders with the opportunity for additional income and portfolio diversification.

The performance fee earned by successful traders who share their trades is one of HFCopy’s standout features. This provides an incentive for experienced traders to participate and share their knowledge.

HFCopy allows traders who prefer a hands-off approach to trading to follow and automatically replicate the trades of other traders directly into their brokerage accounts.

The idea behind copy trading is simple: use technology to mirror the real-time forex trades of other live investors whom one wishes to emulate.

HFCopy is a fantastic platform for traders to connect and learn from one another’s experiences. The tool is simple and provides a convenient way for traders to diversify their investment portfolios while potentially increasing profits.

With the ability to follow various successful traders, HFCopy is a versatile tool that caters to novice and experienced traders.

Is HFCopy available on all account types?

No, HFCopy is a separate feature that might not be associated with specific account types.

How do I follow other traders?

Within the HFCopy platform, you can follow traders and automatically replicate their trades.

HFM Trading Platforms

HFM offers Emirati traders a choice between these trading platforms:

- ✅MetaTrader 4

- ✅MetaTrader 5

- ✅HFM App

MetaTrader 4

While MetaTrader 4 is frequently praised for its ease of use and wide range of technical indicators, it provides “one-click trading” directly from the charts. This is especially useful for scalpers and day traders who need to execute trades quickly without switching between windows.

Furthermore, the Data Window in MT4 provides real-time data points from any selected chart, allowing traders to make more informed decisions without relying solely on visual chart patterns.

MetaTrader 5

MetaTrader 5, however, includes a Depth of Market (DOM) feature uncommon in many platform implementations. The DOM provides traders with a clear picture of market liquidity and depth for various financial instruments, allowing them to gauge market sentiment at a glance.

This is especially useful for traders using a market-making strategy or trading less liquid assets.

Another distinguishing feature is its built-in chat system, which allows traders to communicate and receive updates and news directly from MQL5.community, a MetaTrader user hub.

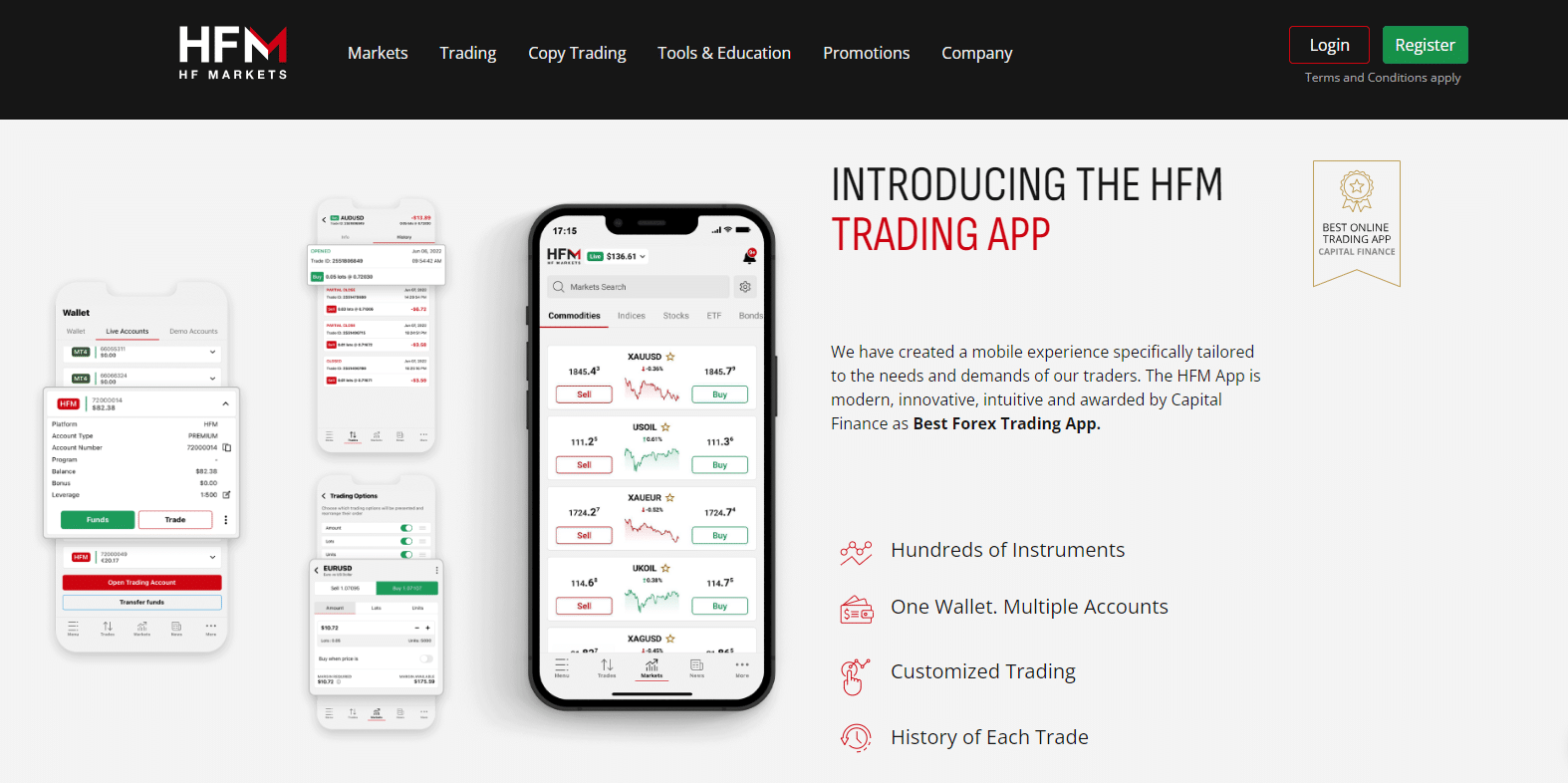

HFM App

The HFM App, HFM’s proprietary mobile trading platform, is more than just a simplified trading terminal; it is a full trading solution for those constantly moving.

While most trading apps provide basic charting and order placement functionality, the HFM App includes advanced risk management tools rarely found on mobile platforms.

For example, it enables traders to place complex conditional orders, allowing for more nuanced trading strategies beyond simple stop-loss and take-profit mechanisms.

Furthermore, the app includes a social trading feature that allows traders to interact, share insights, and even copy trades, making it a comprehensive trading tool for novice and experienced traders.

Pros and Cons HFM Trading Platforms

| ✅Pros | ❎Cons |

| HFM supports MetaTrader 4 and 5 across devices | The proprietary HFM platform is limited to mobile devices |

| HFM offers a proprietary app where traders can manage their trades, make deposits and withdrawals, and more | The HF App has a lack of functionality compared to the apps of competitors |

Is HFM’s MetaTrader 5 better than MetaTrader 4?

MetaTrader 5 has more features and assets, but whether it is superior depends on your trading requirements.

Can I have multiple accounts on the same HFM trading platform?

Yes, multiple trading accounts can be managed on the same platform.

Which Markets Can You Trade with HFM?

Emirati traders can expect the following range of markets from HFM:

- ✅Precious Metals

- ✅Energies

- ✅Spot Indices

- ✅Futures Indices

- ✅Individual Stocks and Stock CFDs

- ✅Commodities

- ✅Cryptocurrencies

- ✅Bonds

- ✅DMA Stocks

- ✅ETFs

Financial Instruments and Leverage offered by HFM

| 🔑Instrument | 🅰️Number of Assets Offered | 🅱️Max Leverage Offered |

| 📈Forex | 53 | 1:2000 |

| 💎Precious Metals | 6 | Gold: 1:2000 Silver: 1:100 Platinum: Floating Palladium: 1:20 |

| 💹ETFs | 34 | 1:5 |

| 📊Stocks DMA | 864 | 1:5 |

| 📉Indices | 24 | 1:200 |

| 📈CFD Stocks | 111 | 1:14 |

| 🪙Cryptocurrency | 40 | 1:50 |

| 💡Energies | 4 | 1:66 |

| 🗂️Bonds | 3 | 1:50 |

| 🍎Agricultural Commodities | 5 | 1:66 |

Broker Comparison for a Range of Markets

| 🔑Broker | 🥇HFM | 🥈JustMarkets | 🥉FXCM |

| 📈Forex | ✅Yes | ✅Yes | ✅Yes |

| 💎Precious Metals | ✅Yes | ✅Yes | ✅Yes |

| 📉ETFs | None | None | None |

| 💹CFDs | ✅Yes | ✅Yes | ✅Yes |

| 📊Indices | ✅Yes | ✅Yes | ✅Yes |

| 📒Stocks | ✅Yes | ✅Yes | ✅Yes |

| 🪙Cryptocurrency | ✅Yes | ✅Yes | ✅Yes |

| 💱Options | None | None | None |

| 💡Energies | ✅Yes | ✅Yes | ✅Yes |

| 🗂️Bonds | ✅Yes | None | None |

Pros and Cons HFM Range of Markets

| ✅Pros | ❎Cons |

| Emiratis can trade over 1,200 CFDs with HFM on MT4 and 5 | While HFM offers negative balance protection, traders can still lose their entire balance with high leverage |

| There is leverage of up to 1:2000 on major forex pairs | HFM does not offer local CFDs from Dubai |

Is gold and silver trading available with HFM?

Yes, precious metals such as gold and silver can be traded.

What is the minimum lot size for forex trading with HFM?

The minimum lot size varies depending on the account type, but it usually starts at 0.01.

HFM Fees, Spreads, and Commissions

HFM Spreads

Spreads are the cost of trading and vary depending on the type of account, market conditions, and financial instruments selected. For example, spreads on the Cent and Premium Accounts begin at 1.2 pips, while the Zero Account begins at 0.0 pips.

Spreads as low as 0.5 pips are available on the Pro Account. The average spread for popular instruments like EUR/USD is around 1.2 pips, while the spread for more volatile assets like BTC/USD can reach 12 pips.

For various financial instruments offered by HFM, Emirati traders can anticipate the following average spreads:

| 🔑Instrument | 📈Average Spread |

| 💵EUR/USD | 1.2 pips |

| 💴NZD/USD | 2.1 pips |

| 💶XAG/USD | 0.03 pips |

| 💷XAU/USD | 0.26 pips |

| 📍US OIL Spot | 0.06 pips |

| 📌US OIL Futures | 0.11 pips |

| 🖥️US Tech 100 Spot | 2.03 pips |

| 📱US Tech 100 Futures | 3.13 pips |

| ⚠️Volatility Index SP 500 (VIX.F) | 0.14 pips |

| 🍏APPLE (NASDAQ – APPLE) | 0.5 pips |

| 💎Commodities | From 0.008 (Copper) |

| 🪙BTC/USD | 12 pips |

| 🗂️Bonds | From 0.05 pips to 0.06 pips |

HFM Commissions

Commissions apply primarily to the HFM Zero Account. The commission per side for Forex trading begins at $0.03 for a trade size of 1,000 and increases to $3 for a trade size of 100,000. The commission per side for gold trading starts at $0.07 for 1 ounce and rises to $7 for 100 ounces.

HFM Overnight Fees

These are fees charged for holding a position overnight, also known as swaps. Market conditions determine the rates and vary across asset classes. All individual stock positions, for example, are subject to daily swaps, with triple swaps applied on Wednesdays.

Precious metals such as XAU and XAG also have daily swaps, with triple swaps on Wednesdays. Energy assets such as USOil and UKOil are charged/credited swaps in US Dollars and incur triple swaps on Wednesdays.

Here are some indicative overnight fees for Emirati traders:

| 🔑Instrument | ▶️Swap Short | ➡️Swap Long |

| 💴EUR/USD | 0.0 pip | -6.9 pips |

| 💵XAG/USD | 0.0 pips | -1.79pips |

| 💶XAU/USD | 0.0 pips | -26.52 pips |

| 📍US OIL Spot | -0.87 pips | -0.75 pips |

| 📌US OIL Futures | -0.87 pips | 0.0 pips |

| 📱US Tech 100 Spot | 0.92 pips | -3.87 pips |

| 💻US Tech 100 Futures | 0.0 pips | 0.0 pips |

| ⚠️Volatility Index SP 500 (VIX.F) | 0.0 pips | 0.0 pips |

| 🍎APPLE (NASDAQ – APPLE) | 1.32 pips | -8.82 pips |

| 💰Copper | -0.53 pips | -1.58 pips |

| 🪙BTC/USD | -6000.0 pips | -6000.0 pips |

| 🗂️Bonds | 0.0 pips | 0.0 pips |

| 📈DMA Stocks NASDAQ | -2.93 pips | -4.57 pips |

| ✴️ETFs | 1.32 pips | -8.82 pips |

HFM Deposit and Withdrawal Fees

Deposits and withdrawals are free of charge at HFM. Deposits made via bank wire transfers less than 367 AED or the equivalent of $100 may be subject to fees. Bank wire transfer fees are waived for deposits over $100.

HFM Inactivity Fees

Inactive accounts for 6 months will be charged a $5 inactivity fee. This is a one-time fee that is applied to accounts that have had no trading activity during the specified time.

HFM Currency Conversion Fees

Currency conversion fees may apply to Emirati traders who deposit or withdraw in AED. These fees are not specified, but they must be considered when making transactions in a currency other than the account’s base currency.

Pros and Cons HFM Trading and Non-Trading Fees

| ✅Pros | ❎Cons |

| HFM has a transparent trading and non-trading fee schedule | HFM will apply withdrawal fees on withdrawals below $100 |

| HFM charges variable spreads from 0.0 pips on the Zero Account and major instruments | Currency conversion fees could apply to AED deposits and withdrawals |

What are the overnight fees for EUR/USD on HFM?

EUR/USD overnight fees are 0.0 pip for short positions and -6.9 pip for long positions.

Are there any currency conversion fees with HFM?

Yes, currency conversion fees may apply for AED deposits and withdrawals.

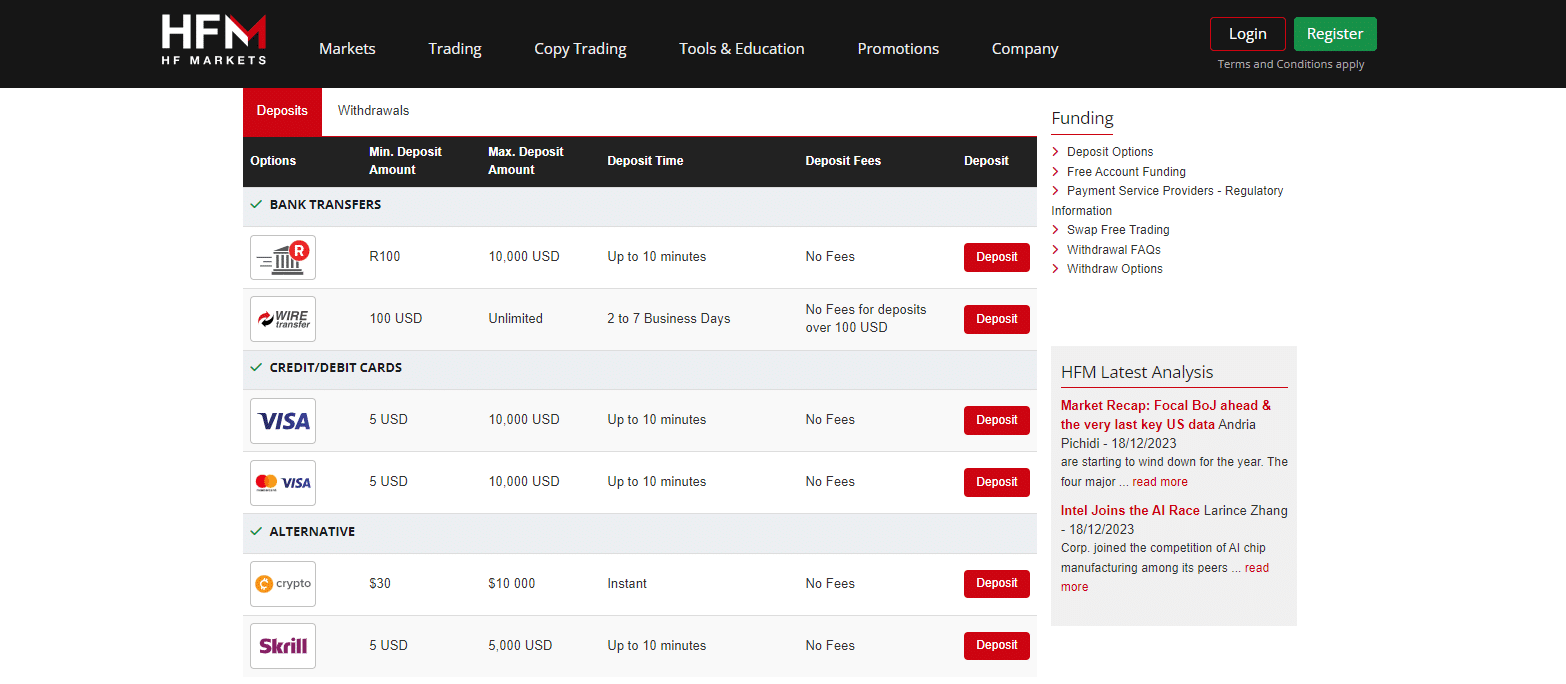

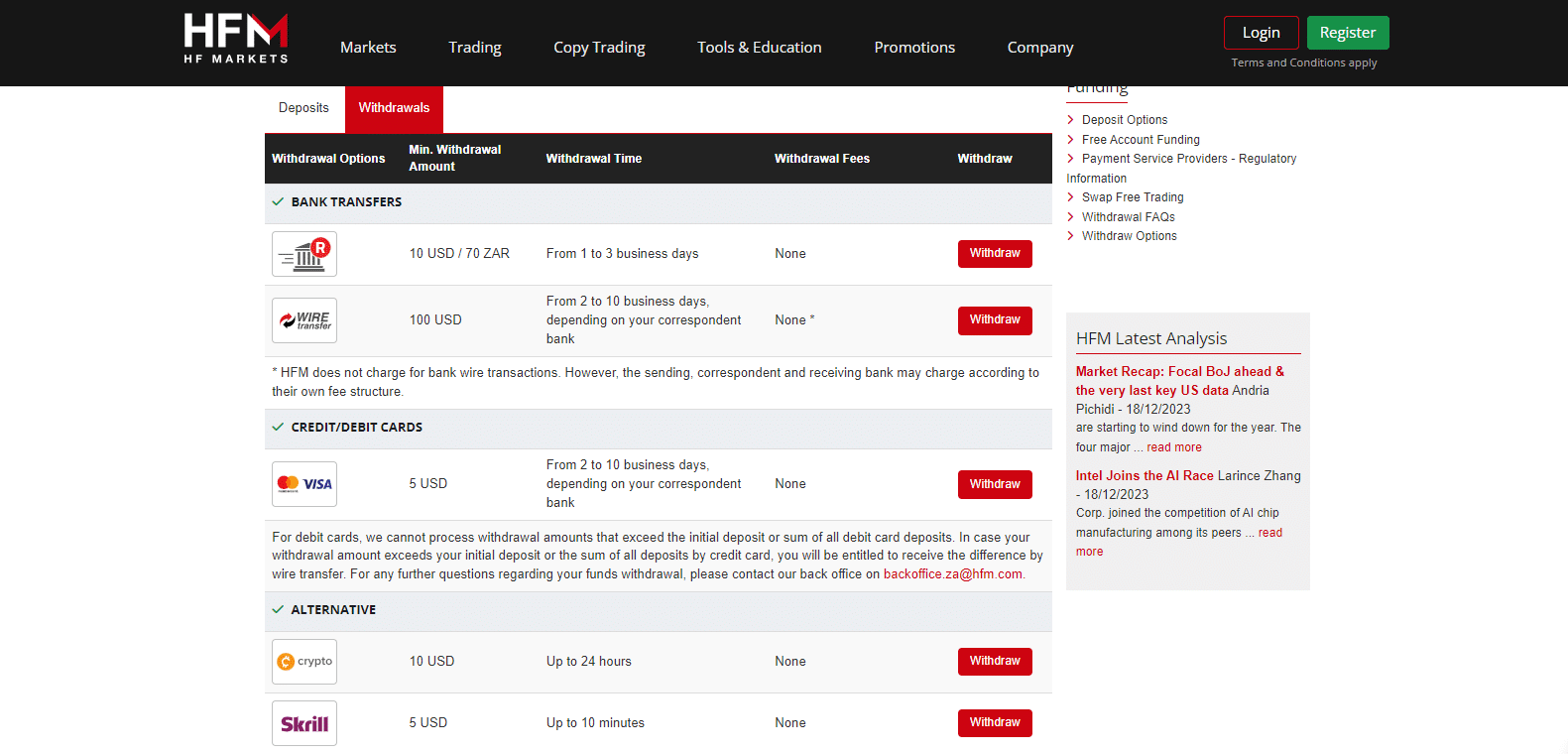

HFM Deposits and Withdrawals

HFM offers Emirati traders the following deposit and withdrawal methods:

- ✅Bank Wire Transfer

- ✅Electronic Transfer

- ✅Credit Card

- ✅Debit Card

- ✅Skrill

How to make a Deposit with HFM

To deposit funds to an account with HFM, Emirati traders can follow these steps:

- ✅Access the dashboard for your HFM account.

- ✅Get there by selecting the “Deposits” tab.

- ✅Select your preferred deposit method from the available options (such as credit/debit cards, bank wire transfers, and e-wallets).

- ✅To complete the deposit procedure, follow the on-screen instructions. These instructions may include confirming your identity or the transaction through a secondary authentication method.

Your HFM trading account will be credited with the funds following the completion of the transaction.

How long do HFM Deposits take?

- ✅Credit/Debit Card: Instant – 10 minutes

- ✅Bank Wire Transfer: 2 – 7 business days

- ✅E-wallets: Up to 10 minutes

Can I use multiple deposit methods with HFM?

Yes, you can make multiple deposits.

What currencies can I deposit in with HFM?

You can make deposits in a variety of currencies, including USD and AED.

How to Withdraw from HFM

To withdraw funds from an account with HFM, Emirati traders can follow these steps:

- ✅Sign in to the dashboard of your HFM account.

- ✅Go to the section called “Withdrawals.”

- ✅Choose the withdrawal method you want to use. Usually, it is best to use the same method you used to deposit.

- ✅Type in the amount you want to take out.

- ✅Fill out any required fields or steps for verification, which may include showing more proof of who you are.

Confirm the request to withdraw.

How long do HFM Withdrawals take?

- ✅Credit/Debit Card: 2 – 10 business days

- ✅Bank Wire Transfer: 2 – 10 business days

- ✅E-wallets: Up to 10 minutes

Can I withdraw to a different HFM account than the one I used for depositing?

No, withdrawals must be made to the same account from which the deposit was made.

Can I cancel an HFM withdrawal request?

Yes, you can cancel a withdrawal request before it is processed.

HFM Deposit Currencies, Deposit and Withdrawal Processing Times

| 🔑Payment Method | 💱Deposit Currencies | 📝Deposit Processing | 🗂️Withdrawal Processing | ⬆️Max Deposit | ⬇️Min Withdrawal |

| 🏦Bank Wire Transfer | Depends on region | 2 to 7 working days | 2 to 10 working days | Unlimited | 100 USD |

| 💻Electronic Transfer | Depends on region | Up to 10 min | Up to 2 working days | 10,000 USD | 10 USD or 70 ZAR |

| 💴Credit Card | Depends on region | Up to 10 min | 2 to 10 working days | 10,000 USD | 5 USD |

| 💳Debit Card | Depends on region | Up to 10 min | 2 to 10 working days | 10,000 USD | 5 USD |

| ⏩Skrill | Depends on region | Up to 10 min | Up to 10 Min | 10,000 USD | 5 USD |

Broker Comparison: Deposit and Withdrawals

| 🔑Broker | 🥇HFM | 🥈JustMarkets | 🥉FXCM |

| ⬇️Minimum Withdrawal Time | 10 Minutes | Instant | Instant |

| ⬆️Maximum Estimated Withdrawal Time | 10 business days | 10 bank days | Up to 2 working days |

| ➡️Instant Deposits and Instant Withdrawals | None | ✅Yes | ✅Yes |

Pros and Cons of HFM Deposits and Withdrawals

| ✅Pros | ❎Cons |

| HFM has unlimited deposits when Emiratis use Bank Wire | Withdrawal fees are charged on Bank Wire withdrawals <$100 |

| Emiratis can deposit and withdraw using flexible and reliable payment methods | HFM does not provide comprehensive information on deposits and withdrawals, especially for different regions like Dubai |

| Electronic Transfers, Credit/Debit Cards, and Skrill deposits are handled within minutes | Instant withdrawals are not available with HFM |

Are there any deposit fees with HFM?

No, all deposits with HFM are free of charge.

How long do withdrawals take with HFM?

Withdrawals from credit and debit cards take 2-10 business days, bank wire transfers take 2-10 business days, and e-wallets take up to 10 minutes.

HFM Education and Research

Education

HFM offers the following Educational Materials to Emirati traders:

- ✅HFM Educational Videos

- ✅Training Course Videos

- ✅Forex Education

- ✅eCourses

- ✅Live Webinars

- ✅Events

and more!

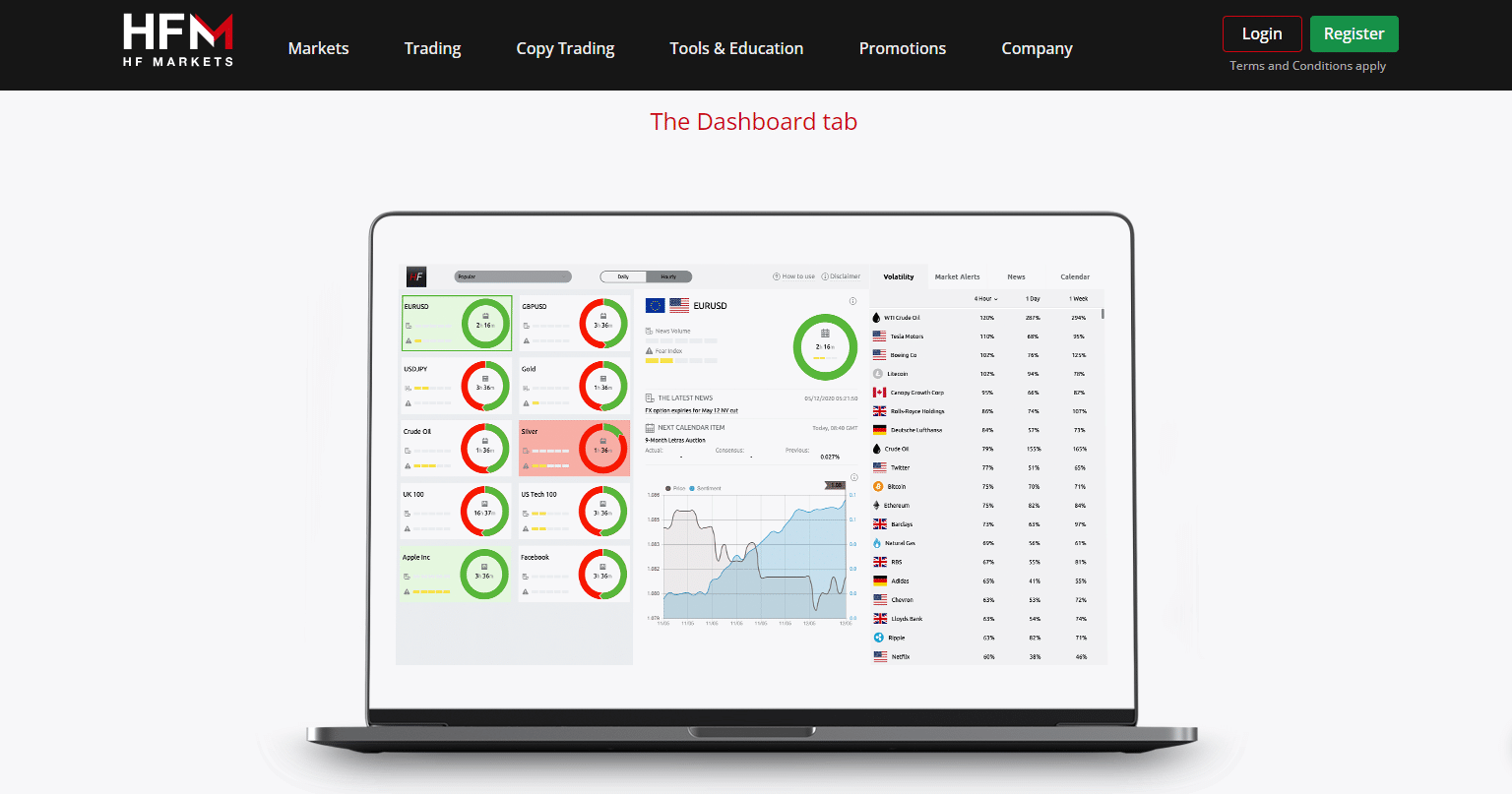

HFM also offers Emirati traders the following additional Research and Trading Tools:

- ✅HF App

- ✅VPS Hosting Services

- ✅Premium Trader Tools

- ✅AutoChartist Tools

- ✅Trading Calculators

- ✅myHF Client Area

- ✅Advanced Insights

- ✅Economic Calendar

and much more!

Research and Trading Tool Comparison

| 🔑Broker | 🥇HFM | 🥈JustMarkets | 🥉FXCM |

| 🔢Economic Calendar | ✅Yes | ✅Yes | ✅Yes |

| 🔒VPS | ✅Yes | ✅Yes | ✅Yes |

| 💹AutoChartist | ✅Yes | None | None |

| 👁️Trading View | None | None | ✅Yes |

| 📍Trading Central | None | None | None |

| 📈Market Analysis | ✅Yes | ✅Yes | ✅Yes |

| 🗞️News Feed | ✅Yes | ✅Yes | ✅Yes |

| 💻Blog | ✅Yes | ✅Yes | ✅Yes |

Pros and Cons of HFM Education and Research

| ✅Pros | ❎Cons |

| HFM’s educational materials are decent, offering beginners a sound foundation | HFM does not offer popular third-party software like Trading Central or TradingView |

Is there a news feed on HFM’s website?

Yes, HFM provides a news feed to keep traders updated on market developments.

Is there a community forum for traders on HFM?

No, HFM does not have a community forum, but it does have social trading capabilities.

HFM Customer Support

| 🔑Customer Support | 🥇HFM Customer Support |

| ⏰Operating Hours | 24/5 |

| 🌎Support Languages | Multilingual |

| 🔊Live Chat | ✅Yes |

| 💻Email Address | [email protected] |

| ☎️Telephonic Support | ✅Yes |

| 🏆The overall quality of HFM Support | 4/5 |

Pros and Cons HFM Customer Support

| ✅Pros | ❎Cons |

| HFM has helpful and prompt customer support across communication channels | Customer support is limited to market hours, which are 24/5 |

Does HFM offer technical support?

Yes, technical support is available for trading platform and account access issues.

Is there a customer support hotline?

Yes, HFM has a customer service hotline where you can get immediate help.

HFM VPS Review

HFM provides Virtual Private Server (VPS) hosting services, which give clients dedicated server space and a reserved set of resources, allowing for more control and customization than shared hosting.

The allocation of dedicated resources, such as an individual operating system, server applications, and root access control, is a key feature of HFM’s VPS hosting.

With plans starting at $30 per month, the service is a viable alternative to the financial and logistical burdens of maintaining physical servers. HFM offers both managed and unmanaged VPS hosting.

HFM manages all server-related responsibilities, such as maintenance and software updates, allowing clients to concentrate on their core business activities. On the other hand, unmanaged VPS hosting requires clients to manage their server environment independently.

Furthermore, HFM provides flexible plans tailored to specific business needs, allowing for seamless scaling as resource requirements change. Clients can choose between Linux and Windows-based VPS hosting, as well as a variety of RAM, CPU, and storage configurations.

Does HFM offer managed VPS hosting?

Yes, HFM provides managed and unmanaged VPS hosting plans.

How flexible are HFM’s VPS plans?

HFM provides several VPS plans, including Linux and Windows-based hosting with varying RAM, CPU, and storage capacities.

HFM Cashback Rebates Features and Conditions

HFM provides a lucrative Cashback Rebate program designed specifically for affiliates, including those in the Emirati trading community.

Affiliates can significantly increase their earnings by earning 60% of the net spreads generated by the traders they refer to HFM. Furthermore, affiliates can earn up to $15 in cashback rebates for each lot their referred clients trade.

HFM has taken it further by launching the RevShare+ affiliate program, which goes above and beyond the standard revenue-sharing commission structure.

In addition to regular commissions, RevShare+ affiliates can earn monthly bonuses based on specific performance metrics such as new client acquisitions, lots traded, and cash flow generated. Monthly incentives for meeting these predetermined objectives can range from $100 to $5,000.

The RevShare+ program provides numerous benefits, including allowing affiliates to supplement their earnings with monthly bonuses. It also creates new revenue opportunities by driving new client acquisitions and trading activity.

The program provides a more comprehensive and rewarding affiliate experience compared to traditional commission models.

Is there a revenue share for HFM affiliates?

Yes, affiliates can earn 60% of the net spreads generated by their referred clients.

Can I increase revenue by driving new HFM client acquisitions?

Yes, RevShare+ is intended to assist you in increasing revenue by acquiring new clients and stimulating trading activity.

HFM Web Traffic Report

| 🌎Global Rank | 27,071 |

| 🌐Country Rank | 6,517 |

| 📊Category Rank | 84 |

| 📈Total Visits | 2.2 million |

| ✳️Bounce Rate | 57.46% |

| 📖Pages per Visit | 4.16 |

| ⏰Average Duration of Visit | 00:04:46 |

| 📝Total Visits in the last three months | June – 1.7 million July – 2.1 million August – 2.2 million |

HFM Geographic Reach and Limitations

HFM’s Current Expansion Focus

HFM is currently expanding globally across Asia, Africa, Europe, etc.

Countries not accepted by HFM

HFM does not accept clients from these countries:

- ✅The United States

- ✅Canada

- ✅North Korea

- ✅Syria

- ✅Sudan

Popularity among Emirati traders who choose HFM

HFM is one of the Top 10 forex and CFD brokers for Emirati traders.

Are there any countries where HFM is restricted?

In countries where financial sanctions are in place or where local laws prohibit Forex trading, HFM is restricted.

Is HFM compliant with Sharia law?

Yes, HFM provides an Islamic account that is Sharia-compliant.

Best Countries by Traders

| 🌎Country | 📈Market Share |

| 🥇Japan | 61.43% |

| 🥈Nigeria | 5.05% |

| 🥉Indonesia | 3.45% |

| 🏅Malaysia | 3% |

| 🎖️Serbia | 2.03% |

HFM vs JustMarkets vs FXCM – A Comparison

| 🔑Broker | 🥇HFM | 🥈JustMarkets | 🥉FXCM |

| 🚨Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | FSA | FCA, ASIC, CySEC, FSCA |

| 📈Trading Platform | MetaTrader 4 MetaTrader 5 HFM App | MetaTrader 5 MetaTrader 4 JustMarkets App | Trading Station MetaTrader 4 NinjaTrader ZuluTrade Capitalise AI TradingView Pro QuantConnect MotiveWave AgenaTrader Sierra Chart SeerTrading NeuroShell Trader |

| 💴Withdrawal Fee | None | None | ✅Yes, bank wire |

| 🆓Demo Account | ✅Yes | ✅Yes | ✅Yes |

| ⬇️Min Deposit | 0 AED | 4 AED | 184 AED |

| 📉Leverage | 1:2000 | Up to 1:3000 | 1:30 (FCA) 1:400 (Other Reg) |

| 📉Spread | 0.0 pips | From 0.0 pips | From 0.2 pips EUR/USD |

| 💰Commissions | $6 per round turn | $3 units per lot/side | $25 per $1m traded |

| ⛔Margin Call/Stop-Out | 50%/20% | 40%/20% | 100%/50% |

| 📝Order Execution | Market | Market | Market |

| 💵No-Deposit Bonus | None | ✅Yes | None |

| 🪙Cent Accounts | None | ✅Yes | None |

| 💳Account Types | Cent Account Premium Account Zero Account Pro Account | MetaTrader 4 Standard Cent Account MetaTrader 4 Standard Account MetaTrader 4 Pro Account MetaTrader 4 Raw Spread Account MetaTrader 5 Standard Account MetaTrader 5 Pro Account MetaTrader 5 Raw Spread Account | Spread Betting CFD Trading Active Trader Professional Trader |

| 📌DFSA Regulation | None | None | None |

| 💶AED Deposits | ✅Yes | ✅Yes | None |

| 🗂️AED Account | None | None | None |

| ⏰Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 💹Retail Investor Accounts | 4 | 7 | 1 |

| ☪️Islamic Account | ✅Yes | ✅Yes | ✅Yes |

| ⬇️Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| ⬆️Maximum Trade Size | 500 lots | 100 lots | 50 million per trade on Forex |

| 💷Minimum Withdrawal Time | 10 Minutes | Instant | Instant |

| ⏱️Maximum Estimated Withdrawal Time | 10 business days | 10 bank days | Up to 2 working days |

| 💸Instant Deposits and Instant Withdrawals | None | ✅Yes | ✅Yes |

HFM Alternatives

- 🥇 OANDA is well-known for its strict regulatory framework and clear pricing. Along with MetaTrader 4, OANDA provides a proprietary trading platform with advanced charting tools and an easy-to-use interface. OANDA is popular among novice and experienced traders due to its API trading and customizable layouts.

- 🥈 Pepperstone’s EDGE technology allows for ultra-low spreads and rapid execution speeds. Pepperstone offers both MetaTrader 4 and cTrader platforms and various trading instruments such as forex, CFDs, and cryptocurrencies. Furthermore, Pepperstone’s customer service is highly rated, which adds to its allure.

- 🥉 FP Markets excels at providing diverse trading instruments, such as forex, indices, commodities, and stocks. FP Markets is well-known for its robust trading software and tight spreads but offers many educational resources. In addition, FP Markets’ strong customer service and transparent pricing make it a trustworthy option for traders.

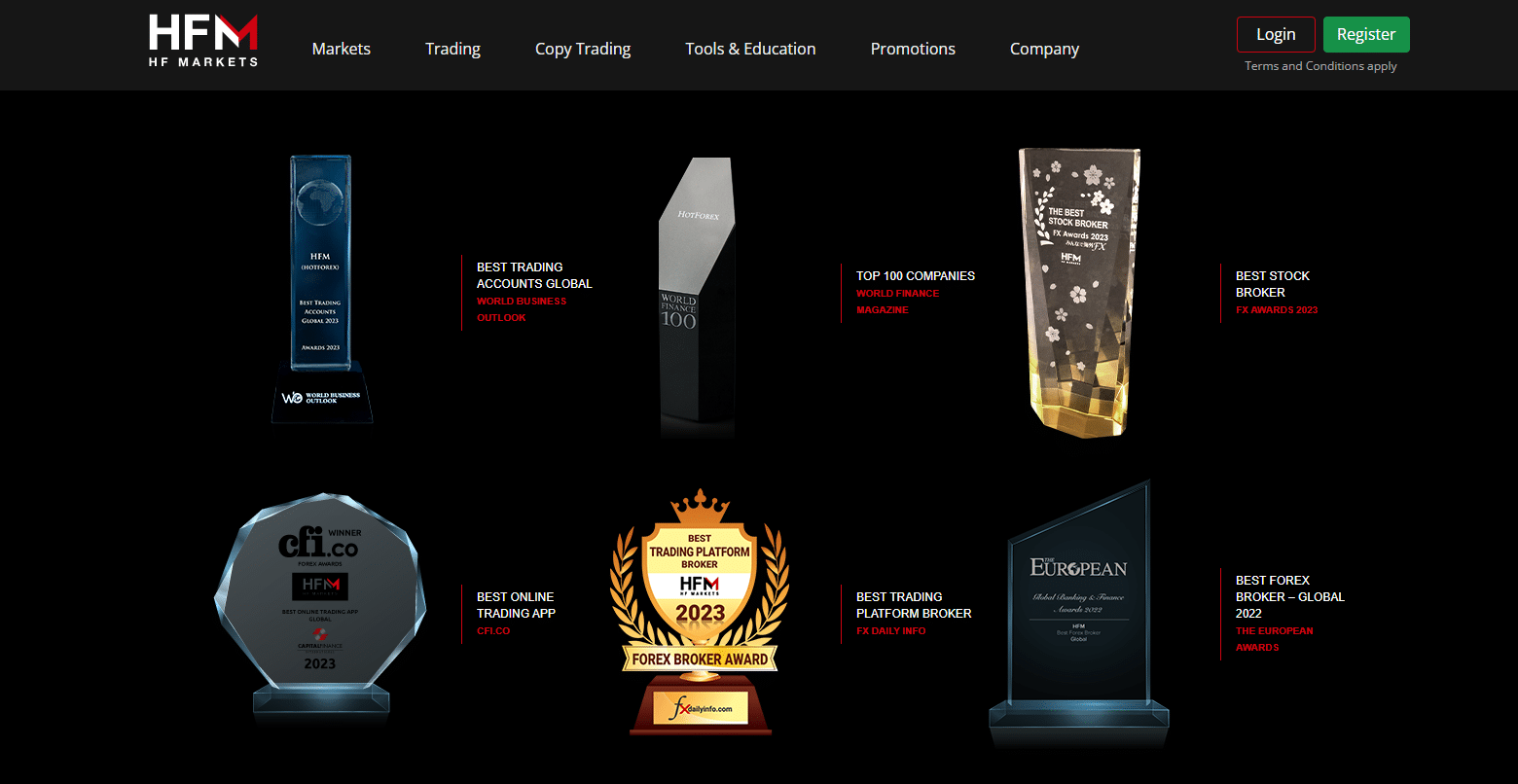

HFM Awards and Recognition

HFM received the following recent awards and recognition:

- ✅Best Trading Accounts Globally in 2024, awarded by the World Business Outlook.

- ✅Top 100 Companies in 2024, awarded by the World Finance Magazine.

- ✅The Best Stock Broker in 2024, awarded during the FX Awards.

- ✅Best Online Trading App in 2024, awarded by CFI.CO.

- ✅Best Trading Platform Broker in 2024, awarded by FX Daily Info.

- ✅Best Forex Broker Globally (2022), awarded during the European Awards.

and more!

Our Experience with HFM

Our trading experience with HFM was quite satisfying. The platform is intuitive and suitable for both novice and experienced traders. We were particularly impressed by the variety of available financial instruments.

We appreciated the competitive spreads and the absence of hidden fees. The demo account was a wonderful feature that allowed us to test our strategies without any financial risk.

HFM Trading Platform

HFM’s trading platforms are robust and user-friendly, specifically MetaTrader 4 and MetaTrader 5. The advanced charting tools and various technical indicators assisted us in making informed trading decisions.

Furthermore, the mobile app was also useful, enabling us to trade on the go without any problems. We also noted the social trading capabilities, which allowed us to learn from other traders and even copy their trades.

Quality of Customer Service

Additionally, HFM excelled in customer service. We found the support team to be knowledgeable and responsive. They promptly resolved any issues we encountered, which made our trading experience even more enjoyable.

In addition, the availability of multiple support channels, including live chat and email, contributed to the overall satisfaction.

HFM Response Time

| 🔑Support Channel | ⏰Average Response Time | ⌚User-based Response Time |

| ☎️Phone | 5 – 10 minutes | 5 minutes |

| 1 working day | Same-day | |

| 🔊Live Chat | 5 minutes | Live chat is not working – an error kept saying that the session expired on the web and mobile browser |

| 📱Social Media | 5 minutes | 2 – 5 minutes |

| 👥Affiliate | 1 working day | Same-day |

Recommendations according to our in-depth review of HFM

- ✅More in-depth market research tools and analysis could give traders a competitive advantage in making more informed decisions.

- ✅Expanding the platform’s language options could make it more accessible to a global audience.

- ✅While HFM’s platforms are robust, the user interface could be more intuitive to cater to new traders.

- ✅Advanced risk management features such as guaranteed stop-loss orders could provide traders with an additional safety net.

- ✅Although HFM provides customer support, having it available 24 hours a day, seven days a week, could improve the user experience, especially for traders in different time zones.

- ✅Increasing the number of payment options can make deposits and withdrawals more convenient for a broader range of clients.

Finally, while HFM offers a variety of promotions, more frequent and diverse promotional offers may appeal to a broader range of traders.

HFM Customer Reviews

🥇Exceptional assistance.

It is impressive how quickly problems are solved. Everyone on staff is exceptionally helpful and quick to resolve any issues that may arise. My experiences with the group have been excellent. – Amira Rashed

🥈Great experience!

After more than three years of trading, my experience with HFM has been the best with any brokerage. The services are excellent, and I appreciate the quick and helpful responses I receive when I contact customer service. – Khalifa Sharqawi

🥉Receptive to suggestions.

As an HFM client, I’d like to share my thoughts on the company’s receptiveness to suggestions and criticisms. After hearing feedback from several customers, the company updated its look. The company’s dedication to evolving in response to customer feedback is on full display here. – Sultan Khouri

Pros and Cons of Trading with HFM

| ✅Pros | ❎Cons |

| HFM MetaTrader 4 and MetaTrader 5 offer a user-friendly and feature-rich trading experience | High leverage can boost profits but also increase the risk of large losses |

| Up to $5,000,000 in insurance coverage provides financial security | Being regulated by multiple bodies means the broker must follow different rules, which may confuse traders unfamiliar with them |

| UAE traderscan benefit from HFM’s extensive educational materials | The many account types and trading assets may overwhelm novice traders |

| Low transaction costs and spreads help traders maximize profits | Lack of a minimum deposit and high leverage could encourage overtrading, resulting in significant losses |

| HFM’s Copy Trading and PAMM Accounts give Emirati traders more income and diversification | HFM offers cryptocurrencies, but these markets are volatile, putting inexperienced traders at risk |

In Conclusion

Our overall impression of HFM is that it is a solid platform that caters to a wide range of traders, from novices to professionals.

The trading platforms available, particularly MetaTrader 4 and MetaTrader 5, offer a user-friendly interface and advanced trading tools that are rarely discussed, such as a customizable charting package and the ability to implement algorithmic trading strategies.

Customer service is excellent, with a dedicated, responsive, knowledgeable support team. This is important because effective customer service can make or break the trading experience.

HFM’s fee structure is clear and competitive, particularly for Emirati traders. The spreads are reasonable, and the lack of deposit and withdrawal fees is a big plus. The overnight fees are also clearly stated, leaving no room for misunderstanding.

Another strong point is the affiliate program, which offers competitive commissions and a flexible structure for various types of partnerships. The Cashback Rebates and RevShare+ initiatives are particularly profitable, offering affiliates multiple ways to earn.

However, no broker is without flaws. While HFM provides various educational resources, it could be more comprehensive to serve new traders better. Furthermore, while VPS services are beneficial, they come at an additional cost that some traders may find unappealing.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Emirati investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Frequently Asked Questions

What are the trading costs at HFM?

HFM’s trading costs are slightly higher than the industry average.

Does HFM offer copy trading?

Yes, in addition to its enhanced MetaTrader offering and high-quality research, HFM provides a proprietary copy trading platform called HFcopy.

Does HFM have VIX 75?

Yes, the Volatility 75 index is accessible through HFM, with spreads starting at 0.14 pips.

Is HFM Safe or a Scam?

HFM is a safe broker. Furthermore, HFM is a reputable brokerage company with a strong presence in the market.

What is the minimum deposit required to open an account with HFM?

To open an account with HFM, no minimum deposit is required.

Is HFM regulated?

Yes, HFM is multi-regulated. The FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA govern HFM. These oversight organizations ensure the broker complies with legal requirements and ethical guidelines.

What is the leverage offered by HFM?

HFM provides leverage of up to 1:2000.

How long does it take to withdraw from HFM?

When using HFM, withdrawals take 10 minutes with Skrill and 10 days with other payment methods like bank wire transfers and credit/debit cards.

What trading platforms does HFM offer?

HFM provides MetaTrader 4 and MetaTrader 5 trading platforms.

Does HFM have Nasdaq 100?

Yes, under the name “US Tech 100,” HFM offers Nasdaq as spot and futures contracts on indices.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai