BDSwiss Review

Overall, BDSwiss offers Emirati traders more than CFD and Forex Trading. BDSwiss offers AutoChartist and Trading Central to Emiratis as part of its all-around offering. BDSwiss Review shows that they offer an intuitive backend dashboard and several tutorials and guides.

- Maryke Myburgh

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 10

Regulators

FSCA, FSC, FSA, MISA

Trading Platform

MT4, MT5, WebTrader, BDSwiss app

Crypto

Yes

Total Pairs

53

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overview

BDSwiss is a Cyprus-based financial services company active in global financial markets since 2012. Its growth has led to a presence in major financial hubs like Berlin, showcasing its global recognition and strategic development.

The broker provides comprehensive educational resources and user-friendly trading platforms, resulting in high ease-of-use ratings.

Furthermore, it is respected by Emirati traders for its commitment to transparency, avoiding bonuses that can complicate the trading experience.

It is a popular choice among Emirati traders seeking a brokerage aligned with their financial objectives. The company’s commitment to regulatory compliance is evident through its adherence to international authorities like CySEC and FSC.

In addition, BDSwiss offers a diverse range of financial instruments and a trading environment suitable for beginners and experienced professionals.

Overall, equipped with trading tools and platforms like MetaTrader 4 and MetaTrader 5, BDSwiss caters effectively to the UAE trading community’s diverse needs.

Is BDSwiss regulated?

Yes, it is regulated by several authorities, including CySEC, FSC, FSA, BaFin, and the Mwali International Services Authority.

Can Emirati traders use BDSwiss?

Yes, Emirati traders can use BDSwiss’ worldwide presence and extensive services.

At a Glance

| 🗓Established Year | 2012 |

| 🪪Regulation and Licenses | CySEC, FSC, FSA, BaFin, Mwali International Services Authority |

| 🌟Ease of Use Rating | 4/5 |

| 💰Bonuses | None |

| ⏰Support Hours | 24/5 |

| 📊Trading Platforms | MetaTrader 4, MetaTrader 5, BDSwiss Web, BDSwiss Mobile |

| 📈Account Types | Cent, Classic, VIP, Zero Spread, Islamic, Demo |

| 💸Base Currencies | ZAR, USD, EUR, GBP, VND, etc. |

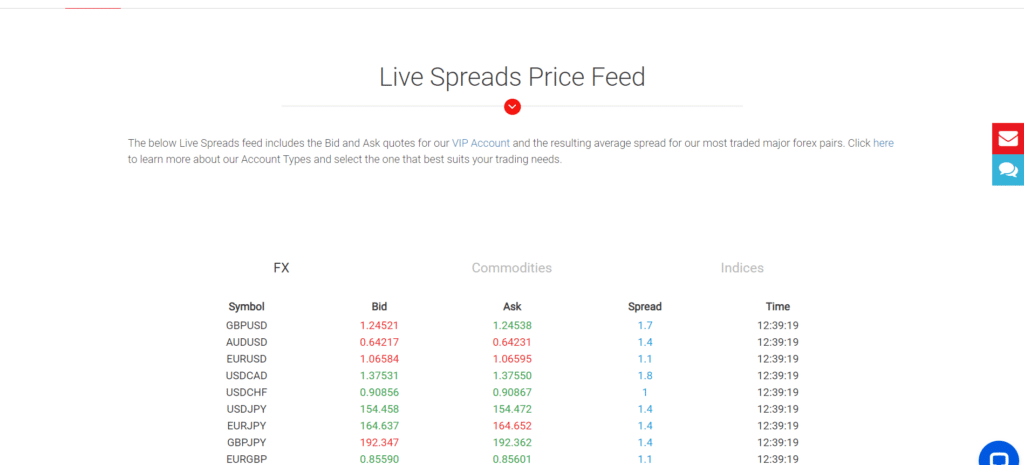

| 📊Spreads | From 0.0 pips EUR/USD |

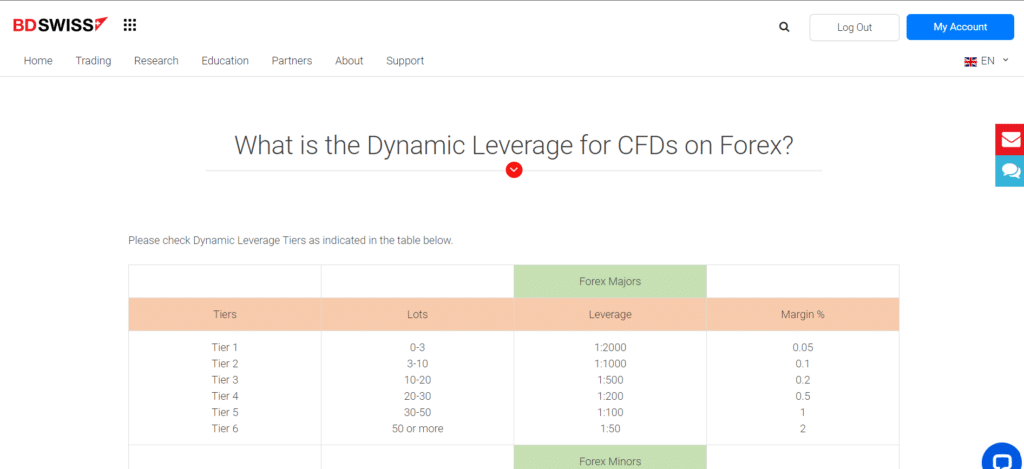

| 📈Leverage | 1:2000 |

| 💳Currency Pairs | 53; Minor, Major, and Exotic Pairs |

| 💰Minimum Deposit | 37 AED ($10) |

| 💸Inactivity Fee | Yes, 10% after 3 months |

| 🗣Website Languages | English, Czech, German, Italian, Spanish, Korean, French, Norwegian, Polish, Danish, Arabic, Malaysian, Thai, Emirati, Filipino, Hindi, Indonesian, Chinese, Portuguese, Romanian, Turkish, Russian |

| ⚖️Fees and Commissions | Spreads from 0.0 pips, commissions from $2 on Indices |

| 📚Affiliate Program | Yes |

| 🏛️Banned Countries | The United States, Belgium, and other OFAC-sanctioned regions |

| 💻Scalping | Yes |

| 🔎Hedging | Yes |

| ✴️Trading Instruments | Forex, Commodities, Shares, Indices, Cryptocurrencies |

| 👉 Open Account | 👉 Open Account |

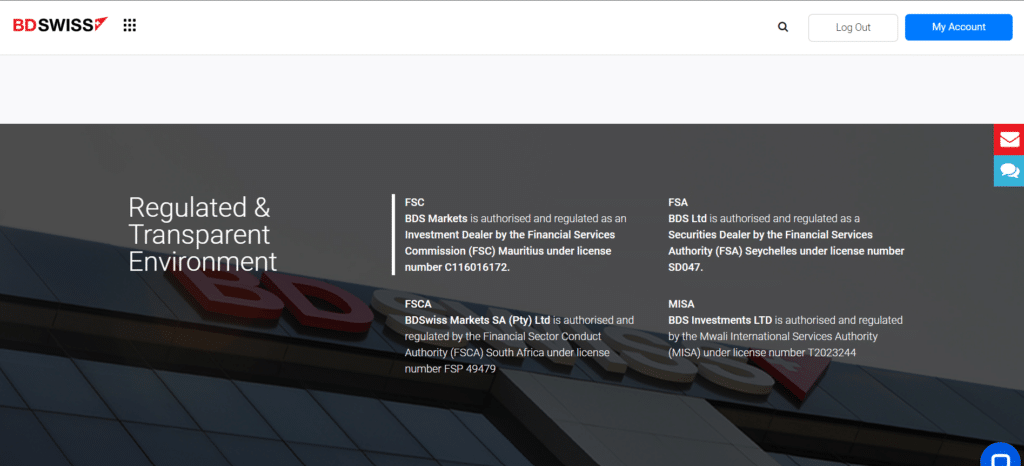

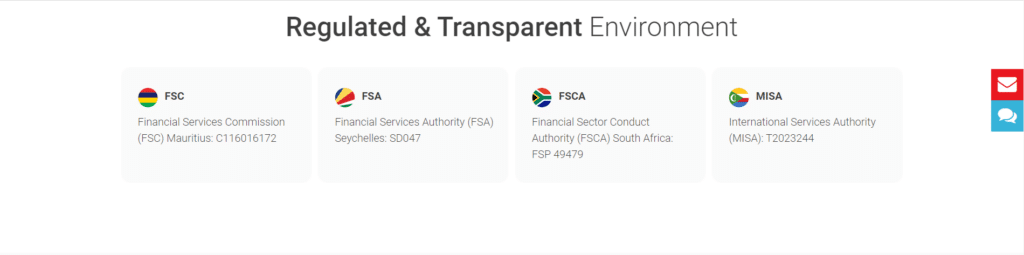

Regulation and Safety of Funds

This ensures high standards of financial security and operational honesty for Emirati traders. BDSwiss implements robust security measures, keeping Emirati traders’ funds separate from the broker’s finances ensuring funds are safeguarded in case of unexpected financial challenges.

Furthermore, Their advanced encryption technologies, such as Secure Sockets Layer (SSL) encryption, are used to secure online transactions.

Their ISO certification demonstrates its commitment to security, demonstrating its quality management systems and information security management.

Despite the absence of local regulatory oversight in Dubai, Emirati traders can trust that BDSwiss prioritizes protecting their investments and personal information by using proactive and robust security measures.

BDSwiss Regulation in Dubai

It is not regulated locally in Dubai but follows strict international regulations by CySEC and BaFin.

BDSwiss Global Regulations

| 🏛️Registered Entity | 🌎Country of Registration | 🪪Registration Number | ⚖️Regulatory Entity | 📊Tier | 🖺License Number/Ref |

| BDS Markets | Mauritius | – | FSC | 3 | 199/13 |

| BDS Ltd | Seychelles | – | FSA | 3 | C116016172 |

| BDSwiss GmbH | Germany | – | BaFin | 1 | 10134687 |

| BDS Holding PLC | Cyprus | – | CySEC | 2 | SD047 |

Protection of Client Funds

| 🛡️Security Measure | 📜Information |

| Segregated Accounts | Yes |

| Compensation Fund Member | No |

| Compensation Amount | None |

| SSL Certificate | Yes |

| 2FA (Where Applicable) | Yes |

| Privacy Policy in Place | Yes |

| Risk Warning Provided | Yes |

| Negative Balance Protection | Yes |

| Guaranteed Stop-Loss Orders | Yes |

How does BDSwiss secure Emirati traders’ funds and personal information?

It uses cutting-edge encryption technology and strong security processes to protect Emirati traders’ funds and sensitive data, putting confidentiality and integrity first.

Does BDSwiss separate customer funds from its operating funds?

Yes, the broker follows client money segregation regulations, which ensure that Emirati traders’ funds are kept separate from the company’s operating funds, protecting traders’ capital and giving further financial security in the case of insolvency.

Awards and Recognition

BDSwiss is a reputable and well-regulated broker that caters to global traders. While evaluating this broker, we found the following recent awards that they won:

- The broker was named the “Best Research and Education Provider” in LATAM by the UF Awards in 2024.

- During the UF Awards in 2024, they were announced the winner as the “Most Innovative Broker” in LATAM.

- In 2024, It was awarded for offering the “Best IB Program” during the HQMena Awards.

- They won the “Broker of the Year” award during the Mindanao Traders Expo in 2023.

- During the HQMena Awards, They won the “Best FX Educational Broker” award in 2023.

- In 2023, BDSwiss was recognized for having the “Best Global Partnership Program” during the UF Awards.

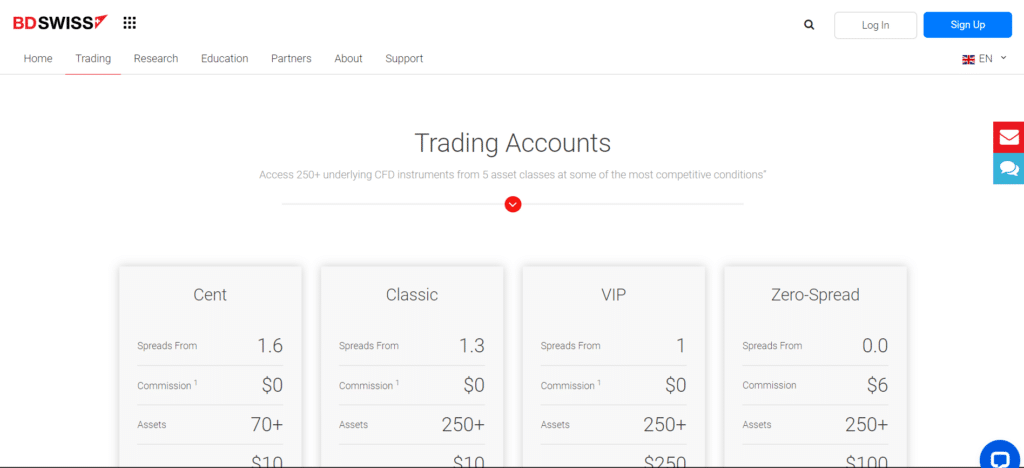

Account Types

| Cent | Classic | VIP | Zero Spread | |

| ⚖️Availability | All, but suited to beginners | All | All, but suited to more experienced traders | All; but ideal for scalpers |

| 📈Markets | Forex, Stocks, Indices, Commodities, Crypto CFDs | Forex, Stocks, Indices, Commodities, Crypto CFDs | Forex, Stocks, Indices, Commodities, Crypto CFDs | Forex, Stocks, Indices, Commodities, Crypto CFDs |

| 💳Commissions | $2 on indices, 0.15% on shares | $2 on indices, 0.15% on indices | $2 on indices, 0.15% on indices | $2 on indices, 0.15% on indices, $6 on Forex and commodities |

| 💻Platforms | All | All | All | All |

| 📊Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 📈Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 |

| 💰Minimum Deposit | 37 AED | 37 AED | 918 AED | 367 AED |

Cent Account

The Cent Account is designed for novice Emirati traders, offering a simple entry into the trading world. It allows traders to trade in markets like Forex, stocks, indices, commodities, and crypto CFDs.

A leverage ratio of up to 1:2000 allows micro lot trading, reducing financial risk. The account requires an initial investment of 37 AED and offers trading alerts and AutoChartist Performance Stats with a $500 deposit.

Classic Account

The Classic Account is designed for experienced Emirati traders, offering cost-effective trading and market access. It provides access to over 250 instruments with low spreads and a leverage cap of 1:2000.

Furthermore, the account eliminates deposit and withdrawal fees on credit cards and offers trading alerts and AutoChartist tools upon certain deposit thresholds.

VIP Account

The VIP Account is designed for experienced Emirati traders seeking advanced features. It offers narrower spreads, personalized trading alerts, and a dedicated account manager.

The account also provides AutoChartist tools, priority service, and access to Trading Central and the Trading Academy, making it a powerful platform for traders to refine their strategies across various trading environments.

Zero Spread Account

The Zero Spread Account is designed for Emirati traders focusing on day trading and scalping. It offers spreads as low as 0.0 pips on major currency pairs like EUR/USD, making it ideal for frequent traders.

Despite a commission on trades, the transparent pricing structure benefits large volume traders. The account provides access to all platforms, priority customer service, and advanced tools like Trade Companion and VIP webinars.

Demo Account

The Demo Account is a risk-free platform for Emirati traders to improve their trading skills. Furthermore, it is pre-loaded with virtual funds, replicating real-market conditions and allowing novice and experienced traders to experiment with strategies.

In addition, the demo account also serves as an educational hub, offering market analysis articles and expert-led webinars to enhance trading skills within the Emirati trading community.

Islamic Account

BDSwiss offers an Islamic Account that adheres to Sharia Law principles, eliminating overnight fees and ensuring compliance with Islamic finance principles. The account is swap-free, transparent, and aligns with religious beliefs.

Furthermore, access to the Islamic Account is subject to religious adherence, demonstrating respect for diverse cultural backgrounds. This account demonstrates a commitment to inclusivity and meeting the specific needs of Emirati traders.

Which account types does BDSwiss offer?

It provides a range of account types, including Cent, Classic, VIP, Zero Spread, Islamic, and Demo accounts, to accommodate different trading tastes and levels of expertise.

What BDSwiss account type is best for beginners?

The Cent Account is perfect for Emirati beginners because it allows for micro lot trading and has reduced initial deposit requirements, allowing for a gradual start into trading.

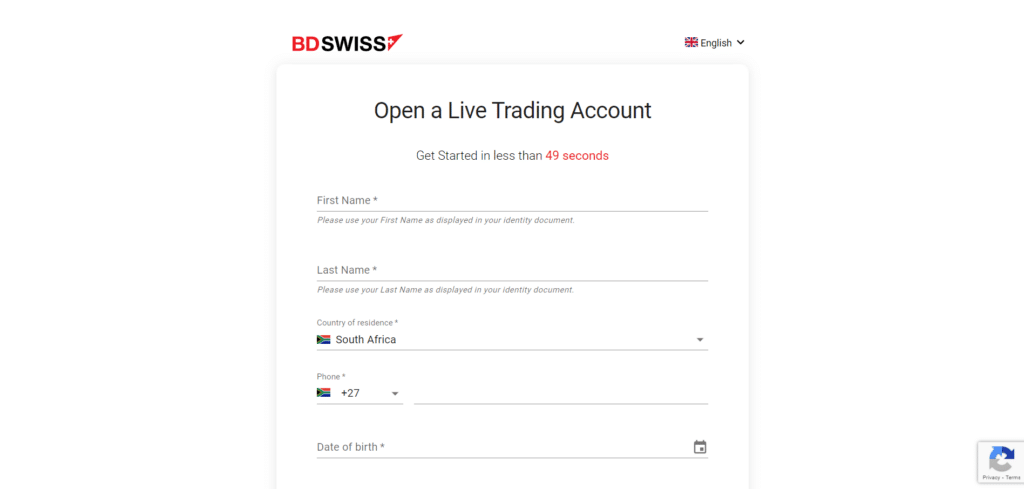

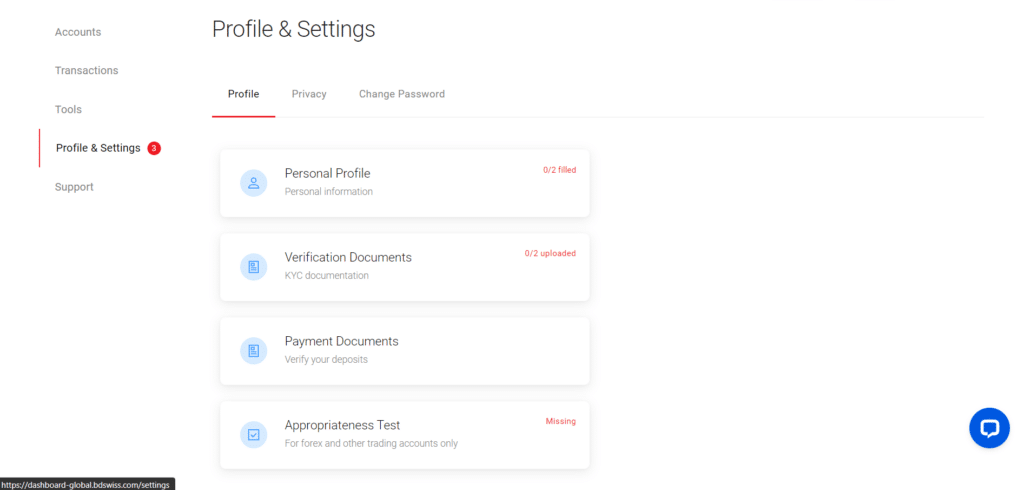

How To Open a BDSwiss Account

To register an account with BDSwiss, follow these steps:

Step 1 – Click on the Sign Up button

Emirati traders can begin their journey with BDSwiss by visiting the official website to learn about the brokerage’s offers. To register, traders can click on the “sign up” banner.

Step 2 – Complete personal information

An online application form will load, requiring personal and contact information. After completing the form, BDSwiss will send a verification link to the trader’s email, which must be clicked to validate the email address.

Step 3 – Complete KYC

Traders will be redirected to the BDSwiss website to finish the application procedure, which involves submitting clear scans of a government-issued identity document and a recent utility bill or bank statement for address verification, per the Know Your Customer (KYC) protocol.

BDSwiss will review the application and any supporting documents, taking a few business days, after which feedback on the account status will be provided to Emiratis.

What is the procedure for creating a BDSwiss account?

To create a BDSwiss account, go to the official website, fill out the online application, verify your email, upload the relevant identity papers, and await approval.

Is there a fee to open a BDSwiss account?

BDSwiss does not charge any fees to create an account. However, Emiratis must first fund their accounts to start trading live markets.

Broker Comparison

| BDSwiss | PrimeXBT | Octa | |

| 🔎Regulation | CySEC, FSC, BaFIN, FSA, Mwali International Services Authority | None; licensed in Seychelles and The Marshall Islands | CySEC, SVG FSA |

| 💻Trading Platform | • MetaTrader 4 • MetaTrader 5 • BDSwiss Mobile • BDSwiss Web | PrimeXBT | • MetaTrader 4 • MetaTrader 5 • OctaTrader • Octa App |

| 💳Withdrawal Fee | No | Yes | No |

| ✅Demo Account | Yes | Yes, with contests | Yes |

| 💰Min Deposit | 37 AED ($10) | 238 AED (0.001 BTC) | 92 AED ($25) |

| 📊Leverage | Up to 1:2000 | 1:1000 | 1:500 |

| 📈Spread | From 0.0 pips | From 0.05% | 0.6 pips |

| 💸Commissions | From $2 | 0.05% | None |

| ➡️Margin Call/Stop-Out | 50%/20% | Flexible | 25%/15% |

| 📜Order Execution | Instant/Market | Instant | Market |

| ❌No-Deposit Bonus | No | No | No |

| 🪙Cent Accounts | Yes | No | No |

| 🖺Account Types | • Cent Account • Classic Account • VIP Account • Zero Spread Account | Live Account | • OctaTrader Account • Octa MetaTrader 4 • Octa MetaTrader 5 |

| 🏛️DFSA Regulation | No | No | No |

| 💳AED Deposits | No | No | No |

| 🖺AED Account | Yes | No | No |

| 📞Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 🖺Retail Investor Accounts | 4 | 1 | 3 |

| ☪️Islamic Account | Yes | No | Yes |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Trade Size | 50 lots | Flexible | 500 lots |

| ⏰Minimum Withdrawal Time | Instant | Instant | 1 – 3 hours |

| ⏲️Maximum Estimated Withdrawal Time | Within 24 hours | Depends on the payment method – a few minutes to 48 hours | 1 – 3 hours |

| 💰Instant Deposits and Instant Withdrawals? | Yes | Yes | Yes, Deposits |

Min Deposit

USD 10

Regulators

FSCA, FSC, FSA, MISA

Trading Platform

MT4, MT5, WebTrader, BDSwiss app

Crypto

Yes

Total Pairs

53

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Trading Instruments & Products

The broker offers the following trading instruments and products:

- Indices – It offers Emirati traders access to 14 diverse indices, enabling them to explore the global economy and various sectors, eliminating the need for individual stock trading, and providing a convenient trading method.

- Cryptocurrencies – They offer 27 cryptocurrency CFDs to Emirati traders, providing access to a diverse range of digital currencies like Bitcoin and Ethereum, allowing them to effectively navigate the dynamic and ever-changing nature of the digital currency market.

- Commodities – UAE traders can diversify their investment portfolios with BDSwiss, trading in six commodities like precious metals and energies, which can potentially hedge against inflation or currency devaluation.

- Shares – Emirati traders can now trade CFDs on 128 shares via BDSwiss, enabling them to invest in globally recognized companies in the technology, finance, and consumer sectors.

- Forex – It offers a diverse range of 53 currency pairs for Emirati traders, allowing them to participate in the world’s largest financial market. It provides a convenient forex trading platform with substantial liquidity and 24/5 trading availability.

How many currency pairs are available to trade on BDSwiss?

The broker offers 53 currency pairings, including major, minor, and exotic pairs, letting Emiratis engage in the global forex market with high liquidity.

Are share CFDs accessible on BDSwiss?

The broker offers CFD trading on 128 shares from various industries, including technology, finance, and consumer products, giving Emirati traders access to well-known firms globally.

BDSwiss Trading Platforms and Software

MetaTrader 4

BDSwiss offers a reliable and functional platform for Emirati traders, integrating MetaTrader 4 (MT4) to meet their needs. With high leverage up to 1:2000, traders can optimize their strategies on a stable platform with comprehensive analytical tools.

The user-friendly interface and competitive spreads on major currency pairs ensure an efficient trading experience.

With over 250 financial instruments, including Forex, commodities, and indices, Emirati traders can explore various markets. BDSwiss also provides dynamic account options like the Cent Account and VIP Account, allowing traders to tailor their trading to their risk tolerance and market goals.

MetaTrader 5

It has introduced MetaTrader 5 (MT5), a multi-asset platform that supports shares and cryptocurrencies, enhancing trading opportunities for Emirati traders.

MT5’s enhanced processing speed and simultaneous display of multiple timeframes and charts are ideal for UAE traders’ dynamic trading strategies. BDSwiss’ educational features, including webinars and seminars, enable traders to make informed decisions.

Combining the BDSwiss Zero Spread account with MT5 can benefit day trading and scalping, allowing traders to use a cutting-edge trading platform to take advantage of tight spreads.

BDSwiss Web

The BDSwiss WebTrader platform is designed to cater to Emirati traders’ flexible trading needs, eliminating the need for software downloads and allowing seamless trading directly from web browsers.

Furthermore, BDSwiss’ 4/5 ease-of-use rating reflects its commitment to providing a user-friendly trading environment. The platform integrates with BDSwiss’ trading conditions, diverse product offerings, and high-leverage options, providing a comprehensive trading experience.

Overall, BDSwiss Web is ideal for Emiratis who prefer not to install dedicated software and those trading on various devices.

BDSwiss Mobile

The BDSwiss Mobile app is a modern trading solution designed to cater to Emirati traders’ needs. It offers full trading functionality, synchronized with the broader BDSwiss platform, and is user-friendly, ensuring the smooth execution of complex trading activities.

Furthermore, the app’s design considers BDSwiss’ leverage and margin requirements, allowing traders to manage their accounts on the go.

Their Mobile provides an agile trading environment to Emiratis without compromising on the comprehensive features and robust analytics of the BDSwiss trading experience.

What are the benefits of utilizing MetaTrader 4 with BDSwiss?

MetaTrader 4 on BDSwiss provides Emiratis with various features, including automated trading, sophisticated technical analysis tools, and customizable trading methods, allowing Emirati traders to maximize their trading activity.

Does BDSwiss provide a proprietary trading platform?

Yes, It delivers BDSwiss Web, its web-based trading platform, allowing Emirati traders to trade seamlessly without downloading or installing. BDSwiss also offers its proprietary app available on iOS and Android devices for seamless mobile trading in UAE.

Leverage and Margin

It provides Emirati traders with dynamic leverage ratios, letting them increase their market influence beyond their initial investment.

With leverage of up to 1:2000, Emiratis can adopt more aggressive trading strategies and larger positions. However, larger profits come with higher risk. Therefore, understanding margin requirements is crucial.

Margin is the amount of money Emiratis must have in their account to keep their positions open, reducing the risk of negative balances.

Furthermore, Emiratis must note that BDSwiss has margin close-out rules to protect traders, closing positions if the trader’s account equity falls below a certain percentage of the margin.

BDSwiss is proactive in adjusting leverage during big economic news, lowering the maximum leverage to 1:200 to protect traders from sudden market swings. Emirati traders must be aware of these changes, which can significantly affect their trading strategies and risk levels.

What leverage levels are accessible to Emirati traders on BDSwiss?

Based on Emirati traders ‘ risk tolerance and trading preferences, BDSwiss provides variable leverage ratios ranging from 1:1 to 1:2000.

Does BDSwiss provide negative balance protection for Emirati traders?

Yes, It offers negative balance protection, ensuring that Emirati traders do not lose more than their original investment, even in adverse market conditions, protecting against potential account deficits.

Spreads and Fees

Spreads

UAE traders should understand BDSwiss’ variable spread model, which adjusts spreads based on market conditions, allowing them to benefit from real-time prices.

The EUR/USD pair offers tight spreads of 0.0 pips, suitable for frequent traders with high spread costs. However, less popular assets may have higher spreads, so traders must plan their strategies accordingly to keep costs in check.

Commissions

BDSwiss has a clear commission structure based on account type and traded assets, with Forex trading being free for Cent, Classic, and VIP accounts.

However, indices and shares incur charges, such as $2 for indices and 0.15% for shares. Forex and commodities trading starts at $6 for Zero Spread accounts, allowing traders to make informed decisions.

Overnight Fees

BDSwiss charges traders overnight fees or swaps based on position type, traded instrument, and duration.

Furthermore, to cater to the Muslim community in UAE, they offer Islamic accounts following Sharia Law, exempting traders from these charges. However, holding positions for over 10 days may result in fees, so traders must plan their trades and account management accordingly.

Deposit and Withdrawal Fees

BDSwiss offers a hassle-free funding solution for Emirati traders, eliminating fees on deposit methods and withdrawals.

However, traders should confirm transfer costs with their banks or payment providers. This transparent, cost-effective approach maximizes trading potential without hidden charges.

Inactivity Fees

BDSwiss charges inactivity fees to inactive accounts if there’s no trading activity for three months. This 10% fee prompts traders to maintain regular trading or withdraw funds.

Emirati traders, particularly those with long-term strategies or sporadic trading habits, should consider this fee to avoid unexpected deductions.

Currency Conversion Fees

Trading in different currencies may incur conversion fees, especially if the account’s base currency differs from the trade currency. BDSwiss allows trading in AED, potentially saving traders from these fees.

However, these fees can impact overall trading expenses, especially in international markets, meaning that Emiratis must calculate these fees when determining their trading and non-trading expenses.

Are there any hidden costs while trading on BDSwiss?

The broker is devoted to transparency, thus there are no hidden costs. Therefore, Emirati traders can trade confidently, knowing that they will only pay fees explicitly stated on the site.

Does BDSwiss give spread or commission reductions for high-volume traders?

Yes, They offer forex cashback rebates to Emiratis as part of their commitment to rewarding active traders and establishing long-term partnerships with Emirati traders.

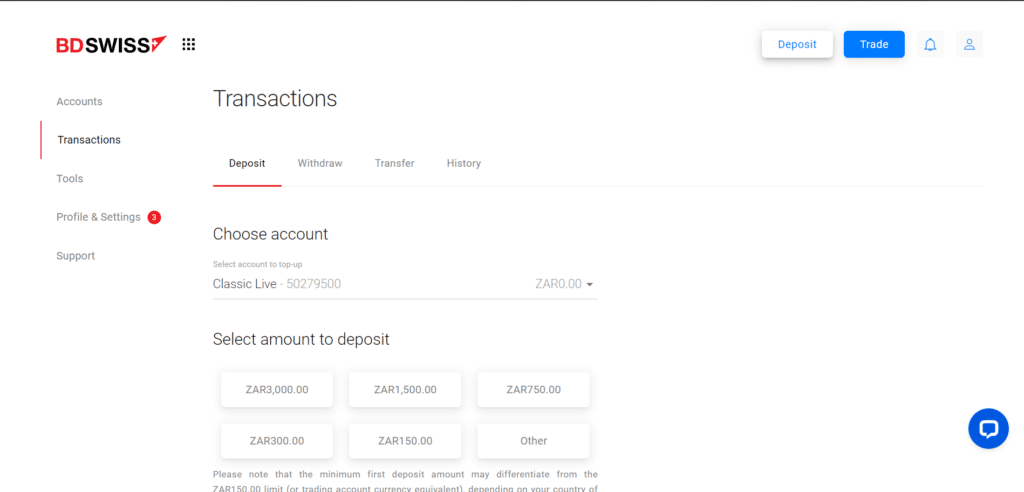

Deposit & Withdrawal Options

| 💰Payment Method | 🌎Country | 💳Currencies Accepted | ⏰Processing Time |

| 💳Credit/Debit Card | All | EUR, GBP, USD | Instant Deposits, Withdrawals in 24 hours |

| 🔁Electronic Funds Transfer (EFT) | South Africa | ZAR | Instant Deposits, Withdrawals in 24 hours |

| 🔄Korapay | Nigeria | NGN | Instant Deposits, Withdrawals in 24 hours |

| 📱Mobile Solutions (OZOW, M-PESA, Vodafone, Airtel, TiGO, MTN, etc.) | South Africa, Kenya, Ghana, Tanzania, Uganda, Benin, Burkina Faso, Ivory Coast, Guinea-Bissau, Mali, Niger, Senegal, and Togo | ZAR, KES, GHS, TZS, XOF, UGX | Instant Deposits, Withdrawals in 24 hours |

| 🛍️Electronic Wallets (GCash, Pay Maya, etc.) | Thailand, Indonesia, Philippines, Dubai, Malaysia | THB, IDR, PHP, VND, MYR | Instant Deposits, Withdrawals in 24 hours |

| 💰Pix | Brazil | BRL | Instant Deposits, Withdrawals in 24 hours |

| 💳Beeteller | Brazil, Chile, Colombia, Costa Rica, Mexico, Peru, Guatemala | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Instant Deposits, Withdrawals in 24 hours |

| 📈Cryptocurrency Wallets | All | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZCASH, ADA | Instant Deposits, Withdrawals in 24 hours |

| ➰Bank Wire Transfer | All | EUR, USD, GBP, PLN, CHF, SEK, DKK, NOK | 1 -5 days on deposits, Withdrawals in 24 hours |

Deposits

How to Deposit using Bank Wire Step by Step

- Access your BDSwiss account and navigate to your dashboard’s ‘Deposits’ section.

- Choose ‘Bank Wire Transfer’ as your preferred deposit method.

- Enter the amount you would like to deposit and provide any additional information as requested by the platform.

- Take note of the banking details shown on the screen, which include the name of the bank, account number, and SWIFT/BIC code.

- Proceed with initiating a wire transfer using the banking details provided by BDSwiss. You can complete this task either online or by visiting your bank.

- Keep a record of the transaction confirmation or reference number given to you by your bank. This will be useful for your records and any future inquiries.

How to Deposit using Credit or Debit Card Step by Step

- Go to your BDSwiss trading account and find the ‘Deposit’ section.

- Select the ‘Credit/Debit Card’ option when making a deposit.

- Enter your card information, including the card number, expiry date, and CVV code.

- Enter the deposit amount you would like to use to fund your account.

- Ensure you fulfill all security verification steps your bank implements to safeguard against unauthorized transactions.

- Confirm the transaction to complete the deposit process.

How to Deposit using Cryptocurrency Step by Step

- Access your BDSwiss account and choose ‘Deposit,’ followed by ‘Cryptocurrency Wallets.’

- Select the cryptocurrency of your choice for the deposit.

- The system will display the amount to be deposited in the currency of your account and generate a unique deposit address or QR code for you.

- Log into your cryptocurrency wallet and make a transfer to the BDSwiss address given, or simply scan the QR code for a speedy transaction.

- Verify the transfer amount and complete the transaction through your crypto wallet.

How to Deposit using e-Wallets or Payment Gateways Step by Step

- Access your BDSwiss trading account and navigate to the ‘Deposit’ section.

- Select from the various e-wallets or payment gateways, like GCash or Pay Maya.

- Choose the suitable e-wallet and, if necessary, sign in to your specific e-wallet account.

- Provide the deposit amount and verify the payment to finalize the transaction.

Withdrawals

How to Withdraw using Bank Wire Step by Step

- Navigate to the ‘Withdrawal’ section in your BDSwiss account.

- Choose ‘Bank Wire Transfer’ as your preferred option for withdrawing funds.

- Complete the withdrawal form with your banking information, including your account number and SWIFT/BIC code.

- Provide the amount you would like to withdraw.

- Submit the request and have all necessary verification documents ready for BDSwiss.

How to Withdraw using Credit or Debit Cards Step by Step

- Access your BDSwiss trading account and go to the ‘Withdrawals’ section.

- Select the ‘Credit/Debit Card’ option for your withdrawal method.

- Choose the card that was previously utilized for deposits.

- Provide the amount of money you would like to withdraw.

- Ensure that all necessary security verification steps are completed.

- Submit your withdrawal request.

How to Withdraw using Cryptocurrency Step by Step

- Navigate to the ‘Withdrawal’ section within your BDSwiss account and choose ‘Cryptocurrency Wallets.’

- Select the cryptocurrency for the withdrawal.

- Enter your cryptocurrency wallet address accurately.

- Indicate the desired withdrawal amount, ensuring it falls within the allowed limits.

- Review the details to ensure accuracy before proceeding to submit your withdrawal request.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

- Access your BDSwiss account and navigate to the ‘Withdrawal’ section.

- Choose the e-wallet category from the available withdrawal options.

- Select your preferred e-wallet service from the range of options provided.

- Provide the necessary information for your e-wallet, such as your email address or account number.

- Enter the amount you would like to withdraw.

- Finalize the withdrawal request.

Are there any fees for depositing funds into my BDSwiss account?

No, BDSwiss does not impose fees for deposits. However, Emirati traders should verify with their payment service providers about any transaction costs.

Can I deposit funds into my BDSwiss account with cryptocurrency?

Yes, BDSwiss accepts deposits in various cryptocurrencies, offering traders a simple and safe payment method.

Min Deposit

USD 10

Regulators

FSCA, FSC, FSA, MISA

Trading Platform

MT4, MT5, WebTrader, BDSwiss app

Crypto

Yes

Total Pairs

53

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

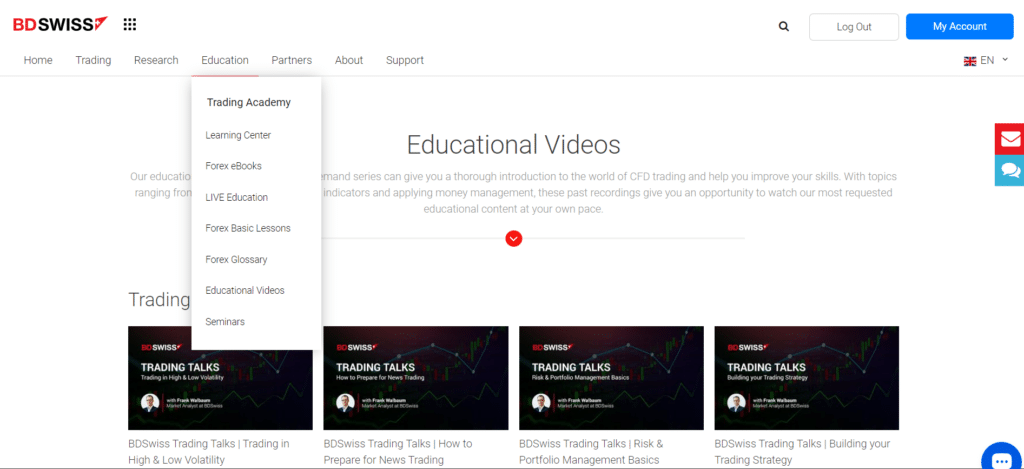

Educational Resources

Live Education

BDSwiss offers Emirati traders real-time trading sessions and webinars, providing a dynamic and practical learning experience.

In addition, these sessions allow traders to witness the application of strategies under live market conditions, receive instant feedback, and improve their decision-making skills in a market-representative environment.

Learning centres

BDSwiss’ Learning Centres are dedicated to trader education, offering structured pathways with diverse materials for Emirati traders.

These centers cater to varying levels of expertise, enabling novice and seasoned investors to expand their knowledge and use BDSwiss’ trading platforms and tools to their full potential.

Forex Glossary

BDSwiss provides a comprehensive Forex Glossary for Emirati traders, containing all necessary terms and expressions for understanding currency trading.

This tool is essential for new traders or those looking to expand their knowledge. Mastering these terms provides market analysis insight and enhances communication with traders worldwide, making a significant impact in the global trading community.

Educational Videos

BDSwiss provides Educational Videos that offer a multimedia learning approach to various trading themes. These videos cover platform tutorials, advanced topics, and complex strategies for Emirati traders.

Furthermore, the visual nature of these resources is particularly useful for traders who prefer real-time examples, providing an engaging way to enhance their trading skills.

Forex Basic Lessons

BDSwiss provides Forex Basic Lessons, an introductory guide to the forex market fundamentals, covering currency pairs, market analysis techniques, and trading mechanics.

These lessons are particularly valuable for Emirati traders who want a solid foundation in forex trading, enabling a deeper understanding and more confident approach to currency market engagement.

Forex eBooks

BDSwiss offers a range of Forex eBooks for UAE traders, catering to beginners and those seeking detailed strategy discussions.

These self-paced learning resources allow traders to explore topics at their convenience, enhancing their understanding of market nuances and refining their trading strategies.

Furthermore, BDSwiss’ eBooks serve as a personal library of knowledge for traders to refer to as they navigate the complexities of the forex market.

Seminars

BDSwiss offers seminars for Emirati traders to enhance their knowledge through in-depth discussions and interactive sessions.

In addition, these seminars cover topics like fundamental market analysis and trading techniques, providing a communal learning environment for traders to network and exchange insights, thereby broadening their understanding of complex financial markets.

What educational materials does BDSwiss provide to Emirati traders?

BDSwiss offers a wide selection of educational materials, like as articles, tutorials, webinars, and video courses, aimed at improving the trading knowledge and abilities of Emirati traders of all experience levels.

Are there any expenses for accessing BDSwiss’ educational materials?

No, BDSwiss provides all registered Emirati traders with free educational tools, proving its commitment to promoting trader education and empowering individuals to make educated trading decisions.

Min Deposit

USD 10

Regulators

FSCA, FSC, FSA, MISA

Trading Platform

MT4, MT5, WebTrader, BDSwiss app

Crypto

Yes

Total Pairs

53

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Bonuses and Promotions

The broker does not currently offer any bonuses or promotions to Emirati traders. However, BDSwiss offers forex cashback rebates to Introducing Brokers.

In Dubai, as an Introducing Broker (IB) partnering with BDSwiss, there is a lucrative opportunity to earn up to $4.20 per lot on Forex trades.

This applies to various account types such as Cent, Classic, VIP, RAW, or Premium. It’s particularly appealing in Dubai’s vibrant market, where both individual and institutional traders favor forex trading.

As your referred clients trade more, your rebate earnings increase due to a direct correlation with trading volume.

Does BDSwiss provide a loyalty program for traders in Dubai?

No, BDSwiss does not have a loyalty program. However, BDSwiss has a profitable Introducing Brokers (IBs) rebate program.

Can Dubai traders join in BDSwiss trading competitions?

No. However, clients of BDSwiss IBs might benefit from rebates based on trading volume.

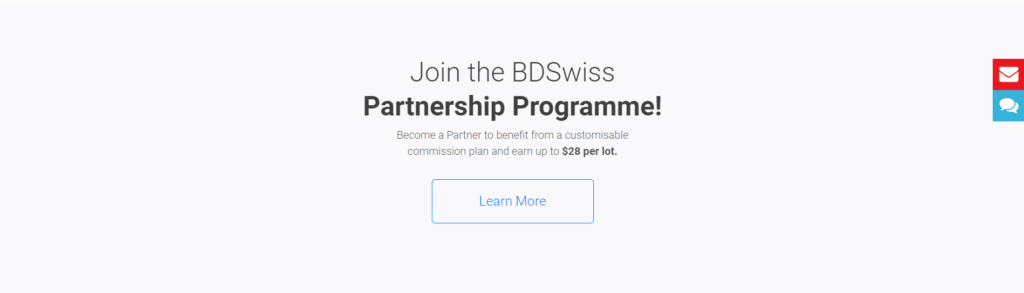

BDSwiss Affiliate Programs

Features

For those in Dubai looking to leverage their online influence in the forex trading market, the BDSwiss Affiliate Program is a good alternative, according to our findings.

We found that BDSwiss has more than twenty thousand affiliates and international business partners worldwide benefit from this program, which the Global Banking and Finance Review has recognized.

Furthermore, the program offers a lucrative chance to earn competitive commissions by driving traffic to BDSwiss goods and services for traders and influencers in Dubai who have a sizable digital presence, whether through websites, social media, or online education platforms.

With an average conversion rate of 36%, the program is designed to maximize results, which is especially useful in Dubai’s thriving financial and digital industry.

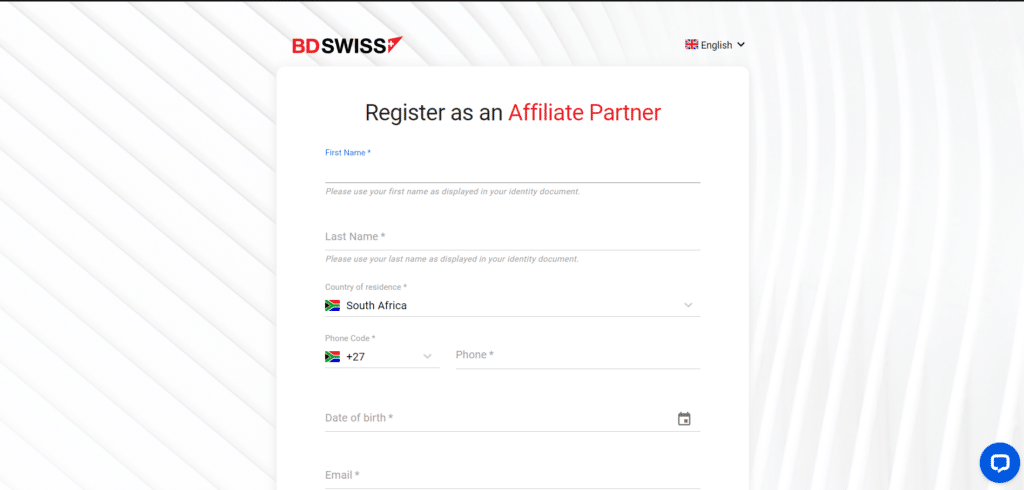

How to Register an Affiliate Account with BDSwiss Step-by-Step

Emirati traders can register to become affiliates with BDSwiss following a few easy steps. However, before registering, ensure that you review the affiliate program features, terms and conditions, and commission structure to ensure that it aligns with your own strategies as an affiliate.

Here’s how you can register an affiliate account with BDSwiss:

Find the “Partners” or “Affiliate Program” section of the BDSwiss website. You can usually find this part of the menu up top. Select “Become a Partner” or “Affiliate Registration” from the list of banners in the Partner Program area. The affiliate registration form will load immediately.

👉Step 2 – Select Partner or Affiliate Option

Select “Become a Partner” or “Affiliate Registration” from the list of banners in the Partner Program area. The affiliate registration form will load immediately.

👉Step 3 – Complete Form

The registration form will request your name, email address, and phone number. Once you have provided all the necessary information, verify it is accurate. After that, hit the “Submit” button, and BDSwiss will get back to you once they’ve reviewed your application.

After reviewing your application, BDSwiss might ask for additional documents or information to confirm your identification. You will get a confirmation email with additional information if your application is accepted. Your affiliate dashboard will be available to you after the verification process is complete. On this dashboard, you will find all the tools you need to manage your referrals, keep tabs on your profits, and promote BDSwiss.

What can I expect from BDSwiss’ commissions for affiliates?

BDSwiss provides attractive commission structures for affiliates in Dubai, with a 36% conversion rate.

How does someone from Dubai join the BDSwiss affiliate program?

Interested parties in Dubai can apply to the BDSwiss affiliate program by completing an application form on the BDSwiss website.

Customer Support

| 🤝Customer Support | 🪪CMTrading Customer Support |

| ⌛Operating Hours | 24/5 |

| 🗣️Support Languages | English, French, Italian, Spanish, German, Portuguese |

| 🎙️Live Chat | Yes |

| 💻Email Address | Yes |

| 📞Telephonic Support | Yes |

| ⭐The overall quality of CMTrading Support | 5/5 |

BDSwiss Response Time

| 📺Support Channel | ⏰Average Response Time | ⏲️User-based Response Time |

| 📞Phone | 5 minutes | 2 – 3 minutes |

| 24 – 48 hours | Same-day | |

| 🗣️Live Chat | 3 – 5 minutes | 3 minutes |

| 📱Social Media | 3 – 5 minutes | 5 minutes |

| 🪪Affiliate | 24 – 48 hours | 24 hours |

How can clients in Dubai contact BDSwiss customer service?

Dubai customers can contact BDSwiss customer service by live chat, email, or phone.

Is BDSwiss customer assistance available to Dubai traders around the clock?

Yes, BDSwiss provides 24/5 customer service to match the trading hours of financial markets.

Social Responsibility

According to our in-depth research, BDSwiss is committed to positively impacting the lives of traders through various social responsibility initiatives. They have a strong dedication that goes beyond just the financial markets, cultivating a culture of philanthropy.

An example of their involvement is participating in the 6th Spring Festival in Cyprus, a lively community and family celebration. This event offered a wide range of enjoyable activities suitable for people of all ages, fostering a sense of unity and happiness.

Furthermore, with BDSwiss’ support, the festival contributed to the Association of the Friends of the Center for Preventive Paediatrics.

They also support a remarkable charity music night through sponsorship. In support of “Ύστερα ήρθε η Άνoιξη,” an organization dedicated to assisting individuals facing hematological health challenges, the event successfully generated awareness and funds for this significant cause.

Furthermore, we also found that BDSwiss is committed to making a lasting impact through its social responsibility initiatives. Their continued collaboration with “Funraising,” a charitable organization, ensures vital support for children in need.

Conclusion

In our experience, BDSwiss is a top choice for traders in the UAE due to its international regulatory compliance and diverse trading tools.

BDSwiss has secure segregated accounts to protect client funds and offers flexible account types, catering to beginners and experienced traders.

The broker also provides advanced platforms like MetaTrader 4 and MetaTrader 5 and offers educational resources to help traders make informed decisions.

Despite Dubai’s lack of local regulatory oversight, we found that BDSwiss’ adherence to international standards provides peace of mind.

However, while BDSwiss’ leverage and dynamic margin offer potential for profit maximization, Emirati traders must manage risk wisely.

Furthermore, Emiratis must acknowledge factors like inactivity fees, commission structures, and currency conversion fees and stay well-informed about leverage adjustments during economic announcements.

Despite not being regulated by the DFSA, not offering AED-denominated accounts, and imposing currency conversion and inactivity fees, we can conclude that BDSwiss is a solid trading platform for the dynamic Emirati forex and CFD market.

Our Insight

If you are looking for a CFD broker that offers a range of tradable assets such as currencies, indices, and cryptocurrencies, BDSwiss might be a good option to consider. While they do provide easy-to-use platforms and educational materials, it is worth noting that their fees are slightly higher than other similar brokers. Choosing BDSwiss could be beneficial if your main focus is on conducting thorough research and quickly executing orders, rather than seeking the most competitive spreads.

BDSwiss Pros and Cons

| ✅Pros | ❌Cons |

| Emiratis can access more than 250 financial instruments spread across markets | BDSwiss is not locally regulated in Dubai |

| There are several educational materials and resources for beginners, helping them build a solid foundation before they start trading | Inactivity fees of 10% apply to inactive accounts |

| There are four powerful and feature-rich platforms offered across devices | BDSwiss does not offer an AED-denominated account |

| Emirati traders can choose from several account types, each tailored to different traders | AED is not a supported deposit or withdrawal currency |

| Traders can use leverage up to 1:2000 on forex major pairs | The platforms offered might present a learning curve to beginners |

| BDSwiss offers multi-lingual customer support to Emiratis across channels | |

| BDSwiss offers AutoChartist and Trading Central | |

| There is a free demo account offered that has a risk-free environment and virtual funds |

You might also like: CMTrading Review

You might also like: FXGT Review

You might also like: Exness Review

You might also like: AvaTrade Review

You might also like: Alpari Review

Frequently Asked Questions

Can I trade in Arabic on the BDSwiss platform?

Yes, BDSwiss provides platform interfaces and comprehensive customer support in Arabic, specifically designed to meet the region’s traders’ requirements.

What can I trade with BDSwiss?

Emiratis can trade indices, shares, forex, commodities, Crypto CFDs, and forex with BDSwiss using their proprietary trading platforms or the MetaTrader suite.

Is BDSwiss a safe broker?

Yes, BDSwiss is a safe broker. While it does not hold licenses in Dubai, BDSwiss is well-regulated by other entities such as BaFin and CySEC, among others.

Can Emirati traders open Islamic accounts with BDSwiss?

BDSwiss provides Islamic accounts for Emirati traders, ensuring compliance with Sharia law through swap-free trading options catering to the Muslim community’s requirements. However, Emiratis must prove their religious beliefs before this account is approved.

What is BDSwiss’ minimum deposit?

Despite budgetary restrictions, BDSwiss has a $10 or 37 AED minimum deposit for entry-level accounts, letting Emiratis get started.

I’m new to trading. Does BDSwiss offer any resources to help me learn?

BDSwiss offers various educational resources, such as webinars, articles, and market analysis, tailored specifically for the Dubai market. They assist in developing a solid understanding of trading.

Where is BDSwiss based?

BDSwiss’ head office is in Limassol, Cyprus. Furthermore, BDSwiss has offices in several other regions.

Does BDSwiss provide leverage to traders from the United Arab Emirates?

Emirati traders have the opportunity to maximize their trading capacity across a wide range of financial instruments with BDSwiss’ high leverage options, which can go up to 1:2000.

How long does BDSwiss’ withdrawal take?

Withdrawals with BDSwiss are processed within 24 hours. While some withdrawals, like e-wallets and cryptocurrencies, reflect quickly, bank transfers can take a few days.

Given the economic volatility in the region, can I trust BDSwiss in Dubai to keep my investment secure?

Yes, BDSwiss prioritizes the safety and security of clients’ funds by maintaining strict regulatory standards and ensuring proper fund segregation. Therefore, investments remain secure even during periods of regional economic instability.

Best Forex Brokers in Dubai

Best Forex Brokers in Dubai

Dirham (AED) Forex Trading Accounts

Dirham (AED) Forex Trading Accounts

Scam Forex Brokers in Dubai

Scam Forex Brokers in Dubai